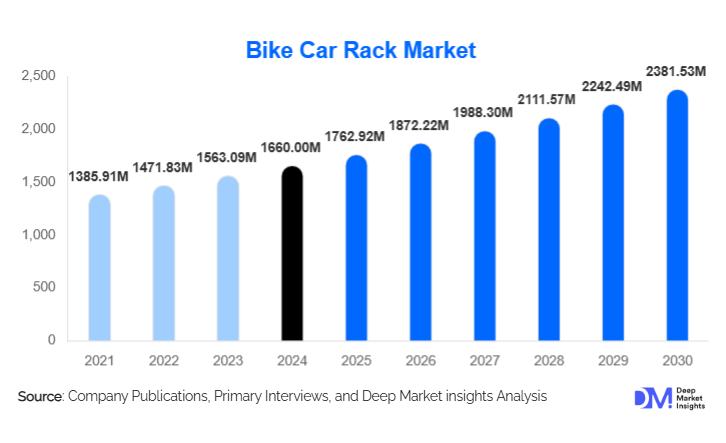

Bike Car Rack Market Size

According to Deep Market Insights, the global bike car rack market size was valued at USD 1,660.00 million in 2024 and is projected to grow from USD 1,762.92 million in 2025 to reach USD 2,381.53 million by 2030, expanding at a CAGR of 6.20% during the forecast period (2025–2030). Market growth is supported by rising global bicycle adoption, increasing popularity of e-bikes that require heavy-duty racks, and growing participation in outdoor recreation, cycle tourism, and weekend adventure activities. Improvements in materials, rack designs, and installation mechanisms are further propelling aftermarket demand, while OEM partnerships with automakers are gradually expanding the market’s structural base.

Key Market Insights

- Hitch-mounted bike racks dominate global market adoption due to superior stability, high load capacity, and compatibility with SUVs and crossover vehicles.

- E-bike usage is creating new demand for heavy-duty racks capable of handling 30–40+ kg loads, boosting premium rack sales.

- Aluminium-based racks lead material preferences as consumers seek lightweight, corrosion-resistant, durable designs.

- The aftermarket channel accounts for nearly 70–75% of sales, supported by e-commerce expansion and DIY installation trends.

- North America holds the largest market share (about 35–40% in 2024), driven by a strong outdoor recreation ecosystem and high SUV ownership.

- Asia-Pacific remains the fastest-growing regional market, fueled by rising car ownership, expanding cycling culture, and affordability-driven rack adoption.

- Technological innovation, including modular tray systems, built-in locks, and smart security integrations, is reshaping premium product offerings.

What are the latest trends in the bike car rack market?

Growth in E-Bike-Compatible & Heavy-Duty Racks

The rapid global growth of the e-bike market is reshaping design priorities in the bike car rack industry. Many e-bikes weigh between 25–35 kg, significantly more than traditional bicycles. This has led manufacturers to introduce heavy-duty hitch and tray racks engineered for higher load ratings, reinforced clamping systems, and vibration-dampening structures. The trend is also pushing innovation in materials, with aluminium alloys, composite arms, and improved locking mechanisms becoming standard in upper-tier products. The willingness of consumers to pay premium prices for secure transport solutions is accelerating the shift toward high-value, load-flexible rack systems. This trend is expected to remain a defining catalyst for product development through the decade.

Technology-Enhanced Mounting and Smart Security Features

Modern bike racks are integrating advanced technologies that improve ease of installation, security, and user experience. Smart locking systems, integrated LED indicators, and anti-theft sensors are emerging in premium models. Digital apps for installation support, compatibility mapping, and maintenance alerts are being adopted by top brands. Tray-style racks now incorporate adjustable wheel cradles, tool-free tightening systems, and foldable frames for compact storage. For online buyers, AR-based vehicle compatibility tools and AI-guided installation assistants are improving purchase confidence. These technology layers are attracting younger, tech-engaged cyclists and expanding the market for high-end racks.

What are the key drivers in the bike car rack market?

Growing Outdoor Recreation and Adventure Cycling

The surge in outdoor activities, including mountain biking, gravel riding, trekking, and recreational short-haul travel, is a major market driver. Families, cycling clubs, and travel enthusiasts increasingly transport bicycles for weekend trips and vacations, fueling demand for versatile car-mounted racks. This aligns with the rise in adventure tourism and broader global health-conscious behaviour trends. In regions with national parks and trail networks, such as North America and Europe, demand is particularly strong for high-capacity racks.

Expansion of the E-Bike Market

E-bikes have become one of the fastest-growing segments in global mobility, and their increased adoption has sharply boosted the need for sturdy, high-load racks. Traditional trunk or roof racks are often inadequate for the weight of e-bikes, resulting in higher demand for hitch-mounted and tray-style systems. This shift has boosted average selling prices and expanded the premium segment of the rack industry. As urban mobility transitions to electric bicycles, the rack market is experiencing a corresponding surge in innovation and replacement demand.

Advancements in Lightweight Materials and Easy-Mount Designs

Manufacturers are increasingly using corrosion-resistant aluminium, reinforced composites, and ergonomic quick-mount systems to improve user-friendliness and product durability. Tool-free installation, foldable arms, adjustable wheel trays, and universal vehicle fitments are driving higher consumer adoption, especially among new cyclists and casual riders.

What are the restraints for the global market?

Vehicle Compatibility and Installation Challenges

Not all rack types fit all vehicles, and variations in bumper shapes, roof load limits, and hitch receiver standards create compatibility concerns. The added complexity of installing certain rack types, especially roof or permanent systems, discourages many first-time buyers. In addition, poor installation can lead to potential damage to vehicles or bicycles, raising consumer hesitation in price-sensitive markets.

High Costs of Premium Racks and Raw Materials

Advanced racks designed for e-bikes or multi-bike transport are relatively expensive due to their engineering, materials, and safety features. Price sensitivity in emerging markets limits the adoption of premium racks, creating a barrier for manufacturers targeting global expansion. Further, fluctuations in aluminium and steel prices affect production costs and final retail prices, impacting margins across the supply chain.

What are the key opportunities in the bike car rack industry?

Heavy-Duty & E-Bike-Specific Rack Expansion

The strong global expansion of the e-bike market presents long-term opportunities for rack manufacturers to introduce heavy-load, reinforced, and electric-assist compatible racks. With e-bike sales growing rapidly in North America, Europe, and China, specialised racks with 40+ kg load capacity and secure wheel clamps will become core revenue contributors. Brands capable of designing racks tailored to cargo e-bikes, folding e-bikes, and premium mountain e-bikes will capture high-margin niche segments.

Growth in E-Commerce and Direct-to-Consumer Channels

Online retail is reshaping the aftermarket landscape. Consumers increasingly compare product specs, watch installation tutorials, and read compatibility reviews before purchasing. Brands adopting direct-to-consumer models can gain higher margins, build stronger customer relationships, and bypass retail intermediaries. This opportunity is especially significant for new players offering affordable, modular rack systems targeting millennials and first-time buyers.

Expansion into High-Growth Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East present untapped potential due to rising urbanisation, growing car ownership, and expanding cycling culture. Affordable rack solutions, combined with localised manufacturing under programs like “Make in India,” can reduce import costs and expand access. Market entrants focusing on tailored designs for smaller cars or scooters with rack systems can unlock significant volume demand in these emerging regions.

Product Type Insights

Hitch-mounted racks dominate the global market, driven by their superior load capacity and compatibility with SUVs, crossovers, and vans. These racks hold approximately 35–40% of the global market in 2024. Roof-mounted racks appeal to sport and fitness cyclists seeking secure, aerodynamic transport but require higher installation effort. Trunk-mounted racks remain popular in budget-conscious markets due to affordability and universal fitment, but lack the load strength required for e-bikes. Spare-tire and pickup-bed racks serve niche sports utility vehicles (SUVs) and truck owners. As consumer focus shifts toward e-bikes, hitch-mounted and tray-style racks are expected to expand their share through 2030.

Application Insights

Recreational cycling remains the dominant application, with families, hobbyists, and travel groups forming the core user base. E-bike transportation is the fastest-growing application due to rising urban mobility trends and the premium nature of electric bicycles. Commercial operators, including tourism companies, bike-rental services, and adventure sports operators, contribute to stable demand for durable, high-capacity racks. Emerging applications include multimodal commuting, micro-mobility integration, and logistics use cases for bike-delivery operations.

Distribution Channel Insights

The aftermarket channel leads the market, contributing nearly 70–75% of global sales. Brick-and-mortar retailers such as sporting goods stores and auto-accessory outlets remain important for hands-on installation support. However, online platforms, including brand websites and e-commerce marketplaces, are experiencing rapid growth with transparent pricing, user reviews, and compatibility filters. OEM distribution is gaining traction, with automakers bundling bike racks with SUVs and outdoor-oriented vehicle packages. Subscription-based accessory models are emerging in developed markets, offering seasonal or on-demand rack rentals.

Customer Type Insights

Group and family travellers represent a strong market segment, particularly in North America and Europe, where biking trips are common. Solo cyclists and commuters increasingly adopt lighter racks suited for everyday transport. Couples favour premium hitch or tray racks designed for two-bike configurations. Adventure cyclists and mountain bikers, often possessing high-value bikes, form a lucrative customer base for premium, heavy-duty racks with reinforced security features.

Age Group Insights

Customers aged 30–50 years account for the largest share of bike car rack purchases, due to higher disposable income and active family lifestyles. Younger consumers (18–30 years) drive growth in budget and online purchases and often prefer universal-fit trunk racks. Customers aged 50+ represent a major driver for e-bike rack sales, reflecting broader adoption of electric bicycles among older demographics. This group prioritises safety, ease of installation, and premium durability.

| By Product Type | By Material | By Bike Capacity | By Holding Mechanism | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market with a 35–40% share in 2024, driven by high SUV and pickup ownership, strong cycling culture, and the popularity of road trips and outdoor recreation. The U.S. leads demand for premium hitch-mounted racks, especially those capable of transporting e-bikes. Canada displays consistent growth supported by recreational cycling and mountain biking destinations such as British Columbia.

Europe

Europe accounts for approximately 25–30% of the global market, with Germany, the U.K., France, and the Netherlands driving demand. Strong cycling infrastructure and a push toward sustainable mobility make bike racks a common accessory among recreational and commuter cyclists. European consumers tend to prefer aluminium and composite materials and demonstrate high adoption of roof-mounted systems.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by rising urbanisation, increasing disposable incomes, and booming cycling communities in China, India, Japan, and Australia. China’s rapidly growing e-bike market is accelerating demand for heavy-duty racks, while India presents strong potential for affordable trunk-mounted systems. Australia continues to show mature demand in premium rack categories due to its active outdoor lifestyle.

Latin America

Latin America shows stable but gradually growing adoption, particularly in Brazil, Mexico, Chile, and Argentina. The region’s expanding cycling culture and adventure tourism sector are encouraging higher demand for multi-bike racks. Price sensitivity remains high, creating opportunities for mid-range and entry-level rack systems.

Middle East & Africa

MEA offers emerging opportunities driven by tourism, outdoor sports, and increasing expatriate cycling communities. South Africa remains a major market within Africa due to strong mountain biking and road cycling cultures. The Middle East, particularly the UAE and Saudi Arabia, is experiencing rising adoption of premium racks linked to high car ownership and adventure sports enthusiasm.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bike Car Rack Market

- Thule Group

- Yakima, Inc.

- Kuat Innovations LLC

- Saris Equipment, LLC

- Hollywood Racks LLC

- Allen Sports USA

- Atera GmbH

- BOSAL International

- Cruzber SAU

- Fiamma S.p.A.

- Peruzzo SRL

- Rhino-Rack

- RockyMounts

- UPPAbaby (bike transport accessories segment)

- Swagman Racks

Recent Developments

- In 2025, Thule announced upgrades to its flagship e-bike capable hitch rack series, including improved load balancing and integrated theft-deterrent technology.

- In 2025, Yakima expanded its modular tray rack lineup with lightweight composite designs targeting mountain bikers and e-bike owners.

- In 2025, Saris introduced a new smart-assist mounting system with digital installation guidance and automated tension calibration for improved user safety.