Ayurvedic Toothpaste Market Size

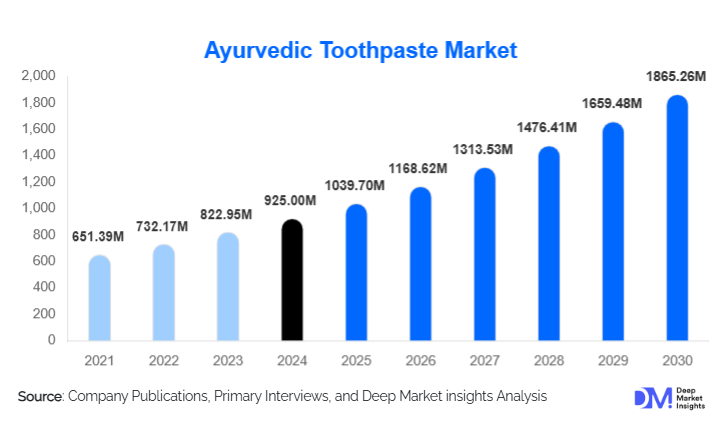

According to Deep Market Insights, the global ayurvedic toothpaste market size was valued at USD 925.00 million in 2024 and is projected to grow from USD 1,039.70 million in 2025 to reach USD 1,865.26 million by 2030, expanding at a CAGR of 12.4% during the forecast period (2025–2030). The Ayurvedic toothpaste market growth is primarily driven by rising consumer preference for herbal and chemical-free oral care solutions, increasing awareness of the link between oral health and overall wellness, and the growing global adoption of traditional medicine-inspired personal care products.

Key Market Insights

- Ayurvedic toothpaste is transitioning from a niche traditional product to a mainstream oral care category, supported by rising clean-label and fluoride-free preferences.

- Asia-Pacific dominates global demand, led by India, while North America and Europe are witnessing rapid premiumization.

- E-commerce and D2C channels are transforming market access, enabling brands to educate consumers and expand globally.

- Neem- and multi-herb-based formulations lead product adoption due to strong antibacterial and gum-care benefits.

- Premium and mid-range segments are growing faster than economy products, driven by functional differentiation and wellness positioning.

- Clinical validation and dentist endorsements are strengthening consumer trust in Ayurvedic oral care solutions.

What are the latest trends in the Ayurvedic toothpaste market?

Premiumization and Functional Herbal Formulations

The Ayurvedic toothpaste market is witnessing strong premiumization, with brands introducing targeted formulations for gum health, sensitivity relief, enamel strengthening, and whitening using natural ingredients. Multi-herb blends, charcoal-herb hybrids, and probiotic-infused toothpastes are gaining traction among urban consumers willing to pay higher prices for specialized oral care. This trend is enabling manufacturers to improve margins while addressing specific dental concerns traditionally managed by chemical-based products.

Rapid Growth of Digital-First and D2C Brands

Digital commerce is reshaping the Ayurvedic toothpaste landscape. Direct-to-consumer platforms allow brands to bypass traditional retail constraints, provide ingredient transparency, and educate consumers through content-driven marketing. Subscription models, influencer endorsements, and personalized oral care recommendations are enhancing customer engagement, particularly among younger, health-conscious consumers. E-commerce sales are growing at a significantly faster pace than offline channels.

What are the key drivers in the Ayurvedic toothpaste market?

Rising Shift Toward Herbal and Preventive Healthcare

Consumers globally are increasingly prioritizing preventive healthcare and natural remedies, driving demand for Ayurvedic toothpaste. Concerns over synthetic chemicals such as triclosan, parabens, and artificial sweeteners have accelerated the shift toward herbal oral care products positioned as safer for long-term use. Ayurvedic toothpaste benefits from strong cultural acceptance in Asia and growing trust in traditional medicine across Western markets.

Expanding Awareness of Oral-Systemic Health Linkages

Scientific research linking oral health with systemic conditions such as diabetes and cardiovascular diseases is reinforcing the importance of daily oral hygiene. Ayurvedic toothpaste, known for its anti-inflammatory and antimicrobial properties, is increasingly perceived as a holistic oral care solution, supporting sustained market growth.

What are the restraints for the global market?

Perceived Efficacy Gap Versus Conventional Toothpaste

Despite growing acceptance, some consumers continue to perceive Ayurvedic toothpaste as less effective in whitening and cavity prevention compared to conventional fluoride-based products. Overcoming this perception requires sustained investment in clinical trials, scientific communication, and professional endorsements, increasing marketing and R&D costs for manufacturers.

Volatility in Herbal Raw Material Supply

The market remains sensitive to fluctuations in the availability and pricing of key herbal ingredients such as neem, clove, and babool. Seasonal dependence and climate variability can disrupt supply chains, impacting production costs and profit margins, particularly for premium formulations that rely on high-quality botanical inputs.

What are the key opportunities in the Ayurvedic toothpaste industry?

Regulatory Support for Natural and Clean-Label Products

Stricter regulations on chemical additives in personal care products across North America and Europe are creating favorable conditions for Ayurvedic toothpaste adoption. Brands that align with vegan, cruelty-free, and clean-label certifications can significantly expand their presence in regulated markets, positioning herbal toothpaste as a compliant and safer alternative.

Expansion into Underpenetrated Emerging Markets

Latin America, the Middle East, and Africa represent high-potential regions with growing awareness of herbal medicine and rising disposable incomes. Localized product offerings, affordable pricing strategies, and regional partnerships can unlock new demand, particularly in urban centers where wellness trends are gaining momentum.

Product Type Insights

Neem-based Ayurvedic toothpaste dominates the market, accounting for approximately 28% of global demand in 2024, driven by its strong antibacterial and gum-care properties. Multi-herb formulations represent the fastest-growing segment, as consumers increasingly prefer comprehensive oral care solutions combining multiple botanical benefits. Clove- and babool-based variants continue to maintain steady demand due to their traditional use in pain relief and gum strengthening.

Application Insights

Complete oral care toothpaste leads the functionality segment with nearly 34% market share, reflecting consumer preference for multi-benefit products. Gum care and periodontal applications are growing rapidly, supported by rising incidences of gum diseases globally. Sensitivity and whitening-focused Ayurvedic toothpastes are also gaining traction, particularly in premium urban markets.

Distribution Channel Insights

Traditional trade remains the largest distribution channel, accounting for around 38% of sales, particularly in developing regions. However, e-commerce and D2C platforms are the fastest-growing channels, expanding at over 18% CAGR. Pharmacies and health stores play a critical role in premium and clinically positioned Ayurvedic toothpaste sales, especially in developed markets.

End-Use Insights

Household consumption dominates the market, contributing over 85% of total demand. Adult consumers account for the largest share, while children’s Ayurvedic toothpaste is emerging as a high-growth niche driven by parental concerns over chemical exposure. Institutional demand from hotels, wellness retreats, and private-label exports is gradually expanding.

| By Ingredient Type | By Product Functionality | By Consumer Category | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the Ayurvedic toothpaste market with approximately 54% share in 2024, driven by India, China, and Southeast Asia. India alone contributes nearly 32% of global demand, supported by strong cultural acceptance of Ayurveda and extensive domestic manufacturing.

North America

North America accounts for about 18% of the market, led by the United States. Demand is driven by premium herbal toothpaste adoption, growing vegan and clean-label trends, and strong e-commerce penetration.

Europe

Europe represents nearly 15% of global demand, with Germany, the U.K., and France leading adoption. Sustainability-focused consumer behavior and regulatory scrutiny of chemical ingredients support market growth.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Rising wellness awareness and increasing availability of imported Ayurvedic products are supporting gradual adoption.

Middle East & Africa

The Middle East & Africa region accounts for around 13% of demand, with strong growth in the UAE and Saudi Arabia driven by premium oral care consumption and import-led availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ayurvedic Toothpaste Market

- Dabur

- Patanjali Ayurved

- Himalaya Wellness

- Colgate-Palmolive

- Unilever

- Procter & Gamble

- Vicco Laboratories

- Emami

- Weleda

- Amway

- Kao Corporation

- Lion Corporation

- Sunstar Group

- Dr. Willmar Schwabe

- The Himalaya Drug Company