Bicycle Gearbox System Market Size

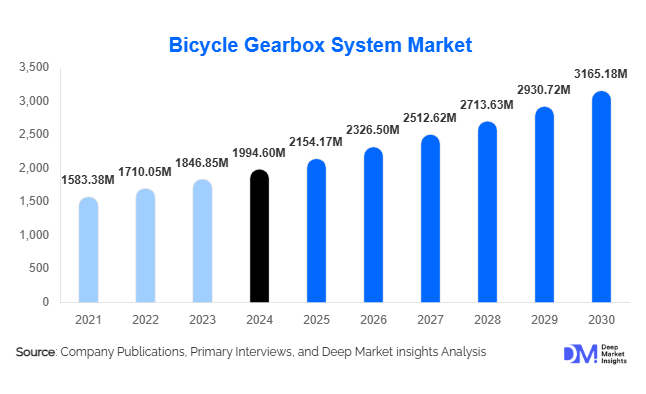

According to Deep Market Insights, the global bicycle gearbox system market size was valued at USD 1,994.60 million in 2024 and is projected to grow from USD 2,154.17 million in 2025 to reach USD 3,165.18 million by 2030, expanding at a CAGR of 8.00% during the forecast period (2025–2030). Market expansion is primarily driven by the rising adoption of electric bicycles (e-bikes), increasing preference for low-maintenance transmission systems, and growing demand for durable, sealed gearboxes suitable for urban commuting, mountain biking, and commercial cargo bikes.

Key Market Insights

- E-bike adoption is the leading growth catalyst, as gearbox systems handle higher torque loads and reduce frequent maintenance associated with derailleurs.

- Urban mobility and last-mile commercial delivery fleets are increasing their use of gearbox-equipped bicycles, especially in Europe, North America, and China.

- Europe remains the largest market, driven by commuter cycling culture, strong OEM presence, and premium gearbox manufacturers.

- Asia-Pacific is the fastest-growing region, due to China’s booming e-bike production and rising cycling adoption in Japan, South Korea, and India.

- Technological advancements such as automatic shifting, motor–gearbox integration, and lightweight composite housings are driving premium segment growth.

- OEM installations dominate the market, with integrated gearbox–motor systems becoming mainstream in mid-drive e-bike categories.

What are the latest trends in the bicycle gearbox system market?

Advanced Motor–Gearbox Integration in E-Bikes

One of the most significant trends is the rapid development of fully integrated motor–gearbox units designed for electric bicycles. Manufacturers are shifting toward compact mid-drive solutions where the gearbox and motor operate within a single enclosed housing, drastically improving torque management, durability, and compactness. Brands are incorporating load-sensing electronics, automated or semi-automatic shifting, and pedal-assist algorithms that adapt gear ratios in real time. This trend is gaining strong traction in premium commuter bikes, cargo e-bikes, and performance e-MTBs, where reliable drivetrain behaviour under varying loads is essential.

Lightweight Composite Gearbox Systems

The push toward weight reduction has encouraged manufacturers to adopt carbon-composite housings, precision-engineered spur gears, and advanced lubrication systems. These innovations support competitive mountain biking and gravel cycling, where efficiency and weight distribution are crucial. This trend is also influenced by professional cyclists increasingly embracing gearbox systems for improved ground clearance and drivetrain protection during rugged terrain use. High-performance gearbox models integrating low-friction coatings and aerospace-grade materials are gaining recognition across global cycling events.

What are the key drivers in the bicycle gearbox system market?

Rising Popularity of E-Bikes

E-bikes accounted for more than half of gearbox-equipped bicycle sales in 2024. Electric bicycles exert higher torque on drivetrains, causing accelerated wear on traditional derailleurs. Gearboxes offer superior durability, making them the optimal choice for long-term performance. Government incentives promoting sustainable mobility, expanding bike-sharing programs, and increased consumer preference for electric commuting are propelling gearbox adoption in this segment.

Shift Toward Low-Maintenance Urban Mobility

Urban commuters increasingly prefer sealed, maintenance-free drivetrains that perform consistently under all-weather conditions. Internal gear hubs and mid-drive gearboxes eliminate derailleur-related issues such as misalignment, exposure to dirt, and frequent chain replacements. European commuter hubs such as the Netherlands, Germany, and Denmark reported strong adoption, boosting overall demand in 2024. Reliability and longer service intervals are major contributors to this driver.

Technological Advancements in Shifting Systems

Automated and semi-automatic gearbox systems that use sensors, microcontrollers, and torque feedback mechanisms have redefined the user experience. Cyclists benefit from smoother pedalling, optimal gear ratios, and integration with smartphone apps that provide diagnostics and performance analytics. Manufacturers leveraging AI-assisted shifting, adaptive torque modulation, and digital calibration tools have strengthened their competitive positioning.

What are the restraints for the global market?

High Initial Cost of Gearbox Systems

Bicycle gearboxes remain significantly more expensive than derailleur systems, often costing up to four times more. This limits adoption in mass-market bicycles, particularly in cost-sensitive regions such as Latin America and Southeast Asia. While lifecycle maintenance costs are lower, the upfront investment continues to act as a restraint for budget-conscious consumers and smaller OEMs.

Limited Awareness in Conventional Cycling Segments

Despite durability and performance advantages, many cyclists, especially road and leisure riders, remain accustomed to conventional derailleurs. Education, product demos, and wider availability of gearbox-equipped bicycles are needed to accelerate adoption. The lack of widespread retail visibility and limited inclusion in entry-level bicycles further restricts consumer awareness.

What are the key opportunities in the bicycle gearbox system industry?

Growth of Commercial Cargo Bikes and Last-Mile Delivery Fleets

Commercial fleets using cargo bikes are rapidly expanding in Europe, North America, and China due to sustainability mandates and urban congestion policies. Cargo bikes undergo high stress and heavy loads, making gearboxes ideal for long-term reliability. Fleet operators seek durable, low-maintenance solutions that reduce downtime, creating substantial demand for gearbox systems and long-term service partnerships.

Premium Cycling and Adventure Sports Expansion

Mountain biking, gravel cycling, and long-distance touring represent a growing opportunity segment. Professional and high-performance cyclists increasingly prefer gearboxes for balanced weight distribution, impact resistance, and shifting reliability during intense off-road conditions. The rising popularity of adventure travel and endurance sports further expands this niche, encouraging manufacturers to invest in lightweight, high-torque gearbox systems with advanced engineering.

Product Type Insights

Internal gear hub systems dominate the market due to their widespread use in commuter bicycles and moderate cost. Mid-drive gearboxes are rapidly gaining prominence among e-bikes because of their torque-handling characteristics and drivetrain integration capabilities. Crank-integrated and shaft-drive systems remain niche but are expanding in cargo and premium bicycle categories. Aluminium alloy gearboxes account for the highest share due to their balance of weight, cost, and durability, while carbon-composite gearboxes are emerging in high-end sports applications.

Application Insights

E-bikes constitute the leading application area, contributing nearly 58% of the market in 2024. The increasing shift toward electric mountain bikes, commuter bikes, and cargo bikes is driving large-scale gearbox adoption. Conventional bicycles such as MTBs, touring bikes, and gravel bikes are also experiencing higher gearbox integration, particularly among premium users. Logistics fleets represent a growing application segment, driven by urban delivery expansion and fleet electrification policies worldwide.

Distribution Channel Insights

OEM installations account for roughly 67% of the total market share, supported by collaborations with bicycle manufacturers designing integrated drivetrains. Aftermarket sales remain significant for performance cyclists upgrading existing bikes. Digital sales channels, including brand-direct online stores and specialised cycling retailers, are gaining momentum due to customisation tools and virtual product demos.

Traveller Type Insights

Urban commuters and recreational cyclists represent the majority of end users, drawn to the low-maintenance performance of gearbox systems. Professional cyclists, including enduro, downhill, and trail riders, contribute significantly to the premium gearbox segment. Commercial fleets, including last-mile delivery operators, constitute a fast-growing user group, emphasising durability and total cost of ownership benefits.

Age Group Insights

Cyclists aged 31–50 years dominate demand, as this group has higher disposable income and prioritises quality, convenience, and daily commuting efficiency. The 18–30 demographic drives adoption of mid-range gearboxes in sporting and recreational applications, while older cyclists (51–65+) prefer premium, automated systems that minimise effort and maintenance.

| By Gearbox Type | By Bicycle Type | By Sales Channel | By Material Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds around 22% of the global market share, driven by strong adoption of e-bikes and MTB gearboxes. The U.S. leads regional demand, particularly in states with robust cycling and mountain biking cultures such as California, Colorado, and Washington. Cargo bike adoption in urban areas is driving additional demand. Canada shows steady growth, supported by commuter-focused cycling infrastructure.

Europe

Europe remains the largest region with approximately 41% of the 2024 market share. Germany, the Netherlands, Switzerland, and Denmark dominate demand due to strong commuter cycling cultures and premium bicycle OEM presence. Germany alone contributes 18% of global gearbox consumption. Europe also leads technological development and hosts top gearbox manufacturers, making it the global innovation center for this market.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 11–13%. China holds the largest regional share, driven by massive e-bike production and increasing adoption of mid-drive gearboxes. Japan and South Korea contribute significantly through premium cycling markets, while India is emerging due to rising urban mobility investment and expanding delivery fleet usage.

Latin America

LATAM accounts for around 5% of global demand, with growth led by Brazil, Chile, and Mexico. Mountain biking and commuter bicycle use are increasing, although cost remains a barrier to widespread gearbox adoption.

Middle East & Africa

MEA holds approximately 4% of the market. The UAE and Saudi Arabia are investing in cycling infrastructure and are seeing rising demand for high-performance bicycles. South Africa contributes through MTB and adventure cycling communities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bicycle Gearbox System Market

- Pinion

- Rohloff

- Shimano

- Kindernay

- Efneo

- Enviolo

- Kappstein

- TQ-Systems

- Archer Components

- Fallbrook Technologies

- Microshift

- Brose

- Bosch Mobility

- Classified Cycling

- Valeo Mobility

Recent Developments

- In January 2025, Pinion launched an integrated e-bike motor–gearbox system featuring automated shifting and torque-optimised drive software.

- In March 2025, Shimano announced a strategic partnership with European e-bike OEMs to expand mid-drive gearbox production capacity.

- In April 2025, Rohloff unveiled its next-generation 14-speed hub gearbox with reduced weight and upgraded sealing for off-road performance.