Sport Utility Vehicle Market Size

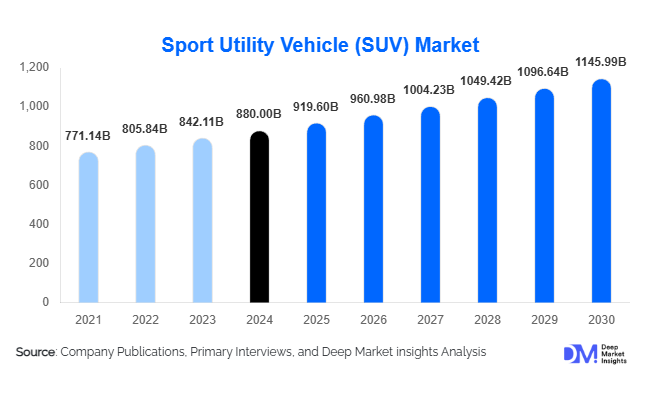

According to Deep Market Insights, the global sport utility vehicle market size was valued at USD 880.00 billion in 2024 and is projected to grow from USD 919.60 billion in 2025 to reach USD 1145.99 billion by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The SUV market growth is primarily driven by the increasing consumer preference for larger and more versatile vehicles, rising urbanization, the growing adoption of electric SUVs, and advancements in connected and autonomous vehicle technologies.

Key Market Insights

- Rising demand for premium and mid-size SUVs is driving overall market expansion, supported by improvements in comfort, safety, and in-car technology.

- Electrification of SUVs is accelerating, with major automakers launching hybrid and fully electric models to meet emissions targets.

- Asia-Pacific dominates the global SUV market, driven by strong sales growth in China and India.

- North America remains a mature but high-value market, where large SUVs and crossovers lead sales volumes.

- Europe is witnessing rapid EV SUV adoption, supported by stringent emission norms and government incentives for electric mobility.

- Technological integration, including ADAS (Advanced Driver Assistance Systems), infotainment connectivity, and AI-based safety features, is redefining SUV design and consumer appeal.

Latest Market Trends

Electric SUVs Gaining Momentum

Automakers are rapidly electrifying their SUV lineups to comply with global carbon emission standards. Models like the Tesla Model Y, Hyundai Ioniq 5, and BMW iX are reshaping consumer perceptions of performance and sustainability. Hybrid and plug-in hybrid SUVs are serving as transitional models, bridging the gap between combustion engines and full electrification. Governments are providing purchase subsidies and infrastructure support, further propelling the shift toward electric SUVs. This electrification trend is expected to dominate new model launches through 2030.

Smart and Connected SUV Technologies

Integration of smart technologies, including over-the-air software updates, voice assistants, and AI-based driver behavior monitoring, is redefining the SUV segment. Connectivity features like real-time traffic data, predictive maintenance alerts, and vehicle-to-everything (V2X) communication are becoming standard across mid- to high-end models. These innovations enhance safety, convenience, and user experience, aligning with growing consumer expectations for technologically advanced mobility solutions.

Sports Utility Vehicle Market Drivers

Consumer Preference for Versatility and Comfort

Modern consumers prefer SUVs for their elevated driving position, ample cargo space, and multipurpose capabilities. The shift toward family-oriented and adventure-ready vehicles continues to drive sales, especially in urban and suburban areas. Automakers are introducing modular designs that combine off-road performance with city comfort, expanding SUV appeal across demographics.

Surge in Electric and Hybrid Adoption

Environmental regulations and fuel efficiency standards are pushing manufacturers toward hybrid and electric SUV offerings. Increasing availability of charging infrastructure, along with innovations in solid-state and fast-charging batteries, is making electric SUVs more practical for long-distance travel. Major brands are setting ambitious electrification targets, with several pledging to produce only electric SUVs by the end of the decade.

Market Restraints

High Manufacturing and Ownership Costs

Despite strong demand, high production costs due to advanced electronics, safety features, and large-sized components continue to restrain affordability in certain markets. Additionally, electric SUVs carry higher upfront costs than traditional counterparts, although long-term savings from fuel and maintenance are improving adoption rates. Volatility in raw material prices, particularly lithium, nickel, and cobalt, also impacts profitability.

Environmental Concerns and Emission Regulations

While SUVs are popular, their size and fuel consumption have made them a focal point of environmental scrutiny. Governments are implementing stricter emission and fuel-efficiency standards, pressuring automakers to invest in lightweight materials and energy-efficient designs. Balancing performance, comfort, and compliance remains a key challenge for industry players.

Sports Utility Vehicle Market Opportunities

Expansion of Electric and Hydrogen Fuel Cell SUVs

Manufacturers are exploring next-generation technologies such as hydrogen fuel cells to complement battery-electric models. Hydrogen SUVs offer extended range and quick refueling, appealing to markets with limited charging infrastructure. This segment presents significant potential in regions like Japan, South Korea, and parts of Europe, investing in hydrogen ecosystems.

Emerging Markets Driving Volume Growth

Rapid urbanization and rising disposable incomes across Asia-Pacific, Latin America, and Africa are fueling SUV adoption. Localized manufacturing, strategic partnerships, and model diversification tailored to regional preferences are enabling automakers to penetrate new markets effectively. Affordable compact SUVs are expected to drive much of this growth.

Product Type Insights

Compact and mid-size SUVs dominate the global market, accounting for over 60% of total sales due to their balance between affordability and utility. Full-size SUVs continue to thrive in North America and the Middle East, where consumers prioritize power and space. The ultra-luxury SUV segment is expanding, with brands like Rolls-Royce, Bentley, and Lamborghini entering the category. Meanwhile, crossovers (CUVs) are capturing urban markets due to their car-like handling and fuel efficiency.

Fuel Type Insights

Gasoline-powered SUVs remain dominant, though their share is declining as electric and hybrid variants gain momentum. Electric SUVs are projected to grow at a CAGR exceeding 25% through 2030, supported by technological innovation and favorable government policies. Diesel SUVs are witnessing a steady decline, particularly in Europe, where emission standards and EV adoption are tightening.

| By Product Type | By Fuel Type | By Drive Type | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global SUV market, driven by surging demand in China and India. Local automakers are introducing affordable compact SUVs, while global brands are investing in regional manufacturing. The growing popularity of electric SUVs in China is setting global benchmarks, supported by extensive EV infrastructure and subsidies.

North America

North America remains a stronghold for large SUVs and crossovers. Consumer preference for spacious vehicles with advanced safety and infotainment features continues to support sales. Electrification is gaining traction, with leading models like the Ford Mustang Mach-E and Rivian R1S accelerating market transformation.

Europe

Europe is transitioning toward sustainability, with EV and hybrid SUVs rapidly gaining share. Stringent CO₂ emission standards and incentives for electric mobility are reshaping the product landscape. Premium European automakers are focusing on electric performance SUVs that blend efficiency with luxury appeal.

Latin America

Latin America’s SUV market is expanding gradually, driven by economic recovery and demand for durable, high-clearance vehicles suited to varied terrain. Brazil and Mexico remain key hubs, with regional assembly facilities helping reduce import costs and boost affordability.

Middle East & Africa

Rising infrastructure development and consumer preference for off-road and luxury vehicles are fueling SUV demand in the Middle East and Africa. Countries like the UAE, Saudi Arabia, and South Africa are major markets, with growing interest in electric models as part of sustainability goals.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the SUV Market

- Toyota Motor Corporation

- Volkswagen AG

- General Motors

- Hyundai Motor Group

- Ford Motor Company

- Tesla, Inc.

- Honda Motor Co., Ltd.

- BMW Group

- Mercedes-Benz Group AG

- BYD Auto Co., Ltd.

Recent Developments

- In October 2025, Toyota launched its new all-electric SUV lineup under the bZ series, targeting zero-emission mobility across Asia and Europe.

- In September 2025, Volkswagen unveiled its ID. X SUV platform, focusing on modular design and extended EV range for global markets.

- In July 2025, Tesla began production of its next-generation compact SUV at its Texas Gigafactory, aimed at making EVs more accessible to mass consumers.