Basil Essential Oils Market Size

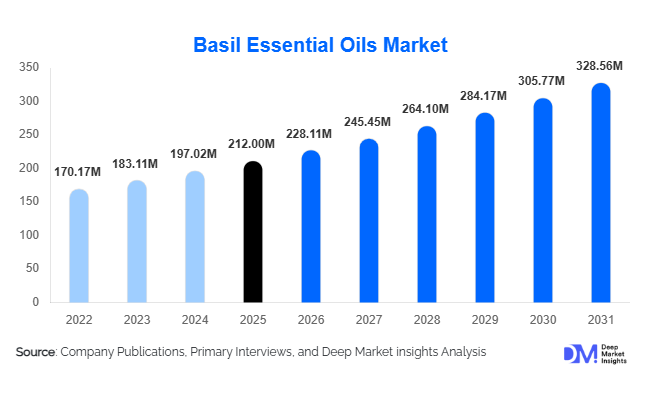

According to Deep Market Insights, the global basil essential oils market size was valued at USD 212.00 million in 2025 and is projected to grow from USD 228.11 million in 2026 to reach USD 328.56 million by 2031, expanding at a CAGR of 7.6% during the forecast period (2026–2031). The basil essential oils market growth is primarily driven by the increasing preference for natural and plant-based products in aromatherapy, personal care, and pharmaceutical applications, along with rising adoption in functional foods and beverages.

Key Market Insights

- Sweet basil oil dominates the market globally, with broad applications in aromatherapy, food flavoring, and pharmaceuticals, accounting for 40% of the 2025 market share.

- Steam distillation remains the leading extraction method, capturing 55% of the market due to its efficiency and ability to produce high-purity oils for medicinal and cosmetic use.

- Aromatherapy and personal care are the largest application segments, contributing 35% to market demand in 2025, driven by wellness trends and consumer preference for natural products.

- North America holds the largest regional market share at 28%, followed closely by Europe at 26%, driven by mature demand for natural wellness products.

- Online retail is the fastest-growing distribution channel, accounting for 30% of the market, due to increasing consumer access to premium oils via e-commerce platforms.

- Emerging markets in the Asia Pacific are witnessing rapid growth, with a 9% CAGR expected over the forecast period, supported by rising disposable income and traditional medicine demand.

What are the latest trends in the basil essential oils market?

Rising Preference for Organic and Premium Oils

Consumers are increasingly seeking certified organic and high-purity basil essential oils, particularly in aromatherapy, cosmetics, and personal care applications. This trend is driving premiumization in the market, with CO₂ extraction and solvent-free methods gaining traction. Manufacturers are differentiating their products through organic certifications, eco-friendly packaging, and sustainable sourcing, responding to demand for authenticity, safety, and environmental responsibility. The trend toward premium oils is also influencing pricing strategies, with high-quality oils commanding 15–25% higher profit margins compared to standard variants.

Integration into Functional Foods and Beverages

Basil essential oils are being increasingly incorporated into functional foods, beverages, herbal teas, and dietary supplements. This trend reflects the growing interest in natural ingredients that provide flavor, aroma, and health benefits. Companies are innovating with flavored teas, wellness drinks, and herbal concoctions that leverage basil oil’s antimicrobial and anti-inflammatory properties. Export-driven demand from Europe and North America is also pushing manufacturers in India and China to scale production for these functional applications.

What are the key drivers in the basil essential oils market?

Rising Demand for Natural and Plant-Based Products

Consumers are actively moving away from synthetic chemicals in personal care, aromatherapy, and pharmaceuticals, creating strong demand for natural products such as basil essential oils. The oil’s versatility, therapeutic properties, and culinary applications align with this shift, supporting steady market growth. Sweet and holy basil oils are particularly sought after for their stress-relief, immunity-boosting, and skincare benefits.

Growth of Wellness and Personal Care Industry

The expansion of global wellness markets, including spa services, organic cosmetics, and aromatherapy products, is boosting demand for basil essential oils. Anti-inflammatory, antimicrobial, and soothing properties make these oils integral to creams, lotions, and massage oils. Increasing awareness of holistic wellness and natural remedies is driving manufacturers to expand product offerings tailored to health-conscious consumers.

Adoption in Food and Beverage Applications

Basil essential oils are being widely used as flavoring agents in beverages, sauces, and functional foods. Rising health consciousness among consumers and increasing interest in exotic flavors are expanding market opportunities. Innovative product launches in herbal drinks, dietary supplements, and flavor-enhanced foods are enabling companies to capture new consumer segments and drive market growth.

What are the restraints for the global market?

High Price of Premium Oils

The cost of organic certification, CO₂ extraction, and high-purity production increases product prices, limiting affordability for price-sensitive consumers. While premium oils attract niche segments, the broader adoption of basil essential oils can be constrained by these higher costs.

Supply Chain and Cultivation Challenges

Basil cultivation is sensitive to climate conditions, and certain species have seasonal limitations. Supply disruptions due to weather variability, limited cultivation areas, or quality inconsistencies can affect production and export potential, creating challenges for manufacturers aiming for stable growth.

What are the key opportunities in the basil essential oils market?

Expansion in Emerging Economies

Emerging markets in the Asia Pacific, Latin America, and the Middle East are offering new growth opportunities. Rising disposable income, increasing health awareness, and preference for natural remedies are driving demand. India, China, and Brazil are not only expanding domestic consumption but are also becoming key production and export hubs. Companies can leverage local partnerships and distribution networks to increase market penetration in these regions.

Technology Integration in Production and Distribution

Advanced extraction methods, such as CO₂ extraction, enhance oil purity and yield. IoT-enabled farms and blockchain-based supply chain tracking ensure quality, traceability, and authenticity, enabling premium products to gain consumer trust. AI-driven demand forecasting and digital marketing optimize production, reduce wastage, and enhance sales efficiency, presenting an attractive opportunity for both established and new players.

Regulatory and Government Support

Governments in India, China, and Europe are promoting organic agriculture and exports of essential oils through initiatives such as “Make in India” and EU sustainability programs. These policies provide incentives for production, quality compliance, and export promotion, creating a favorable investment environment. Compliance with GMP and ISO standards enhances product credibility and consumer confidence in global markets.

Product Type Insights

Sweet basil oil dominates the global market, accounting for 40% of 2025 revenue due to broad usage in aromatherapy, food flavoring, and pharmaceuticals. Holy basil oil is growing rapidly, driven by traditional medicinal applications, particularly in the Asia Pacific. Lemon basil oil and Thai basil oil serve niche markets in cosmetics and perfumes, while demand for specialty oils is increasing among premium aromatherapy consumers. Trends indicate steady growth in high-purity and organic variants, reflecting consumer preference for premium, functional oils.

Application Insights

Aromatherapy and personal care applications account for the largest share (35%) of the market. The wellness trend is driving the use of basil essential oils in massage oils, aromatherapy diffusers, and spa treatments. Pharmaceuticals and healthcare applications are growing, particularly for stress relief, immunity boosting, and skin care. Food and beverage applications, including functional drinks, herbal teas, and sauces, are expanding rapidly. Cosmetic applications are increasing in creams, lotions, and fragrances, driven by demand for natural and organic ingredients.

Distribution Channel Insights

Online retail dominates the market, capturing 30% of sales, as consumers increasingly purchase oils through e-commerce platforms for convenience and access to premium products. Specialty stores and pharmacies cater to high-end customers, while supermarkets/hypermarkets are used for mass-market distribution. Direct B2B sales support bulk manufacturers and exporters, particularly in Europe and North America. Digital marketing, subscription models, and influencer campaigns are enhancing direct-to-consumer engagement and sales growth.

End-Use Insights

The largest end-use segments are aromatherapy, personal care, and pharmaceuticals, contributing over 70% of total market demand. Aromatherapy and wellness products are growing fastest due to rising health consciousness. Skincare applications are also expanding, with a CAGR of 8.5% forecasted over 2025–2030. Food and beverage applications are emerging, supported by functional beverage and herbal tea innovation. Export-driven demand, particularly from Europe and North America, is fueling global market growth, with trade valued at USD 150 million in 2025.

| By Product Type | By Extraction Method | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for 28% of the global share. The U.S. leads due to high wellness awareness, aromatherapy adoption, and strong e-commerce penetration. Canada contributes 3%, primarily for culinary and therapeutic uses. Rising interest in organic and premium oils continues to drive growth.

Europe

Europe holds 26% of the market, with Germany (18%) and France (12%) as key contributors. Demand is supported by regulations for organic and natural products, high consumer willingness to pay for premium oils, and strong wellness industry adoption. Younger demographics in the region are driving rapid uptake of aromatherapy and personal care applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region with 9% CAGR. India (14%) and China are key producers and consumers, driven by Ayurveda, functional foods, and skincare applications. Rising middle-class income, urbanization, and wellness awareness are supporting market expansion. Japan and Australia show steady growth in aromatherapy and cosmetic applications.

Latin America

Brazil is the largest contributor in Latin America, accounting for 5% of the market, primarily for culinary and cosmetic applications. Outbound demand for premium oils is gradually increasing among affluent consumers.

Middle East & Africa

UAE and Saudi Arabia are emerging markets for premium basil oils, collectively holding 6% share. Africa remains a key production hub, particularly for export-oriented cultivation, while intra-regional consumption is slowly rising.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|