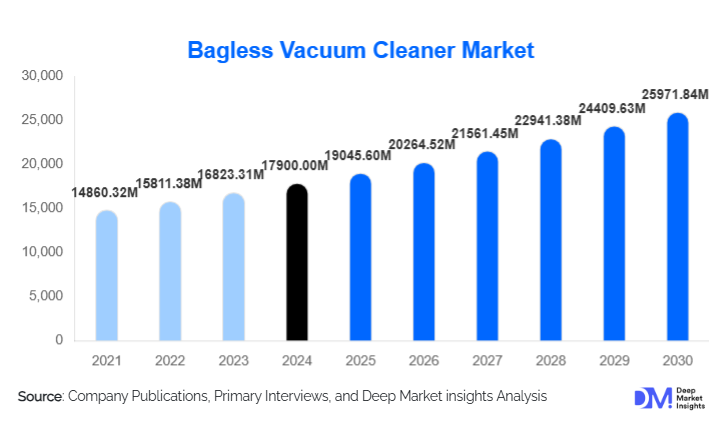

Bagless Vacuum Cleaner Market Size

According to Deep Market Insights, the global bagless vacuum cleaner market size was valued at USD 17,900.00 million in 2024 and is projected to grow from USD 19,045.60 million in 2025 to reach USD 25,971.84 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The market’s sustained expansion is driven by the accelerating adoption of cordless and robotic bagless vacuums, rising demand for HEPA-based filtration solutions, and growing consumer preference for low-maintenance, energy-efficient cleaning devices.

Key Market Insights

- Cordless and robotic bagless vacuum cleaners dominate innovation investment, reshaping product portfolios through AI navigation, smart sensors, and advanced battery systems.

- Residential households account for nearly 70% of global demand, driven by urbanization, reduced cleaning time availability, and rising expectations for convenience-driven home appliances.

- Asia-Pacific leads global demand, supported by growing middle-class populations, strong e-commerce penetration, and expanding local manufacturing capacity.

- North America remains the highest-value market due to premiumization trends, higher robotic vacuum adoption, and strong brand loyalty toward Tier-1 manufacturers.

- HEPA and multi-cyclonic filtration technologies continue to drive premium segment growth, with consumers prioritizing indoor air quality and low allergen emission.

- Supply-chain localization and sustainability initiatives (recycled plastics, modular repairable designs, and energy-efficient motors) are becoming crucial differentiators for global manufacturers.

What are the latest trends in the Bagless Vacuum Cleaner Market?

Cordless Innovation and Battery Advancements

Rapid advancements in lithium-ion battery technology are enabling significantly longer run times, faster charging, and lighter device designs. Cordless stick vacuums are increasingly replacing traditional corded uprights, especially in North America and Europe. Manufacturers are integrating modular batteries, allowing users to replace or expand capacity as needed. This has transformed cordless vacuums into the largest and fastest-growing subsegment of the bagless market, appealing strongly to apartment dwellers and households seeking flexible, quick-clean solutions.

Smart & Robotic Bagless Vacuum Adoption

AI-powered robotic vacuums equipped with lidar, SLAM navigation, 3D sensors, and self-emptying bagless dust docks are witnessing mass-market adoption. These models offer automated cleaning schedules, smart mapping, and app-based control, making them popular among tech-savvy and time-constrained consumers. Integration with major smart home ecosystems (Google Home, Amazon Alexa, Apple HomeKit) further enhances user convenience. Manufacturers are also beginning to introduce subscription models for consumables and cloud services associated with robotic units.

What are the key drivers in the Bagless Vacuum Cleaner Market?

Growing Preference for Convenience-Centric Cleaning

Modern households prefer lightweight, cordless, and bagless designs capable of quick everyday cleaning. The shift toward smaller living spaces and dual-income households increases demand for efficient solutions that reduce cleaning time. Cordless sticks and handhelds have become mainstream, helping this driver accelerate global adoption across all income levels.

Heightened Awareness of Indoor Air Quality

HEPA and multi-stage filtration systems are increasingly necessary as consumers place greater emphasis on allergen removal and air purification. Hospitals, hospitality groups, and commercial cleaning contractors are specifically demanding bagless models with HEPA filters to meet hygiene standards, driving premium segment growth and boosting margins for Tier-1 manufacturers.

Rise of Smart Homes & Autonomous Cleaning

Connected robotic vacuums are benefiting from the growth of IoT ecosystems worldwide. Consumers expect automated, low-intervention cleaning solutions with intelligent navigation and integration into broader home automation systems. Their ability to perform daily maintenance cleaning without human involvement has accelerated adoption in high-income regions and among younger consumers.

What are the restraints for the global market?

High Cost of Premium Cordless and Robotic Models

Advanced cordless and robotic bagless vacuums often feature high-performance motors, AI navigation, and multi-sensor systems, resulting in high retail prices. Price-sensitive markets across LATAM, Africa, and Southeast Asia frequently gravitate toward basic models or cheaper bagged alternatives, slowing premium penetration. Battery replacement costs also impact long-term affordability.

Supply Chain Volatility & Raw Material Constraints

Fluctuating prices of copper, plastics, and lithium-ion cells influence manufacturing costs. Global supply chain disruptions, particularly in motor components and HEPA media, have created inconsistent lead times and impacted inventory planning. Smaller manufacturers lacking vertically integrated supply networks face greater risks to profitability and product availability.

What are the key opportunities in the Bagless Vacuum Cleaner Market?

Smart & Connected Bagless Ecosystems

Manufacturers can build ecosystem-based revenue models by integrating cloud diagnostics, consumable alerts, and predictive maintenance features. Subscriptions for accessories, filters, and consumables, alongside app-linked service plans, provide recurring revenue opportunities. This is especially relevant for robotics, where self-emptying bases and cloud algorithms drive premium adoption.

Expansion into Emerging Economies

Rising urbanization and increasing disposable income in India, Indonesia, Vietnam, and Brazil present vast opportunities. As e-commerce penetration rises, consumers in these markets are shifting from manual cleaning tools to affordable bagless vacuums. Localization of manufacturing and region-specific value models (lower cost, simpler designs) presents high-growth potential for global brands.

Product Type Insights

Upright bagless vacuums currently retain the largest market share (35%), driven by strong adoption in North America and the U.K., thanks to their deep-cleaning capabilities and household familiarity. Cordless stick vacuums are growing the fastest, driven by lightweight and maneuverable designs. Robotic bagless vacuums continue to expand rapidly in premium urban markets due to autonomy features and smart home integration, while canister bagless vacuums hold steady demand in Europe and parts of APAC where multi-surface cleaning versatility is preferred.

Application Insights

Residential households dominate demand with nearly 70% market share, fueled by increasing adoption of robotic and cordless devices for daily maintenance cleaning. Commercial applications such as offices, retail spaces, and hotels are rising steadily due to requirements for HEPA filtration and low-maintenance cleaning tools. Industrial environments use heavy-duty wet-dry bagless systems for sawdust, metal particles, and debris, though this remains a smaller segment. Growing opportunities exist in healthcare and hospitality, where hygiene standards are driving procurement of advanced HEPA-enabled bagless vacuums.

Distribution Channel Insights

Online platforms (brand D2C, Amazon, Flipkart, JD, etc.) dominate distribution with 45% share due to price transparency, product comparisons, and reviews. Retail electronics chains remain influential, especially for premium cordless and robotic models requiring in-store demonstrations. Brand-owned stores and service centers help top manufacturers differentiate through warranties and post-sales support. Subscription-based consumable and battery replacement programs are emerging as new revenue channels for robotic and cordless segments.

Customer Type Insights

Family households with children and pets represent a high-priority customer segment due to recurring cleaning needs and preference for HEPA filtration. Urban young professionals prefer robotic and cordless stick vacuums that offer convenience and time savings. Commercial cleaning contractors prioritize cost efficiency, durability, and fleet manageability. Premium customers in high-income regions often favor smart vacuums with high-performance motors and multi-cyclone technology.

| By Product Type | By Power Source | By Technology | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the global market value and remains a premium stronghold. Adoption of cordless and robotic bagless vacuums is highest here, supported by strong brand recognition (Dyson, SharkNinja, Bissell) and high household spending power. Replacement cycles are shorter, and demand for HEPA-equipped models is driven by allergy awareness.

Europe

Europe contributes 22–26% of global revenues, with Germany, the U.K., and France leading demand. Strict EU energy-efficiency and noise regulations encourage regular product refresh cycles. Consumers in Europe show strong loyalty to canister models and premium engineering brands such as Miele and Bosch, while robotic adoption continues to rise.

Asia-Pacific

APAC is the largest regional market (36%) and the fastest-growing. China leads in both manufacturing and consumption, while India and Southeast Asia show strong first-time buyer growth. E-commerce platforms drive substantial sales volume, and localized mid-range models appeal to price-sensitive customers.

Latin America

Growth in Brazil, Mexico, and Argentina is moderate but accelerating due to rising urbanization and increasing household appliance penetration. Imported premium models face pricing sensitivity, boosting opportunities for mid-range bagless vacuums and locally assembled units.

Middle East & Africa

MEA currently accounts for 3–5% of global share but is expanding, driven by premium demand in GCC countries and gradual adoption in urban centers across Africa. Tourism, hospitality, and commercial construction projects contribute to the rising procurement of high-performance bagless systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bagless Vacuum Cleaner Market

- Dyson

- SharkNinja

- Electrolux

- Miele

- Bissell

- LG Electronics

- Samsung Electronics

- Panasonic

- Philips

- Haier Group

- Nilfisk

- Bosch

- Techtronic Industries (TTI)

- Vorwerk

- Eureka Forbes