Youth Hostel Market Size

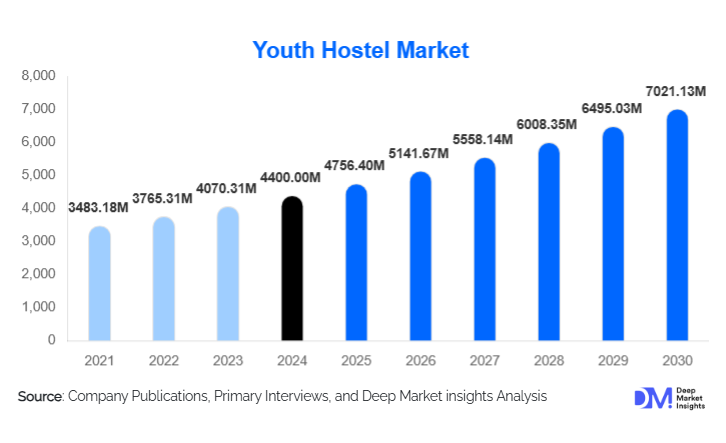

According to Deep Market Insights, the global youth hostel market size was valued at USD 4,400.00 million in 2024 and is projected to grow from USD 4,756.40 million in 2025 to reach USD 7,021.13 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The youth hostel market growth is driven by the resurgence of international youth travel, increasing preference for affordable and experience-led accommodations, and the transformation of hostels into lifestyle-oriented, community-centric lodging formats that appeal to Gen Z, millennials, and digital nomads.

Key Market Insights

- Dormitory-based hostels continue to dominate due to their affordability and appeal to backpackers and solo travelers.

- Branded and chain-operated hostels are gaining share as travelers prioritize safety, consistency, and social experiences.

- Europe remains the largest market owing to dense travel infrastructure and a deeply ingrained hostel culture.

- Asia-Pacific is the fastest-growing region, supported by backpacker tourism, visa liberalization, and low operating costs.

- Digital nomads and long-stay travelers are reshaping demand, driving the integration of coworking and extended-stay pricing models.

- Online travel agencies dominate bookings, though direct bookings are rising through loyalty and mobile-first platforms.

What are the latest trends in the youth hostel market?

Rise of Lifestyle and Hybrid Hostels

Youth hostels are increasingly evolving into lifestyle-oriented accommodations that blend lodging with coworking spaces, cafés, bars, and social programming. These hybrid hostels appeal to travelers seeking community, cultural exchange, and flexible living environments. The trend is particularly strong in urban centers across Europe, North America, and Southeast Asia, where hostels host events such as city tours, music nights, and skill-sharing workshops. This evolution has helped hostels command higher average daily rates while maintaining affordability relative to hotels.

Technology-Driven Guest Experience

Technology adoption is reshaping hostel operations and guest engagement. Mobile check-in, smart locks, digital payment systems, and AI-driven pricing tools are becoming standard across branded hostels. Booking platforms now integrate social reviews, dynamic pricing, and real-time availability, improving occupancy management. Community apps that allow guests to connect before arrival and participate in local experiences are gaining traction, particularly among younger, tech-savvy travelers.

What are the key drivers in the youth hostel market?

Growth in Budget and Experiential Travel

The rising popularity of budget travel and experiential tourism among young travelers is a primary growth driver. Youth hostels align well with multi-destination itineraries, low-cost airlines, and rail-based travel, especially in Europe and APAC. Travelers increasingly value shared experiences, cultural immersion, and affordability over luxury, positioning hostels as a preferred accommodation format.

Expansion of Branded Hostel Chains

Professionalization and consolidation within the hostel industry have improved service quality, safety perceptions, and global reach. Branded chains benefit from standardized operations, centralized marketing, and cross-location loyalty programs. This has attracted institutional investment and enabled rapid expansion across high-traffic tourism corridors.

What are the restraints for the global market?

Rising Urban Real Estate and Operating Costs

High property prices and rental costs in prime urban locations significantly impact hostel profitability. Increasing labor and utility expenses further compress margins, particularly for independent operators. These cost pressures limit new supply in tier-1 cities and can slow expansion.

Competition from Alternative Accommodations

Budget hotels, serviced apartments, and peer-to-peer rental platforms increasingly compete with hostels by offering private rooms at comparable prices. This intensifies competition and forces hostel operators to continuously innovate in experience design and pricing strategies.

What are the key opportunities in the youth hostel industry?

Digital Nomad and Long-Stay Accommodation

The normalization of remote work has created strong demand for long-stay, affordable accommodations with coworking facilities. Hostels offering monthly pricing, work-friendly environments, and community networking are well-positioned to capture this growing segment, particularly in destinations offering digital nomad visas.

Expansion into Emerging Tourism Regions

Underpenetrated markets in Southeast Asia, Eastern Europe, Latin America, and parts of Africa present significant growth opportunities. Government tourism promotion, visa easing, and infrastructure investment in these regions support new hostel development and early-mover advantages for branded operators.

Accommodation Type Insights

Dormitory-based hostels remain the dominant accommodation type, accounting for approximately 46% of the 2024 market. Their leadership is driven by highly competitive pricing, strong appeal among backpackers and solo travelers, and the flexibility to accommodate varying group sizes. Dormitories also benefit from high occupancy rates and lower operational costs, making them attractive for both operators and travelers. Private-room hostels are increasingly gaining traction as travelers seek a balance between privacy and affordability, especially for couples or small groups who still prefer social hostel environments. Meanwhile, hybrid lifestyle hostels, though currently representing a smaller share, are the fastest-growing segment globally. Their growth is fueled by the integration of coworking spaces, cafés, bars, and community-focused events, which appeal strongly to digital nomads, long-stay travelers, and flashpackers. This segment benefits from higher margins per guest due to premium pricing on private or semi-private accommodations and additional revenue from on-site amenities.

Booking Channel Insights

Online travel agencies (OTAs) dominate the booking landscape, accounting for nearly 48% of total bookings. Their popularity stems from global reach, price transparency, real-time availability, and access to extensive reviews, which are particularly valued by younger and first-time travelers. Direct online bookings through hostel websites and mobile apps are rising rapidly, supported by loyalty programs, mobile-optimized booking interfaces, and exclusive member discounts. These channels allow operators to maintain better control over pricing and customer engagement. Offline channels, including walk-ins, educational group contracts, and institutional bookings, continue to play a role in select segments, particularly for student travel and short-duration urban stays.

Traveler Demographics Insights

International backpackers aged 18–30 remain the primary consumer group, contributing roughly 41% of global revenue. Their travel patterns, short city stays, multi-destination itineraries, and preference for shared accommodations align closely with hostel offerings. Domestic budget travelers and student groups represent a stable secondary segment, typically driven by academic programs, local exploration, and seasonal travel. The fastest-growing demographic is digital nomads and extended-stay youth travelers. They are drawn by flexible, long-term pricing models, coworking facilities, and community engagement opportunities. Their increased presence is also encouraging hostels to adopt services tailored to long-stay travelers, including enhanced Wi-Fi, private rooms, and communal networking events.

| By Accommodation Type | By Traveler Demographics | By Booking Channel | By Price Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global youth hostel market with approximately 38% market share in 2024. Key countries include Germany, Spain, France, the U.K., Italy, and the Netherlands. The region’s growth is driven by well-established backpacker and student travel culture, dense intercity rail networks, and a high concentration of cultural and historical attractions. Government initiatives supporting youth mobility programs, affordable travel passes, and hostel associations also strengthen the market. Urban destinations in Europe are benefiting from lifestyle hostel models that combine lodging with social, cultural, and co-working experiences.

Asia-Pacific

Asia-Pacific accounts for nearly 29% of the market and is the fastest-growing region, expanding at over 9.5% CAGR. Thailand, Australia, Japan, Vietnam, and Indonesia are key demand centers. Growth is primarily driven by increasing youth and backpacker tourism, affordable living and travel costs, government incentives for tourism development, and favorable visa regimes that encourage longer stays. Emerging destinations in Southeast Asia attract international travelers seeking adventure tourism, cultural immersion, and lifestyle experiences, while hostels in Australia and Japan cater to both domestic travelers and international students. Rapid digital adoption in the region further supports online bookings and brand loyalty for hostel chains.

North America

North America holds around 18% market share, led by the U.S. and Canada, with key cities including New York, Los Angeles, Toronto, and Vancouver. Market growth is supported by urban tourism, educational travel programs, and the rising acceptance of lifestyle hostels among millennials and Gen Z travelers. Increasing demand for experiential and flexible accommodations, such as hybrid hostels with social and co-working spaces, is driving new developments. International student mobility and adventure-focused domestic tourism are additional growth drivers, particularly in university towns and major urban hubs.

Latin America

Latin America represents approximately 9% of global demand. Mexico, Brazil, Colombia, and Peru are emerging hotspots for youth hostel development. Growth is fueled by adventure tourism, increasing domestic and international backpacker flows, cultural tourism, and improving hostel infrastructure. Government support for tourism, coupled with rising middle-class incomes and youth travel programs, is encouraging expansion in both urban and scenic destinations. Online booking penetration and mobile-first strategies also play a role in attracting younger travelers to these markets.

Middle East & Africa

This region accounts for about 6% of the market, with South Africa, Morocco, and the UAE leading demand. Growth is primarily supported by youth travel, adventure tourism, and increasing intra-regional mobility. Africa benefits from iconic destinations, wildlife tourism, and government initiatives aimed at developing budget-friendly accommodations for international travelers. In the Middle East, high disposable incomes, growing cultural tourism, and connectivity with Europe and Africa are driving demand for lifestyle hostels catering to international visitors and local youth seeking social experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Youth Hostel Market

- A&O Hostels

- Generator Hostels

- Meininger Hotels

- YHA (Youth Hostels Association)

- Hostelling International

- Selina

- St Christopher’s Inns

- Freehand Hotels

- Safestay

- Wombat’s City Hostels

- Clink Hostels

- Plus Hostels

- Lub d Hostels

- Nomads World

- HI USA