Automatic Garage Door Openers Market Size

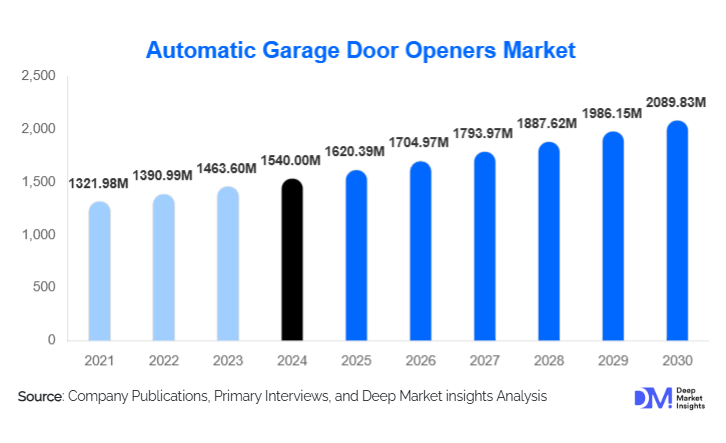

According to Deep Market Insights, the global automatic garage door openers market size was valued at USD 1,540.00 million in 2024 and is projected to grow from USD 1,620.39 million in 2025 to reach USD 2,089.83 million by 2030, expanding at a CAGR of 5.22% during the forecast period (2025–2030). The automatic garage door openers market growth is primarily driven by rising smart home adoption, increasing residential construction, heightened security requirements, and rapid integration of IoT and AI-enabled connectivity across garage automation systems globally.

Key Market Insights

- Smart garage door systems with Wi-Fi and app-based control are becoming the dominant technology, driven by smart home ecosystem integration.

- Belt-drive garage door openers lead global installations due to low noise and superior durability, especially in residential homes.

- North America dominates the market, with high penetration of automated garages and rapid replacement demand for connected systems.

- Asia-Pacific is the fastest-growing region, fueled by expanding housing infrastructure, urbanization, and rising household income.

- Commercial and industrial facilities are increasingly adopting automated systems for improved operational efficiency and security.

- Technology advancements, including AI diagnostics, encrypted connectivity, and geofencing, are reshaping customer expectations in garage automation.

What are the latest trends in the automatic garage door openers market?

IoT-Integrated Smart Garage Ecosystems

Garage door openers are rapidly evolving into fully integrated smart home devices, with Wi-Fi, Bluetooth, voice assistant compatibility, and mobile apps becoming standard features. Homeowners now expect remote operation, real-time alerts, access logs, geofencing-based auto-opening, and camera-enabled monitoring. Cloud-based platforms enable secure, encrypted communication and multi-user permissions for families. The rise of subscription services for video storage and advanced security analytics is transforming traditional hardware sales into hybrid recurring revenue models.

Noise-Free, Efficient, and Eco-Friendly Motor Technologies

Consumers increasingly prefer quiet, energy-efficient openers, leading to widespread adoption of belt-drive and direct-drive systems over chain-drive models. Brushless DC motors (BLDC) are gaining popularity due to their reduced vibration, extended lifespan, and superior energy performance. Manufacturers are introducing standby power-saving features and low-voltage operational modes, aligning with green building certifications. Battery backup systems have become mainstream, ensuring uninterrupted access during power outages, a major demand driver in regions prone to extreme weather or unstable grids.

What are the key drivers in the automatic garage door openers market?

Rising Smart Home Penetration Globally

Smart home adoption continues to surge, with consumers increasingly investing in devices that enhance convenience, automation, and security. Garage door openers have become an essential component of connected home ecosystems, often bundled with security cameras, lights, and access control systems. The seamless integration with Amazon Alexa, Google Home, and Apple HomeKit has accelerated replacement cycles as homeowners upgrade from legacy systems to app-controlled models.

Expansion of Residential Construction and Renovation Activities

Increasing investments in residential development, especially in suburban areas, are elevating the demand for automated garages. Housing renovations driven by modernization, energy efficiency goals, and security upgrades are further boosting adoption. Markets such as the U.S., Canada, Germany, China, and Australia exhibit high installation rates, while emerging nations like India and Vietnam are witnessing accelerated uptake due to rising income levels and urbanization.

Strong Emphasis on Home Security and Safety Regulations

Safety expectations continue to evolve, with many countries mandating auto-reverse, infrared sensors, and obstruction detection systems. Homeowners also prioritize secure access control, leading to increased adoption of rolling-code encryption, tamper alerts, and integrated camera modules. Insurance providers in several regions incentivize the installation of automated, safety-certified garage systems, indirectly stimulating market growth.

What are the restraints for the global market?

High Installation and Maintenance Costs

Advanced openers equipped with smart connectivity, cameras, and AI features come at a premium price point. Professional installation, wiring upgrades, structural modifications, and ongoing maintenance of belts, rollers, and sensors further raise costs. In lower-income markets, manual or semi-automatic doors remain preferred due to affordability constraints, limiting penetration of automatic systems.

Interoperability and Technical Compatibility Issues

Integrating garage door openers with diverse home automation platforms and legacy garage structures can be challenging. Compatibility concerns between various smart ecosystems (Alexa, Google, HomeKit) and security vulnerabilities associated with connected systems reduce consumer confidence. Standardization and cybersecurity improvements are essential for ensuring broader adoption.

What are the key opportunities in the automatic garage door openers industry?

AI-Powered Predictive Maintenance & Enhanced Security Analytics

AI is enabling smart predictive maintenance features, including motor stress analysis, vibration pattern monitoring, and auto-alerts for component wear. Integrated cameras with AI-enabled motion recognition can categorize activities, detect anomalies, and notify homeowners instantly. These innovations open new business models centered around subscription-based diagnostics and security monitoring services.

Smart Cities & Connected Residential Infrastructure

Global smart city initiatives are intensifying demand for integrated, IoT-ready access control systems. Large-scale residential complexes increasingly require centralized management of garage access, remote system control, and automated entry restrictions. This presents opportunities for manufacturers to tailor commercial-grade cloud-connected openers for multi-unit housing developments.

High Growth Potential in Emerging Markets

Countries such as India, Brazil, Mexico, Indonesia, and South Africa are experiencing booming residential development and rising household purchasing power. As consumers skip older technologies and adopt smart-enabled systems directly, manufacturers have opportunities to introduce affordable Wi-Fi-enabled models tailored for these markets. Partnerships with local builders and distributors will accelerate regional penetration.

Product Type Insights

Belt-drive garage door openers dominate the global market, favored for their quiet operation, long service life, and suitability for attached residential garages. Chain-drive models remain common in cost-sensitive markets, while direct-drive systems are gaining ground in premium and European applications. Screw-drive openers retain niche demand in high-torque applications and extreme climate regions due to their mechanical simplicity.

Application Insights

Residential installations account for the majority of global demand, driven by smart home upgrades, security enhancements, and new housing developments. Commercial applications, including warehouses, loading bays, retail facilities, and logistics centers, are growing steadily as businesses seek automated access solutions to improve operational efficiency. Industrial applications are increasingly adopting heavy-duty openers for frequent-use environments and high-security zones.

Distribution Channel Insights

Online retail platforms and D2C manufacturer websites are rapidly transforming sales channels, offering transparent pricing, installation services, and product comparisons. Specialty home improvement stores, OEM installers, and hardware retailers remain essential, especially in regions where professional installation is preferred. Influencer marketing, digital reviews, and DIY installation videos have significantly influenced customer purchase behavior in this category.

End-User Insights

Residential homeowners, property developers, and renovation contractors represent the largest customer group. Demand among commercial HVAC, logistics, and warehousing sectors continues to rise due to automation-driven operational efficiency. Industrial users prioritize high-durability openers for heavy-duty cycles and enhanced security systems. Emerging end-user categories include smart residential complexes and co-living spaces integrating centralized access management.

| By Product Type | By Operation Mode | By Connectivity | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for 35% of global demand in 2024. The U.S. dominates with high smart home penetration and frequent garage opener replacements. Canada continues to show strong demand driven by residential construction and home automation adoption. The region also leads in premium smart systems featuring cameras, AI analytics, and encrypted connectivity.

Europe

Europe accounts for 27% of the global market, with Germany, the U.K., France, and Italy serving as key demand centers. Strict noise regulations, energy efficiency standards, and a preference for high-quality engineering drive demand for belt-drive and direct-drive systems. Renovation projects and increasing security awareness further support market expansion.

Asia-Pacific

The Asia-Pacific region is the fastest-growing, with a projected CAGR above 10% through 2030. China, India, Japan, and Australia are major contributors, driven by rapid urbanization, rising income levels, and large-scale housing development. Japan and Australia represent mature markets with strong demand for premium features, while India and Southeast Asia drive volume growth through affordable smart-enabled models.

Latin America

Latin America is experiencing gradual adoption, led by Brazil, Mexico, and Argentina. Growing awareness of home security, expanding middle-income populations, and rising home renovation trends support market uptake. Although overall penetration remains modest, the shift toward smart living environments is boosting long-term demand.

Middle East & Africa

MEA markets are expanding steadily, with the UAE, Saudi Arabia, and South Africa leading demand. Smart city initiatives, luxury housing growth, and large-scale commercial infrastructure developments fuel adoption. South Africa’s residential estates and gated communities increasingly integrate automated garage systems with security networks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Automatic Garage Door Openers Market

- Chamberlain Group

- Genie Company

- Overhead Door Corporation

- Hörmann

- Sommer Group

- Nice S.p.A.

- Nortek (Linear)

- Marantec Group

- Skylink Group

- BFT Automation

Recent Developments

- In March 2025, Chamberlain Group introduced an AI-enabled opener with enhanced camera security and predictive maintenance alerts.

- In January 2025, Hörmann announced the expansion of its smart home-compatible opener lineup across Europe with improved connectivity features.

- In October 2024, Nice S.p.A. launched a new series of ultra-quiet, energy-efficient belt-drive systems designed for premium residential applications.