Air Compression Leg Massager Market Size

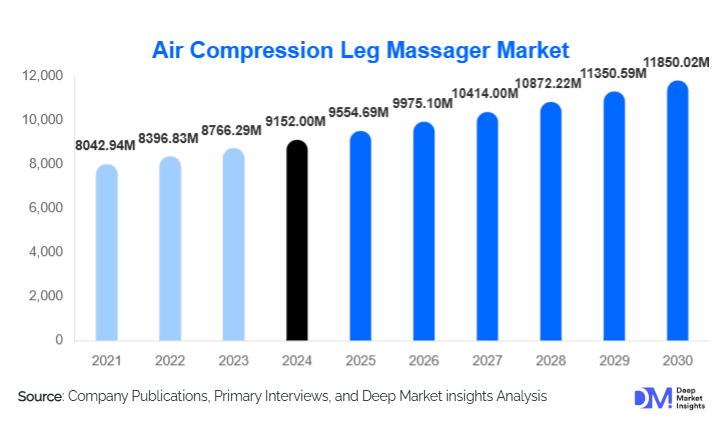

According to Deep Market Insights, the global air compression leg massager market size was valued at USD 9152.00 million in 2024 and is projected to grow from USD 9554.69 million in 2025 to reach USD 11850.02 million by 2030, expanding at a CAGR of 4.40% during the forecast period (2025–2030). This market is expanding rapidly due to the rising adoption of home-based wellness solutions, increased prevalence of circulatory and musculoskeletal disorders, and growing use of pneumatic compression technology in sports recovery, rehabilitation, and clinical therapy. Technological advancements such as app-connected devices, IoT-enabled diagnostics, and portable battery-powered massagers are further accelerating global demand.

Key Market Insights

- Portable air compression leg massagers dominate global demand, driven by rising home-use adoption and online retail expansion.

- Sequential compression technology leads the market due to its clinical effectiveness in circulation improvement and post-exercise recovery.

- North America holds the largest share of global consumption, led by high wellness spending and established healthcare use of compression systems.

- Asia-Pacific is the fastest-growing region, driven by increasing disposable income, expanding e-commerce, and large-scale device manufacturing.

- Technological integration, including IoT connectivity, mobile app control, and AI-driven therapy recommendations, is reshaping consumer expectations.

- Sports & athletic recovery applications are expanding as athletes adopt pneumatic compression for performance enhancement and faster rehabilitation.

What are the latest trends in the air compression leg massager market?

Smart, Connected, and App-Enabled Devices

Air compression leg massagers are increasingly integrating smart features such as mobile app connectivity, customizable compression modes, therapy tracking, and AI-driven session optimization. These technologies allow users to personalize pressure cycles, monitor circulation improvements, and integrate data with broader health ecosystems, including fitness trackers and wearable devices. Such advancements particularly appeal to tech-savvy consumers, athletes, and rehabilitation facilities seeking measurable therapeutic outcomes. Manufacturers are also embedding diagnostic insights, enabling proactive wellness monitoring and remote therapy management.

Clinical Adoption and Medical-Grade Enhancements

Hospitals, physiotherapy clinics, and rehabilitation centers are incorporating advanced pneumatic compression devices for postoperative recovery, DVT prevention, lymphatic drainage, and chronic venous insufficiency management. As demand for non-invasive treatments grows, air compression systems are being redesigned to meet clinical certification standards, offering stronger compression cycles, zonal adjustability, and programmable therapy modes. Increased recognition of compression therapy in medical protocols is expanding clinical use and driving product innovation across premium segments.

What are the key drivers in the air compression leg massager market?

Growing Prevalence of Circulatory and Musculoskeletal Disorders

The global rise in sedentary lifestyles, diabetes, obesity, and age-related vascular issues has significantly increased the incidence of poor leg circulation, swelling, and muscle fatigue. Air compression devices offer an accessible, non-invasive solution for improving circulation and alleviating symptoms, driving widespread adoption. Increasing awareness of preventive care further strengthens market growth as consumers proactively seek wellness tools for long-term health maintenance.

Expansion of Home-Based Wellness and Self-Care

The shift toward home wellness solutions, accelerated by the pandemic, has led consumers to invest in therapeutic devices that reduce dependency on clinical visits. Affordable portable massagers, e-commerce accessibility, product reviews, and wellness influencers are collectively fueling market penetration. Consumers now view air compression devices as essential components of at-home recovery, relaxation, and preventative therapy routines.

Sports Recovery and Performance Optimization

Air compression leg massagers are increasingly adopted by athletes to improve blood flow, accelerate muscle recovery, reduce lactic acid, and prevent injuries. Professional sports teams, fitness centers, and amateur athletes rely heavily on pneumatic compression, integrating it into daily training and recovery protocol. This trend is supported by advancements in technology, rising awareness of sports science, and growing consumer spending on athletic performance tools.

What are the restraints for the global market?

High Cost of Advanced & Medical-Grade Devices

Premium compression systems with advanced pressure levels, zonal customization, and medical certifications often come at high price points. This restricts adoption in developing regions and price-sensitive consumer groups. Additionally, insurance reimbursement challenges in many countries limit clinical uptake, slowing broader market penetration.

Regulatory and Certification Challenges

Air compression leg massagers that target medical applications must adhere to strict regulatory standards, which vary significantly across regions. Compliance with FDA, CE, and ISO medical device requirements can delay product launches, increase development costs, and limit entry for smaller manufacturers. This regulatory complexity can also impede global scaling.

What are the key opportunities in the air compression leg massager market?

IoT-Integrated, Data-Driven Wellness Platforms

There is a significant opportunity for brands to integrate pneumatic compression devices with digital wellness ecosystems. Users increasingly seek personalized, data-informed therapy sessions. Offering real-time analytics, therapy recommendations, and smart customization could transform air compression systems into fully integrated health solutions, enabling subscription-based digital services and recurring revenue streams.

Expansion in Emerging Markets through Localization & Affordable Models

Asia-Pacific, Latin America, and parts of Africa remain underpenetrated despite rising health awareness. Localized product development, cost-optimized models, and partnerships with regional e-commerce platforms can unlock significant new revenue. Manufacturers establishing regional production centers can also reduce pricing barriers and accelerate mass-market adoption.

Product Type Insights

Portable air compression leg massagers dominate the market, accounting for nearly 60% of global revenue in 2024. Their lightweight design, affordability, long battery life, and ease of use make them the preferred choice for home users and travelers. Non-portable and tabletop units target clinical and rehabilitation environments, while medical-grade devices cater to advanced therapeutic applications requiring higher pressure and specialized treatment modes.

Application Insights

Home & personal therapy remains the largest application segment, representing over 65% of global demand in 2024. Sports & athletic recovery is one of the fastest-growing segments, fueled by increased fitness participation and professional adoption. Clinical applications, including DVT prevention, post-surgery recovery, and lymphatic therapy, continue expanding as hospitals integrate non-invasive compression devices into standard care protocols.

Distribution Channel Insights

Online sales dominate the market with more than 50% share in 2024, driven by rising e-commerce penetration, digital shopping behaviors, and easy accessibility of product reviews. Specialty stores and offline retail remain important for mid-range and premium purchases, while institutional sales support clinical and sports facility adoption.

Target User Insights

Home users represent the largest user group, while athletes and sports recovery centers form a rapidly expanding customer base. Clinical users, including rehabilitation centers and hospitals, constitute a high-value segment, driven by medical-grade device adoption. Growing demand from wellness centers, massage studios, and physiotherapy clinics is further diversifying the user landscape.

| By Product Type | By Technology Type | By Target User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global market, approximately 35% in 2024. High wellness spending, advanced healthcare infrastructure, and strong adoption among athletes and elderly populations drive the region’s dominance. The U.S. leads consumption due to widespread awareness of compression therapy benefits and the presence of top brands and innovative startups.

Europe

Europe accounts for nearly 25% of global demand, with Germany, the U.K., and France as key markets. A large aging population and strong medical-grade device adoption support regional growth. EU regulations also promote high product standards, enhancing consumer trust in advanced compression solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing market, projected to expand at over 11% CAGR through 2030. China and India lead volume growth due to rising incomes, increased health consciousness, and widespread online retail usage. Japan and South Korea represent strong premium markets, with high adoption of smart wellness devices.

Latin America

Brazil and Mexico drive regional momentum, supported by rising fitness culture and growing private healthcare adoption of compression therapy. E-commerce expansion is reducing barriers to entry for global brands.

Middle East & Africa

Demand is emerging across the UAE, Saudi Arabia, and South Africa, driven by wellness tourism, premium consumer segments, and growing adoption of non-invasive therapeutic devices in private clinics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Air Compression Leg Massager Industry

- Renpho LLC

- Beurer GmbH

- HoMedics Inc

- Therabody Inc

- Lifepro Fitness LLC

- Naipo International

- FIT KING LLC

- Rapid Reboot Recovery Products LLC

- Nekteck Inc

- Brookstone LLC

- Vive Health LLC

- Bio Compression Systems Inc

- AGARO Healthcare Pvt Ltd

- Snailax LLC

- Actegy Health Inc