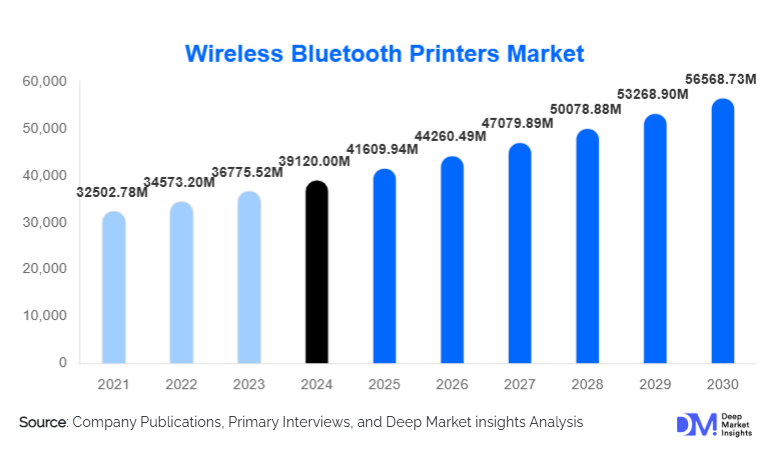

Wireless Bluetooth Printers Market Size

According to Deep Market Insights, the global wireless Bluetooth printers market size was valued at USD 39,120.00 million in 2024 and is projected to grow from USD 41,609.94 million in 2025 to reach USD 56,568.73 million by 2030, expanding at a CAGR of 6.37% during the forecast period (2025–2030). Market growth is primarily driven by the accelerating adoption of mobile point-of-sale (mPOS) systems, expansion of e-commerce and last-mile delivery networks, and rising demand for portable, cable-free printing solutions across retail, logistics, healthcare, and industrial applications.

Key Market Insights

- Thermal Bluetooth printers dominate the market, supported by low operating costs and widespread use in retail billing and logistics labeling.

- Portable Bluetooth printers account for the largest mobility segment, reflecting the shift toward decentralized and field-based operations.

- Asia-Pacific leads global demand, driven by manufacturing scale, rapid retail digitization, and expanding e-commerce ecosystems.

- Bluetooth Low Energy (BLE) adoption is accelerating, enabling longer battery life and extended connectivity for enterprise deployments.

- Healthcare and logistics are the fastest-growing end-use segments, fueled by point-of-care printing and last-mile documentation needs.

- Moderate market consolidation exists, with the top five players collectively accounting for over half of global revenue.

What are the latest trends in the wireless Bluetooth printers market?

Rise of Mobile and On-the-Go Printing

Enterprises are increasingly adopting mobile workflows, driving demand for compact and lightweight Bluetooth printers capable of seamless integration with smartphones, tablets, and handheld terminals. Retail associates, delivery personnel, healthcare professionals, and field technicians rely on mobile printing for instant receipts, labels, prescriptions, and service documentation. This trend is particularly strong in logistics and e-commerce fulfillment, where real-time printing at the point of action improves accuracy, speed, and customer satisfaction.

Integration with Cloud, IoT, and Enterprise Software

Wireless Bluetooth printers are evolving from standalone devices into connected components of digital ecosystems. Integration with cloud-based POS systems, warehouse management platforms, and ERP software enables real-time data synchronization and analytics. IoT-enabled Bluetooth printers are being deployed for predictive maintenance, device monitoring, and automated consumables replenishment. This technology convergence is increasing the value proposition of printers beyond hardware, supporting higher margins through software and service-based offerings.

What are the key drivers in the wireless Bluetooth printers market?

Expansion of Retail Digitization and mPOS Systems

The rapid digitization of retail operations is a major growth driver. Small and medium retailers, food service outlets, and pop-up stores increasingly prefer mPOS systems paired with Bluetooth printers due to ease of setup, flexibility, and lower infrastructure costs. The shift toward omnichannel retail and contactless transactions further reinforces demand for wireless printing solutions.

Growth of E-commerce and Last-Mile Logistics

The surge in global e-commerce volumes has significantly increased demand for Bluetooth printers used in shipping labels, proof-of-delivery receipts, and returns processing. Logistics operators value portable Bluetooth printers for their ability to operate in dynamic environments, supporting real-time documentation during last-mile delivery operations.

Declining Hardware Costs and Improved Battery Performance

Advancements in component manufacturing and battery technology have reduced average selling prices while improving device longevity. Longer battery life, faster print speeds, and ruggedized designs have expanded adoption across cost-sensitive SMEs and emerging markets.

What are the restraints for the global market?

Limited Throughput for High-Volume Industrial Applications

While Bluetooth printers excel in mobility and flexibility, they may not match the speed and duty cycles required for continuous high-volume industrial printing. This limits adoption in certain heavy manufacturing and centralized printing environments.

Interoperability and Connectivity Challenges

Compatibility issues across operating systems, Bluetooth standards, and enterprise software platforms can create integration challenges. Large organizations deploying diverse device fleets must invest in testing and customization, potentially slowing adoption.

What are the key opportunities in the wireless Bluetooth printers industry?

Healthcare Digitization and Point-of-Care Printing

Healthcare facilities are rapidly adopting Bluetooth printers for patient wristbands, specimen labels, prescriptions, and diagnostic reports at the point of care. Rising emphasis on patient safety, traceability, and workflow automation positions healthcare as one of the most attractive long-term growth opportunities.

Government Digitization and Smart Infrastructure Programs

Public-sector digitization initiatives such as electronic invoicing, smart transportation, and automated public distribution systems are creating large-scale demand for mobile Bluetooth printers. Vendors aligned with government procurement standards and local manufacturing initiatives stand to benefit significantly.

Product Type Insights

Thermal Bluetooth printers dominate the global wireless Bluetooth printers market, accounting for approximately 62% of total revenue in 2024. Their leadership is primarily driven by low total cost of ownership, minimal maintenance requirements, and high reliability in high-frequency printing environments. Thermal printers do not require ink or toner, making them particularly suitable for applications such as receipts, shipping labels, barcode printing, and inventory tags across retail, logistics, and healthcare sectors. The widespread adoption of point-of-sale systems and last-mile delivery solutions continues to reinforce demand for thermal Bluetooth printers globally.

Inkjet Bluetooth printers represent a smaller but stable share of the market, catering to niche applications that require color output, such as small office printing, marketing materials, and customized labeling. Their adoption is largely limited by higher operating costs and lower durability compared to thermal alternatives. Laser Bluetooth printers are primarily deployed in office, commercial, and enterprise environments where higher print speeds, sharper text quality, and multi-function capabilities are essential. However, their relatively larger size and higher power consumption restrict their use in mobile and field-based applications, limiting overall market penetration.

Mobility Class Insights

Portable Bluetooth printers lead the mobility class segment with nearly 48% market share, reflecting the global shift toward mobile-first operations. Their dominance is driven by strong demand from logistics, retail, healthcare, and field service industries, where real-time, on-site printing improves workflow efficiency and customer experience. Lightweight designs, extended battery life, and seamless integration with smartphones and handheld terminals have made portable printers indispensable for last-mile delivery personnel, healthcare workers, and retail associates.

Desktop Bluetooth printers continue to hold relevance in small offices, fixed retail counters, clinics, and hospitality environments where moderate printing volumes and limited mobility are required. These printers strike a balance between affordability, compact size, and stable performance. Industrial Bluetooth printers, while accounting for a smaller share, serve mission-critical roles in manufacturing plants and warehouses. Their growth is supported by increasing automation, demand for ruggedized equipment, and the need for reliable label printing in harsh operating conditions such as dust, temperature variation, and continuous-duty cycles.

End-Use Industry Insights

Retail and e-commerce represent the largest end-use segment, accounting for approximately 34% of global market revenue in 2024. Growth in this segment is driven by the rapid adoption of mobile POS systems, omnichannel retail strategies, and the need for flexible billing and inventory labeling solutions. Bluetooth printers enable faster checkout, reduced infrastructure costs, and improved customer engagement, making them a preferred choice for both organized retail chains and small merchants.

Logistics and warehousing form the second-largest segment, supported by the exponential growth of parcel volumes, cross-border trade, and last-mile delivery operations. Bluetooth printers are widely used for shipping labels, proof-of-delivery receipts, and return processing, particularly in decentralized and outdoor environments. Healthcare is the fastest-growing end-use segment, expanding at over 13% CAGR. Demand is driven by point-of-care printing applications such as patient wristbands, specimen labels, prescriptions, and diagnostic reports. Increasing focus on patient safety, traceability, and workflow automation is accelerating adoption across hospitals, diagnostic centers, and home healthcare settings.

Distribution Channel Insights

Direct sales channels dominate the wireless Bluetooth printers market with approximately 46% market share. Large enterprises and government organizations prefer direct procurement from OEMs to ensure customized configurations, software compatibility, long-term service agreements, and compliance with internal IT and security standards. Direct sales are particularly strong in healthcare, logistics, and public-sector deployments.

Value-added resellers (VARs) play a critical role in regional and mid-market penetration, offering bundled solutions that include hardware, software integration, maintenance, and training services. Online and e-commerce platforms are gaining momentum among SMEs and startups due to transparent pricing, faster procurement cycles, and access to standardized product offerings. The rise of B2B digital marketplaces is expected to further strengthen online distribution channels over the forecast period.

| By Product Type | By Mobility Class | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market share, led by the United States. Regional growth is driven by high penetration of mobile POS systems, advanced healthcare infrastructure, and strong logistics automation. The region’s mature retail and e-commerce ecosystem creates sustained demand for reliable and rugged Bluetooth printers. Additionally, enterprises in North America prioritize software integration, data security, and device management capabilities, supporting demand for premium, enterprise-grade Bluetooth printing solutions.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, holding nearly 38% of the global market. Growth is fueled by rapid urbanization, large-scale manufacturing activity, expanding retail networks, and government-led digitization initiatives. China dominates regional production and exports, while India represents the fastest-growing national market with a CAGR exceeding 14%, supported by initiatives such as digital invoicing, GST compliance, and retail formalization. Japan contributes through strong adoption in industrial automation and healthcare printing applications.

Europe

Europe contributes around 18% of global revenue, with Germany, the U.K., and France leading demand. Growth in the region is driven by logistics efficiency requirements, healthcare digitization, and regulatory compliance. European enterprises emphasize precision, sustainability, and operational efficiency, supporting the adoption of energy-efficient Bluetooth printers with longer lifecycle performance. Strong intra-European trade and warehouse automation further reinforce market stability.

Latin America

Latin America accounts for approximately 5% of the global market share, led by Brazil and Mexico. Market growth is supported by retail modernization, expanding e-commerce penetration, and improving logistics infrastructure. While adoption remains lower compared to developed regions, increasing investments in digital payments and last-mile delivery are steadily driving Bluetooth printer demand.

Middle East & Africa

The Middle East & Africa region represents roughly 7% of the global market. Growth is driven by retail expansion, smart government initiatives, and logistics development in countries such as the UAE, Saudi Arabia, and South Africa. Government-led digital transformation programs, combined with rising adoption of mobile workforce solutions, are creating new opportunities for Bluetooth printer deployments across public services, transportation, and healthcare sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wireless Bluetooth Printers Market

- Zebra Technologies

- Brother Industries

- Seiko Epson Corporation

- HP Inc.

- Canon Inc.

- Honeywell International

- Toshiba Tec Corporation

- Star Micronics

- Bixolon

- SATO Holdings

- Ricoh Company

- Lexmark International

- OKI Electric Industry

- TSC Auto ID Technology

- Fujitsu Limited