Brain Health Supplements Market Size

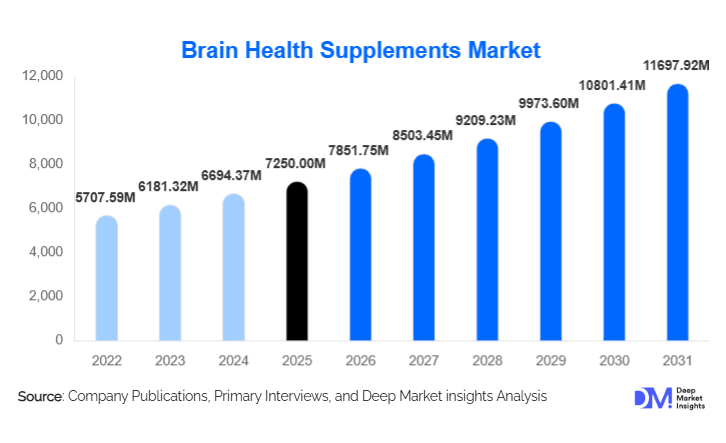

According to Deep Market Insights, the global brain health supplements market size was valued at USD 7,250 million in 2025 and is projected to grow from USD 7,851.75 million in 2026 to reach USD 11,697.92 million by 2031, expanding at a CAGR of 8.3% during the forecast period (2026–2031). The brain health supplements market growth is primarily driven by rising cognitive health awareness, increasing prevalence of neurodegenerative disorders, and the growing adoption of preventive healthcare and wellness-focused supplements across all age groups.

Key Market Insights

- Nootropics and cognitive enhancers dominate the market, with strong demand among adults seeking focus, memory, and productivity improvements.

- Capsules and tablets remain the most consumed forms of brain health supplements, favored for convenience and standardized dosing, particularly among seniors and adults.

- North America dominates the global market, accounting for 42% of sales in 2025, driven by high awareness, disposable income, and regulatory approvals.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising income, and increased awareness of mental health in China, India, and Japan.

- E-commerce and online retail are rapidly reshaping distribution, accounting for 28% of global sales and enabling convenient access to premium and international brands.

- Technological integration, including AI-driven personalized nutrition, smart supplements, and digital health tracking, is enhancing consumer engagement and product adoption.

What are the latest trends in the brain health supplements market?

Rising Demand for Preventive Cognitive Health

Consumers are increasingly investing in supplements for preventive brain health, aiming to reduce the risk of neurodegenerative disorders, improve memory, and enhance mental performance. With stress and lifestyle-related cognitive decline rising globally, demand for neuroprotective supplements, nootropics, and mood enhancers is expanding across all age groups. Wellness-focused formulations, including plant-based and natural ingredients, are particularly popular among health-conscious consumers seeking long-term cognitive benefits.

Technology-Driven Personalized Nutrition

Emerging technologies such as AI-based cognitive profiling, DNA testing, and app-integrated supplement tracking are transforming the brain health supplements market. Companies now offer personalized formulations tailored to an individual’s cognitive needs, lifestyle, and health conditions. Subscription-based e-commerce models, mobile apps for dosage tracking, and AI-driven recommendations are driving engagement among younger, tech-savvy consumers, while enhancing brand loyalty and repeat purchases.

What are the key drivers in the brain health supplements market?

Increasing Prevalence of Cognitive Disorders

The aging global population and rising stress levels are increasing the prevalence of cognitive disorders such as dementia, Alzheimer’s disease, and mild cognitive impairment. Adults and seniors are increasingly turning to brain health supplements for memory enhancement and neuroprotection. The nootropics and neuroprotective segment alone accounts for approximately 40% of the 2025 market, reflecting strong consumer adoption for cognitive well-being.

Health and Wellness Trend

Global consumers are shifting toward preventive healthcare, with supplements becoming an integral part of lifestyle management. Brain health supplements that support focus, memory, and mental clarity are increasingly adopted by students, professionals, and fitness enthusiasts. The popularity of functional beverages and powders enriched with cognitive boosters further drives market growth, particularly in developed regions such as North America and Europe.

Digital and E-Commerce Penetration

E-commerce is accelerating market growth by providing convenient access to premium supplements and global brands. Online platforms account for approximately 28% of global sales in 2025 and are the fastest-growing distribution channel. Subscription models, direct-to-consumer offerings, and online wellness communities are increasing repeat purchases and expanding consumer reach.

What are the restraints for the global market?

Regulatory Complexities

Stringent regulations regarding labeling, health claims, and ingredient approvals in different countries can limit market growth. Delays in product approvals, compliance costs, and country-specific regulatory variations may hinder the launch of new products and expansion into global markets.

High Costs of Premium Supplements

Premium brain health supplements, particularly those containing advanced formulations or plant-based extracts, are relatively expensive. High pricing limits adoption among price-sensitive consumers in emerging markets, slowing mass-market growth and potentially restricting overall market penetration.

What are the key opportunities in the brain health supplements industry?

Rising Cognitive Health Awareness

With the global population increasingly aware of the importance of mental wellness, companies have opportunities to expand product adoption through educational campaigns, collaborations with healthcare professionals, and digital marketing initiatives. Targeted awareness programs in emerging markets such as India, China, and Brazil are particularly effective for stimulating new demand.

Integration of Advanced Technologies

AI-driven personalized nutrition and smart supplements offer opportunities for product differentiation. Companies can leverage genetic profiling and digital health tracking to create customized formulations, boosting consumer loyalty. Time-release capsules, functional beverages, and app-based dosage monitoring are gaining traction, creating premium product segments and new revenue streams.

Emerging Markets & Regional Demand

APAC, LATAM, and MEA are witnessing rapid demand growth due to rising urbanization, increasing disposable incomes, and government health initiatives. Export-driven opportunities exist as high-demand regions such as North America and Europe continue to source supplements from emerging markets. Companies can capitalize by establishing local manufacturing and distribution networks to meet rising regional demand.

Product Type Insights

Nootropics and cognitive enhancers continue to dominate the product type segment, accounting for approximately 40% of global sales in 2025. Their leadership is primarily driven by the clinically validated benefits they offer in improving memory, focus, and mental clarity, which appeal strongly to working adults, students, and professionals seeking enhanced cognitive performance. Omega-3 and DHA-based supplements are gaining significant traction for their neuroprotective effects, particularly among seniors and individuals seeking long-term brain health support. Meanwhile, mood support supplements are increasingly integrated into wellness routines, targeting stress reduction and mental resilience in high-pressure environments. The growing interest in preventive healthcare, coupled with a rising emphasis on mental performance and overall well-being, reinforces the dominance of nootropics and cognitive enhancers as the preferred product category globally. Emerging natural and plant-based formulations within this segment further drive consumer adoption, aligning with increasing health-conscious preferences and premiumization trends in developed markets.

Form Insights

Capsules and tablets remain the most widely consumed forms of brain health supplements, holding a 55% market share in 2025. This leadership is fueled by their convenience, precise dosing, shelf stability, and widespread availability in pharmacies and retail outlets. Gummies, powders, and liquid formulations are experiencing rapid growth, especially among younger demographics and pediatric or geriatric populations, due to their palatability, ease of consumption, and innovative delivery formats. Powders and functional beverages are increasingly used in fitness and corporate wellness applications, while gummies appeal to lifestyle-conscious consumers seeking convenient, on-the-go solutions. The diversification of forms not only supports market expansion but also allows companies to target multiple age groups and lifestyle segments effectively, driving higher adoption rates across both developed and emerging markets.

Distribution Channel Insights

Pharmacies and drug stores remain the dominant distribution channel, capturing a 45% market share in 2025. Their leadership is underpinned by consumer trust, professional recommendations, and regulatory compliance, making them the go-to choice for reliable supplementation. However, online retail has emerged as the fastest-growing channel, accelerated by subscription-based and direct-to-consumer (D2C) models that allow for convenient access to premium global brands. Supermarkets, hypermarkets, and specialty health stores are also gaining relevance, particularly in urban areas, due to rising health awareness and the popularity of in-store promotions and experiential marketing. E-commerce platforms provide companies with the ability to offer personalized supplement bundles, loyalty programs, and educational content, enhancing customer engagement and repeat purchases. The combination of traditional trust channels and digital convenience is shaping the future distribution landscape of the brain health supplements market.

Age Group Insights

Adults aged 20–59 years account for the largest share of the brain health supplements market, approximately 50% in 2025. This demographic is driven by workplace stress, lifestyle-induced cognitive fatigue, and the desire for improved focus and mental performance. Seniors aged 60+ represent a key segment for neuroprotective and memory-enhancing supplements, motivated by aging concerns and prevention of cognitive decline. Children and teenagers are increasingly adopting products for academic performance, mental alertness, and concentration enhancement, particularly in Asia-Pacific and North America. Tailoring products and delivery formats for these age segments, such as liquid extracts for children or soft gels for seniors, is enhancing accessibility and driving market expansion across diverse demographic groups.

| By Product Type | By Form | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market for brain health supplements, contributing 42% of global sales in 2025. The USA dominates due to high consumer awareness of cognitive health, robust disposable incomes, and established regulatory frameworks that enable market trust. Canada also demonstrates strong demand, particularly among aging populations concerned with neuroprotection. The regional growth is fueled by multiple drivers: increasing workplace-related cognitive stress, rising preventive healthcare adoption, a growing fitness and wellness culture, and rapid e-commerce penetration, facilitating convenient access to supplements. Additionally, technological adoption, such as app-integrated dosage tracking and personalized nutrition plans, further supports product consumption. Pharmacies, wellness clinics, and direct-to-consumer channels continue to drive market penetration, while subscription-based online platforms strengthen repeat purchase behavior.

Europe

Europe accounts for 28% of global sales, with Germany, the UK, and France as the largest markets. Growth is driven by high preventive healthcare awareness, an aging population concerned with neuroprotection, and the increasing adoption of natural, plant-based, and functional supplements. Younger demographics are actively driving demand for functional powders, gummies, and liquid supplements, aligning with trends in convenience and lifestyle-focused wellness. E-commerce penetration and health-focused retail expansion facilitate easier access to premium and innovative products. Additionally, regulatory support, wellness campaigns, and government-backed nutritional programs encourage supplement adoption, while cross-border trade within the EU simplifies market entry for new products and fosters regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia, with a projected CAGR of 9.5% during 2025–2030. Drivers include rapid urbanization, rising disposable incomes, increasing health awareness, and strong adoption of preventive healthcare practices. Chinese consumers favor luxury and premium cognitive enhancement products, while Indian consumers drive growth in mid-range and locally manufactured supplements. Japan and Australia represent mature, steady-growth markets with high awareness of brain health and cognitive wellness. Additional growth factors include expanding e-commerce infrastructure, rising corporate wellness programs, educational campaigns for cognitive performance, and the increasing popularity of plant-based and natural formulations. Social media influence, digital marketing, and wellness influencer campaigns further accelerate adoption in this region.

Latin America

Latin America accounts for 6% of the global market, with Brazil and Mexico leading consumption. Regional growth is primarily driven by increasing disposable incomes, urbanization, rising health awareness, and the adoption of cognitive-enhancing supplements in educational and professional settings. Market expansion is further supported by culturally tailored marketing, localized product offerings, and a growing middle-class interest in wellness and preventive healthcare. Online retail penetration and educational campaigns highlighting brain health benefits are also fostering higher adoption rates, while niche players focus on family-oriented and convenient supplement formats to capture a broader demographic.

Middle East & Africa

MEA contributes 5% of the global market, with the UAE, Saudi Arabia, and South Africa driving premium supplement adoption. High-income populations, increasing awareness of mental wellness, and growing online retail penetration are key drivers. Corporate wellness initiatives, rising lifestyle-related cognitive stress, and the popularity of luxury and plant-based supplements further boost market growth. Government-led health programs and international collaborations for nutraceutical standards are also encouraging adoption, while affluent consumers show a strong preference for scientifically validated nootropics and cognitive enhancers, reinforcing the region’s growth trajectory.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|