Aspartame Market Size

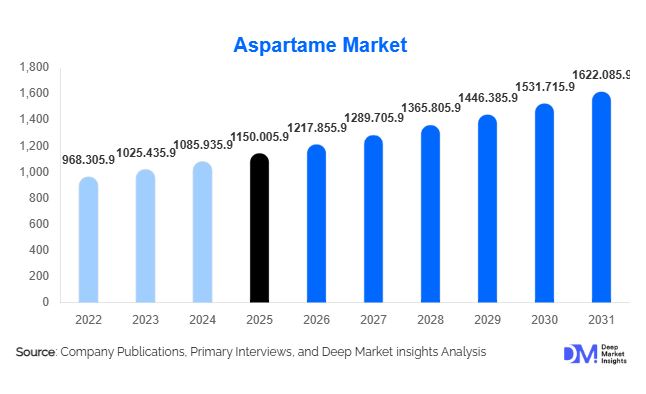

According to Deep Market Insights, the global aspartame market size was valued at USD 1,150 million in 2025 and is projected to grow from USD 1,217.85 million in 2026 to reach USD 1,622.08 million by 2031, expanding at a CAGR of 5.9% during the forecast period (2026–2031). The aspartame market growth is primarily driven by rising global sugar reduction initiatives, increasing demand for low-calorie beverages, and the continued reformulation of food and pharmaceutical products to meet health-conscious consumer preferences.

Aspartame remains one of the most widely used high-intensity artificial sweeteners globally, offering nearly 200 times the sweetness of sucrose. Its cost efficiency, taste profile, and compatibility with beverage formulations have sustained strong adoption, particularly in carbonated soft drinks and powdered beverage mixes. With more than 50 countries implementing sugar taxes and stricter labeling norms, food and beverage manufacturers are increasingly relying on artificial sweeteners such as aspartame to maintain flavor while reducing caloric content. Asia-Pacific leads global production and consumption, while North America and Europe remain mature, innovation-driven markets with stable demand.

Key Market Insights

- Carbonated soft drinks account for nearly 38% of global demand, making beverages the dominant application segment in 2025.

- Asia-Pacific holds approximately 42% market share, driven by China’s large-scale production and export capabilities.

- Food-grade aspartame represents about 85% of total market revenues, reflecting its dominant use in beverages and processed foods.

- Direct B2B sales account for nearly 70% of distribution, supported by long-term supply contracts with multinational beverage manufacturers.

- The top five manufacturers control around 60% of the global market, indicating moderate consolidation.

- India is the fastest-growing country, expanding at nearly 8% CAGR due to rapid beverage industry growth.

What are the latest trends in the aspartame market?

Reformulation of Zero-Sugar Beverages

Global beverage manufacturers are aggressively expanding zero-sugar and diet product lines to comply with sugar taxes and meet consumer demand for calorie-conscious products. Aspartame is frequently used either as a standalone sweetener or blended with acesulfame-K to enhance taste stability and reduce aftertaste. The surge in reformulated carbonated drinks, flavored waters, and ready-to-drink teas has strengthened baseline demand. Emerging markets in Asia and Latin America are witnessing new product launches targeting urban middle-class consumers seeking affordable diet alternatives.

Blended Sweetener Technologies

Manufacturers are investing in proprietary sweetener blends combining aspartame with other high-intensity sweeteners to improve stability under varying temperature and pH conditions. These blends enhance taste perception and reduce cost per sweetness unit, offering beverage producers flexibility in formulation. Encapsulation techniques are also being introduced to improve shelf life in powdered beverage mixes and pharmaceutical chewables. This technological integration is supporting premium pricing in specialized applications.

What are the key drivers in the aspartame market?

Global Sugar Reduction Policies

Governments worldwide have introduced sugar taxes and mandatory nutritional labeling regulations to combat obesity and diabetes. These measures are compelling food and beverage companies to reduce sugar content in products, directly increasing reliance on high-intensity sweeteners such as aspartame. Reformulation initiatives across North America and Europe continue to sustain steady volume growth.

Cost Efficiency Compared to Natural Alternatives

Although natural sweeteners such as stevia are gaining popularity, aspartame remains more cost-effective on a per-sweetness basis. In price-sensitive markets, especially in Asia and Latin America, manufacturers prioritize cost optimization, ensuring aspartame’s continued relevance in mass-market beverages and confectionery products.

What are the restraints for the global market?

Health Perception Concerns

Despite regulatory approvals from major global authorities, public debates and media scrutiny around artificial sweeteners occasionally influence consumer sentiment. This can result in temporary demand fluctuations, particularly in premium food segments where clean-label preferences are strong.

Rising Adoption of Natural Sweeteners

The clean-label movement and preference for plant-based sweeteners may gradually limit aspartame’s growth in high-end food categories. Manufacturers must address this challenge through transparent communication and technological innovation.

What are the key opportunities in the aspartame industry?

Expansion in Emerging Markets

Asia-Pacific and Africa present substantial untapped potential due to rising disposable incomes and urbanization. Establishing regional production facilities and export networks can reduce costs and strengthen supply chain efficiency. India and Southeast Asia are particularly promising due to expanding soft drink consumption.

Pharmaceutical and Nutraceutical Applications

Sugar-free syrups, chewable tablets, and dietary supplements are emerging as high-margin applications. Pharmaceutical-grade aspartame demand is growing at over 6% CAGR, offering diversification opportunities beyond beverage-centric revenue streams.

Application Insights

Carbonated soft drinks (CSDs) continue to dominate the global aspartame market, accounting for approximately 38% of total revenues in 2025. The leadership of this segment is primarily driven by aggressive reformulation strategies adopted by multinational beverage manufacturers in response to sugar taxes, front-of-pack labeling regulations, and rising consumer demand for zero-calorie beverages. Aspartame’s high sweetness intensity (around 200 times sweeter than sucrose), strong taste profile, and cost efficiency make it particularly suitable for diet colas and flavored carbonated drinks. Additionally, its compatibility with blended sweetener systems enhances flavor stability and reduces aftertaste, further strengthening its position in the beverage industry.

Non-carbonated beverages, including ready-to-drink teas, flavored water, and sports drinks, represent the second-largest application segment, supported by growing urban consumption patterns and demand for low-calorie hydration options. Powdered beverage mixes are also expanding steadily in emerging markets due to affordability and longer shelf life. Dairy products and confectionery contribute moderate shares, particularly in flavored yogurts and chewing gums. Meanwhile, pharmaceutical applications, though smaller in volume, remain high-margin segments due to increasing demand for sugar-free syrups and chewable tablets. Tabletop sweeteners maintain stable retail demand, particularly in North America and Europe, where diabetic and calorie-conscious consumers drive consistent uptake.

Form Insights

Powdered aspartame accounts for approximately 62% of global volume in 2025, making it the leading form segment. Its dominance is attributed to superior handling efficiency, ease of blending, extended shelf stability, and compatibility with high-speed beverage manufacturing lines. Powdered formulations also reduce logistical complexities in bulk transportation and storage, which is particularly critical for multinational beverage producers operating large-scale production facilities.

Granular aspartame serves niche applications, including tabletop sweeteners and select confectionery products, where specific particle size distribution is required. However, blended formulations are gaining traction at a faster rate, driven by the need for optimized sweetness profiles and improved thermal stability in beverages exposed to varying processing conditions. The expansion of proprietary sweetener blends, combining aspartame with acesulfame-K or other sweeteners, is expected to gradually increase the blended form share over the forecast period.

Distribution Channel Insights

Direct B2B sales dominate the aspartame market, accounting for nearly 70% of total revenues in 2025. This channel benefits from long-term procurement contracts between aspartame manufacturers and global beverage, dairy, and pharmaceutical companies. Bulk purchasing agreements ensure stable pricing, consistent quality compliance, and supply chain reliability, critical factors for high-volume beverage producers.

Ingredient distributors play a significant role in serving mid-sized and regional food processors, particularly in emerging markets where direct sourcing may not be feasible. Retail and e-commerce channels primarily support the tabletop sweetener segment, catering to individual consumers. The growing digitization of procurement platforms and supply chain management systems is further streamlining industrial purchasing processes, enhancing transparency and cost optimization across distribution networks.

End-Use Industry Insights

The global beverage industry represents nearly 45% of total aspartame demand in 2025, valued at over USD 500 million. Continued growth in zero-sugar carbonated drinks and functional beverages is the primary driver of this dominance. The global soft drinks sector is expanding steadily at around a 4–5% CAGR, directly influencing aspartame consumption volumes. Reformulation efforts by leading beverage brands across Asia-Pacific, North America, and Europe are reinforcing baseline demand.

The pharmaceutical sector is growing at approximately 6–7% CAGR, supported by rising demand for sugar-free oral syrups, chewable supplements, and pediatric formulations. Nutraceuticals and sports nutrition products represent emerging growth avenues, particularly in urban markets focused on weight management and fitness. Export-driven demand remains strong, with China acting as the largest global producer and exporter, supplying significant volumes to North America and Europe to meet industrial-scale requirements.

| By Application | By Form | By Distribution Channel | By Purity Grade |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global aspartame market with approximately 42% market share in 2025, driven by strong production capacity, expanding beverage consumption, and export-oriented manufacturing. China dominates regional output and serves as the primary global exporter due to cost-efficient manufacturing infrastructure and raw material availability. India is the fastest-growing country in the region, expanding at nearly 8% CAGR, fueled by rapid urbanization, rising disposable income, and increasing penetration of diet beverages. Japan and South Korea remain mature, high-value markets, supported by established food processing industries and strong demand for sugar-free products.

North America

North America accounts for nearly 25% of global demand, with the United States contributing approximately 80% of the regional market. Regional growth is supported by widespread consumption of diet sodas, established regulatory approvals, and strong pharmaceutical manufacturing capabilities. Increasing awareness of obesity and diabetes, combined with ongoing product reformulation by beverage giants, sustains stable demand. Canada and Mexico contribute moderately, with Mexico’s sugar tax policies encouraging gradual shifts toward low-calorie alternatives.

Europe

Europe holds around 22% share of the global market, led by Germany, France, and the United Kingdom. Regional growth is primarily driven by stringent EU sugar taxation policies and front-of-pack nutritional labeling regulations. The mature beverage industry and strong consumer inclination toward reduced-calorie products support consistent demand. Eastern Europe is witnessing moderate growth as multinational beverage brands expand distribution and reformulate legacy products to align with EU health standards.

Latin America

Latin America contributes roughly 6% of global revenues, with Brazil and Mexico serving as key consumption hubs. Growth drivers include rising urban populations, implementation of sugar taxes, and expanding availability of zero-sugar beverages. Multinational beverage manufacturers are investing in localized production and marketing strategies to capture middle-income consumer segments seeking affordable diet options.

Middle East & Africa

The Middle East & Africa accounts for about 5% share of the global market. Growth in GCC countries is driven by high per capita soft drink consumption, increasing imports of low-calorie beverage ingredients, and expanding modern retail infrastructure. South Africa leads sub-Saharan demand due to its established food processing industry. Rising health awareness and gradual implementation of sugar taxation policies in select Middle Eastern countries are expected to further stimulate demand for aspartame-based formulations over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aspartame Market

- Ajinomoto Co., Inc.

- Tate & Lyle PLC

- Celanese Corporation

- JK Sucralose Inc.

- Niutang Chemical Ltd.

- Changmao Biochemical Engineering

- Hyet Sweet

- Vitasweet Co., Ltd.

- NutraSweet Company

- Daesang Corporation

- Merisant Company

- Cargill, Incorporated

- ADM

- Ingredion Incorporated

- Foodchem International Corporation