Baking Enzymes Market Size

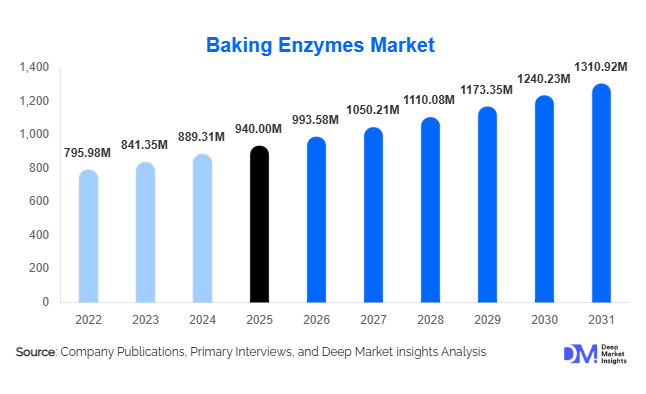

According to Deep Market Insights, the global baking enzymes market size was valued at USD 940 million in 2025 and is projected to grow from USD 993.58 million in 2026 to reach USD 1,310.92 million by 2031, expanding at a CAGR of 5.7% during the forecast period (2026–2031). The baking enzymes market growth is primarily driven by increasing demand for clean-label bakery products, rapid expansion of industrial bakery operations, and technological advancements in enzyme engineering that enhance dough performance, texture, and shelf life.

Key Market Insights

- Carbohydrases dominate the global market, accounting for over 60% of total revenue, driven by strong demand for bread and packaged bakery products.

- Microbial enzymes represent nearly 85% of total production, owing to scalable fermentation processes and cost efficiency.

- Industrial bakeries account for approximately 68% of total demand, reflecting large-scale automated production and standardized formulations.

- Europe leads the global market with 34% share, supported by clean-label reformulations and high per capita bread consumption.

- Asia-Pacific is the fastest-growing region, projected to expand at over 7% CAGR, driven by rising urbanization and packaged food demand.

- The top five manufacturers control nearly 58% of the global market share, highlighting moderate consolidation and strong R&D-driven competition.

What are the latest trends in the baking enzymes market?

Clean-Label Reformulation and Emulsifier Replacement

Food manufacturers are increasingly replacing chemical emulsifiers such as DATEM and mono- and diglycerides with enzyme-based solutions. Consumers are demanding shorter ingredient lists and more natural processing aids, encouraging bakeries to adopt enzyme blends that enhance dough strength, crumb softness, and shelf life without synthetic additives. Enzyme innovation focuses on multifunctional blends that can replace multiple additives simultaneously, reducing formulation complexity and improving cost efficiency. Regulatory support in Europe and North America is further accelerating this transition, positioning enzymes as a strategic ingredient in clean-label bakery reformulation.

Growth of Frozen and Ready-to-Bake Applications

The frozen bakery segment is expanding rapidly, particularly in Asia-Pacific and Latin America. Enzymes designed for freeze-thaw stability are increasingly being adopted to maintain dough elasticity and final product volume. Maltogenic amylases and hemicellulases are gaining prominence for their ability to preserve crumb softness in frozen storage conditions. As frozen bakery products grow at over 7% annually in developing markets, enzyme suppliers are investing in tailored solutions that enhance consistency in large-scale frozen dough operations.

What are the key drivers in the baking enzymes market?

Rising Demand for Packaged and Convenience Foods

Global urbanization and changing lifestyles are boosting consumption of packaged bread, biscuits, cakes, and pizza crusts. The global bakery industry exceeds USD 480 billion in annual revenue, directly supporting enzyme demand. Industrial bakeries rely heavily on enzyme formulations to optimize yield, improve machinability, and extend product shelf life, making enzymes essential to scalable production systems.

Industrial Automation and Production Efficiency

Large-scale bakery manufacturers are investing in automated production lines to enhance consistency and reduce waste. Enzymes improve dough handling properties, reduce batch variability, and increase throughput efficiency. As bakeries modernize facilities in North America, Europe, and Asia, enzyme integration becomes critical to maintaining process stability and minimizing raw material losses.

What are the restraints for the global market?

Raw Material Price Volatility

Enzyme production relies on fermentation substrates derived from agricultural commodities such as corn and wheat. Fluctuations in commodity prices can influence manufacturing costs and compress profit margins, particularly for mid-sized enzyme producers operating in price-sensitive markets.

Regulatory and Approval Complexities

Regulatory approvals for enzyme strains differ across regions, creating compliance challenges. Lengthy approval timelines in emerging economies can delay product launches and restrict market penetration, particularly for genetically optimized enzyme variants.

What are the key opportunities in the baking enzymes industry?

Expansion in Emerging Markets

Asia-Pacific and Middle Eastern markets are witnessing strong growth in organized retail and packaged bread consumption. Government initiatives promoting food processing infrastructure, including large-scale investments in India and China, are supporting local bakery expansion. Enzyme manufacturers can capitalize on these developments through localized production and strategic distribution partnerships.

Customized Enzyme Blends for Specialty Applications

Demand for gluten-free, high-fiber, and reduced-sugar bakery products is creating opportunities for specialized enzyme formulations. Tailored blends that enhance texture in alternative flour systems or improve sugar reduction performance offer high-margin growth potential. Companies investing in advanced enzyme engineering and R&D capabilities are well-positioned to address these niche but expanding segments.

Product Type Insights

Carbohydrases continue to dominate the global baking enzymes market, accounting for approximately 62% of total revenue in 2025. Within this segment, amylases lead the market due to their critical role in improving crumb softness, volume retention, and anti-staling properties in bread and other bakery products. Proteases and lipases, while smaller in market share, remain strategically important, enhancing dough extensibility, texture, and fat emulsification functions essential for cakes, pastries, and biscuits. Microbial-sourced enzymes constitute nearly 85% of the market, reflecting the scalability, cost efficiency, and consistent activity levels of fermentation-based production. Powder formulations represent approximately 55% of total sales, preferred for longer shelf life, transport stability, and ease of integration in industrial bakery operations, whereas liquid and granular forms are gaining traction in specialized and automated applications. Overall, product innovation focusing on multifunctional enzyme blends and clean-label compliance continues to drive adoption across both industrial and artisanal bakery segments.

Application Insights

Bread remains the largest application segment, accounting for nearly 48% of total market revenue, due to its high global consumption, industrial production volumes, and the growing preference for packaged and ready-to-eat products. Biscuits and cookies represent a secondary segment, particularly strong in Asia-Pacific markets, driven by rising urban demand for convenience foods and snack consumption. Pizza crusts and tortillas are experiencing rapid growth in line with the expansion of quick-service restaurants (QSRs) worldwide. The frozen dough category is among the fastest-growing applications, as demand for ready-to-bake and export-oriented bakery products increases. Enzyme systems optimized for extended softness, enhanced volume, and improved dough machinability are becoming critical for these applications, enabling manufacturers to maintain consistent product quality while reducing waste and processing time.

Distribution Channel Insights

Direct B2B sales dominate the baking enzymes market, contributing approximately 72% of total revenue. Major enzyme producers maintain long-term contracts with industrial bakery manufacturers, offering technical support, formulation guidance, and customized enzyme solutions. Ingredient distributors account for the remaining share, primarily serving small-scale and artisanal bakeries. Increasing adoption of digital procurement platforms is gradually transforming B2B transactions by enhancing supply chain transparency, enabling real-time pricing comparisons, and streamlining logistics. The trend toward integrated supply chains and technical service offerings is further strengthening direct engagement between enzyme manufacturers and end-users.

End-Use Industry Insights

Industrial bakeries represent the largest end-use segment, accounting for nearly 68% of global demand in 2025. Growth is driven by automation adoption, expansion of large-scale production facilities, and increasing demand for packaged and frozen bakery products in Europe, North America, and Asia-Pacific. Artisanal bakeries are gradually incorporating enzymes to improve product consistency and dough handling, while maintaining traditional baking methods. Foodservice chains, particularly QSRs, are among the fastest-growing end-use categories, expanding at 6–7% annually due to global menu standardization and high-volume production of bread, pizza crusts, and pastries. Export-driven demand, particularly from Germany, the United States, and Turkey, further supports enzyme adoption, as manufacturers aim to maintain consistent quality during long-distance shipping of frozen and packaged bakery products.

| By Product Type | By Form | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global baking enzymes market with a 34% share in 2025. Germany, France, and the U.K. are the largest contributors, driven by high per capita bread consumption, strong organized bakery infrastructure, and the increasing prevalence of clean-label reformulations. Germany alone accounts for nearly 9% of global enzyme demand. Key drivers include stringent food safety regulations, widespread adoption of multifunctional enzyme blends to reduce chemical additives, and an emphasis on reducing food waste through anti-staling enzyme solutions. Mature industrial bakery operations, coupled with consumer demand for higher-quality, longer-shelf-life bread, reinforce Europe’s dominance in the market.

North America

North America holds approximately 28% of the global market share, led by the United States due to large-scale industrial bakeries, advanced automation, and growing clean-label product adoption. Drivers include rising consumer awareness of natural ingredients, the need for consistent dough performance in high-volume bakeries, and technological integration in production lines to improve yield and reduce processing costs. Canada contributes to demand growth through expanding frozen bakery and QSR chains, emphasizing ready-to-bake products. Additionally, regulatory clarity and the widespread use of enzyme blends for anti-staling and dough conditioning in large-scale operations sustain regional growth.

Asia-Pacific

Asia-Pacific accounts for roughly 24% of the market and is the fastest-growing region, expanding at over 7% CAGR. China and India are the largest demand centers, driven by urbanization, rising disposable incomes, and increasing consumption of packaged bread and bakery products. India is projected to grow at over 8% annually during the forecast period. Regional growth is supported by government initiatives promoting organized food processing industries, increasing demand for frozen and ready-to-bake bakery products, and the entry of international bakery brands requiring consistent enzyme solutions. The trend of premiumization and clean-label demand in urban centers further accelerates enzyme adoption across both industrial and retail segments.

Latin America

Latin America represents around 7% of global demand, with Brazil and Mexico as primary contributors. Mexico’s strong tortilla and flatbread production, along with Brazil’s expanding packaged bread sector, significantly support enzyme consumption. Drivers for regional growth include increasing industrialization of bakeries, rising urban snack and pastry consumption, and the growing influence of international QSR chains. Enzyme adoption is particularly strong in frozen dough and high-volume bakery operations to ensure consistent quality and longer shelf life for both domestic and export markets.

Middle East & Africa

The Middle East & Africa account for approximately 7% of the global market share. Saudi Arabia and the UAE are key growth markets, driven by rising demand for packaged bread, expanding foodservice chains, and government investments in food processing infrastructure. Additional drivers include urbanization, adoption of modern bakery equipment, and increasing consumer preference for high-quality, shelf-stable bakery products. Intra-regional trade and export-oriented bakery operations are also encouraging enzyme adoption, particularly for frozen dough and specialty bread products targeting both local and international markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baking Enzymes Market

- Novonesis

- DSM-Firmenich

- IFF (Danisco)

- AB Enzymes

- Kerry Group

- BASF

- Amano Enzyme

- Advanced Enzyme Technologies

- Aum Enzymes

- Jiangsu Boli Bioproducts

- Enmex

- Dyadic International

- Soufflet Biotechnologies

- SternEnzym

- Puratos Group