Automatic Door Sensors Market Size

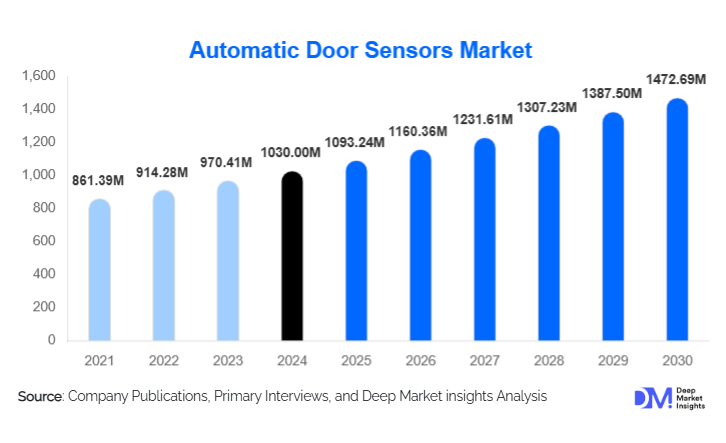

According to Deep Market Insights, the global automatic door sensors market size was valued at USD 1,030.00 million in 2024 and is projected to grow from USD 1,093.24 million in 2025 to reach USD 1,472.69 million by 2030, expanding at a CAGR of 6.14% during the forecast period (2025–2030). Growth is driven by the rising adoption of touchless entry systems, rapid expansion of commercial and infrastructure construction, and the increasing integration of smart and IoT-enabled sensors within modern buildings.

Key Market Insights

- Infrared sensors remain the dominant technology, capturing over 35–40% of global demand due to reliability and affordability.

- Commercial buildings account for nearly half of total installations, driven by malls, offices, hotels, and retail expansion worldwide.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, smart city investments, and large-scale infrastructure upgrades.

- IoT-enabled and AI-enhanced sensors are gaining rapid traction, improving safety, remote monitoring, and energy efficiency.

- Retrofit and modernization projects represent a major global opportunity as aging buildings upgrade to touchless, automated entry systems.

- Healthcare, airports, and logistics are emerging as high-growth end-use industries due to hygiene, safety, and automation requirements.

What are the latest trends in the automatic door sensors market?

Growing Shift Toward Smart Building & IoT-Integrated Sensor Systems

The market is witnessing rapid adoption of IoT-enabled automatic door sensors that integrate seamlessly with building management systems (BMS), HVAC controls, and centralized security platforms. These smart sensors enable remote monitoring, predictive maintenance, and occupancy-based energy optimization. High-end commercial buildings, healthcare facilities, and premium residential developments increasingly prefer AI-assisted sensors capable of advanced motion detection, people-counting, and pattern analysis. This trend aligns with global smart city initiatives and sustainability-driven construction practices.

Touchless and Hygiene-Focused Solutions Accelerating Globally

Post-pandemic health awareness continues to fuel demand for touchless door activation systems. Infrared, LiDAR, and camera-based sensors are rapidly replacing manual or push-button doors in hospitals, airports, offices, and retail stores. These systems minimize surface contact, reduce infection risks, and improve accessibility. Additionally, companies are investing in multi-sensor fusion technologies that combine motion, presence, and safety detection for enhanced accuracy in high-footfall environments.

What are the key drivers in the automatic door sensors market?

Rapid Growth in Infrastructure & Commercial Construction

Urbanization across Asia-Pacific, the Middle East, and Latin America is driving large-scale development of airports, metro stations, malls, hotels, and business parks. Automatic doors are increasingly specified in new building codes for safety, accessibility, and energy efficiency, directly boosting demand for sensors. Commercial real estate investments, especially in retail and hospitality, remain the strongest drivers of global market expansion.

Rising Focus on Hygiene, Safety & Accessibility Standards

The need for hands-free operation in public and commercial spaces has significantly increased. Automatic door sensors help reduce physical contact, support compliance with accessibility regulations, and enhance safety via obstacle detection and anti-crush functionality. Healthcare institutions, pharmaceutical facilities, and airports are major adopters of advanced hygiene-focused door systems.

What are the restraints for the global market?

High Initial Installation & Integration Costs

Advanced automatic door sensors, especially IoT-enabled, laser-based, or camera-driven systems, can be expensive to install and maintain. Integration with existing doors or building automation systems adds further cost. These financial barriers hinder adoption in small businesses, older buildings, and budget-sensitive markets.

Volatility in Raw Material & Electronic Component Prices

Fluctuations in semiconductor, metal, and electronics pricing affect manufacturing costs and reduce margins for suppliers. Supply chain disruptions also delay deployment schedules. These challenges are particularly impactful in price-sensitive regions, where cost variations significantly influence purchasing decisions.

What are the key opportunities in the automatic door sensors industry?

Smart Infrastructure Expansion & Advanced Sensor Integration

Global smart city programs and modern commercial complexes are creating strong demand for intelligent, connected sensor systems. Companies offering AI-based analytics, cloud connectivity, and real-time monitoring solutions are well-positioned to capture this emerging high-value segment.

Rapid Growth in Retrofit & Modernization Projects

A large portion of existing buildings still operate on manual or outdated automatic door technologies. Retrofitting these structures with modern sensors, especially touchless variants, represents a multi-billion-dollar opportunity. Commercial, healthcare, and public infrastructure upgrades are driving recurring revenue streams for sensor manufacturers.

Product Type Insights

Infrared sensors dominate the market, with a share of 35–40%, due to their cost-effectiveness and reliability in both commercial and residential environments. Microwave and ultrasonic sensors serve high-traffic and industrial applications, while LiDAR and vision-based technologies are rapidly expanding in premium smart-building installations. Safety sensors that detect obstacles, motion, and environmental variations are increasingly bundled with basic motion sensors as part of stricter building safety codes.

Application Insights

Commercial buildings account for 45–50% of global installations, driven by rapid mall, hotel, retail, and office development. Airports and metro stations are adopting high-precision sensors to manage heavy passenger flows, while hospitals are prioritizing touchless and hygiene-focused systems. Industrial facilities increasingly use heavy-duty sensor-activated doors to enhance safety, workflow efficiency, and automation in warehouses and manufacturing lines.

Distribution Channel Insights

Direct sales through door automation manufacturers and integrators dominate the market, particularly for large projects requiring customization. Online channels are expanding rapidly for replacement sensors and small-scale installations. Specialized automation installers continue to serve retrofit and modernization projects. Growing digital adoption enables customers to compare models, evaluate safety ratings, and choose IoT-compatible systems more easily.

End-Use Industry Insights

Commercial real estate, healthcare, transportation infrastructure, and logistics facilities represent the strongest demand clusters. Healthcare institutions are among the fastest-growing users due to stringent hygiene standards. Logistics and warehousing benefit from automated, sensor-driven industrial doors that reduce energy loss and speed up material flow. Smart homes and premium residential complexes are gradually adopting touchless entry systems, creating a new consumer-driven segment.

| By Sensor Technology Type | By Application | By Functionality / Integration Level | By End-User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

Accounting for 25–30% of global revenue, North America is a mature yet steadily expanding market. The U.S. leads due to high commercial construction, airport modernization, and healthcare investments. Strong adoption of smart building technologies sustains demand for IoT-enabled sensors.

Europe

Europe holds 15–20% of the global market and shows stable adoption driven by stringent safety, accessibility, and energy-efficiency regulations. Germany, France, and the U.K. dominate installations, with strong retrofitting activity in commercial and institutional buildings.

Asia-Pacific

APAC is the fastest-growing region with a 30–35% share in 2024. China and India lead due to massive urbanization, expanding retail infrastructure, new airports, and smart city projects. Southeast Asia and Japan contribute significant demand across hospitality, healthcare, and commercial sectors.

Latin America

LATAM contributes 5–8% of market share, with Brazil and Mexico leading adoption. Growth is supported by the modernization of public buildings, hotels, and retail chains, though constrained by economic fluctuations.

Middle East & Africa

MEA holds a 5–7% share, driven by large-scale infrastructure development in the UAE, Saudi Arabia, and Qatar. Africa shows growing adoption in urban centers and airports, while Gulf countries favor premium, smart automation systems for commercial and public buildings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Automatic Door Sensors Market

- BEA SA

- BBC Bircher AG

- GEZE GmbH

- Pepperl+Fuchs SE

- Nabtesco Corporation

- Hörmann Group

- Dormakaba Holding AG

- Stanley Black & Decker, Inc.

- TORMAX

- Hotron Ltd.

- Ditec Entrematic

- Ningbo VEZE Automatic Door Co., Ltd.

- KBB

- Shanghai PAD

- Assa Abloy AB