Smart Home Hub Market Size

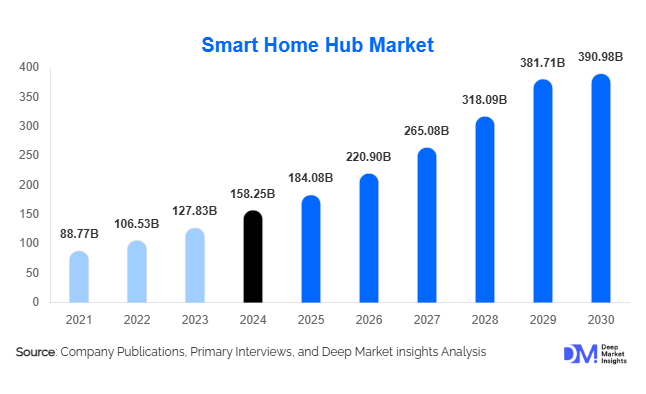

According to Deep Market Insights, the global smart home hub market size was valued at USD 40.0 billion in 2024 and is projected to grow from USD 44.8 billion in 2025 to reach USD 78.953 billion by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The smart home hub market growth is primarily driven by the rising adoption of Internet of Things (IoT) technologies, increasing consumer demand for home automation, and growing emphasis on energy-efficient and secure residential solutions.

Key Market Insights

- Smart home hubs serve as central control units for multiple connected devices, enhancing convenience, energy efficiency, and home security.

- Voice-controlled hubs dominate the market, with the integration of popular virtual assistants such as Amazon Alexa, Google Assistant, and Apple HomeKit driving adoption.

- North America currently leads the market, supported by high consumer awareness, technological adoption, and mature smart home infrastructure.

- Asia-Pacific is the fastest-growing region, propelled by rising urbanization, disposable income, and government initiatives promoting smart cities.

- Europe is witnessing steady growth, driven by energy efficiency policies and strong demand in Germany, the UK, and France.

- Technological advancements, including AI integration, Matter protocol adoption, and improved wireless connectivity (Zigbee, Z-Wave, Thread), are reshaping user experience and expanding device interoperability.

What are the prevailing trends influencing the global smart home hub market?

AI-Enabled Smart Home Hubs

Integration of artificial intelligence (AI) and machine learning in smart home hubs is revolutionizing home automation. AI-driven hubs can learn user preferences, optimize energy consumption, and provide predictive maintenance alerts, enhancing convenience and cost savings. Personalized automation routines, voice recognition improvements, and intelligent security monitoring are increasingly adopted features, contributing to higher market demand. Consumers are gravitating toward hubs that can autonomously manage connected devices, offering both operational efficiency and enhanced lifestyle comfort.

Interoperability through the Matter Protocol

The Matter protocol, an open-source standard for smart home devices, is facilitating cross-platform compatibility and reducing fragmentation. Adoption of this standard allows devices from different manufacturers to communicate seamlessly, simplifying installation and user experience. Smart home hubs that support Matter are becoming more attractive to consumers seeking unified ecosystems, thereby encouraging wider adoption and accelerating market growth globally.

Which key factors are driving growth and adoption in the smart home hub market worldwide?

Rising Consumer Demand for Home Automation

Consumers are increasingly adopting smart home hubs to centralize control of lighting, climate, entertainment, and security systems. The convenience of managing multiple devices from a single interface, coupled with energy monitoring and automation capabilities, has driven significant market growth. The proliferation of voice assistants and mobile app integration further enhances adoption rates, particularly in residential applications.

Advancements in Connectivity Technologies

Improved wireless communication protocols, including Zigbee, Z-Wave, Thread, and Matter, have enhanced device compatibility and network reliability. These technological advancements reduce setup complexity, improve response times, and expand the range of connected devices, positively impacting global smart home hub adoption.

Government Incentives and Energy Efficiency Policies

Governments worldwide are promoting energy-efficient technologies through incentives and policy support. Smart home hubs that monitor energy consumption and enable automated control of appliances are encouraged, particularly in Europe, North America, and the Asia-Pacific. Such initiatives enhance market growth by motivating consumers and businesses to invest in smart home ecosystems.

What challenges or restraints are affecting the expansion of the smart home hub market?

Privacy and Security Concerns

The centralized nature of smart home hubs raises potential risks related to data privacy and cybersecurity. Vulnerabilities in connected devices may expose users to unauthorized access, deterring adoption among security-conscious consumers. Manufacturers must continuously improve encryption, access controls, and monitoring systems to mitigate these concerns.

High Initial Investment

The cost of smart home hubs and compatible devices can be substantial, creating a barrier for price-sensitive customers. While early adopters are willing to invest in premium solutions, widespread adoption is limited by affordability, especially in emerging markets.

What key opportunities exist for businesses in the smart home hub market?

Expansion in Emerging Markets

While North America and Europe dominate, Asia-Pacific and Latin America present significant growth potential. Rising urbanization, increasing disposable income, and greater consumer awareness are driving adoption. Entry into these regions can provide first-mover advantages for new players and increase market penetration for existing companies.

Integration of AI and Machine Learning

AI-enabled smart home hubs offer predictive automation, personalized user experiences, and energy optimization, creating an opportunity to differentiate products. Manufacturers can leverage AI to provide intelligent, adaptive solutions that respond to individual household needs, enhancing customer satisfaction and brand loyalty.

Standardization through Matter Protocol

Device interoperability remains a critical challenge in the smart home ecosystem. Adoption of the Matter protocol enables seamless communication between devices from multiple manufacturers, simplifying installation and improving user experience. This standardization is expected to drive broader adoption and encourage new entrants to offer compatible solutions.

Product Type Insights

Voice-controlled hubs are the leading product type, accounting for a significant share of the market due to user-friendly interfaces and compatibility with popular virtual assistants. These hubs accounted for approximately 45% of the 2024 market. Touchscreen and gesture-based hubs are gaining traction as complementary options, while sensor-integrated and hub-less smart systems are emerging as niche segments.

Application Insights

Home automation is the leading application, including lighting, climate control, security, and entertainment management. In 2024, this segment represented over 50% of market share, driven by the increasing demand for integrated smart living solutions. Security-focused applications are also growing rapidly, supported by consumer awareness of smart surveillance and emergency alert systems. Energy management and entertainment applications are expected to grow alongside smart utility monitoring and connected media devices.

End-Use Analysis

The residential sector dominates the smart home hub market, fueled by urban consumers adopting connected devices for convenience, safety, and energy efficiency. Commercial adoption, particularly in offices and hospitality, is emerging due to smart energy management and facility automation needs. The export-driven demand is notable from North America and Europe to the Asia-Pacific region, highlighting cross-regional market expansion. Residential adoption is projected to grow at a 21% CAGR, while commercial adoption is forecasted at 19%, reflecting increasing diversification of end-use industries.

| Hub Type | Protocol Support | Value-added Features |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a leading market share of 35% in 2024, driven by high consumer awareness, technological adoption, and mature smart home infrastructure. The U.S. and Canada are primary contributors, with demand for voice-controlled hubs and AI-integrated devices supporting market growth. Consumer focus on convenience, energy savings, and security underpins sustained adoption rates.

Europe

Europe accounts for 28% of the 2024 market, with Germany, the U.K., and France leading in adoption. Energy efficiency policies and government incentives encourage the deployment of smart home hubs, particularly in residential segments. The region emphasizes sustainability and interoperability, supporting Matter-compliant device adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, Japan, and Australia driving demand. Rising urbanization, disposable income growth, and smart city initiatives are key factors. Early adoption in metropolitan areas is encouraging growth, particularly in premium and mid-range hubs.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is gradually adopting smart home hubs, with rising urbanization and awareness driving early growth. Affluent consumers are targeted for high-end devices, while mid-range adoption is expanding in urban centers.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, shows growing adoption due to high disposable income and a preference for luxury technology. Africa presents emerging opportunities, with government-backed smart city projects in countries like South Africa promoting demand for integrated smart home solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Home Hub Market

- Amazon.com, Inc.

- Google LLC

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- LG Electronics Inc.

- Bosch Group

- Philips Lighting N.V.

- Ecobee Inc.

- Honeywell International Inc.

- Lenovo Group Ltd.

- Panasonic Corporation

- TP-Link Technologies Co., Ltd.

- Ring LLC

Recent Developments

- In March 2025, Amazon expanded its Echo smart home hub portfolio with AI-driven automation features, enhancing energy management and security for residential users.

- In April 2025, Google launched a new Nest Hub with Matter protocol support, enabling seamless interoperability with a broader range of smart home devices.

- In June 2025, Apple introduced advanced HomeKit-enabled smart home hubs with enhanced privacy and remote control capabilities, improving user experience and device integration.