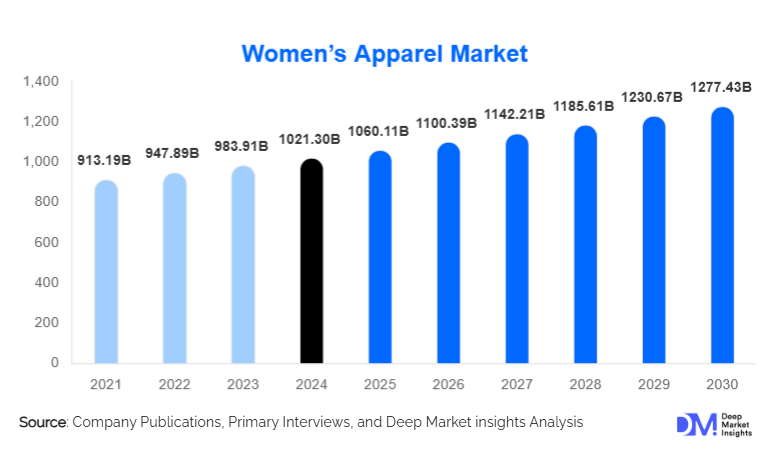

Women’s Apparel Market Size

According to Deep Market Insights, the global women's apparel market size was valued at USD 1,021.30 billion in 2024 and is projected to grow from USD 1,060.11 billion in 2025 to reach USD 1,277.43 billion by 2030, expanding at a CAGR of 3.80% during the forecast period (2025–2030). Market growth is fueled by rising female workforce participation, rapid expansion of e-commerce channels, evolving fashion trends, and increasing purchasing power, particularly across emerging economies. The shift toward casual wear, athleisure, and sustainable fashion continues to reshape global consumer preferences, while premium and luxury apparel segments remain resilient due to brand-driven value perception.

Key Market Insights

- Casual wear remains the dominant apparel category, driven by lifestyle shifts, remote work culture, and increasing preference for comfort-centered fashion.

- E-commerce and D2C channels hold nearly one-third of total global sales, supported by digital payments, virtual try-on tools, and influencer-driven marketing.

- Asia-Pacific accounts for the largest share of the market, led by strong demand from China, India, Japan, and Southeast Asia.

- Europe remains the leading region for premium and luxury women’s apparel, driven by fashion-conscious consumers and long-established brands.

- Growing demand for sustainable and ethically sourced apparel is prompting companies to adopt eco-friendly fabrics and transparent supply chains.

- Technology-driven innovation, such as AI-based fashion personalization, automated supply chains, and smart textiles, is transforming product design and retail strategies.

What are the latest trends in the women’s apparel market?

Rise of Sustainable and Ethical Fashion

Consumers, especially Gen Z and millennials, are increasingly prioritizing sustainability, ethical sourcing, and environmentally responsible brands. This shift is driving demand for clothing made from recycled fibers, organic cotton, low-impact dyes, and biodegradable packaging. Brands are introducing traceable supply chains, transparency dashboards, and “slow fashion” collections to appeal to conscious consumers. Circular fashion models, such as rental platforms, resale marketplaces, and upcycling programs, are gaining popularity across developed and emerging economies. This trend not only reshapes production processes but also strengthens brand loyalty and attracts premium pricing.

Digital Retail Acceleration and Omni-Channel Experiences

E-commerce continues to be the fastest-growing distribution channel, supported by enhanced user experiences such as virtual try-on tools, AI-powered product recommendations, real-time tracking, and same-day delivery. Many retailers are adopting an omni-channel strategy, integrating physical stores, mobile apps, and social commerce channels, to provide seamless shopping experiences. Live-stream fashion selling, influencer partnerships, and personalized styling services are rising globally. Increasing smartphone usage, especially among female shoppers in APAC and LATAM, continues to expand digital apparel sales.

What are the key drivers in the women’s apparel market?

Increasing Female Workforce Participation

The growing number of working women globally is driving strong demand for professional wear, semi-formal clothing, and versatile day-to-night outfits. Rising disposable income among women, especially in APAC and LATAM, supports higher spending on apparel across casual, office, and festive categories. Dual-income households and urban female professionals significantly contribute to the sustained expansion of the global market.

Shifting Fashion Preferences Toward Casual and Athleisure Wear

Modern lifestyles emphasize comfort, flexibility, and personal expression. As a result, casual wear and athleisure account for some of the fastest-growing segments. Remote and hybrid work models further boost demand for comfortable, versatile clothing. Fitness culture, social media trends, and fashion–wellness convergence are reinforcing consumer interest in stylish yet functional apparel.

What are the restraints for the global market?

Volatility in Raw Material Prices and Supply Chain Constraints

Fluctuations in cotton, synthetic fiber, and dye prices significantly affect production costs. Global supply chain disruptions, stemming from geopolitical conflicts, freight issues, and raw material shortages, continue to pressure margins. The industry’s dependence on globalized manufacturing hubs makes it vulnerable to logistics delays and transportation cost escalations.

Regulatory and Environmental Pressures

The apparel sector is under growing scrutiny for waste generation, pollution, carbon emissions, and labor conditions. Increasing regulatory requirements for sustainable production, ethical compliance, and waste reduction raise operational costs. Fast fashion brands face heightened criticism, prompting the need for major structural and operational reforms, which may slow short-term growth.

What are the key opportunities in the women’s apparel industry?

Expansion in Emerging Economies

The largest untapped potential lies in emerging markets such as India, Indonesia, Vietnam, Brazil, and parts of Africa. Rapid urbanization, digital adoption, and rising income levels are driving strong apparel consumption. Local fashion preferences and cultural wear categories (e.g., sarees, abayas, kurti sets) present opportunities for global brands to localize portfolios and capture market share.

Technological Integration Across the Fashion Value Chain

Digitization offers major opportunities for innovation, from smart textiles and AI-assisted design tools to predictive demand analytics. Blockchain-based transparency systems, automated manufacturing, and 3D sampling reduce waste and improve efficiency. Fashion-tech partnerships enable brands to streamline operations, enhance customer experiences, and accelerate new design cycles.

Product Type Insights

Casual wear dominates the women’s apparel market, accounting for approximately 30–35% of total revenue in 2024. This category includes tops, jeans, casual dresses, and everyday wear influenced by evolving lifestyle norms and work-from-home culture. Athleisure and activewear continue to grow rapidly, blending performance fabrics with fashion aesthetics. Formal wear remains stable but less dominant, while luxury apparel retains strong demand in Europe, North America, and affluent Asian markets. Loungewear and sleepwear saw accelerated growth post-pandemic and remain preferred for comfort-driven consumption.

Application Insights

Everyday wear forms the largest application category, followed by professional wear, activewear, and occasion-specific clothing. Social media and influencer-driven trends accelerate the frequency of wardrobe updates, particularly among younger demographics. Sustainable and ethical apparel is emerging as a fast-growing application segment as consumers shift toward conscious consumption. Occasion wear, including weddings, festivals, and cultural events, remains a major revenue generator in Asia-Pacific and the Middle East. Export-driven applications serve major European and North American retailers sourcing from APAC manufacturing hubs.

Distribution Channel Insights

Online platforms lead global distribution, holding nearly 25–30% market share due to convenience, competitive pricing, and broad assortment. Omni-channel retail strategies enable seamless switching between online browsing and in-store purchases. Specialty fashion boutiques remain crucial for premium and luxury brands, while department stores and mass retailers dominate mid-range apparel purchases. Social commerce, driven by Instagram, TikTok, and live shopping, continues to accelerate global sales, especially among younger female buyers.

Age Group Insights

Women aged 26–45 represent the largest consumer segment, accounting for approximately 40–45% of total market spending in 2024. This demographic values convenience, fashion versatility, and brand reliability. The 18–25 age segment drives trend-driven and fast fashion purchases, influenced by social media and pop culture. Women above 45 remain a stable market, favoring quality, comfort, and durability. The above-60 demographic, though smaller, is increasingly engaging in online apparel shopping, demanding inclusive sizing and functional designs.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 20–25% of global demand, with the U.S. driving significant consumption of casual wear, athleisure, and premium apparel. High digital adoption, strong brand loyalty, and a mature retail landscape support steady growth. Consumers prioritize comfort, sustainability, and size inclusivity.

Europe

Europe contributes nearly 25–30% of global revenue, led by fashion-centric markets such as the U.K., Germany, France, and Italy. Premium and luxury apparel dominate, supported by a strong cultural affinity for designer fashion. Sustainability regulations and eco-conscious consumer behavior are reshaping brand strategies across the region.

Asia-Pacific

APAC is the largest and fastest-growing region, representing 35–40% of global market share in 2024. China and India are the primary growth engines, supported by large populations, rising income levels, and rapidly expanding e-commerce ecosystems. Japan, South Korea, and Southeast Asia exhibit strong demand for premium and trend-driven clothing.

Latin America

LATAM shows increasing demand driven by urbanization and rising middle-class purchasing power in Brazil, Mexico, and Argentina. Consumers favor affordable yet stylish apparel, creating opportunities for mid-range and fast fashion brands.

Middle East & Africa

MEA markets, including the UAE, Saudi Arabia, and South Africa, demonstrate growing demand for both luxury and modest fashion. High-spending consumers and strong tourism-driven retail support premium apparel sales. African manufacturing hubs such as Ethiopia are emerging as apparel exporters.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Women’s Apparel Market

- Zara (Inditex)

- H&M Group

- Uniqlo (Fast Retailing)

- Nike (Women’s Apparel Division)

- Adidas (Women’s Apparel Division)

- Victoria’s Secret

- Lululemon Athletica

- Puma

- Chanel (Women’s Fashion)

- Dior (Christian Dior SE)

- Gucci (Kering)

- Prada

- Gap Inc.

- Next Plc

- Boohoo Group

Recent Developments

- In January 2025, Zara expanded its sustainable material portfolio, introducing 100% recycled polyester and circular denim collections.

- In March 2025, Lululemon launched its first AI-driven personalized athleisure line designed for female athletes.

- In April 2025, H&M announced investments in next-generation textile recycling technologies to reduce supply chain emissions by 30% by 2030.