Blueberry Pie Cream Market Size

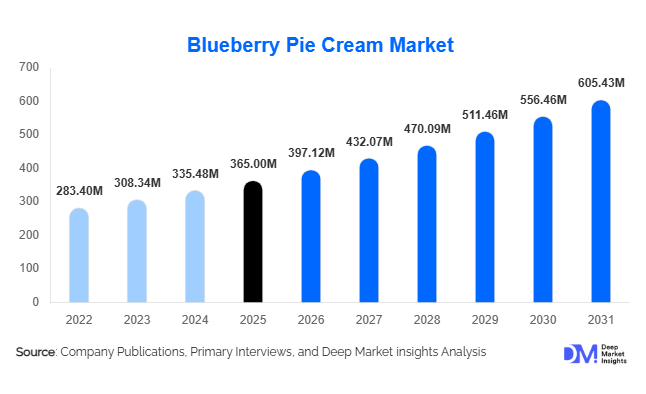

According to Deep Market Insights, the global blueberry pie cream market size was valued at USD 365 million in 2025 and is projected to grow from USD 397.12 million in 2026 to reach USD 605.43 million by 2031, expanding at a CAGR of 8.8% during the forecast period (2026–2031). The blueberry pie cream market growth is primarily driven by rising demand for premium bakery fillings, increasing consumption of fruit-based desserts, and the expansion of commercial bakeries and foodservice chains globally.

Key Market Insights

- Bakery applications dominate global demand, accounting for nearly half of total blueberry pie cream consumption due to widespread use in pies, pastries, muffins, and filled desserts.

- Ready-to-use blueberry pie cream leads by formulation, driven by operational convenience and consistent quality for commercial bakeries and foodservice operators.

- North America holds the largest market share, supported by strong bakery culture, premium dessert consumption, and established food processing infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, Westernization of diets, and rapid expansion of café and bakery chains.

- Clean-label and organic variants are gaining momentum, reflecting shifting consumer preferences toward natural ingredients and reduced artificial additives.

- Direct B2B distribution channels dominate, as manufacturers increasingly engage in long-term supply contracts with industrial food producers.

What are the latest trends in the blueberry pie cream market?

Shift Toward Clean-Label and Natural Formulations

One of the most prominent trends in the blueberry pie cream market is the shift toward clean-label, organic, and natural ingredient formulations. Food manufacturers are reformulating products to remove artificial colors, synthetic flavors, and preservatives while maintaining taste stability and shelf life. This trend is especially strong in North America and Europe, where regulatory scrutiny and consumer awareness are higher. Clean-label blueberry pie creams are increasingly used in premium bakery and private-label retail products, helping brands differentiate on health and transparency while commanding higher margins.

Application-Specific Product Innovation

Manufacturers are focusing on developing application-specific blueberry pie creams, such as baking-stable fillings, freeze-thaw-resistant creams, and beverage-compatible variants. Advances in emulsification and encapsulation technologies allow these creams to retain flavor integrity under high temperatures and extended storage. This trend supports growth across industrial baking, frozen desserts, and ready-to-eat food categories, enabling broader adoption across multiple end-use industries.

What are the key drivers in the blueberry pie cream market?

Expansion of Commercial Bakeries and Foodservice Chains

The global expansion of commercial bakeries, café chains, and quick-service restaurants is a major driver of blueberry pie cream demand. These establishments rely on consistent, scalable, and high-quality filling solutions to meet standardized taste and texture requirements. Blueberry pie cream offers versatility across seasonal menus and limited-edition desserts, making it a preferred ingredient for foodservice innovation.

Growing Preference for Fruit-Based Indulgent Desserts

Consumers are increasingly favoring fruit-based dessert flavors over purely chocolate or caramel profiles, perceiving them as lighter and more premium. Blueberry, in particular, benefits from its association with natural sweetness and antioxidant properties. This perception supports higher consumption of blueberry pie cream in both bakery and dairy dessert applications, driving sustained market growth.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of dairy inputs and blueberry concentrates pose a significant challenge for manufacturers. Seasonal variability in blueberry supply and changes in milk prices directly impact production costs, creating margin pressure and pricing uncertainty across the value chain.

Shelf-Life Constraints for Natural Products

Clean-label and organic blueberry pie creams typically have shorter shelf lives due to reduced preservative content. This increases dependence on cold-chain logistics and raises the risk of product wastage, particularly in emerging markets with less developed distribution infrastructure.

What are the key opportunities in the blueberry pie cream industry?

Rising Demand in Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East present significant growth opportunities as Western-style bakeries and dessert formats gain popularity. Increasing disposable incomes, urban lifestyles, and exposure to global food trends are driving demand for premium dessert ingredients, including blueberry pie cream.

Private-Label and Contract Manufacturing Growth

The rapid expansion of private-label bakery and dessert products by retailers is creating new opportunities for blueberry pie cream suppliers. Long-termional-ice-cream supply agreements and customized formulations for private-label brands allow manufacturers to secure stable revenue streams and scale production efficiently.

Product Type Insights

Ready-to-use blueberry pie cream dominates the global market, accounting for approximately 42% of total demand. This leadership is primarily driven by its ease of application, uniform texture, and consistent flavor profile, which reduce preparation time and operational complexity for commercial bakeries and foodservice operators. The growing preference for convenience ingredients in high-volume production environments further strengthens demand for ready-to-use formats.

Concentrated and powdered blueberry pie cream variants are widely preferred in industrial-scale manufacturing, where cost efficiency, extended shelf life, and reduced storage and transportation requirements are critical. These formats allow manufacturers greater flexibility in formulation and dosage control, making them particularly suitable for packaged baked goods and private-label production.

Application Insights

Bakery applications represent the largest share of the blueberry pie cream market, driven by strong global consumption of pies, tarts, danishes, turnovers, and filled pastries. The leading growth driver for this segment is the sustained demand for premium and fruit-based bakery offerings, particularly in artisanal, in-store, and café-style bakeries.

Dairy desserts, including cheesecakes, yogurts, parfaits, and layered desserts, form the second-largest application segment. Growth in this category is supported by increasing consumer preference for indulgent yet fruit-forward dessert options and the integration of blueberry flavors into premium dairy formulations.

Distribution Channel Insights

Direct B2B sales dominate the global distribution landscape, accounting for more than half of total market revenue. This channel is favored by large commercial bakeries and industrial food manufacturers seeking consistent supply, customized formulations, and long-term supplier partnerships.

Foodservice distributors and specialty ingredient suppliers play a critical role in supporting regional bakeries, café chains, and mid-sized foodservice operators. These intermediaries enable broader market access and localized distribution, particularly in emerging economies.Online B2B platforms are gradually gaining traction, especially among small-batch producers, specialty bakeries, and premium dessert brands. Digital procurement offers flexibility, transparency, and access to niche and customized blueberry pie cream products.

End-Use Industry Insights

Commercial bakeries represent the largest end-use segment, driven by high-volume production of fruit-filled baked goods and increasing demand for standardized, ready-to-use fillings. Operational efficiency and consistent quality remain the primary purchasing drivers in this segment.

Foodservice and HoReCa operators form the second-largest segment, supported by menu diversification, premium dessert offerings, and the growing influence of café culture across urban markets.Industrial food manufacturers are a fast-growing end-use segment, fueled by rising production of packaged baked goods, frozen desserts, and private-label products. The key growth driver is the need for scalable, shelf-stable, and cost-effective fruit fillings that support mass production without compromising taste or appearance.

| By Product Formulation | By Nature | By Functionality | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global blueberry pie cream market, led by the United States. Strong bakery consumption, high penetration of premium and indulgent desserts, and a well-established food processing infrastructure support sustained demand.

Key regional growth drivers include high consumer awareness of berry-based flavors, strong seasonal demand for pies and desserts, and continuous innovation in frozen and ready-to-eat bakery products.

Europe

Europe holds around 28% of the global market share, with Germany, France, and the U.K. driving demand. The region benefits from deeply rooted artisanal bakery traditions and a strong emphasis on quality and authenticity.

Growth is further supported by increasing adoption of clean-label, natural fruit-based ingredients, rising premium dessert consumption, and expanding private-label bakery offerings across major retail chains.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market, led by China, Japan, and India. Rapid urbanization, rising disposable incomes, and growing exposure to Western-style desserts are accelerating market expansion.

Key growth drivers include the rapid expansion of café culture, increasing number of urban bakeries, and rising demand for premium and visually appealing dessert products among younger consumers.

Latin America

Latin America is an emerging market for blueberry pie cream, with Brazil and Mexico showing increasing demand for premium bakery fillings.

Regional growth is driven by urbanization, evolving consumer preferences toward indulgent desserts, and the gradual modernization of bakery and foodservice sectors.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing growing demand due to the rapid expansion of premium foodservice outlets, international bakery chains, and luxury hospitality projects.

In Africa, the market remains comparatively smaller but is gradually developing, supported by improving food retail infrastructure, increasing urban populations, and growing interest in Western-style baked goods.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Blueberry Pie Cream Market

- Kerry Group

- ADM

- Cargill

- Tate & Lyle

- Puratos

- Ingredion

- Barry Callebaut

- Sensient Technologies

- IFF

- Döhler

- Corbion

- Symrise

- Mane

- Givaudan

- Flavorchem