Women Face Razor Market Size

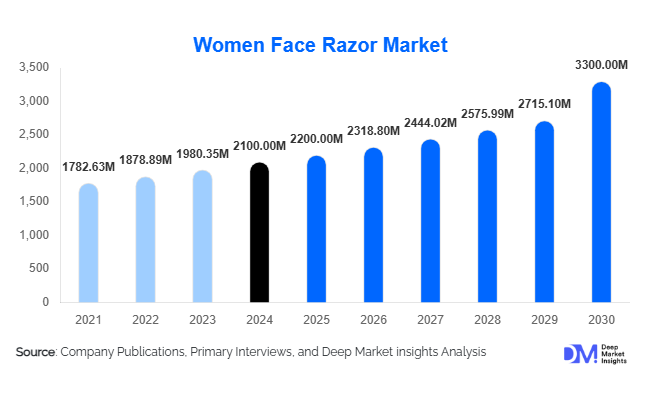

According to Deep Market Insights, the global women face razor market size was valued at USD 2,100 million in 2024 and is projected to grow from USD 2,213 million in 2025 to reach USD 2,879 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The market growth is primarily driven by rising awareness of personal grooming, increasing adoption of at-home dermaplaning and facial hair removal, and the expansion of premium and eco-friendly razor offerings targeting women globally.

Key Market Insights

- Disposable and refillable razors dominate the market, offering convenience, hygiene, and affordability for everyday grooming routines.

- Electric and battery-operated razors are gaining traction, particularly in premium segments, due to enhanced skin protection and multifunctionality.

- Asia-Pacific holds the largest share in the global women face razor market, driven by rising disposable incomes, urbanization, and growing awareness of beauty and self-care trends.

- North America remains a key premium market, with the U.S. leading demand for technologically advanced and skin-friendly facial razors.

- Online channels and e-commerce platforms are emerging as critical sales drivers, allowing direct-to-consumer access, subscription models, and personalized product offerings.

- Technological integration in product design, including hypoallergenic blades, ergonomic handles, and dermaplaning functionalities, is reshaping consumer expectations.

What are the latest trends in the women face razor market?

Sustainable and Eco-Friendly Products

Manufacturers are increasingly developing refillable, biodegradable, and recyclable razors to meet growing consumer demand for environmentally responsible grooming solutions. Sustainability initiatives, such as reduced plastic usage and recyclable packaging, are gaining prominence, particularly in Europe and North America. Brands that focus on eco-conscious innovations are positioned to attract premium pricing and strengthen consumer loyalty, while also complying with tightening environmental regulations on single-use plastics.

Dermaplaning and Skincare Integration

Women’s facial razors are evolving from simple hair removal tools into multifunctional skincare devices. Dermaplaning razors, which remove fine hair while exfoliating the skin, are becoming increasingly popular. Electric variants with vibration technology or built-in lubrication strips provide gentle hair removal while protecting sensitive skin. Premiumization in this segment is strong, appealing to users who incorporate facial razors into their daily beauty and skincare routines.

What are the key drivers in the women face razor market?

Rising Grooming Awareness and Beauty Standards

Changing societal norms, influencer-driven content, and growing awareness of personal grooming are driving increased adoption of women face razors. Consumers are seeking smoother skin, better makeup application, and hygienic solutions for facial hair removal, fueling demand across both emerging and mature markets.

Convenience and Cost-Effectiveness of At-Home Use

Face razors provide a convenient, low-cost alternative to salons and professional treatments. With the growing trend of at-home beauty routines and reduced salon visits, especially in post-pandemic contexts, women face razors are increasingly seen as essential grooming tools, boosting market penetration and repeat purchases.

What are the restraints for the global market?

Skin Sensitivity and Safety Concerns

Potential irritation, cuts, or rashesparticularly among women with sensitive skin or acne-prone areasremain key challenges. Negative consumer experiences can hinder repeat purchases and affect brand loyalty, especially in markets where safety certifications and quality standards are strictly enforced.

Environmental Concerns and Regulatory Pressures

Disposable razors dominate sales but are under scrutiny due to plastic waste. Regulatory pressures and consumer demand for sustainable alternatives may impact the sales of single-use products. Manufacturers must balance affordability with eco-friendly designs to maintain market share.

What are the key opportunities in the women face razor industry?

Premium and Dermaplaning Razor Innovations

Expanding the premium segment through dermaplaning and multifunctional razors presents significant opportunities. Advanced products that combine hair removal with exfoliation, skin-soothing features, and plant-based skincare ingredients cater to consumers willing to pay a premium for comfort, efficacy, and safety.

Emerging Markets and E-Commerce Expansion

Rapidly growing economies in Asia-Pacific, Latin America, and the Middle East present untapped demand for facial grooming products. Digital retail and subscription-based models allow companies to overcome distribution challenges, personalize offerings, and capture tech-savvy, beauty-conscious consumers.

Product Type Insights

Disposable razors dominate the global women face razor market due to their affordability, hygiene, and ease of use, capturing roughly 80% of the product-type market share. Their widespread adoption is driven by the simplicity, convenience, and accessibility for budget-conscious consumers who prioritize cost-effective grooming solutions. Refillable or reusable razors are gaining traction in premium and eco-conscious segments, as sustainability trends and long-term cost-effectiveness appeal to environmentally aware consumers. Manual razors remain popular across broad demographics due to their simplicity, reliability, and low maintenance requirements, particularly in regions with lower disposable income levels. Battery-operated and electric razors are experiencing rapid growth among urban, higher-income, and tech-savvy consumers, with advanced features such as precision heads, LED lighting, and skin-sensitive technology enhancing user experience. Overall, the market is witnessing a trend toward multifunctionality and premiumization, with innovative designs that combine comfort, aesthetics, and skin protection to meet evolving consumer expectations.

Application Insights

Personal grooming continues to be the most significant application, with at-home facial hair removal driving the majority of sales globally. Professional applications, such as dermaplaning in salons and dermatology clinics, are contributing to higher-value product adoption, especially in developed markets where premium services are in demand. Emerging applications include subscription-based beauty kits and travel-friendly razors, which are expanding market reach by targeting convenience-focused and frequent travelers. The integration of face razors into wellness and skincare routines is also increasing, highlighting the product’s versatility beyond simple hair removal.

Distribution Channel Insights

Offline retail channels, including hypermarkets, pharmacies, and specialty beauty stores, continue to dominate the market due to their ability to offer tactile product experiences, instant availability, and consumer trust. Offline channels maintain strong adoption, particularly for disposable and manual razors, where tactile evaluation is important. Meanwhile, online retail and e-commerce platforms are rapidly growing, driven by convenience, broader product availability, personalized recommendations, and the rise of subscription-based models. Online sales growth is particularly strong for premium, battery-operated, and refillable razors, catering to digitally engaged and urban consumers seeking innovative grooming solutions.

End-User Insights

Individual consumers represent the largest end-user segment, with young, urban women leading adoption due to their growing interest in personal grooming, skincare integration, and social media-driven beauty trends. Professional users, such as salons and dermatology clinics, are expanding demand for premium and multifunctional razors, including dermaplaning variants. Export-driven demand is notable, as developed regions import premium razors from Asia-Pacific manufacturers. Emerging end-use segments include wellness-integrated grooming routines and subscription beauty boxes, reflecting evolving consumer lifestyles and preferences for convenience, personalization, and premium experiences.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 22% of the global women face razor market in 2024. Growth in the U.S. is driven by high disposable incomes, a strong preference for premium grooming products, and growing consumer awareness of skincare and hygiene practices. The rising popularity of multifunctional and battery-operated razors, along with the rapid adoption of e-commerce platforms, further supports regional expansion. Canada contributes to market growth through the adoption of eco-friendly and refillable razors, aligning with sustainability trends and environmentally conscious consumer behavior. Technological innovations and brand loyalty in premium segments are key drivers sustaining market growth in North America.

Europe

Europe holds around 18% of the global market, with leading countries including the U.K., Germany, and France. Premiumization and eco-friendly product adoption are major growth drivers, supported by stringent environmental regulations and rising consumer awareness of sustainable grooming practices. Dermaplaning and skin-sensitive razors are particularly popular in mature markets, reflecting an emphasis on integrated beauty and wellness routines. Established offline retail networks, combined with growing online penetration, are enhancing accessibility, while strong brand presence and loyalty among consumers drive steady growth across the region.

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for approximately 42% of the global share, led by China, India, and Japan. Rapid urbanization, rising disposable incomes, and increasing emphasis on personal grooming are major drivers of growth. Social media influence, heightened beauty consciousness, and the proliferation of e-commerce platforms are accelerating adoption, particularly for premium, multifunctional, and eco-conscious razors. India and China are the fastest-growing markets, fueled by the rise of urban middle-class consumers, digital-first retail strategies, and exposure to global beauty trends. Additionally, the region’s youthful demographic and increasing participation of women in the workforce are contributing to higher grooming expenditure, supporting robust market expansion.

Latin America

Latin America, with key markets including Brazil, Argentina, and Mexico, is witnessing growing interest in personal grooming and beauty routines. Market growth is driven by increasing e-commerce penetration, rising disposable incomes in urban areas, and exposure to global beauty trends through social media. Consumers are showing greater willingness to adopt premium, multifunctional razors and imported products, particularly in larger metropolitan areas. Offline retail channels remain relevant for traditional disposable and manual razors, while online sales growth is concentrated in urban, tech-savvy populations.

Middle East & Africa

GCC countries such as the UAE and Saudi Arabia, along with South Africa, are emerging markets, supported by high-income urban populations and growing personal grooming awareness. Luxury and multifunctional razors are particularly in demand, driven by consumer preference for premium grooming experiences. Intra-regional trade, rising female workforce participation, and increasing adoption of online retail channels are additional drivers fueling market expansion. The region’s focus on aesthetics, wellness, and technological adoption in beauty devices is further accelerating growth in both mature urban centers and emerging markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Women Face Razor Market

- Procter & Gamble

- Edgewell Personal Care

- BIC Group

- Revlon

- Tweezerman

- Shiseido

- Philips

- Dorco

- Sirona Hygiene

- Gillet Venus

- Schick

- Feather

- Panasonic

- Remington

- Hikary

Recent Developments

- In March 2025, Procter & Gamble launched a new eco-friendly refillable razor line for women in North America, emphasizing biodegradable materials and sustainable packaging.

- In February 2025, Edgewell Personal Care introduced a dermaplaning razor with built-in lubrication strips and hypoallergenic blades in Europe and Asia-Pacific markets.

- In January 2025, BIC Group expanded its premium battery-operated women’s face razor portfolio across India and Southeast Asia, targeting urban female consumers seeking multifunctional grooming tools.