Fitness & Recreational Sports Centers Market Size

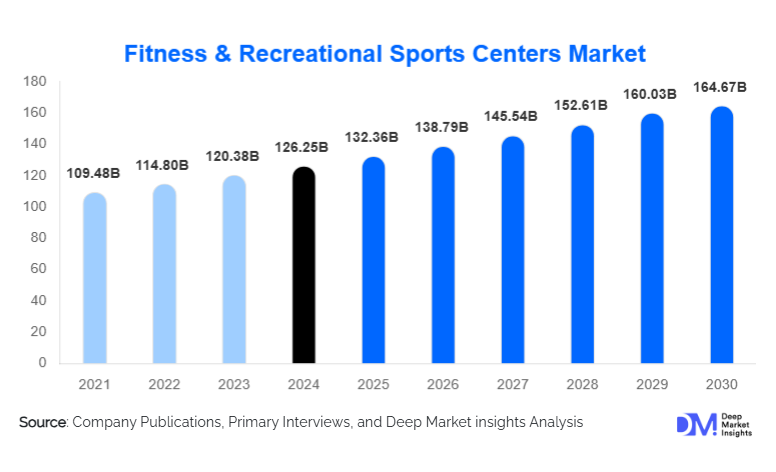

According to Deep Market Insights, the global fitness and recreational sports centers market size was valued at USD 126.25 billion in 2024 and is projected to grow from USD 132.36 billion in 2025 to reach USD 164.67 billion by 2030, expanding at a CAGR of 4.86% during the forecast period (2025–2030). Market growth is driven by rising global health awareness, increasing urbanization, growing adoption of preventive healthcare, and rapid expansion of hybrid (digital + physical) fitness models. Technological integration, boutique fitness specialization, and wellness-focused offerings are reshaping the industry and broadening the consumer base across all regions.

Key Market Insights

- Traditional gyms and mid-tier fitness clubs dominate global market share, owing to broad accessibility, affordability, and mass-market appeal.

- Hybrid fitness models (in-person + digital) are expanding rapidly as consumers demand flexible, tech-enabled workouts.

- North America accounts for the largest share (30–35%) due to a mature fitness culture and high membership penetration.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class wealth, urbanization, and growing gym adoption.

- Boutique and specialized studios such as yoga, Pilates, HIIT, and martial arts continue to gain traction among younger and premium segments.

- Preventive healthcare and wellness integration (recovery zones, physiotherapy, nutrition counseling) are transforming fitness centers into holistic health hubs.

What are the latest trends in the Fitness & Recreational Sports Centers Market?

Hybrid Digital–Physical Fitness Models Leading Adoption

Fitness centers are increasingly integrating digital platforms such as virtual training, online classes, and mobile booking systems to enhance customer engagement. Wearables-driven insights, data-enabled personalization, and remote coaching are now mainstream features. These hybrid models not only extend fitness access beyond physical centers but also drive recurring subscription revenues. Younger and tech-savvy consumers are embracing app-based fitness ecosystems, while corporate clients are adopting hybrid wellness packages for employee health programs. As gyms modernize their offerings, digital integration is becoming a cornerstone of long-term competitiveness.

Holistic Wellness and Preventive Health Integration

The market is shifting beyond physical exercise toward holistic well-being. Fitness centers are offering wellness add-ons such as physiotherapy, sports medicine, massage therapy, spa services, meditation zones, and nutrition counseling. Preventive healthcare awareness is driving demand for functional fitness, mobility training, and senior-focused wellness programs. This transformation positions fitness centers as multi-dimensional health hubs, expanding their ability to attract older demographics, corporate clients, and lifestyle-oriented consumers seeking comprehensive mind-body wellness.

What are the key drivers in the Fitness & Recreational Sports Centers Market?

Growing Worldwide Health Awareness & Lifestyle Disease Prevention

The increasing prevalence of lifestyle-related conditions such as obesity, diabetes, hypertension, and cardiovascular diseases is prompting consumers to adopt structured fitness programs. Fitness centers benefit from rising global emphasis on preventive healthcare, supported by government awareness campaigns and employer wellness initiatives. As urban sedentary lifestyles intensify, demand for accessible and structured fitness routines continues to rise across all demographic groups.

Urbanization, Growing Middle-Class Income & Demographic Shifts

Urban population growth and rising disposable incomes, especially in emerging markets, are fueling gym memberships. Young professionals prefer convenient fitness options near workplaces or residences, giving rise to rapid gym expansion in metropolitan areas. Growing middle-class households in Asia-Pacific, the Middle East, and parts of Latin America are also driving demand for mid-tier and premium fitness clubs, while senior populations increasingly require mobility and wellness programs.

Technological Modernization of Fitness Services

Technology adoption is reshaping both customer experience and operational efficiency. AI-driven personalized workouts, virtual classes, smart equipment, digital member management, and connected wearables are boosting retention and engagement. These innovations allow fitness centers to deliver hybrid, flexible, and data-driven solutions that appeal to a broad set of consumers, thereby increasing overall market size and long-term revenue opportunities.

What are the restraints for the global market?

Market Saturation in Mature Regions & High Competitive Pressure

Regions such as the U.S., UK, Germany, and Western Europe have dense gym networks and mature membership bases. High competition results in lower membership retention, increased marketing costs, and downward pricing pressure. New entrants face difficulties differentiating themselves in saturated urban areas, limiting the opportunity for expansion in mature markets compared to emerging regions.

High Operational Costs and Infrastructure Constraints

Fitness centers carry substantial operational costs, including equipment acquisition, facility maintenance, real estate expenses, utilities, and qualified staffing. For premium facilities, these costs escalate significantly. High CapEx requirements create barriers for new entrants and limit large-scale expansion for smaller operators. In addition, regulatory compliance for safety, hygiene, and zoning adds complexity and cost.

What are the key opportunities in the Fitness & Recreational Sports Centers Industry?

Expansion into Emerging Markets with Untapped Fitness Demand

Asia-Pacific, the Middle East, and Africa present high-growth opportunities due to their expanding middle-class populations, urbanization, and rising health awareness. Operators can capitalize by offering mid-tier and budget gyms targeted at affordability-conscious yet increasingly health-aware consumers. First movers can establish strong brand presence and capitalize on growing regional demand that remains far from saturation.

Technology-First Fitness Centers & Virtual Expansion

Operators can introduce app-based training, AI-powered coaching, digital fitness subscriptions, and remote wellness programs. Digital platforms expand reach beyond physical facility limitations and allow gyms to monetize global audiences. Integrating wearables, connected machines, and performance analytics helps centers differentiate and retain members through personalized experiences.

Wellness-Centric Fitness Centers & Preventive Health Programs

Fitness centers can evolve into holistic health providers offering recovery therapy, physiotherapy, nutritional counseling, spa services, and mindfulness programs. With increasing demand for preventive healthcare, wellness integration attracts seniors, corporate groups, and lifestyle-driven clients. Gyms that adopt this model can boost loyalty, premium pricing, and long-term growth potential.

Product Type Insights

Traditional gyms and fitness clubs represent the largest product type segment, capturing nearly 45–50% of the market due to widespread affordability and mass appeal. Boutique fitness centers, including yoga, Pilates, HIIT, and spin studios, are growing rapidly among younger urban consumers seeking community-driven and specialized experiences. Wellness-focused fitness clubs are emerging as premium offerings, combining spa services, physiotherapy, and recovery zones to cater to affluent and health-conscious segments. Recreational sports centers, multi-sport complexes, and mixed-use health clubs are gaining traction in urban areas lacking outdoor spaces, particularly in the Asia-Pacific and Europe.

Application Insights

General fitness and wellness applications dominate global demand, accounting for more than 50% of the market. These include strength training, cardio, group classes, and mobility-focused programs. Sports and recreational applications, including swimming, racquet sports, and indoor sports, are expanding as urban families seek holistic and community-oriented activities. Rehabilitation and preventive health applications are rising due to aging populations and growing chronic disease prevention efforts. High-performance training applications also attract athletes and fitness enthusiasts seeking specialized conditioning programs.

Distribution Channel Insights

Membership-based centers lead the market with a 60–65% share due to recurring subscription revenue models and long-term customer retention. Hybrid membership models combining virtual subscriptions with in-person access are expanding rapidly. Direct-to-consumer digital apps and virtual fitness platforms are gaining traction among busy professionals and remote workers. Pay-per-visit and class-based models are popular in boutique studios and recreational centers due to flexibility and lower entry barriers. Corporate wellness partnerships are also emerging as a strong B2B distribution channel.

User Type Insights

Adults aged 20–40 represent the largest user base, driven by lifestyle fitness adoption, urban living, and rising disposable incomes. Seniors (55+) are the fastest-growing user group, seeking physical therapy, low-impact training, and mobility programs. Youth fitness demand is expanding due to increased emphasis on sports training and physical activity in schools. Corporate employees represent a growing user segment as companies invest in workplace wellness programs to enhance productivity and employee well-being.

Age Group Insights

Young adults aged 18–35 drive the majority of boutique and hybrid fitness demand, valuing convenience and community-based training. The 31–50 age group holds a significant share in mid-tier and premium gym memberships, focusing on long-term health management. Seniors above 55 increasingly participate in wellness-based and rehabilitation fitness programs, reflecting demographic aging trends. Adolescents and youth primarily use recreational sports centers and specialized training facilities for sports development and structured fitness routines.

| By Center Type | By Pricing Tier | By Mode of Access | By User Demographics |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest regional share (30–35%) due to a strong gym culture, high membership penetration, and widespread adoption of boutique fitness models. The U.S. leads the region with consistent demand for strength training, hybrid fitness memberships, and specialty studios. Rising corporate wellness initiatives and technological integration in fitness facilities further reinforce market dominance.

Europe

Europe accounts for 20–25% of global revenue, supported by urbanization, wellness culture, and strong demand for mid-range and boutique studios. Germany, the U.K., France, the Netherlands, and the Nordics lead the region with high fitness penetration. Preventive health and sustainability-focused gym models resonate strongly with European consumers, driving regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising incomes, urban population growth, and increasing health awareness. China, India, Japan, and Southeast Asia are major contributors. Mid-tier gyms and international chains are expanding rapidly, capitalizing on underpenetrated urban markets. Social media influence, coupled with demand for lifestyle fitness experiences, is accelerating growth among younger demographics.

Latin America

Fitness adoption in Latin America is increasing, particularly in Brazil, Mexico, and Argentina. Demand is driven by urban fitness culture, rising interest in group training, and the expansion of regional gym chains. Though the region faces economic fluctuations, steady urban demand supports mid-tier gym growth.

Middle East & Africa

MEA is witnessing strong growth propelled by high-income populations in the Gulf Cooperation Council (GCC), lifestyle modernization, and government-led health programs. The UAE, Saudi Arabia, Qatar, and South Africa lead regional demand. Premium fitness clubs, luxury wellness centers, and expatriate-driven gym memberships are key growth drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fitness & Recreational Sports Centers Market

- Planet Fitness

- Life Time, Inc.

- 24 Hour Fitness

- Anytime Fitness

- Equinox Holdings

- LA Fitness

- Virgin Active

- Gold’s Gym International

- F45 Training

- Crunch Fitness

- Basic-Fit

- David Lloyd Leisure

- Fitness First

- PureGym

- Snap Fitness

Recent Developments

- In 2024, Planet Fitness announced new club expansions across Asia-Pacific, accelerating its global franchising footprint.

- In early 2025, Equinox launched a wellness-driven membership model integrating recovery therapy, sleep coaching, and personalized nutrition planning.

- In 2025, F45 Training rolled out AI-enabled workout personalization tools to enhance class performance and member retention.