Work Light Market Size

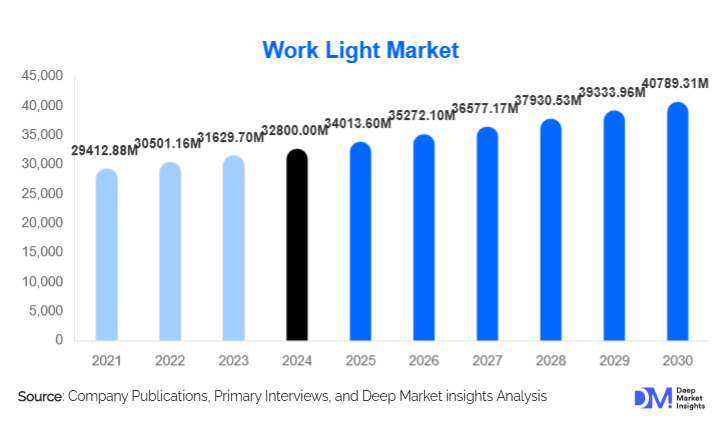

According to Deep Market Insights, the global work light market size was valued at USD 32,800.00 million in 2024 and is projected to grow from USD 34,013.60 million in 2025 to reach USD 40,789.31 million by 2030, expanding at a CAGR of 3.7% during the forecast period (2025–2030). The work light market growth is primarily driven by rapid infrastructure development, rising industrial safety standards, and the accelerated shift toward energy-efficient LED-based and cordless lighting solutions across construction, industrial, automotive, and emergency response applications.

Key Market Insights

- LED work lights dominate the market, accounting for over two-thirds of global revenue due to superior efficiency, durability, and compliance with energy regulations.

- Rechargeable and cordless work lights are witnessing strong adoption, supported by improvements in lithium-ion battery performance and portability requirements.

- Asia-Pacific leads global demand, driven by large-scale infrastructure projects and industrial expansion in China and India.

- Construction and infrastructure applications remain the largest demand drivers, supported by public and private capital expenditure.

- Online and direct B2B sales channels are expanding rapidly, improving accessibility and reducing procurement friction.

- Ruggedized, high-lumen, and smart-connected work lights are gaining traction in industrial and emergency-use scenarios.

What are the latest trends in the work light market?

Rapid Transition Toward LED and Smart Lighting Solutions

The work light market is experiencing a strong transition from halogen, HID, and fluorescent technologies toward LED-based solutions. LEDs offer longer operational life, lower energy consumption, and reduced maintenance costs, making them the preferred choice for industrial and commercial users. Manufacturers are also integrating smart features such as adjustable lumen output, motion sensors, and app-based controls, enabling energy optimization and improved workplace safety. This trend is particularly prominent in industrial maintenance, warehousing, and large construction projects where efficiency and compliance are critical.

Growth of Cordless and Battery-Powered Work Lights

Advancements in rechargeable battery technology have significantly boosted demand for cordless work lights. Lithium-ion batteries now provide longer runtimes, faster charging, and improved durability, enabling uninterrupted operation in remote or off-grid locations. Hybrid work lights that combine corded and battery operation are also gaining popularity, offering flexibility across diverse job-site conditions. This trend is reshaping procurement preferences among contractors, emergency responders, and automotive service providers.

What are the key drivers in the work light market?

Expansion of Construction and Infrastructure Activities

Global investments in residential, commercial, and public infrastructure projects are a major driver of work light demand. Construction activities often extend into night shifts and low-visibility environments, requiring reliable and high-lumen lighting solutions. Emerging economies are witnessing accelerated urbanization and government-led infrastructure initiatives, significantly increasing demand for durable and portable work lights.

Rising Emphasis on Workplace Safety and Compliance

Stricter occupational safety regulations across industrialized and developing economies are driving the adoption of certified, high-performance work lighting. Proper illumination reduces accident risks, enhances productivity, and ensures regulatory compliance. Industries such as mining, oil & gas, and manufacturing are increasingly standardizing advanced work lights as part of safety protocols.

Technological Advancements in Lighting and Power Systems

Continuous innovation in LED efficiency, thermal management, and battery chemistry is enhancing product performance and reliability. These advancements are encouraging the replacement of legacy lighting systems and supporting premium product adoption, contributing positively to market growth.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as aluminum, copper, electronic components, and battery materials pose challenges for manufacturers. Cost volatility can impact pricing strategies and profit margins, particularly for companies operating in highly competitive segments.

Intense Price Competition

The presence of low-cost manufacturers, especially in Asia, has intensified price competition. This limits pricing power for established brands and necessitates continuous investment in innovation and differentiation to sustain margins.

What are the key opportunities in the work light industry?

Infrastructure Development in Emerging Markets

Rapid infrastructure expansion across Asia-Pacific, the Middle East, and Africa presents significant opportunities for work light manufacturers. Localization of production, customization for harsh environments, and alignment with regional standards can help companies secure large-scale government and industrial contracts.

Integration of Smart and Connected Lighting Technologies

The integration of IoT, sensors, and connectivity into work lights offers opportunities to deliver value-added solutions. Smart work lights enable remote monitoring, predictive maintenance, and energy optimization, appealing to large industrial customers focused on operational efficiency.

Rising Demand for Emergency and Disaster-Response Lighting

Climate-related disasters and increased focus on emergency preparedness are driving demand for rugged, battery-backed, and high-lumen work lights. Government and disaster management agencies represent a high-value, relatively stable demand segment.

Product Type Insights

LED work lights dominate the market, accounting for approximately 68% of total revenue in 2024. Halogen and fluorescent work lights continue to decline due to lower efficiency and higher maintenance requirements. Battery-powered and hybrid work lights represent the fastest-growing product categories, supported by portability and improved power storage technologies. High-lumen work lights above 5,000 lumens are increasingly preferred in industrial, mining, and large-scale construction applications.

Application Insights

Construction and infrastructure applications account for nearly 31% of global demand, driven by continuous project execution and safety requirements. Industrial manufacturing and warehousing represent another major segment, supported by maintenance and inspection needs. Automotive repair, mining, oil & gas, and emergency response applications are witnessing steady growth, while residential and DIY usage is expanding rapidly through online retail channels.

Distribution Channel Insights

Offline retail and direct B2B sales remain dominant, particularly for industrial procurement and contractor purchases. However, online channels are the fastest-growing distribution segment, supported by improved digital catalogs, competitive pricing, and direct-to-consumer brand strategies. E-commerce platforms are particularly influential in residential and small commercial segments.

End-Use Insights

Industrial users represent the largest end-use segment, accounting for approximately 44% of global consumption in 2024. Commercial users, including construction contractors and service providers, follow closely. Government and municipal demand is growing due to infrastructure spending and emergency preparedness programs. Residential consumers represent a smaller but fast-growing segment driven by DIY activities and home improvement trends.

| By Light Source Technology | By Power Source | By Mounting & Portability | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global work light market with approximately 38% share in 2024. China leads regional demand due to extensive manufacturing and infrastructure activity, while India is the fastest-growing market, supported by urbanization and public infrastructure investments.

North America

North America accounts for around 27% of the global market, led by the United States. Demand is driven by industrial maintenance, automotive repair, construction safety compliance, and the adoption of premium cordless LED solutions.

Europe

Europe holds approximately 22% market share, supported by strict energy-efficiency regulations and strong demand from Germany, the UK, and France. Adoption of certified and eco-friendly work lights is particularly high.

Latin America

Latin America shows moderate growth, led by Brazil and Mexico, supported by construction activity and gradual industrial expansion.

Middle East & Africa

Demand in the Middle East & Africa is driven by infrastructure development, oil & gas projects, and mining activities. Gulf countries and South Africa are key contributors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|