Apple Concentrate Market Size

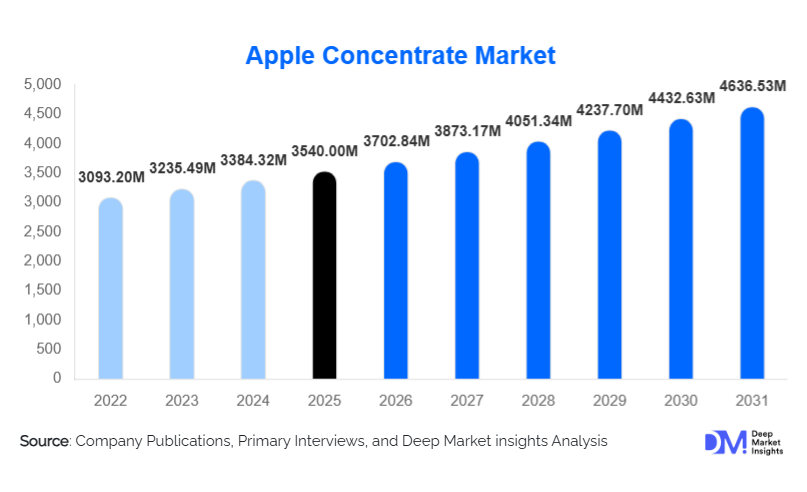

According to Deep Market Insights, the global apple concentrate market size was valued at USD 3,540.00 million in 2025 and is projected to grow from USD 3,702.84 million in 2026 to reach USD 4,636.53 million by 2031, expanding at a CAGR of 4.6% during the forecast period (2026–2031). The apple concentrate market growth is primarily driven by rising demand for natural sweeteners, increasing consumption of fruit-based beverages and processed foods, and strong export-oriented production from major apple-growing regions.

Key Market Insights

- Apple concentrate is increasingly replacing refined sugar and HFCS in beverages and processed foods due to clean-label and natural ingredient demand.

- Beverage applications dominate global consumption, particularly juices, RTD drinks, and cider formulations.

- Asia-Pacific leads global production and exports, with China accounting for the largest share of supply.

- Organic and clarified apple concentrates are gaining traction, driven by premium beverage and infant nutrition manufacturers.

- Aseptic bulk packaging remains the preferred format, enabling long shelf life and cost-efficient international trade.

- Price volatility in raw apples continues to influence concentrate pricing and processor margins.

What are the latest trends in the apple concentrate market?

Rising Demand for Clean-Label and Natural Sweeteners

Food and beverage manufacturers are increasingly shifting away from artificial sweeteners and refined sugars toward fruit-based alternatives such as apple concentrate. Its natural sweetness, neutral flavor profile, and labeling advantages make it an ideal ingredient for juices, bakery products, dairy desserts, and sauces. This trend is particularly pronounced in North America and Europe, where regulatory scrutiny and consumer awareness around sugar reduction are high. As a result, manufacturers are reformulating products to include apple concentrate as a core ingredient, supporting sustained market growth.

Expansion of Organic and Premium Apple Concentrates

Organic apple concentrate is emerging as a fast-growing segment, driven by demand from premium beverage brands and infant food manufacturers. Certified organic sourcing, traceability, and minimal processing are becoming key differentiators. Although organic concentrates currently represent a smaller share of total volume, they command higher margins and are witnessing above-average growth rates, particularly in Europe and Asia-Pacific.

What are the key drivers in the apple concentrate market?

Growth in Fruit Juice and RTD Beverage Consumption

The global rise in consumption of fruit juices, blended drinks, and functional beverages is a major driver of apple concentrate demand. Apple concentrate is widely used as a base ingredient due to its consistency, availability, and compatibility with other fruit flavors. Growth in urban populations and on-the-go consumption patterns is further supporting demand from beverage manufacturers.

Expansion of Processed Food Industries

Processed food industries, including bakery, confectionery, dairy, and sauces, are expanding rapidly in emerging economies. Apple concentrate is used to enhance flavor, moisture retention, and sweetness in these products. Industrial-scale food production growth directly correlates with rising apple concentrate consumption.

What are the restraints for the global market?

Volatility in Raw Apple Prices

Apple concentrate pricing is highly sensitive to fluctuations in raw apple supply, which can be affected by weather conditions, crop diseases, and labor availability. Variability in harvest volumes directly impacts concentrate production costs and pricing stability, posing a challenge for processors and buyers.

High Energy and Processing Costs

Apple concentrate production is energy-intensive, requiring evaporation, refrigeration, and aseptic packaging. Rising energy costs, particularly in Europe, are exerting pressure on profit margins, especially for smaller processors with limited economies of scale.

What are the key opportunities in the apple concentrate industry?

Infant Nutrition and Baby Food Applications

The infant nutrition industry presents a significant growth opportunity for apple concentrate manufacturers. Apple concentrate is widely used in purees, juices, and cereals due to its digestibility and mild sweetness. Rising birth rates in emerging markets and increasing preference for packaged baby foods are expected to drive strong demand for food-grade and organic apple concentrates.

Export-Led Growth and Trade Diversification

Export-oriented production from apple-rich countries such as China, Poland, Turkey, and Chile is expanding rapidly. Improvements in bulk packaging, cold-chain logistics, and trade agreements are enabling suppliers to access high-demand import markets such as the U.S., Middle East, and Southeast Asia, creating long-term growth opportunities.

Product Type Insights

High-brix apple concentrate dominates the market, accounting for approximately 48% of total market value in 2025. Its lower transportation costs and suitability for bulk export make it the preferred choice for international trade. Single- and double-strength concentrates continue to serve regional beverage and food processing applications, while organic concentrates represent the fastest-growing product type due to premium positioning.

Application Insights

Beverages represent the largest application segment, contributing nearly 45% of total market demand in 2025. Apple concentrate is extensively used in juices, RTD drinks, flavored waters, and cider production. Food processing applications, including bakery and confectionery, form the second-largest segment, while infant nutrition is the fastest-growing application, supported by rising demand for packaged baby foods.

Distribution Channel Insights

Direct sales to food and beverage manufacturers dominate the distribution landscape, accounting for the majority of global trade volumes. Traders and exporters play a critical role in cross-border supply, particularly for bulk shipments. Specialized food ingredient distributors serve smaller manufacturers and regional markets, offering flexibility and value-added services.

End-Use Industry Insights

The food and beverage manufacturing industry accounts for approximately 68% of total apple concentrate consumption, valued at around USD 5.4 billion in 2025. Infant nutrition is the fastest-growing end-use segment, expanding at over 8% CAGR, while nutraceutical and pharmaceutical applications represent a smaller but high-margin segment.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel | By Form |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global apple concentrate market with around 41% share in 2025. China dominates both production and exports, accounting for nearly 28% of global market value. India is the fastest-growing market in the region, driven by rising processed food consumption and beverage manufacturing.

Europe

Europe holds approximately 27% of the global market, led by Poland, Germany, and Italy. Poland is the largest exporter within the region, supplying concentrate to Western Europe and North America. Demand is supported by strong beverage and bakery industries.

North America

North America accounts for about 18% of global demand, with the United States being the largest importer of apple concentrate. Strong consumption of juices, RTD beverages, and infant food products supports steady demand.

Latin America

Latin America represents roughly 9% of the global market, led by Chile and Argentina. The region benefits from export-oriented production and growing regional food processing industries.

Middle East & Africa

The Middle East & Africa account for nearly 5% of global demand, driven primarily by import-dependent GCC countries. Growing beverage consumption and food processing capacity are supporting market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Apple Concentrate Market

- Döhler Group

- Ingredion Incorporated

- Agrana Group

- Louis Dreyfus Company

- Yantai North Andre Juice

- SVZ International

- China Haisheng Juice

- Tree Top Inc.

- Austria Juice

- Kerry Group

- Herbafood Ingredients

- Saftunion

- Manzana Products Co.

- Valio Ltd.

- Suntory Holdings