Biodegradable Diapers Market Size

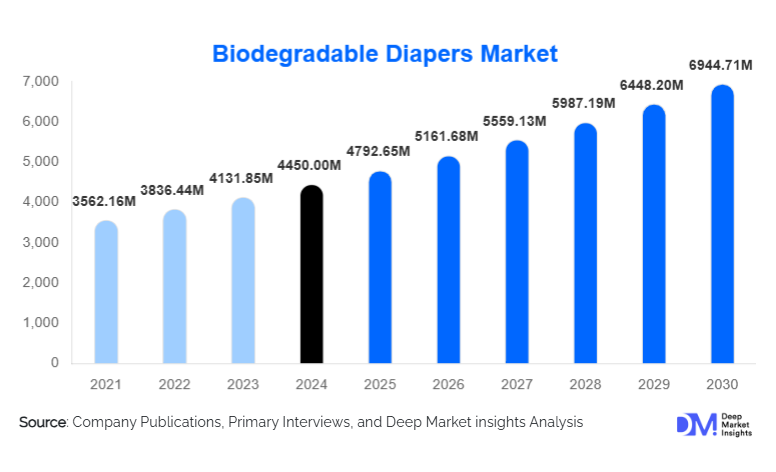

According to Deep Market Insights, the global biodegradable diapers market size was valued at USD 4,450.00 million in 2024 and is projected to grow from USD 4,792.65 million in 2025 to reach USD 6,944.71 million by 2030, expanding at a CAGR of 7.7% during the forecast period (2025–2030). The biodegradable diapers market growth is primarily driven by rising environmental awareness among parents, increasing pressure to reduce landfill waste, and rapid advancements in bio-based absorbent materials that closely match the performance of traditional disposable diapers.

Key Market Insights

- Biodegradable diapers are gaining mass-market acceptance due to concerns about conventional diapers contributing to long-term plastic pollution.

- Material innovation, particularly in bamboo fiber, PLA, and bio-based SAP, is enhancing absorbency, comfort, and biodegradation rates.

- Europe dominates global demand due to strict sustainability mandates and the wide adoption of compostable consumer goods.

- Asia-Pacific is the fastest-growing region, supported by high birth rates, rising disposable incomes, and expanding e-commerce distribution.

- North America demonstrates strong premium-segment growth, with parents prioritizing organic, hypoallergenic materials.

- Brands are adopting subscription-based D2C models, improving consumer retention and product accessibility.

What are the latest trends in the biodegradable diapers market?

Shift Toward Fully Compostable Material Systems

Manufacturers are transitioning from partially biodegradable diapers to fully compostable designs using PLA films, PHA-based linings, and bamboo-fiber topsheets. Certification programs such as OK Compost Home, FSC, and BPI Compostable are becoming standard requirements for premium brands. This trend is reinforced by government-backed waste-reduction policies and rising consumer expectations for authentic, eco-friendly products. Compostable diaper pickup services are also emerging in North America and Europe, enabling closed-loop waste solutions and boosting adoption among environmentally conscious families.

Technological Advancements in Bio-Absorbent Performance

New-generation bio-based super absorbent polymers (Bio-SAP) are dramatically improving moisture retention and leak protection. Many brands now offer biodegradable diapers with comparable absorbency to conventional petroleum-based SAP. Breathable back sheets, odor-neutralizing natural fibers, and advanced plant-based adhesives are further enhancing product performance. Integrated sensor patches, used to detect moisture levels, are being tested in premium eco-diaper lines, reflecting the rising overlap between sustainability and smart baby-care technologies.

What are the key drivers in the biodegradable diapers market?

Growing Environmental Awareness Among Parents

Heightened public concern about plastic waste and microplastics is pushing families toward sustainable baby-care products. With conventional diapers taking up to 500 years to decompose, demand is rapidly shifting to biodegradable alternatives that break down significantly faster. Parents increasingly seek brands that publish transparent sustainability reports and use traceable organic materials. This shift is especially strong among millennial and Gen-Z consumers.

Increasing Birth Rates in Developing Economies

Emerging markets such as India, Indonesia, Nigeria, and the Philippines contribute a major share of global births annually. As disposable incomes rise and modern retail formats expand, biodegradable diapers are entering mainstream distribution channels. Manufacturers who localize production and reduce import reliance gain cost advantages, accelerating adoption in high-population nations.

What are the restraints for the global market?

High Price Points Compared to Traditional Diapers

Biodegradable diapers cost 30–60% more than conventional diapers due to premium materials and specialized production processes. This cost barrier restricts adoption in price-sensitive markets and limits penetration among middle- and lower-income families. Raw material volatility, especially in bio-polymers, adds upward pricing pressure, challenging brands to balance sustainability with affordability.

Lack of Composting Infrastructure

Despite being compostable, many regions lack proper industrial composting facilities. This reduces the environmental benefits consumers seek, weakening value perception. In markets without compost collection systems, parents may hesitate to pay a premium for diapers that cannot be disposed of sustainably. Improved infrastructure and municipal programs are critical to unlocking full market value.

What are the key opportunities in the biodegradable diapers industry?

Government-Backed Sustainability Policies

Countries implementing landfill bans, single-use plastic restrictions, and EPR (Extended Producer Responsibility) laws are fueling demand for biodegradable diaper alternatives. Brands aligning with national sustainability programs gain early mover advantages, preferred procurement status, and access to public funding for green innovation. Europe and parts of APAC are emerging as regulatory hotspots that will shape global product standards.

Material Innovation and Technology Integration

Bio-material advancements, such as next-gen PLA films, biodegradable SAP, and high-performance bamboo fibers, are closing the performance gap between eco-friendly and conventional diapers. Manufacturers investing in R&D can capture premium markets with superior absorption, odor control, and breathability. Smart diapers with integrated sensors represent a future opportunity, merging sustainability with digital parenting solutions for health monitoring.

Product Type Insights

Disposable biodegradable diapers dominate the market, accounting for 74% of the global share in 2024. This segment’s leadership is driven by daily-use convenience, broad retail penetration, and consistent improvements in bio-based material performance. Fully biodegradable diapers are the fastest-growing subcategory, supported by stringent European regulations and rising demand for compostable consumer goods. Training pants and swim pants represent smaller yet expanding segments aligned with the premium eco-friendly baby-care trend.

Application Insights

Household consumption represents over 88% of global demand, positioning parents as the primary adopters of sustainable diapers. Daycare centers are the fastest-growing application segment, with a projected CAGR of 15% as facilities adopt eco-friendly operations. Hospitals and maternity centers increasingly prefer biodegradable diapers for sensitive newborn skin and sustainability commitments. NGOs and relief organizations are adopting compostable diapers for humanitarian missions, particularly in regions facing waste-management challenges.

Distribution Channel Insights

Online retail channels, comprising e-commerce marketplaces and direct-to-consumer subscription platforms, make up 38% of total 2024 sales. Parents prefer online models for convenience, recurring deliveries, and access to niche eco-brands. Offline channels such as supermarkets and baby stores remain essential for mass-market awareness, especially in emerging regions. Brands are investing heavily in digital engagement, influencer marketing, and sustainability storytelling to differentiate themselves online.

Age Group Insights

Infants aged 6–12 months represent the largest demographic segment with 41% of market demand due to high daily diaper usage. Newborns account for strong adoption of premium hypoallergenic diapers. Toddler and special-needs diapers are niche but steadily growing segments driven by expanding product variety and custom-fit compostable designs.

| By Product Type | By Material Composition | By Age Group | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America contributes 28% of global biodegradable diaper revenue, led by the United States. High awareness of plastics pollution and strong adoption of organic baby products support the market. Canada is among the fastest-growing subregions due to robust composting programs and rising eco-conscious parenting trends.

Europe

Europe is the largest market with a 32% share in 2024. Countries such as Germany, France, the U.K., and the Nordic region enforce strict compostability standards and support circular economy initiatives. High institutional adoption in hospitals and daycare centers strengthens regional demand.

Asia-Pacific

APAC is the fastest-growing market (CAGR 15–17%). China leads regional consumption, followed by Japan, South Korea, India, and Indonesia. Growth is driven by population density, rising incomes, and expanding online retail ecosystems. Local manufacturing investments are accelerating cost reductions.

Latin America

Brazil and Mexico dominate regional demand. Adoption is supported by expanding middle-class populations and increasing availability of imported eco-friendly diapers. Sustainable baby-care brands are partnering with large retail chains to penetrate the region.

Middle East & Africa

MEA shows steady adoption, particularly in the UAE, Saudi Arabia, and South Africa. Growing awareness of sustainable consumer goods and expanding premium retail formats are supporting biodegradable diaper sales. Nigeria and Kenya represent emerging long-term opportunity zones due to large birth rates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Biodegradable Diapers Market

- Procter & Gamble

- Unicharm Corporation

- Kimberly-Clark

- Essity AB

- Ontex Group

- The Honest Company

- Naty AB (Eco by Naty)

- Dyper Inc.

- Seventh Generation

- GroVia

- Babyganics

- Bambo Nature (Abena)

- Earth & Eden

- Bumkins

- Biobaby