Bakery Enzymes Market Size

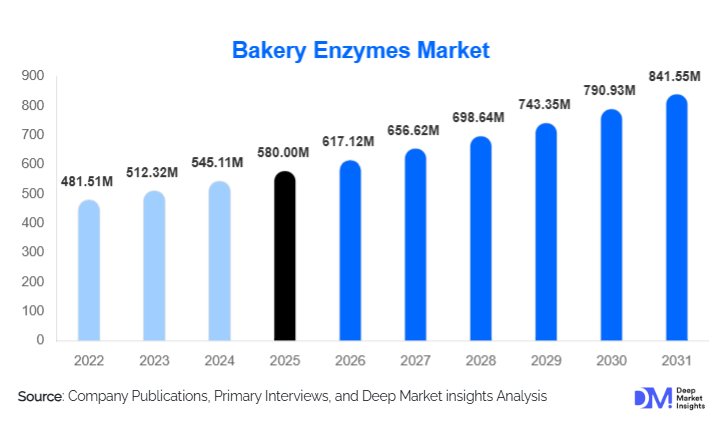

According to Deep Market Insights, the global bakery enzymes market size was valued at USD 580 million in 2025 and is projected to grow from USD 617.12 million in 2026 to reach USD 841.55 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The bakery enzymes market growth is primarily driven by the rising demand for clean-label baked goods, increasing industrialization of bakery production, and the growing adoption of enzymes as natural alternatives to chemical additives for dough conditioning, shelf-life extension, and texture enhancement.

Key Market Insights

- Amylases remain the most widely used bakery enzymes, driven by their critical role in fermentation control, crumb softness, and volume improvement.

- Clean-label and additive-free bakery formulations are accelerating enzyme adoption across Europe and North America.

- Industrial bakeries dominate global demand, accounting for over half of total bakery enzyme consumption.

- Asia-Pacific is the fastest-growing region, supported by urbanization, changing dietary habits, and the rapid expansion of packaged bakery consumption.

- Frozen and ready-to-bake products are emerging as a high-growth application area, requiring advanced enzyme systems.

- Technological advancements in fermentation and customized enzyme blends are strengthening long-term supplier–bakery partnerships.

Bakery Enzymes Market Size

According to Deep Market Insights, the global bakery enzymes market size was valued at USD 580 million in 2025 and is projected to grow from USD 617.12 million in 2026 to reach USD 841.55 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The bakery enzymes market growth is primarily driven by the rising demand for clean-label baked goods, increasing industrialization of bakery production, and the growing adoption of enzymes as natural alternatives to chemical additives for dough conditioning, shelf-life extension, and texture enhancement.

Key Market Insights

- Amylases remain the most widely used bakery enzymes, driven by their critical role in fermentation control, crumb softness, and volume improvement.

- Clean-label and additive-free bakery formulations are accelerating enzyme adoption across Europe and North America.

- Industrial bakeries dominate global demand, accounting for over half of total bakery enzyme consumption.

- Asia-Pacific is the fastest-growing region, supported by urbanization, changing dietary habits, and the rapid expansion of packaged bakery consumption.

- Frozen and ready-to-bake products are emerging as a high-growth application area, requiring advanced enzyme systems.

- Technological advancements in fermentation and customized enzyme blends are strengthening long-term supplier–bakery partnerships.

Bakery Enzymes Market Size

According to Deep Market Insights, the global bakery enzymes market size was valued at USD 580 million in 2025 and is projected to grow from USD 617.12 million in 2026 to reach USD 841.55 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The bakery enzymes market growth is primarily driven by the rising demand for clean-label baked goods, increasing industrialization of bakery production, and the growing adoption of enzymes as natural alternatives to chemical additives for dough conditioning, shelf-life extension, and texture enhancement.

Key Market Insights

- Amylases remain the most widely used bakery enzymes, driven by their critical role in fermentation control, crumb softness, and volume improvement.

- Clean-label and additive-free bakery formulations are accelerating enzyme adoption across Europe and North America.

- Industrial bakeries dominate global demand, accounting for over half of total bakery enzyme consumption.

- Asia-Pacific is the fastest-growing region, supported by urbanization, changing dietary habits, and the rapid expansion of packaged bakery consumption.

- Frozen and ready-to-bake products are emerging as a high-growth application area, requiring advanced enzyme systems.

- Technological advancements in fermentation and customized enzyme blends are strengthening long-term supplier–bakery partnerships.

Bakery Enzymes Market Size

According to Deep Market Insights, the global bakery enzymes market size was valued at USD 580 million in 2025 and is projected to grow from USD 617.12 million in 2026 to reach USD 841.55 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The bakery enzymes market growth is primarily driven by the rising demand for clean-label baked goods, increasing industrialization of bakery production, and the growing adoption of enzymes as natural alternatives to chemical additives for dough conditioning, shelf-life extension, and texture enhancement.

Key Market Insights

- Amylases remain the most widely used bakery enzymes, driven by their critical role in fermentation control, crumb softness, and volume improvement.

- Clean-label and additive-free bakery formulations are accelerating enzyme adoption across Europe and North America.

- Industrial bakeries dominate global demand, accounting for over half of total bakery enzyme consumption.

- Asia-Pacific is the fastest-growing region, supported by urbanization, changing dietary habits, and the rapid expansion of packaged bakery consumption.

- Frozen and ready-to-bake products are emerging as a high-growth application area, requiring advanced enzyme systems.

- Technological advancements in fermentation and customized enzyme blends are strengthening long-term supplier–bakery partnerships.

What are the latest trends in the bakery enzymes market?

Rising Adoption of Clean-Label Enzyme Solutions

Bakery manufacturers are increasingly replacing chemical emulsifiers and preservatives with enzyme-based solutions to meet clean-label requirements. Enzymes such as xylanases, lipases, and maltogenic amylases enable manufacturers to achieve desired dough strength, softness, and shelf life without synthetic additives. This trend is particularly strong in Europe, where regulatory frameworks and consumer awareness favor natural processing aids. Clean-label positioning is also becoming a key differentiator for premium and health-focused bakery brands globally.

Customized and Function-Specific Enzyme Blends

Another major trend is the development of tailored enzyme blends designed for specific flour qualities, climatic conditions, and baking processes. Enzyme producers are increasingly working closely with industrial bakeries to co-develop solutions optimized for high-speed production lines, frozen dough stability, and sugar-reduced formulations. Advances in biotechnology and fermentation efficiency are enabling suppliers to deliver highly targeted enzyme systems that improve consistency while reducing overall formulation costs.

What are the key drivers in the bakery enzymes market?

Industrialization of Bakery Production

The global shift toward large-scale, automated bakery production is a major driver of bakery enzyme demand. Industrial bakeries rely on enzymes to ensure consistency, improve dough machinability, and reduce wastage across high-volume operations. Enzymes also help optimize fermentation tolerance and baking performance, enabling manufacturers to maintain uniform quality across multiple production sites.

Growth in Packaged and Frozen Bakery Products

Rising consumption of packaged bread, rolls, cakes, and frozen bakery products is significantly boosting enzyme demand. Enzymes play a crucial role in extending shelf life, maintaining texture after freezing and thawing, and improving product resilience during long-distance transportation. The rapid expansion of frozen bakery manufacturing in the Asia-Pacific and the Middle East is further strengthening this driver.

What are the restraints for the global market?

High Technical Complexity in Enzyme Application

The effective use of bakery enzymes requires precise dosing and formulation expertise. Incorrect enzyme selection or overuse can negatively affect dough structure and final product quality, limiting adoption among small and artisanal bakeries with limited technical capabilities.

Price Sensitivity in Developing Markets

In cost-sensitive regions, traditional chemical improvers remain widely used due to their lower upfront costs. Although enzymes offer long-term efficiency benefits, higher initial pricing can slow adoption in developing economies, particularly among small-scale bakery operators.

What are the key opportunities in the bakery enzymes industry?

Expansion of Frozen and Ready-to-Bake Bakery Segments

The growing popularity of frozen dough, par-baked bread, and ready-to-bake products presents a major opportunity for enzyme manufacturers. These products require advanced enzyme systems to ensure dough stability, volume retention, and texture consistency after thawing, creating sustained demand for premium enzyme solutions.

Technological Innovation and Precision Baking

Advances in fermentation technology, data-driven formulation, and AI-assisted baking optimization are opening new avenues for innovation. Enzyme suppliers that invest in precision baking solutions and customized formulations are well positioned to secure long-term contracts with large industrial bakeries and QSR chains.

Enzyme Type Insights

Amylases dominate the global bakery enzymes market, accounting for approximately 38% of total revenue in 2024, making them the leading enzyme type segment. Their dominance is primarily driven by their essential role in bread and roll production, where they facilitate starch breakdown, improve yeast fermentation efficiency, enhance loaf volume, and deliver a softer crumb structure. Amylases are highly versatile and compatible with both traditional and industrial baking processes, making them the preferred enzyme category across high-volume bakery applications. Their cost-effectiveness and ability to replace chemical dough improvers further strengthen adoption, particularly in clean-label bakery formulations.

Proteases and xylanases represent the next significant enzyme categories, driven by their functionality in dough relaxation, gluten modification, and structure optimization. Proteases are widely used to improve dough extensibility and machinability, especially in pizza crusts, flatbreads, and laminated dough products. Xylanases play a critical role in strengthening dough structure, improving gas retention, and increasing bread volume, making them indispensable for industrial bakeries operating high-speed production lines.

Application Insights

Bread and rolls constitute the largest application segment in the bakery enzymes market, contributing approximately 46% of total global demand in 2024. This leadership is driven by consistently high global consumption, the dominance of bread as a staple food across regions, and the extensive use of enzymes in industrial bread production to ensure product consistency, shelf-life extension, and volume optimization. Enzyme usage is particularly critical in packaged and sliced bread, where freshness retention during storage and transportation is a key quality parameter.

Pizza crusts and flatbreads are emerging as fast-growing application segments, largely due to the rapid expansion of global QSR and foodservice chains. Enzymes help achieve consistent dough elasticity, fermentation tolerance, and freeze-thaw stability, critical for centralized dough production and international supply chains. Additionally, specialty baked goods such as gluten-free, low-sugar, and functional bakery products are creating a niche but high-value demand, where enzymes help compensate for structural and sensory challenges associated with alternative ingredients.

End-Use Insights

Industrial bakeries represent the largest end-use segment, accounting for over 50% of total bakery enzyme demand globally. Their dominance is driven by large-scale production volumes, export-oriented manufacturing, and the need for consistent product quality across multiple facilities. Enzymes are integral to industrial operations as they help reduce raw material variability, improve yield efficiency, and lower overall production costs while supporting clean-label positioning.

Frozen and ready-to-bake manufacturers are the fastest-growing end-use segment, expanding at a CAGR of over 8%. This growth is fueled by rising demand for frozen dough, par-baked bread, and ready-to-bake products from retail, foodservice, and international markets. Enzymes are essential in this segment to maintain dough strength, volume, and texture after freezing and thawing, making them critical formulation components.

Artisanal and in-store retail bakeries are gradually increasing enzyme adoption, particularly in developed markets. While maintaining traditional product positioning, these bakeries are using enzymes selectively to improve batch consistency, reduce dependency on skilled labor, and extend freshness without compromising product authenticity. This segment is expected to witness steady, incremental growth as enzyme solutions become more user-friendly and accessible.

| By Enzyme Type | By Application | By Functionality | By Form | By Source | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global bakery enzymes market with approximately 34% share in 2024, driven by strong demand from Germany, France, the U.K., and the Netherlands. Regional growth is supported by strict regulatory frameworks favoring clean-label and additive-free formulations, high consumer awareness regarding ingredient transparency, and a well-established industrial bakery ecosystem. Europe is also a global hub for enzyme innovation, with significant investments in R&D, fermentation technology, and specialty enzyme development. The widespread presence of multinational bakery brands and frozen bakery exporters further reinforces enzyme demand across the region.

North America

North America accounts for around 27% of global bakery enzyme demand, led by the U.S. and Canada. Growth in this region is driven by high consumption of packaged bakery products, a strong presence of QSR chains, and increasing demand for extended shelf-life solutions. Rising adoption of enzymes as replacements for chemical dough conditioners, supported by clean-label trends and evolving labeling practices, continues to strengthen market penetration. Large-scale frozen bakery production and export activity further support sustained enzyme consumption.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 8% CAGR, with China, India, Japan, and Indonesia as key contributors. Growth is fueled by rapid urbanization, rising disposable incomes, changing dietary preferences, and increasing penetration of Western-style baked goods. Expansion of industrial bakery capacity, growing demand for packaged bread and cakes, and investments in cold-chain infrastructure are accelerating enzyme adoption. The rapid growth of QSR chains and frozen bakery manufacturing further strengthens regional demand.

Latin America

Latin America shows steady growth, led by Brazil and Mexico, supported by increasing packaged food consumption and the modernization of bakery manufacturing facilities. Rising urban populations, expanding retail bakery chains, and greater focus on production efficiency are driving enzyme adoption. Local manufacturers are increasingly using enzyme solutions to enhance product quality and compete with imported baked goods.

Middle East & Africa

The Middle East and Africa represent emerging markets for bakery enzymes, with demand driven by food security initiatives, expanding QSR chains, and growing frozen bakery production. Countries such as Saudi Arabia and the UAE are investing in domestic food processing to reduce import dependency, boosting industrial bakery enzyme demand. In Africa, South Africa remains a key market due to its developed bakery sector, while other countries are gradually increasing enzyme adoption as packaged bread consumption rises and bakery infrastructure improves.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bakery Enzymes Market

- Novozymes

- DSM-Firmenich

- DuPont (IFF)

- BASF

- AB Enzymes

- Amano Enzyme

- Kerry Group

- Chr. Hansen

- Advanced Enzyme Technologies

- Puratos