Aquarium Accessories Market Size

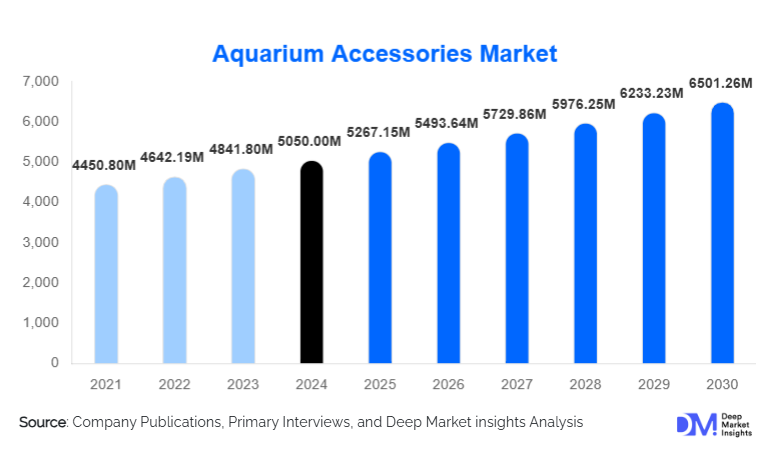

According to Deep Market Insights, the global aquarium accessories market size was valued at USD 5,050.00 million in 2024 and is projected to grow from USD 5,267.15 million in 2025 to reach USD 6,501.26 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). Market growth is supported by rising global interest in aquarium keeping as a lifestyle hobby, increasing applications of aquariums in residential and commercial décor, and rapid technological advancements in filtration, lighting, and water-monitoring systems. The expansion of online retail channels and the growing adoption of eco-friendly materials and smart devices are further accelerating demand across major regions.

Key Market Insights

- Decorative items and substrates dominate the product landscape, driven by rising demand for aesthetic and thematic aquarium setups among residential users.

- Residential aquariums account for nearly two-thirds of global demand, reflecting the strong penetration of aquarium-keeping trends in urban households.

- Asia-Pacific is the fastest-growing regional market, supported by rising middle-class incomes, e-commerce expansion, and widespread adoption of freshwater aquariums.

- North America and Europe collectively account for over 45% of global market value, driven by established hobbyist bases and premium accessory adoption.

- Smart accessories, including automated feeders, water-quality sensors, and app-controlled filters, are reshaping consumer expectations for convenience and low-maintenance ownership.

- Eco-friendly materials and sustainable décor products are gaining traction as consumers seek safer, more environmentally responsible aquarium components.

What are the latest trends in the aquarium accessories market?

Technology-Driven Aquarium Systems

Smart aquarium technologies are transforming the way hobbyists manage and interact with their aquariums. IoT-integrated aquarium filters, automated feeders, programmable LED lighting, and water-quality monitoring systems enable remote control and real-time data visualization through mobile apps. These tools reduce maintenance complexity, improving accessibility for beginners while appealing strongly to tech-savvy hobbyists. Digital test kits, AI-driven maintenance alerts, and eco-efficient pumps are becoming mainstream features in new product launches. As manufacturers increasingly incorporate sensors, automation, and energy-efficiency upgrades, technology-driven aquarium ecosystems are emerging as a central growth pillar for the market.

Eco-Friendly and Naturalistic Décor Trends

Growing consumer awareness of sustainability has led to rising demand for environmentally safe, natural-looking décor materials. Recycled plastics, resin-free ornaments, biodegradable substrates, and sustainably sourced driftwood are gaining prominence. Aquascaping, a popular hobby focused on creating artistic underwater landscapes, has accelerated demand for premium, nature-inspired décor, live plants, and specialty substrates. Manufacturers are responding by developing eco-certified décor products, toxin-free paints, and plant-friendly LED systems. This shift toward naturalistic aesthetics not only enhances visual appeal but also promotes healthier aquatic environments, reinforcing long-term market adoption.

What are the key drivers in the aquarium accessories market?

Growing Household Adoption and Lifestyle Shifts

Urban lifestyle trends, rising disposable incomes, and the desire for stress-relieving home décor are driving the popularity of aquariums in households worldwide. Fishkeeping is increasingly viewed as a therapeutic hobby that enhances interior aesthetics while requiring relatively low maintenance. This is especially pronounced among millennials and apartment dwellers seeking compact, visually appealing pets. As home aquariums become mainstream décor elements, demand for lighting, filtration systems, decorative items, and maintenance tools continues to expand.

Expansion of Online Retail and Global Distribution Networks

E-commerce has significantly widened consumer access to a broader range of aquarium accessories. Platforms offering detailed product comparisons, user reviews, bundled aquarium kits, and fast shipping have reduced barriers for new hobbyists. Online channels are particularly influential in markets where specialty aquarium stores are limited. This shift supports strong growth in mid-range and premium accessories, as consumers increasingly rely on digital platforms to explore advanced equipment and aesthetic décor solutions.

What are the restraints for the global market?

High Costs of Premium and Smart Accessories

Advanced filtration systems, digital monitoring devices, and high-efficiency LED lighting often come at elevated prices, creating barriers for budget-conscious consumers. In emerging markets where price sensitivity is high, consumers may opt for low-cost alternatives, slowing the adoption of innovative equipment. This creates a gap between technological availability and mass-market affordability.

Maintenance Complexity and Limited Beginner Awareness

New aquarium owners frequently underestimate the maintenance requirements associated with water quality, filtration, algae control, and fish health. Poor maintenance can lead to equipment replacement costs, failed aquarium setups, or hobby abandonment. This challenge can restrict long-term growth, particularly in regions lacking widespread access to aquarium education or after-sales support.

What are the key opportunities in the aquarium accessories industry?

Rising Commercial Adoption in Hospitality and Corporate Interiors

Hotels, restaurants, luxury spas, malls, and corporate offices increasingly incorporate aquariums into interior environments to enhance visual appeal and create calming atmospheres. Commercial demand often requires larger tanks, premium lighting systems, professional-grade filtration, and decorative ecosystems, driving higher-value sales. As wellness-centered design trends expand globally, the hospitality-driven aquarium segment is expected to unlock significant B2B opportunities for manufacturers.

Smart Aquarium Ecosystems and Automated Maintenance

The integration of sensors, AI alerts, Wi-Fi controls, and automated feeding systems opens a high-margin pathway for manufacturers targeting tech-oriented consumers. Smart kits dramatically reduce maintenance burdens, making aquarium ownership more accessible for busy professionals and younger demographics. With IoT-enabled pet care on the rise, the next generation of aquarium accessories is shifting toward automation, predictive analytics, and integrated control hubs.

Product Type Insights

Decorative items and substrates lead the global aquarium accessories market, accounting for approximately 30–35% of total market share in 2024. This dominance is fueled by the growing aesthetic focus among aquarium hobbyists and the rise of aquascaping as a mainstream trend. Decorative rocks, artificial plants, driftwood, themed ornaments, and natural-looking substrates enhance visual appeal and allow users to create personalized aquatic environments. Filtration systems constitute the second-largest category, while lighting solutions, especially LED-based systems, are rapidly growing due to energy efficiency and customizable visual effects.

Application Insights

Residential aquariums represent the most significant application, contributing nearly 60–70% of global demand in 2024. Homeowners increasingly view aquariums as wellness-oriented décor, stable, low-maintenance pets, and artistic centerpieces. Commercial applications, including aquariums in hotels, restaurants, office lobbies, and retail spaces, are accelerating due to the ambience-enhancing qualities of aquariums. Professional aquascaping studios, educational institutions, and ornamental fish exporters also contribute meaningfully to demand, particularly for high-grade, specialty accessories.

Distribution Channel Insights

Offline specialty stores currently dominate distribution with a 55–65% market share, supported by the consumer need for tactile inspection of décor items and expert advice. However, online retail channels are growing at the fastest rate, driven by expanding e-commerce penetration and the availability of reviews, bundle kits, and competitive pricing. Direct-to-consumer (D2C) brand websites and online specialty aquarium retailers are expected to capture a growing portion of premium accessory sales.

| By Product Type | By Application | By Distribution Channel | By Aquarium Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25–30% of the global market share in 2024, driven by a mature aquarium hobbyist community and high adoption of premium accessories. The U.S. leads demand due to strong consumer purchasing power, widespread aquarium ownership, and growing interest in aquascaping and reef-keeping. Commercial aquariums in hotels and corporate interiors are also expanding across the region.

Europe

Europe contributes 20–25% of global revenues and remains a strong market for sustainable, eco-friendly aquarium accessories. Germany, France, and the U.K. exhibit a high preference for premium décor and technologically advanced aquarium equipment. European consumers also show notable interest in aquascaping competitions and live-planted aquariums, increasing demand for lighting, CO₂ systems, and nutrient-rich substrates.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market with a rising share projected to exceed 30–35% by 2030. Rapid urbanization, rising middle-class incomes, and strong uptake of freshwater aquariums are driving growth in China, India, Japan, Indonesia, and Thailand. E-commerce expansion and increasing interest in aquascaping culture further accelerate demand for premium accessories.

Latin America

Latin America shows steady growth, with increasing aquarium adoption in Brazil, Mexico, and Argentina. Demand centers around decorative products and budget-to-midrange accessories, though premium aquariums are gaining popularity among affluent consumers. Growing pet ownership rates contribute to rising household aquarium setups.

Middle East & Africa

The region contributes approximately 3–5% of global demand, with growth driven by luxury aquarium installations in the UAE, Saudi Arabia, and Qatar. Affluent consumers and commercial establishments are adopting large, premium aquariums as luxury interior elements. In Africa, South Africa remains the key market, supported by a growing aquarium hobbyist base and expanding retail distribution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aquarium Accessories Market

- Guangdong Boyu Group Co., Ltd.

- Spectrum Brands, Inc.

- Aqua Design Amano Co., Ltd.

- API (Aquarium Pharmaceuticals, Inc.)

- Rolf C. Hagen, Inc.

- Qian Hu Corporation Limited

- Interpet Limited

- Tropical Marine Centre

- Zoo Med Laboratories, Inc.

- Penn Plax

- Hailea

- Marukan

- EHEIM

- Juwel Aquarium

- OASE

Recent Developments

- In March 2025, several leading manufacturers launched smart, app-integrated LED lighting and filtration systems designed for residential aquariums, enhancing automation and energy efficiency.

- In January 2025, European brands introduced eco-friendly decorative product lines made from recycled plastics and biodegradable materials to meet growing sustainability demands.

- In November 2024, major Asian manufacturers expanded production capacity for mid-range filtration systems to support rising demand across India, China, and Southeast Asia.