Home Aquarium Filter Market Size

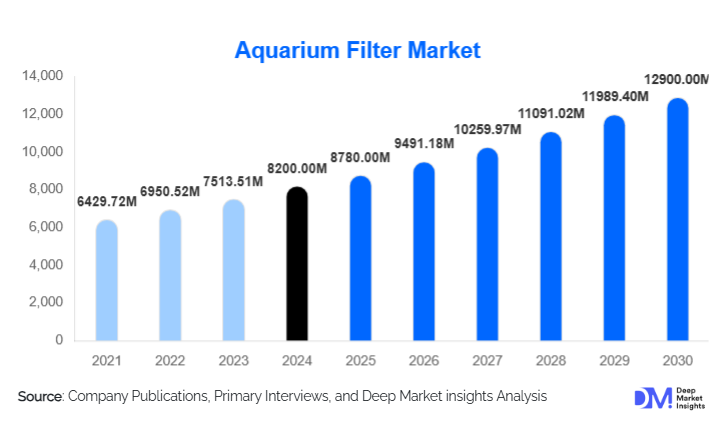

According to Market Insights, the global home aquarium filter market size was valued at USD 8,200 million in 2024 and is projected to grow from USD 8,780 million in 2025 to reach USD 12,900 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of aquascaping and ornamental fish-keeping as a hobby, growing awareness of aquatic animal welfare, and technological advancements in filtration systems that enhance water quality and energy efficiency.

Key Market Insights

- Rising demand for smart and automated aquarium filters featuring Wi-Fi connectivity, water quality sensors, and self-cleaning mechanisms.

- Growing adoption of aquariums as interior décor elements in homes, offices, and commercial spaces, boosting aesthetic and lifestyle-driven demand.

- Asia-Pacific dominates the global aquarium filter market due to high pet fish ownership in China, Japan, and India.

- Europe is witnessing rapid growth owing to increasing focus on eco-friendly filtration systems and sustainable aquatic pet care.

- Technological integration, including IoT-enabled filters and AI-based water monitoring, is reshaping the market landscape.

- Rising disposable incomes and urbanization in developing countries are fueling new aquarium installations, especially among millennials and Gen Z households.

What are the latest trends in the home aquarium filter market?

Smart Aquarium Filtration Systems

Manufacturers are increasingly incorporating smart technologies into aquarium filters, enabling real-time monitoring and control via mobile apps. Features such as automatic cleaning, AI-based alerts for filter replacement, and integration with smart home ecosystems are becoming mainstream. These innovations cater to tech-savvy consumers who value convenience and precision in aquarium maintenance. Companies are also focusing on energy-efficient designs that reduce operational costs and environmental impact, aligning with global sustainability trends.

Eco-Friendly and Bio-Based Filter Media

With growing environmental awareness, consumers are shifting toward eco-friendly filtration materials such as biodegradable sponges, natural zeolite, and activated carbon derived from sustainable sources. Manufacturers are emphasizing recyclable and reusable filter components to minimize waste. The adoption of natural biological filtration techniques, including live plants and bacteria-based media, is also rising, promoting a balanced aquatic ecosystem and reducing chemical dependency.

What are the key drivers in the home aquarium filter market?

Growing Popularity of Aquascaping and Ornamental Fish-Keeping

Aquascapingthe art of designing aesthetically appealing underwater landscapes becoming a global trend. Social media exposure, particularly through platforms like Instagram and YouTube, has fueled interest in aquarium hobbies, driving sales of premium filtration systems. The growing number of aquascaping competitions and dedicated retail outlets further amplifies demand for advanced filtration technologies that support plant growth and clear water conditions.

Technological Innovation and Product Customization

Manufacturers are offering modular, customizable filter designs that cater to a variety of aquarium sizes and types, from nano tanks to large reef aquariums. Integration of digital controls, noise-reduction technologies, and improved mechanical and biological filtration systems enhances user experience and reliability. These innovations are attracting both new hobbyists and professional aquarists seeking efficient and low-maintenance solutions.

What are the restraints for the global market?

High Cost of Advanced Filtration Systems

Premium filters with smart technology and multi-stage purification systems come at a higher cost, limiting adoption among price-sensitive consumers. Additionally, replacement parts, maintenance, and electricity consumption add to long-term operational expenses. These cost factors may restrain growth, particularly in developing economies with lower discretionary spending.

Limited Awareness in Emerging Regions

In several developing countries, limited awareness about proper aquarium maintenance and the importance of filtration systems remains a challenge. Many consumers still rely on basic or manual cleaning methods, which can lead to poor fish health and high mortality rates. The lack of organized retail channels and after-sales support further constrains market penetration in rural and semi-urban areas.

What are the key opportunities in the home aquarium filter industry?

Integration of IoT and AI Technologies

The integration of Internet of Things (IoT) and artificial intelligence (AI) in aquarium filters presents a major opportunity for market expansion. Smart filters capable of analyzing water parameters, predicting maintenance needs, and optimizing flow rates autonomously are expected to gain strong traction. Partnerships between aquarium product manufacturers and tech firms are likely to drive innovation in this segment.

Expansion in Developing Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant growth potential due to rising pet adoption rates, urban lifestyle trends, and increasing disposable incomes. Localized product development, such as compact, affordable filters designed for smaller living spacescan help manufacturers capture this growing demographic. Government initiatives promoting sustainable pet care and eco-friendly home products will also support market growth.

Product Type Insights

External filters dominate the market owing to their superior filtration capacity, durability, and suitability for large aquariums. Internal filters are popular in smaller home setups due to their affordability and ease of installation. Sponge filters are witnessing renewed interest among beginners and breeders for their gentle water flow and bio-filtration efficiency. Canister filters, with advanced multi-stage purification capabilities, remain the preferred choice for professional aquascapers and reef tank enthusiasts.

Application Insights

The residential segment accounts for the largest market share, driven by the increasing integration of aquariums in home interiors and hobbyist culture. The commercial segmentincluding hotels, restaurants, and offices, is experiencing steady growth as aquariums are increasingly used as decorative and stress-relief elements. Educational and research institutions also represent a niche but growing segment, utilizing advanced filtration systems for marine biology and environmental science applications.

Distribution Channel Insights

Online channels dominate sales, supported by the rise of e-commerce platforms and direct-to-consumer models offering competitive pricing and extensive product variety. Offline retail stores remain vital for premium and customized purchases, where expert advice and physical inspection play crucial roles. Pet specialty stores and aquarium boutiques continue to expand in urban areas, often combining product sales with installation and maintenance services.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest market share, driven by strong pet fish ownership in China, Japan, and India. Rapid urbanization, growing middle-class incomes, and cultural affinity for ornamental fish make the region a major growth hub. Government support for the aquaculture industry also indirectly benefits the aquarium filter market.

North America

North America represents a mature market with strong consumer demand for technologically advanced and energy-efficient filters. The U.S. and Canada show high adoption rates of premium aquarium systems, driven by well-established pet care infrastructure and the growing influence of home décor trends.

Europe

Europe is witnessing strong growth in eco-friendly and sustainable filtration systems. Consumers in countries such as Germany, the U.K., and France prioritize low-noise, energy-efficient, and recyclable filter models. The region also benefits from a growing aquascaping community and organized retail channels promoting advanced aquarium care.

Latin America

Latin America is an emerging market, with Brazil and Mexico showing rising interest in aquarium hobbies. Increasing urbanization and social media influence are fueling demand for decorative aquariums and related accessories. However, limited product availability and higher import costs pose short-term challenges.

Middle East & Africa

Growing disposable income and luxury lifestyle trends are stimulating aquarium installations in residential and commercial spaces across the UAE, Saudi Arabia, and South Africa. Import-based distribution remains dominant, but local production initiatives are expected to emerge as demand grows for affordable and climate-resilient filtration systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Aquarium Filter Market

- EHEIM GmbH & Co. KG

- Tetra (Spectrum Brands Holdings, Inc.)

- Fluval (Rolf C. Hagen Inc.)

- API Fishcare

- Aqua One

- Sera GmbH

- Aqueon

Recent Developments

- In July 2025, Fluval launched its next-generation “FX Smart Series” canister filters with IoT connectivity and energy-efficient design, targeting premium aquascaping enthusiasts.

- In March 2025, EHEIM announced the introduction of an eco-line of filters using recyclable materials and low-consumption motors to reduce carbon footprint.

- In January 2025, Tetra introduced a bio-filter line utilizing plant-based filtration media aimed at sustainable aquarium maintenance for beginner hobbyists.