Agritourism Market Size

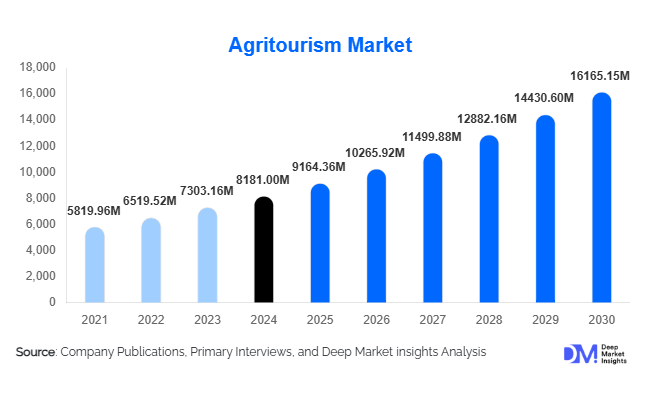

According to Deep Market Insights, the global agritourism market size was valued at USD 8,181.00 million in 2024 and is projected to grow from USD 9,164.36 million in 2025 to reach USD 16,165.15 million by 2030, expanding at a CAGR of 12.02% during the forecast period (2025–2030). The agritourism market growth is primarily driven by the rising global preference for experiential and sustainable travel, increasing demand for farm-to-table and cultural immersion experiences, and government-backed rural development programs that are enhancing agritourism infrastructure worldwide.

Key Market Insights

- Farm stays and immersive rural experiences are evolving into mainstream tourism offerings, driven by travelers’ growing desire for authentic, nature-centric experiences.

- Governments across North America, Europe, and the Asia-Pacific are heavily investing in rural tourism infrastructure, fostering favorable conditions for agritourism expansion.

- Digital transformation is reshaping agritourism, with farms increasingly adopting online booking platforms, VR tours, and AI-enabled customer engagement tools.

- North America dominates the global agritourism market, driven by strong domestic travel demand and well-established rural tourism ecosystems.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class incomes in India, China, and Southeast Asia and a surge in government-supported rural tourism circuits.

- Culinary and wellness-integrated agritourism experiences are gaining traction as travelers seek retreats centered around organic food, regenerative agriculture, and farm-based well-being activities.

What are the latest trends in the agritourism market?

Eco-Sustainable and Regenerative Agritourism Experiences

A major trend shaping the agritourism landscape is the integration of sustainability and regenerative farming into tourism packages. Farms increasingly offer workshops on organic cultivation, soil regeneration, composting, and local biodiversity preservation. These experiences appeal to environmentally conscious travelers looking for meaningful nature engagement. Many agritourism operators are certifying their farms as eco-friendly, using renewable energy, implementing zero-waste initiatives, and partnering with sustainability NGOs. These practices not only elevate visitor experiences but also create added value through premium pricing, long-term loyalty, and expanded off-season demand.

Technology-Enabled Agritourism Experiences

Technology adoption is accelerating across the agritourism industry. AR and VR farm tours allow potential visitors to preview farm activities before booking, improving conversion rates. AI-powered itinerary planning tools personalize experiences based on visitor interests, such as culinary tours, animal interactions, or farm workshops. Mobile apps now support real-time farm navigation, schedule management, and integrated farm-to-consumer marketplaces. Operators are also deploying drones for aerial farm experiences and digital storytelling, enhancing the visual appeal of rural landscapes. Social media and influencer-driven content continue to play a pivotal role in promoting lesser-known farm destinations globally.

What are the key drivers in the agritourism market?

Growing Demand for Experiential and Authentic Travel

Travelers worldwide are increasingly favoring immersive experiences over traditional sightseeing. Agritourism offers authentic cultural exposure, hands-on farming participation, and interactions with local communities, elements that strongly resonate with modern experiential travel trends. This driver is especially influential among millennials and Gen Z consumers, who constitute the fastest-growing demographic of agritourism participants.

Urbanization and the Desire for Nature Reconnection

The expanding urban population has intensified the desire for quiet, open, and nature-rich destinations. Agritourism provides accessible escapes from urban congestion, offering peaceful environments, outdoor activities, and educational experiences. Family travelers, wellness tourists, and digital nomads are particularly drawn to rural stays and farm-based retreats, boosting year-round demand in key regions.

What are the restraints for the global market?

Seasonality and Climate Dependency

Agritourism activities are often sensitive to agricultural seasons and weather conditions. Many farms face reduced visitor numbers during off-season periods, limiting consistent revenue flow. Extreme weather events, driven by climate change, also affect crop cycles, farm access, and event planning, creating operational challenges for agritourism providers.

Infrastructure Limitations in Rural Areas

Many high-potential agritourism destinations lack essential tourism infrastructure such as paved roads, transportation access, lodging facilities, and digital connectivity. These limitations deter international travelers and constrain the scalability of agritourism businesses. Addressing infrastructural gaps requires significant government and private sector investment, especially in emerging markets.

What are the key opportunities in the agritourism industry?

Digital Booking Platforms and Virtual Discovery Tools

The increasing adoption of OTAs, mobile apps, and integrated farm booking platforms presents enormous opportunities for agritourism operators. Digital visibility enables small and medium farms to reach global audiences, diversify revenue streams, and offer personalized packages. VR previews, automated itinerary creation, and AI-driven recommendations are emerging as powerful tools to attract tech-savvy tourists and upscale the overall visitor experience.

Government-Led Rural Development Programs

Many countries are expanding support for agritourism through grants, subsidies, tax incentives, and the development of rural tourism routes. These programs help farmers invest in infrastructure upgrades, accommodation construction, safety certifications, and experiential add-ons. Public sector involvement also enhances marketing reach and brings structure to emerging agritourism corridors, creating new business opportunities for operators targeting domestic and international visitors.

Product Type Insights

Farm stays and hospitality experiences dominate the market, accounting for nearly 30% of global revenue. These stays offer extended, immersive encounters with rural life and generate higher per-capita spending than other categories. Outdoor recreation experiences, including horseback riding, nature trails, and seasonal farm festivals, represent a rapidly growing segment, especially among younger travelers seeking adventure. Educational agritourism for school groups and universities continues to expand as institutions emphasize environmental learning and sustainable agriculture exposure. Culinary and farm-to-table experiences are also rising significantly, supported by global demand for organic foods and regional gastronomy.

Application Insights

Leisure travel remains the primary application for agritourism, driven by families, couples, and eco-tourists seeking relaxation and nature immersion. Educational applications account for a sizable share, with schools and universities integrating agritourism into environmental science and cultural studies programs. Culinary and wellness applications, including vineyard tours, farm cooking workshops, and wellness retreats, are emerging as high-growth niches. Adventure-linked agritourism, including guided trekking, cycling through farmlands, and interactive farming activities, is gaining traction among repeat visitors seeking fresh, hands-on experiences.

Distribution Channel Insights

Direct booking channels dominate the agritourism market, capturing over 50% of total reservations as travelers increasingly prefer personalized farm communication and tailor-made itineraries. Online travel agencies (OTAs) are growing rapidly, providing global exposure for small farms and bundling experiences with transportation and lodging. Specialist agritourism travel agencies are emerging in Europe, India, and North America, offering curated rural circuits for premium travelers. Social media platforms, influencer marketing, and integrated digital marketplaces are becoming critical discovery channels, significantly influencing traveler decision-making.

Traveler Type Insights

Domestic travelers represent the largest contributor to agritourism demand, accounting for nearly half of total market participation. Families form a major segment due to educational and recreational benefits for children, while couples increasingly seek romantic, nature-centered farm stays. Solo travelers and digital nomads are turning to agritourism for wellness and retreat-style experiences, often staying longer than average visitors. Group travelers, including schools, corporations, and hobby clubs, drive consistent weekday and off-season demand, helping stabilize revenue cycles for agritourism operators.

Age Group Insights

Travelers aged 31–50 years hold the largest market share due to higher disposable incomes and a strong interest in experiential rural travel. Younger travelers aged 18–30 continue to drive budget-friendly and adventure-focused agritourism, leveraging digital platforms to discover unique, immersive experiences. Older travelers (51–65 years) show a strong preference for comfort-oriented farm stays, culinary experiences, and low-impact nature activities. The 65+ demographic, though smaller in volume, represents a stable market for premium and wellness-integrated agritourism experiences.

| By Activity Type | By Visitor Type | By Booking Channel | By Farm Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global agritourism market with a 40–45% share in 2024. The United States drives the majority of demand, supported by high domestic travel rates, strong rural tourism infrastructure, and the popularity of farm stays, pumpkin patches, and seasonal festivals. Canada contributes steadily through nature-based agritourism, maple farm experiences, and ranch stays.

Europe

Europe represents 20–25% of the market, with Italy, France, Germany, and Spain leading adoption. Vineyard tours, olive farm experiences, and heritage agriculture routes are key drivers. EU-funded rural development programs significantly support growth, and European travelers exhibit a strong preference for sustainability-focused farm experiences.

Asia-Pacific

Asia-Pacific is the fastest-growing agritourism region (CAGR 13–15%), anchored by demand from India, China, Japan, and Southeast Asia. Government-backed rural tourism missions, rising middle-class incomes, and expanding interest in cultural-culinary experiences are propelling the region forward.

Latin America

The region is gaining traction through vineyard agritourism in Chile and Argentina, eco-farm stays in Brazil, and cultural rural experiences in Mexico. Although smaller in total volume, Latin America presents significant long-term growth opportunities.

Middle East & Africa

MEA remains a developing agritourism market, with South Africa, Kenya, and the UAE showing notable progress. Desert farms, heritage agriculture, and luxury eco-farm experiences are emerging niches that attract both domestic and international travelers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Agritourism Market

- Expedia Group Inc.

- Star Destinations

- GTI Travel

- Farm to Farm Tours

- Blackberry Farm, LLC

- Agri Tourism Development Corporation

- Greenmount Travel

- Harvest Travel International

- Field Farm Tours Limited

- Select Holidays

- Bay Farm Tours

- Agricultural Tour Operators International

- Agrilys Voyages

- Nandini Agri Tourism

- Feather Down Farms