Black Alkaline Water Market Size

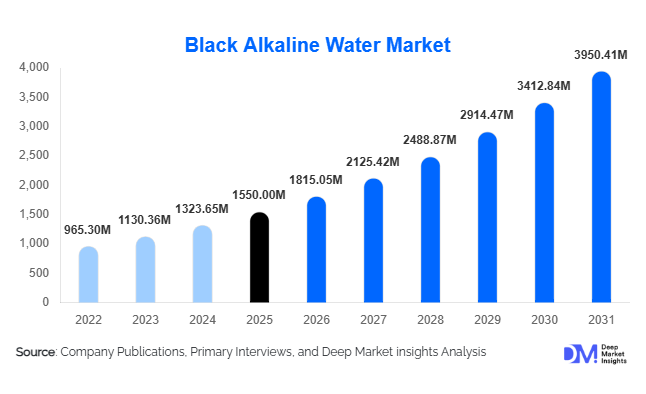

According to Deep Market Insights, the global black alkaline water market size was valued at USD 1,550.00 million in 2025 and is projected to grow from USD 1,815.05 million in 2026 to reach USD 3,950.41 million by 2031, expanding at a CAGR of 17.1% during the forecast period (2026–2031). The black alkaline water market growth is driven by rising health consciousness, increasing demand for premium functional beverages, and the growing influence of wellness-oriented lifestyles among millennials and Gen Z consumers. The market benefits from strong premiumization trends within the bottled water and functional beverage industries, supported by visually distinctive branding and perceived detoxification benefits.

Key Market Insights

- Black alkaline water is emerging as a premium functional hydration product, positioned at the intersection of wellness, detox, and lifestyle branding.

- Activated charcoal–infused formulations dominate the product landscape, accounting for the majority of consumer preference due to detox-related perceptions.

- North America leads global demand, supported by high disposable income, fitness culture, and strong penetration of premium bottled water brands.

- Asia-Pacific is the fastest-growing regional market, driven by urban wellness trends and expanding middle-class consumption in China and India.

- E-commerce and direct-to-consumer channels are transforming distribution, enabling subscription-based models and influencer-led brand growth.

- Sustainable packaging and clean-label positioning are becoming critical differentiators for premium brands.

What are the latest trends in the black alkaline water market?

Premium Functional Beverage Positioning

The black alkaline water market is increasingly aligning with the broader premium functional beverage trend. Brands are positioning products not just as hydration solutions, but as wellness enhancers that support detoxification, digestive balance, and improved hydration efficiency. Sleek packaging, minimalist labeling, and high-contrast black aesthetics are reinforcing the premium image. Consumers are willing to pay significantly higher prices compared to conventional bottled water, particularly in fitness centers, boutique hotels, and specialty wellness retail outlets. This trend is strengthening brand loyalty and driving higher margins for established players.

Growth of Digital-First and DTC Brands

Digital-native brands are reshaping market dynamics through direct-to-consumer strategies, social media marketing, and influencer partnerships. Online platforms enable brands to educate consumers about product benefits, promote lifestyle narratives, and offer subscription-based delivery models. This approach is particularly effective among younger demographics who prioritize convenience, transparency, and brand storytelling. Data-driven personalization, loyalty programs, and limited-edition product launches are further enhancing customer engagement and repeat purchases.

What are the key drivers in the black alkaline water market?

Rising Health and Detox Awareness

Growing awareness around gut health, detoxification, and acid-alkaline balance is a primary driver of the black alkaline water market. Consumers increasingly associate alkaline water with reduced acidity and improved hydration, while activated charcoal is perceived as a natural detoxifying agent. This combination has resonated strongly with wellness-focused consumers, fitness enthusiasts, and individuals adopting preventive healthcare practices. The shift toward daily functional hydration is supporting sustained demand growth.

Premiumization of Bottled Water

The bottled water industry is undergoing rapid premiumization, with consumers seeking differentiated products that offer functional benefits and aesthetic appeal. Black alkaline water fits squarely within this trend, offering a visually distinctive alternative to traditional clear bottled water. Premium pricing, limited-edition packaging, and curated brand experiences are driving higher average selling prices and improving profitability for manufacturers.

What are the restraints for the global market?

High Production and Pricing Constraints

Black alkaline water production involves higher costs due to advanced filtration, mineral balancing, charcoal infusion, and premium packaging materials. These costs translate into higher retail prices, which can limit adoption in price-sensitive markets. In developing regions, consumers may perceive black alkaline water as a luxury rather than a necessity, constraining volume growth.

Regulatory and Scientific Scrutiny

Health-related claims associated with alkaline water and activated charcoal are subject to regulatory scrutiny in several markets. Limited clinical validation of certain benefits can restrict marketing language and require compliance investments. Regulatory inconsistencies across regions also pose challenges for global brand expansion and cross-border trade.

What are the key opportunities in the black alkaline water industry?

Expansion in Asia-Pacific Wellness Markets

Asia-Pacific represents a major growth opportunity, supported by rising urbanization, growing disposable incomes, and increasing adoption of Western wellness trends. Markets such as China, India, Japan, and South Korea are witnessing rapid growth in premium beverage consumption. Localized manufacturing, region-specific branding, and partnerships with e-commerce platforms can significantly accelerate market penetration.

Sustainable Packaging and ESG Alignment

Increasing regulatory and consumer emphasis on sustainability presents opportunities for brands to differentiate through eco-friendly packaging. Aluminum cans, recyclable PET, and glass bottles are gaining traction. Brands that align with ESG principles and carbon-neutral initiatives are likely to gain stronger acceptance in Europe and North America, while also enhancing long-term brand equity.

Product Type Insights

Activated charcoal–infused black alkaline water dominates the market, accounting for approximately 52% of global market share in 2025. This segment leads due to strong consumer association with detoxification and digestive health benefits. Mineral-based black alkaline water represents a significant share, supported by demand for electrolyte balance and trace mineral intake. Electrolyte-enhanced formulations are the fastest-growing sub-segment, particularly among athletes and fitness enthusiasts seeking performance hydration solutions.

Packaging Type Insights

PET bottles remain the most widely used packaging format, contributing nearly 48% of total market revenue in 2025 due to cost efficiency and convenience. However, aluminum cans are witnessing the fastest growth, driven by sustainability concerns and premium positioning. Glass bottles maintain a niche presence in hospitality and ultra-premium retail channels, where aesthetics and brand perception are critical.

Distribution Channel Insights

Supermarkets and hypermarkets account for around 35% of global sales, benefiting from high foot traffic and impulse purchasing. Online and direct-to-consumer channels are expanding rapidly, supported by subscription models and influencer marketing. Specialty health and wellness stores play a key role in consumer education and premium brand discovery, particularly in developed markets.

End-Use Insights

Individual consumers dominate the black alkaline water market, accounting for nearly 70% of total demand in 2025. This segment is driven by daily hydration needs and lifestyle adoption. Athletes and sports nutrition users represent the fastest-growing end-use segment, supported by the global sports nutrition industry growth of approximately 8–9% annually. Hospitality and foodservice demand is expanding steadily, particularly in premium hotels, spas, and wellness retreats.

| By Product Type | By Packaging Type | By Distribution Channel | By Price Tier | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global black alkaline water market with an estimated 38% share in 2025. The United States dominates regional demand due to strong health awareness, high disposable income, and widespread availability of premium bottled water brands. Canada also contributes steadily, driven by wellness-oriented urban consumers.

Europe

Europe accounts for approximately 22% of the global market share, led by Germany, the United Kingdom, and France. Demand is supported by clean-label preferences, sustainability awareness, and growing adoption of functional beverages. Regulatory emphasis on packaging sustainability is shaping product innovation across the region.

Asia-Pacific

Asia-Pacific represents around 27% of global demand and is the fastest-growing region, expanding at a CAGR of over 13%. China and India are key growth engines, driven by urban wellness trends, expanding e-commerce penetration, and rising disposable incomes. Japan and South Korea show steady demand for premium and functional hydration products.

Latin America

Latin America holds a smaller but growing share of the market, led by Brazil and Mexico. Increasing health awareness and gradual premiumization of beverages are supporting long-term growth, although price sensitivity remains a limiting factor.

Middle East & Africa

The Middle East & Africa region is witnessing emerging demand, particularly in the UAE and South Africa. High-income consumers, luxury hospitality demand, and expanding fitness culture are contributing to market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Black Alkaline Water Market

- Essentia Water

- blk. Water

- Flow Beverage Corp

- Waiakea

- PathWater

- Icelandic Glacial

- Eternal Water

- VOSS Water

- Evian (Danone)

- San Pellegrino (Nestlé)

- LIFEWTR

- Smartwater

- JUST Water

- Core Hydration

- Aqua Hydrate