Anti-Caking Agent Market Size

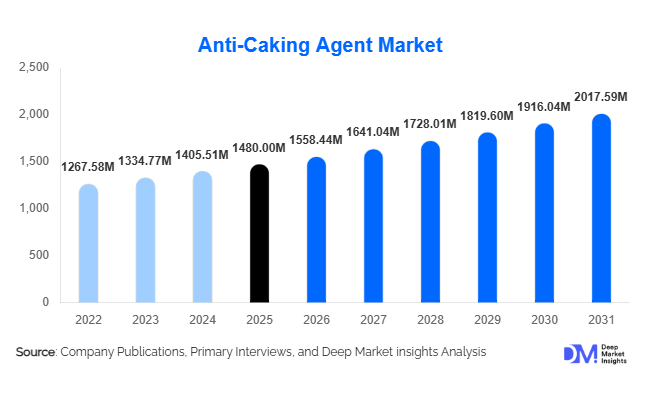

According to Deep Market Insights, the global anti-caking agent market size was valued at USD 1,480 million in 2025 and is projected to grow from USD 1,558.44 million in 2026 to reach USD 2,017.59 million by 2031, expanding at a CAGR of 5.3% during the forecast period (2026–2031). The anti-caking agent market growth is primarily driven by increasing demand for processed and packaged foods, expanding fertilizer production, and rising pharmaceutical powder manufacturing. Growing concerns over moisture control, improved flowability, and extended shelf life across industrial applications are further strengthening demand. Manufacturers are investing in high-purity silica, phosphate-based, and natural anti-caking solutions to meet stringent regulatory and performance standards across food, pharma, and agrochemical industries.

Key Market Insights

- Food & beverages account for nearly 45% of global demand, driven by salt, spices, dairy powders, bakery mixes, and instant beverages.

- Silicon dioxide dominates product consumption with approximately 34% market share, owing to superior moisture absorption and regulatory acceptance.

- Asia-Pacific leads the global market with around 38% share, supported by strong food processing and fertilizer production in China and India.

- Natural and bio-based anti-caking agents are the fastest-growing segment, expanding at nearly 7% CAGR due to clean-label trends.

- Fertilizer exports and global agricultural trade are creating steady bulk demand for industrial-grade anti-caking additives.

- Pharmaceutical excipient demand is rising, supported by increasing generic drug manufacturing and nutraceutical powder production.

What are the latest trends in the anti-caking agent market?

Shift Toward Clean-Label and Natural Additives

Food manufacturers are increasingly reformulating products to align with clean-label expectations. Natural anti-caking agents derived from starch, cellulose, and mineral sources are gaining traction, particularly in North America and Europe. Consumers are scrutinizing ingredient lists more closely, prompting companies to replace synthetic sodium aluminosilicates and other chemical additives with naturally positioned alternatives. Regulatory frameworks are also encouraging safer and transparent labeling practices, which are accelerating the commercialization of plant-based and mineral-based anti-caking agents in premium food segments.

Advanced Silica Engineering and Surface-Treated Additives

Technological innovation in precipitated and fumed silica is enhancing moisture absorption efficiency and dispersibility. Surface-treated microfine powders are increasingly used in pharmaceuticals and specialty food powders to improve blending uniformity. Manufacturers are optimizing particle size distribution to enhance flow properties in automated packaging lines. This trend is particularly strong in pharmaceutical manufacturing hubs in the Asia-Pacific, where high-speed tablet production requires precise powder handling and stability.

What are the key drivers in the anti-caking agent market?

Expansion of the Processed and Packaged Food Industry

The rapid growth of processed food consumption globally is a primary driver. Rising urbanization, dual-income households, and demand for convenience foods are increasing the production of powdered and granulated products requiring anti-caking functionality. Food manufacturers rely on these additives to prevent clumping in salt, seasonings, coffee creamers, and dairy powders. Automation in packaging facilities further necessitates consistent flow properties, reinforcing demand.

Rising Fertilizer Production and Export Demand

Global fertilizer output exceeds 200 million metric tons annually, with significant export flows from China, the Middle East, and Russia to Brazil and India. Fertilizer granules are highly sensitive to moisture-induced caking during shipping and storage. Anti-caking agents improve granule integrity, reduce product loss, and enhance application efficiency. Growing agricultural productivity initiatives and food security programs are sustaining demand for industrial-grade anti-caking solutions.

What are the restraints for the global market?

Regulatory Limitations on Chemical Additives

Certain chemical-based anti-caking agents face strict regulatory scrutiny in food and pharmaceutical applications. Compliance with evolving safety standards increases R&D and reformulation costs for manufacturers. Regulatory disparities across regions further complicate global product standardization.

Volatility in Raw Material and Energy Costs

Silica, phosphates, and mineral compounds are energy-intensive to produce. Fluctuating mining costs and energy price volatility can impact manufacturing margins, particularly for commodity-grade products. Price sensitivity in bulk fertilizer applications adds pressure on supplier profitability.

What are the key opportunities in the anti-caking agent industry?

Growth in Nutraceutical and Protein Powder Applications

The expanding global nutraceutical market is driving demand for anti-caking agents in protein powders, dietary supplements, and sports nutrition products. These applications require superior flow characteristics for packaging precision. The segment is benefiting from health-conscious consumer trends and e-commerce-driven supplement sales.

Industrial and Agrochemical Expansion in Emerging Markets

Rapid industrialization and agricultural intensification in the Asia-Pacific and Latin America present strong opportunities. Government-backed fertilizer capacity expansions and agrochemical manufacturing investments are generating consistent bulk additive demand. Companies expanding regional production capacity can capitalize on reduced logistics costs and improved supply chain responsiveness.

Product Type Insights

Silicon dioxide continues to lead the anti-caking agent market, accounting for approximately 34% of total revenue in 2025. Its dominance is driven by superior moisture adsorption capacity, high surface area, chemical stability, and global regulatory acceptance across food and pharmaceutical applications. The rapid expansion of processed foods, dairy powders, nutraceutical blends, and instant beverage mixes has reinforced demand for high-purity precipitated and fumed silica. In pharmaceutical manufacturing, silicon dioxide improves powder flowability, enhances uniform mixing, and ensures dosage accuracy in high-speed tablet production lines. Technological advancements in engineered silica, such as surface-treated and microfine grades, are further strengthening its performance in humidity-sensitive supply chains, especially in tropical export markets.

Calcium compounds, including calcium silicate and calcium carbonate, represent the second-largest segment due to their cost-effectiveness in salt, spice blends, and seasoning formulations. Magnesium stearate remains critical in pharmaceutical tablet compression as a lubricant and flow enhancer, while phosphate-based agents such as tricalcium phosphate are widely used in dairy powders and nutritional formulations. The overall product trend indicates a gradual shift toward higher-purity, multifunctional additives capable of delivering moisture control, anti-compaction, and improved bulk handling efficiency simultaneously.

Source Insights

Synthetic anti-caking agents dominate the global market with nearly 72% share in 2025, primarily due to large-scale production capabilities, consistent quality standards, and cost competitiveness in industrial applications such as fertilizers and chemicals. Their scalability supports high-volume end uses, particularly in emerging economies with expanding food processing and agrochemical industries.

However, natural and bio-based anti-caking agents are the fastest-growing source segment, supported by clean-label trends and regulatory encouragement in North America and Europe. Rising consumer scrutiny of synthetic additives has prompted manufacturers to adopt mineral-based and plant-derived alternatives in premium food categories. This shift is especially evident in organic food products, infant nutrition, and specialty health supplements, where ingredient transparency significantly influences purchasing decisions.

End-Use Industry Insights

The food & beverages sector accounts for approximately 45% of the global anti-caking agent market, making it the leading end-use industry. Demand is primarily driven by processed salt, seasoning blends, bakery premixes, dairy powders, coffee creamers, and ready-to-drink beverage powders. Automation in food packaging facilities requires stable, free-flowing powders to minimize downtime and product loss, directly increasing additive consumption.

Fertilizers represent a major industrial segment, particularly in export-oriented economies such as China, Saudi Arabia, and Russia. Anti-caking agents prevent moisture-induced clumping during long-distance storage and shipping, enhancing product application efficiency. The pharmaceutical industry is one of the fastest-growing segments, supported by expanding generic drug manufacturing in India and China. Anti-caking agents ensure uniform blending and compressibility in tablets and capsules. Additionally, cosmetics and personal care applications are emerging steadily, particularly in talc-free formulations and pressed powders, reflecting evolving safety and regulatory standards.

Form Insights

Powdered anti-caking agents account for nearly 63% of global demand, as most target applications involve powdered and granulated materials requiring homogeneous dispersion. Powdered forms provide easy blending in automated production lines and offer flexibility in formulation adjustments. Microfine and surface-treated variants are gaining popularity in high-precision pharmaceutical and nutraceutical applications, where particle size optimization enhances bioavailability and production efficiency. Granular forms are widely used in fertilizer and industrial chemical applications to ensure even distribution across bulk volumes.

| By Product Type | By Source | By End-Use Industry | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the anti-caking agent market with approximately 38% share in 2025 and remains the fastest-growing region at over 6% CAGR. China contributes nearly 18% of global demand, driven by its dominant fertilizer manufacturing base and expansive food processing industry. Large-scale exports of fertilizers and processed foods necessitate moisture-control additives to maintain product stability during transportation. India is emerging as a significant demand hub due to rapid growth in pharmaceutical manufacturing and government initiatives such as “Make in India,” which encourage domestic chemical production. Rising middle-class consumption of packaged foods across Southeast Asia is further accelerating regional demand.

North America

North America accounts for around 24% of the global market share, with the United States contributing nearly 20%. Strong processed food consumption, advanced pharmaceutical infrastructure, and stringent FDA regulations drive demand for high-purity and compliant additives. The region also benefits from established silica manufacturing facilities and technological innovation in excipient development. Clean-label reformulation trends are pushing food manufacturers toward premium and natural anti-caking solutions, further strengthening market value growth.

Europe

Europe holds approximately 22% of global demand, supported by Germany, France, the UK, and Italy. Strict EFSA regulations and strong food safety compliance standards are major growth drivers. Western Europe demonstrates high adoption of natural and mineral-based anti-caking agents due to consumer preference for transparent ingredient labeling. Additionally, Europe’s substantial dairy powder exports and processed food manufacturing base sustain steady additive consumption. Sustainability initiatives and energy-efficient production processes are also influencing supplier investments in the region.

Latin America

Brazil dominates Latin American demand due to its position as a major agricultural producer and fertilizer importer. Anti-caking agents are essential to ensure the stability of fertilizers in humid climates and during long-distance inland transportation. Growing packaged food industries in Mexico and Argentina are contributing to incremental demand growth. Expanding regional trade agreements and improving logistics infrastructure are further facilitating market expansion across the region.

Middle East & Africa

The Middle East & Africa region is witnessing gradual expansion, primarily driven by fertilizer production hubs in Saudi Arabia and the UAE. Large-scale petrochemical and phosphate-based fertilizer manufacturing operations require anti-caking solutions to maintain granule flowability in arid yet storage-sensitive environments. Increasing food imports and rising packaged food demand across Africa are generating additional requirements for moisture-control additives. Government investments in agrochemical capacity expansion and food security programs are expected to sustain steady long-term growth in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Caking Agent Market

- Evonik Industries

- PPG Industries

- W. R. Grace & Co.

- Huber Engineered Materials

- Solvay

- BASF SE

- Tosoh Corporation

- PQ Corporation

- Imerys

- Cabot Corporation

- Nouryon

- Fuji Silysia Chemical

- Madhu Silica

- Tata Chemicals

- Agropur