Betaine Market Size

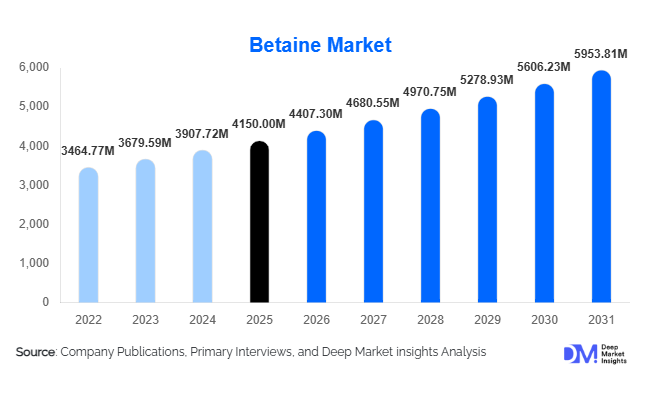

According to Deep Market Insights, the global betaine market size was valued at USD 4,150 million in 2025 and is projected to grow from USD 4,407.30 million in 2026 to reach USD 5,953.81 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The betaine market growth is primarily driven by rising demand for high-performance animal feed additives, increasing consumption of functional foods and dietary supplements, and expanding applications in personal care and industrial surfactants. Growing global livestock production, particularly in poultry and aquaculture, continues to anchor baseline demand, while sustainability trends are accelerating the adoption of natural, sugar-beet-derived betaine in Europe and North America.

Key Market Insights

- Animal feed remains the dominant application, accounting for nearly 57% of the global market revenue in 2025, supported by poultry and aquaculture expansion.

- Natural (bio-based) betaine holds approximately 48% share, benefiting from sustainability regulations and clean-label preferences.

- Asia-Pacific leads global consumption with around 38% market share, driven by China and India’s livestock industries.

- Aquaculture feed is the fastest-growing sub-segment, expanding at over 7% CAGR due to export-driven seafood production.

- Direct B2B sales dominate distribution channels, representing nearly 65% of total transactions.

- The top five companies control roughly 55% of global revenue, indicating moderate market consolidation.

What are the latest trends in the betaine market?

Shift Toward Sustainable and Bio-Based Betaine

Manufacturers are increasingly investing in sugar-beet-derived betaine to align with sustainability mandates and carbon-reduction strategies. European regulatory frameworks promoting bio-based chemicals have accelerated the substitution of synthetic variants with natural betaine in feed, cosmetics, and detergent applications. Producers are integrating circular production models by utilizing by-products from sugar processing, improving overall resource efficiency, and enhancing ESG positioning. Multinational buyers, particularly in personal care and food sectors, are prioritizing traceable and non-GMO sources, strengthening demand for certified natural betaine.

Expansion in Functional Nutrition and Sports Supplements

Betaine is gaining prominence in dietary supplements due to its role as a methyl donor and performance enhancer. Sports nutrition brands are incorporating betaine anhydrous into pre-workout and endurance formulations. This trend is particularly visible in North America and parts of Europe, where nutraceutical consumption is rising steadily. Clinically backed marketing and regulatory approvals have improved consumer confidence, enabling premium pricing for high-purity grades.

What are the key drivers in the betaine market?

Growth in Livestock and Aquaculture Production

Global protein consumption continues to rise, particularly in Asia-Pacific and Latin America. Betaine improves feed conversion ratios, reduces heat stress in animals, and enhances nutrient absorption, making it a cost-effective performance additive. Poultry feed alone represents nearly 28% of total market demand, reinforcing feed-grade betaine’s strategic importance.

Rising Demand for Functional and Fortified Foods

Health-conscious consumers are driving demand for functional ingredients supporting cardiovascular and liver health. Betaine hydrochloride and anhydrous forms are increasingly incorporated into dietary supplements, supporting steady growth in the food and beverage segment, which accounts for approximately 18% of total revenue.

What are the restraints for the global market?

Raw Material Price Volatility

Betaine production is closely linked to sugar beet molasses availability. Fluctuations in sugar output due to climatic or trade disruptions impact production costs and profit margins.

Substitution by Alternative Additives

In feed applications, alternatives such as choline chloride can replace betaine during pricing spikes, limiting short-term demand stability.

What are the key opportunities in the betaine industry?

Antibiotic Replacement in Animal Feed

With antibiotic growth promoters increasingly restricted worldwide, betaine serves as a natural performance enhancer. Emerging livestock markets in Southeast Asia and Africa provide untapped potential for suppliers expanding production capacity.

Industrial Surfactants and Oilfield Applications

Betaine-based surfactants are gaining traction in oilfield chemicals due to thermal stability and low toxicity. Expanding energy exploration activities in the Middle East and North America create high-margin growth opportunities.

Product Type Insights

Natural betaine remains the leading product category, accounting for approximately 48% of the global market share in 2025. Its dominance is primarily driven by increasing regulatory and consumer preference for bio-based and sustainable ingredients, particularly across Europe and North America. Derived mainly from sugar beet molasses, natural betaine aligns with circular economy initiatives and carbon-reduction goals adopted by multinational food, feed, and personal care companies. Growing pressure on supply chains to improve traceability and meet non-GMO and clean-label standards further strengthens its competitive advantage. In addition, bio-based certification programs and sustainability reporting requirements among global consumer goods manufacturers are accelerating the shift toward naturally sourced variants.

Synthetic betaine continues to maintain a significant presence in cost-sensitive markets, particularly in parts of Asia and Latin America, where price competitiveness remains a key procurement criterion for feed manufacturers. Among chemical forms, betaine anhydrous leads specialty nutrition applications due to its superior purity, enhanced bioavailability, and stability in dietary supplements and sports nutrition formulations. Meanwhile, betaine hydrochloride maintains strong demand in digestive health supplements, supported by increasing global awareness of gut health and aging population demographics.

Application Insights

Animal feed remains the largest application segment, contributing nearly 57% of total revenue in 2025. The segment’s leadership is driven by the growing global demand for high-efficiency livestock production and the gradual replacement of antibiotic growth promoters. Poultry feed accounts for the largest share within this segment, supported by rising chicken meat consumption in the Asia-Pacific and Latin America. Betaine enhances feed conversion ratios, improves carcass yield, and mitigates heat stress, factors that directly impact producer profitability. Aquaculture is the fastest-growing sub-segment within animal feed, expanding at over 7% CAGR due to increasing seafood exports from China, Vietnam, India, and Norway. Swine and ruminant feed segments also contribute steadily, particularly in Europe and North America where feed optimization strategies are highly advanced.

Food and beverage applications represent around 18% of total market revenue, primarily driven by dietary supplements and sports nutrition products. The rising global nutraceutical market and increasing health-conscious consumer behavior support this segment’s expansion. Personal care and cosmetics account for approximately 12% share, leveraging betaine’s humectant, anti-irritant, and conditioning properties in shampoos, facial cleansers, and skincare formulations. Industrial applications, including oilfield chemicals and detergents, constitute the remaining share, benefiting from the growing adoption of low-toxicity surfactants.

Distribution Channel Insights

Direct sales dominate the betaine market, representing nearly 65% of total transactions in 2025. This channel’s leadership is primarily driven by bulk procurement practices among feed mills, nutraceutical manufacturers, and multinational personal care companies. Long-term supply contracts, price-lock mechanisms, and technical service agreements strengthen direct supplier–buyer relationships and reduce transaction volatility. Distributors and traders account for approximately 30% of market share, particularly in fragmented regional markets across Southeast Asia, Africa, and Latin America, where smaller feed producers rely on localized supply networks. These intermediaries play a critical role in ensuring product availability in regions with limited direct manufacturing presence. Online B2B platforms are gradually emerging, especially for specialty and high-purity grades, but currently represent a relatively small portion of overall market volume.

End-Use Industry Insights

The global animal nutrition industry, accounting for over USD 2,350 million in betaine consumption in 2025, continues to anchor demand growth. Rising protein consumption, particularly in emerging economies, is driving investments in poultry and aquaculture production efficiency. Aquaculture remains the fastest-growing end-use segment, expanding at over 7% CAGR, fueled by export-oriented seafood industries in China, Vietnam, India, and Norway.

The global nutraceutical industry, valued at more than USD 450 billion, increasingly incorporates betaine into performance-enhancing and cardiovascular health supplements. Rising consumer awareness of methylation support and muscle endurance benefits strengthens this demand. In personal care, global cosmetic revenues exceeding USD 500 billion create stable incremental demand for betaine-based surfactants and moisturizers. Export-driven poultry industries in Brazil and the United States further stimulate feed-grade consumption, as improved feed efficiency directly enhances international competitiveness.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 38% of the global betaine market share in 2025, making it the largest regional market. China alone accounts for nearly 18% of global demand, supported by its massive poultry and aquaculture sectors. Government initiatives aimed at modernizing feed production, improving livestock productivity, and reducing antibiotic dependence are key growth drivers. India is the fastest-growing country in the region, with CAGR approaching 8%, driven by expanding poultry consumption, aquaculture exports, and increasing domestic supplement demand. Southeast Asian countries such as Vietnam, Thailand, and Indonesia are also contributing to growth through aquaculture expansion and feed mill capacity additions.

North America

North America represents nearly 27% of global demand, with the United States accounting for over 22% share. Regional growth is supported by advanced livestock farming practices, high adoption of feed optimization technologies, and strong demand from the nutraceutical sector. The presence of large-scale poultry and swine producers, coupled with rising consumer preference for functional dietary supplements, sustains steady market expansion. Additionally, growing emphasis on sustainable and non-antibiotic livestock production strengthens the use of betaine as a performance enhancer.

Europe

Europe captures approximately 22% of the global market share, led by Germany, France, and the Netherlands. Strict environmental regulations, strong animal welfare standards, and well-established feed additive frameworks drive demand for high-quality natural betaine. The region’s leadership in bio-based chemicals and circular economy initiatives further accelerates the adoption of sugar-beet-derived variants. Growth is also supported by mature personal care and nutraceutical industries, emphasizing clean-label formulations.

Latin America

Latin America accounts for roughly 6% of global demand, with Brazil leading regional consumption due to its export-oriented poultry and beef industries. Rising global meat exports from Brazil create continuous demand for feed efficiency enhancers. Argentina and Mexico also contribute to steady regional growth, supported by livestock sector modernization and expanding animal protein consumption.

Middle East & Africa

The Middle East & Africa region represents about 7% of the global market share. Growth is driven by increasing poultry production in Saudi Arabia and South Africa, supported by government initiatives to improve food security and reduce import dependency. In the Gulf region, oilfield chemical applications provide additional demand for betaine-based surfactants due to expanding energy exploration activities. Improving feed infrastructure and rising protein consumption across parts of Africa are expected to further support long-term regional expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Betaine Market

- DuPont

- BASF SE

- Solvay SA

- Kao Corporation

- Amino GmbH

- Evonik Industries

- Associated British Foods plc

- Sunwin Biotech

- Nutreco NV

- Arkema SA

- Stepan Company

- Kemin Industries

- American Crystal Sugar Company

- Esco Company Limited

- Huanghua Jinhai Biotechnology