Almond Extract Market Size

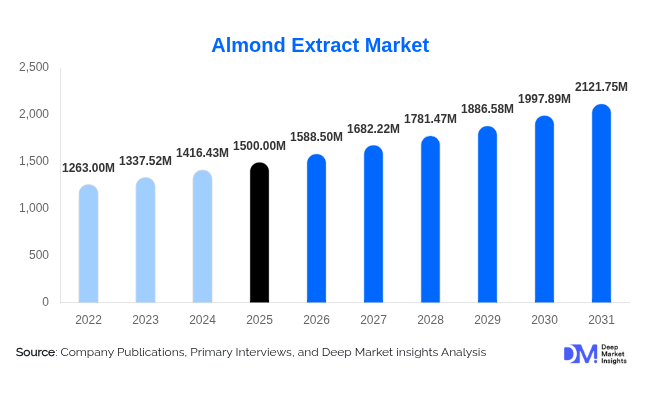

According to Deep Market Insights, the global almond extract market size was valued at USD 1,500.00 million in 2025 and is projected to grow from USD 1,588.50 million in 2026 to reach USD 2,121.75 million by 2031, expanding at a CAGR of 5.9% during the forecast period (2026–2031). The almond extract market growth is primarily driven by rising demand for natural and clean-label flavoring agents, expanding bakery and confectionery production globally, and increasing adoption of almond-based flavor compounds across food, beverage, pharmaceutical, and personal care applications.

Key Market Insights

- Natural almond extract is gaining strong traction as food manufacturers increasingly replace artificial flavorings to meet clean-label and regulatory requirements.

- Bakery and confectionery applications dominate global demand, supported by growth in packaged baked goods, premium desserts, and artisanal food production.

- North America leads global consumption, driven by advanced food processing infrastructure and high consumer preference for natural ingredients.

- Asia-Pacific is the fastest-growing regional market, supported by rapid expansion of bakery chains, urbanization, and westernization of diets.

- Liquid almond extract remains the preferred form due to superior solubility, ease of formulation, and consistent flavor delivery.

- Cross-industry adoption in cosmetics, nutraceuticals, and aromatherapy is expanding the addressable market beyond food applications.

What are the latest trends in the almond extract market?

Shift Toward Natural and Organic Extracts

The almond extract market is experiencing a structural shift toward natural and organic variants, driven by consumer demand for transparency, minimal processing, and chemical-free ingredients. Food and beverage brands are reformulating products to remove artificial additives, positioning natural almond extract as a premium flavoring solution. Organic almond extract, although higher in cost, is witnessing faster adoption in North America and Europe, particularly within premium bakery, dairy alternatives, and organic packaged foods. Certification, traceability, and sustainable sourcing are becoming key differentiators for manufacturers competing in this segment.

Technological Advancements in Extraction and Formulation

Advances in extraction technologies, including improved solvent extraction, cold processing, and encapsulation techniques, are enhancing flavor stability and shelf life of almond extract. These innovations are enabling broader application across beverages, frozen desserts, and cosmetics, where heat and storage stability are critical. Manufacturers are also focusing on standardizing flavor profiles to ensure consistency for large-scale industrial customers, strengthening almond extract’s role as a reliable functional ingredient in global food manufacturing.

What are the key drivers in the almond extract market?

Expansion of Global Bakery and Confectionery Industry

The rapid expansion of industrial and artisanal bakery production is a major driver of almond extract demand. Almond extract offers a cost-effective alternative to whole almonds while delivering consistent flavor intensity across cakes, cookies, pastries, and chocolates. Rising urban populations, increased consumption of packaged baked goods, and premiumization of desserts are fueling sustained demand from large-scale food processors and specialty bakeries alike.

Growing Consumer Preference for Clean-Label Ingredients

Consumers are increasingly scrutinizing ingredient labels, driving food manufacturers to adopt natural flavoring agents. Almond extract aligns well with clean-label positioning, particularly in markets with stringent food safety regulations. Regulatory pressure on artificial additives in Europe and North America has further accelerated adoption of natural almond extract, supporting long-term market growth.

What are the restraints for the global market?

Volatility in Almond Raw Material Prices

Almond extract production is highly sensitive to fluctuations in almond prices, which are influenced by climatic conditions, water availability, and labor costs. Droughts and regulatory constraints in major almond-producing regions can increase raw material costs, compressing margins for natural extract producers and creating pricing uncertainty for buyers.

Regulatory and Compliance Challenges

Certain almond extract formulations require strict compliance with food safety and labeling regulations, particularly for natural extracts derived from bitter almonds. Navigating varying regulatory frameworks across regions increases compliance costs and can delay product launches, especially for smaller manufacturers entering new markets.

What are the key opportunities in the almond extract industry?

Rising Demand from Asia-Pacific Food Manufacturing

Asia-Pacific presents a significant growth opportunity as bakery, confectionery, and beverage manufacturing expands rapidly across China, India, Japan, and Southeast Asia. Almond extract is increasingly used to standardize flavors at scale, making it attractive for mass-market production. Localization of flavor profiles and regional manufacturing partnerships offer strong entry opportunities for global players.

Expansion into Cosmetics and Nutraceutical Applications

Beyond food, almond extract is gaining traction in cosmetics, personal care, and nutraceutical formulations due to its pleasant aroma and perceived wellness benefits. Growth in natural beauty and wellness products is creating incremental demand, allowing manufacturers to diversify revenue streams and reduce reliance on food industry cycles.

Product Type Insights

Natural almond extract accounts for the largest share of the market, representing approximately 48% of global revenue in 2025, driven by clean-label demand and regulatory preference for natural ingredients. Artificial almond extract continues to be used in cost-sensitive, high-volume applications, particularly in emerging markets, while organic almond extract is the fastest-growing sub-segment, supported by premium food, beverage, and personal care products targeting health-conscious consumers.

Form Insights

Liquid almond extract dominates the market with nearly 72% share in 2025, owing to its ease of blending, faster flavor dispersion, and compatibility with a wide range of formulations. Powdered almond extract is gaining traction in dry mixes, bakery premixes, and nutraceuticals, where longer shelf life and ease of transport are critical advantages.

Application Insights

Food and beverage applications represent approximately 67% of total almond extract demand, led by bakery and confectionery products. Dairy and frozen desserts are emerging as high-growth applications, particularly within plant-based alternatives. Pharmaceutical and nutraceutical uses, while smaller in volume, provide stable demand for flavor masking, while cosmetics and personal care applications are expanding steadily due to rising preference for natural fragrances.

Distribution Channel Insights

Direct B2B sales dominate the distribution landscape, accounting for over 54% of market revenue, as large food manufacturers prefer long-term supply agreements for quality consistency and cost efficiency. Specialty ingredient distributors play a critical role in serving mid-sized manufacturers, while online retail and e-commerce channels are expanding for small-batch producers and household consumers.

End-Use Industry Insights

Industrial food processing is the leading end-use segment, contributing nearly 58% of total demand in 2025. Artisanal and craft food producers represent the fastest-growing end-use category, driven by premiumization trends and consumer preference for differentiated flavors. Pharmaceutical and cosmetic manufacturers provide diversified demand, supporting overall market resilience.

| By Product Type | By Form | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global almond extract market in 2025, led by the United States. Strong domestic almond production, advanced food processing infrastructure, and high adoption of clean-label products support regional dominance. Canada contributes steady demand, particularly from bakery and dairy manufacturers.

Europe

Europe represents nearly 29% of global market share, with Germany, France, Italy, and the U.K. driving demand. Strict food safety regulations and strong consumer preference for natural ingredients favor adoption of natural and organic almond extracts, particularly in bakery and confectionery applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of over 10%. China and India are key growth markets, supported by rapid expansion of bakery chains and packaged food consumption. Japan and South Korea contribute demand for premium and specialty food applications.

Latin America

Latin America holds a smaller but growing share, led by Brazil and Mexico. Expansion of confectionery manufacturing and increasing adoption of flavored dairy products are supporting gradual market growth.

Middle East & Africa

The Middle East and Africa market is driven by premium bakery imports and growing foodservice sectors in the UAE and Saudi Arabia. South Africa represents the primary African market, supported by domestic food manufacturing and export-oriented production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Almond Extract Market

- Givaudan

- Firmenich

- International Flavors & Fragrances (IFF)

- Symrise

- Sensient Technologies

- Mane

- Takasago

- Robertet Group

- Kerry Group

- Flavorchem

- Blue Diamond Growers

- OliveNation

- Nielsen-Massey Vanillas

- LorAnn Oils

- Watkins Incorporated