Black Soldier Fly Market Size

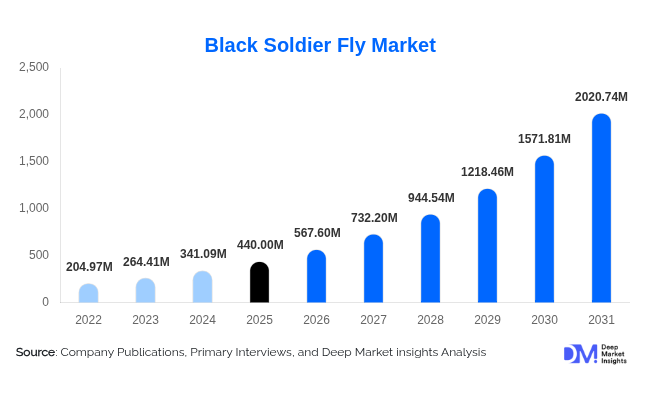

According to Deep Market Insights, the global black soldier fly market size was valued at USD 440.00 million in 2025 and is projected to grow from USD 567.60 million in 2026 to reach USD 2,020.74 million by 2031, expanding at a CAGR of 29.0% during the forecast period (2026–2031). The Black Soldier Fly market growth is primarily driven by the rising demand for sustainable alternative proteins, increasing pressure to reduce organic waste, and growing adoption of insect-based ingredients across animal feed, pet food, and organic agriculture industries.

Key Market Insights

- BSF protein meal dominates the product mix, accounting for over half of total market revenue due to strong demand from aquaculture and poultry feed manufacturers.

- Animal feed remains the largest application segment, supported by global fishmeal shortages and rising aquaculture production.

- Europe leads the global market, driven by regulatory approvals, industrial-scale facilities, and strong circular economy policies.

- Asia-Pacific is the fastest-growing region, fueled by feed protein deficits, rapid aquaculture expansion, and abundant organic waste availability.

- Midstream processing and extraction capture the highest value share, as refined protein and oil command premium pricing.

- Technological automation and vertical integration are becoming key competitive differentiators among leading producers.

What are the latest trends in the Black Soldier Fly market?

Industrial-Scale Insect Farming and Automation

The BSF market is witnessing a rapid transition from pilot-scale operations to fully industrialized production facilities. Automated larvae harvesting systems, AI-driven climate control, and precision feeding technologies are improving yield consistency and reducing labor dependency. Large-scale plants with annual capacities exceeding 50,000 tons are becoming more common, particularly in Europe and North America. This trend is enabling cost reductions, standardized quality, and long-term supply agreements with multinational feed and pet food companies, accelerating mainstream adoption of BSF-derived ingredients.

Expansion into Premium Pet Food and Specialty Nutrition

BSF ingredients are increasingly being incorporated into premium and hypoallergenic pet food formulations. Pet food brands are leveraging insect protein’s sustainability credentials and digestibility benefits to target environmentally conscious consumers. This trend is particularly strong in Europe and North America, where insect-based pet food has moved beyond niche positioning into mainstream retail channels. Specialized formulations for dogs, cats, and exotic pets are contributing to higher margins compared to bulk animal feed applications.

What are the key drivers in the Black Soldier Fly market?

Rising Demand for Sustainable Feed Proteins

Global shortages and price volatility of traditional feed proteins such as fishmeal and soybean meal are driving adoption of BSF protein. Black Soldier Fly larvae provide a high-protein, low-carbon alternative that can be produced locally using organic waste streams. Feed manufacturers are increasingly incorporating BSF protein to improve supply security, reduce environmental impact, and comply with sustainability commitments, making this a primary growth driver for the market.

Regulatory Support and Circular Economy Policies

Supportive regulatory frameworks have played a critical role in unlocking commercial demand for BSF products. Approvals for insect-based feed ingredients across aquaculture, poultry, and pet food applications in Europe and North America have transformed BSF into a viable industrial input. At the same time, government-led circular economy initiatives encouraging waste valorization are directly benefiting BSF producers that utilize food and agricultural waste as feedstock.

What are the restraints for the global market?

High Capital Expenditure Requirements

Establishing industrial-scale BSF facilities requires significant upfront investment in automation, biosecurity systems, and processing infrastructure. Capital intensity remains a barrier for new entrants, particularly in regions with limited access to long-term financing. Without secured off-take agreements, payback periods can be extended, slowing capacity expansion in emerging markets.

Regulatory Fragmentation Across Regions

While regulatory acceptance of BSF products has improved, standards related to feedstock use, labeling, and biosecurity vary significantly by country. This fragmentation increases compliance complexity for companies operating across multiple regions and can delay market entry in countries with less-defined regulatory frameworks.

What are the key opportunities in the Black Soldier Fly industry?

Municipal Waste-to-Value Partnerships

Growing pressure on municipalities to divert organic waste from landfills presents a major opportunity for BSF producers. Long-term contracts with cities and food processors provide stable feedstock supply while enabling governments to meet waste reduction targets. These partnerships improve project economics and strengthen the role of BSF farming within urban circular economy models.

Vertical Integration and Co-Product Monetization

Producers that integrate BSF farming with downstream processing and formulation are capturing higher margins by monetizing multiple outputs, including protein meal, oil, and frass-based fertilizers. Refined BSF oil for bioenergy and pelletized frass for organic agriculture are emerging as high-potential revenue streams that enhance overall profitability and resilience.

Product Type Insights

BSF protein meal is the dominant product type, accounting for approximately 52% of the global market in 2025. Its high protein content and favorable amino acid profile make it particularly suitable for aquaculture and poultry feed. BSF oil represents a growing segment, driven by its application in animal nutrition and emerging interest as a biofuel feedstock. Whole and dried larvae continue to find demand in niche feed and pet food markets, while BSF frass is gaining traction as an organic fertilizer in sustainable agriculture.

Application Insights

Animal feed remains the largest application segment, representing over 60% of total market demand, with aquaculture as the leading sub-segment. Pet food is the fastest-growing application, supported by premiumization trends and consumer interest in sustainable nutrition. Organic fertilizers derived from BSF frass are increasingly adopted in horticulture and specialty crops, while industrial applications such as biodiesel feedstock remain at an early but promising stage.

End-Use Industry Insights

Commercial feed manufacturers are the primary end users, driven by bulk procurement volumes and long-term supply contracts. Pet food manufacturers represent a high-growth, high-margin segment, while organic farming and horticulture users are driving demand for BSF frass. Bioenergy and industrial chemical companies are emerging end users, particularly in regions promoting renewable fuel development.

| By Product Form | By Application | By End-Use Industry | By Feedstock Source |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 38% of the global BSF market in 2025, led by France, the Netherlands, Germany, and the U.K. Strong regulatory clarity, public funding for circular bioeconomy projects, and large-scale industrial facilities have positioned Europe as the global leader in BSF production and consumption.

Asia-Pacific

Asia-Pacific represents around 32% of the market and is the fastest-growing region. China, Indonesia, Vietnam, and Thailand are key demand centers, supported by rapid aquaculture expansion, feed protein shortages, and abundant organic waste availability. China is the fastest-growing country, with growth exceeding 23% CAGR.

North America

North America holds roughly 18% market share, driven by demand from aquaculture and premium pet food segments in the U.S. and Canada. Investment in automation and sustainability-focused feed solutions is supporting steady growth.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growth is supported by expanding livestock and aquaculture industries, although commercial-scale adoption remains in early stages.

Middle East & Africa

This region accounts for about 12% of the global market, with South Africa, Kenya, and the UAE emerging as regional hubs. Abundant organic waste and favorable climates support long-term growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Black Soldier Fly Market

- Innovafeed

- Protix

- Ynsect

- Aspire Food Group

- EnviroFlight

- Nutrition Technologies

- Hexafly

- Entocycle

- Agriprotein

- Beta Hatch

- Enterra Feed

- NextProtein

- Protenga

- BioFlyTech

- Amusca