Winter Hats Market Size

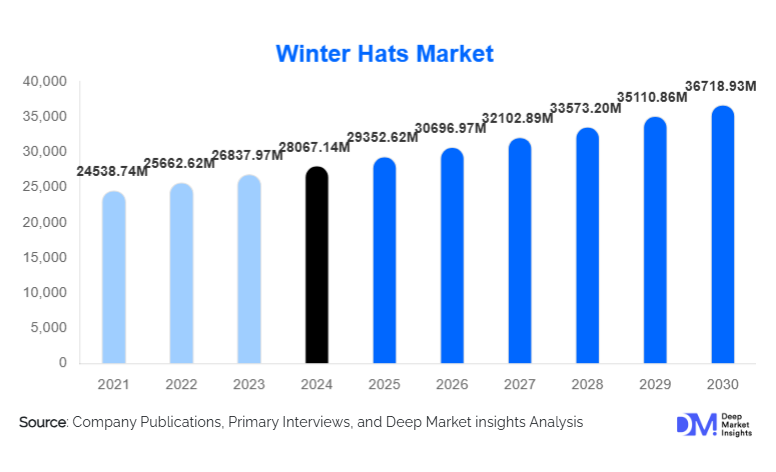

According to Deep Market Insights, the global winter hats market size was valued at USD 28,067.14 million in 2024 and is projected to grow from USD 29,352.62 million in 2025 to reach USD 36,718.93 million by 2030, expanding at a CAGR of 4.58% during the forecast period (2025–2030). The winter hats market growth is primarily driven by rising demand for cold-weather apparel, increasing participation in outdoor and winter sports activities, and the growing influence of seasonal fashion trends across both developed and emerging economies.

Key Market Insights

- Beanies and knit caps dominate global demand, supported by their versatility, affordability, and year-on-year fashion refresh cycles.

- Women represent the largest end-user segment, driven by higher purchase frequency and broader style variations.

- Online marketplaces account for the largest share of sales, benefiting from convenience, wider assortments, and competitive pricing.

- North America leads global consumption, supported by prolonged winter seasons and a strong outdoor recreation culture.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, winter tourism, and urban fashion adoption.

- Sustainable and eco-friendly materials, such as recycled polyester and merino wool, are increasingly shaping purchasing decisions.

What are the latest trends in the winter hats market?

Sustainable and Eco-Friendly Winter Headwear

Sustainability has emerged as a defining trend in the winter hats market. Consumers are increasingly favoring products made from organic wool, recycled fibers, and ethically sourced materials. Brands are responding by adopting low-impact dyes, biodegradable packaging, and transparent sourcing practices. This trend is particularly strong in Europe and North America, where environmental awareness is influencing apparel purchases. Sustainable winter hats are also commanding premium pricing, improving margins for manufacturers that successfully align product design with eco-conscious branding.

Performance-Oriented and Smart Winter Hats

Performance enhancement is gaining traction, especially within outdoor and sports-oriented winter hats. Features such as moisture-wicking linings, thermal insulation, wind resistance, and UV protection are increasingly standard. Additionally, smart winter hats incorporating Bluetooth-enabled audio, temperature-regulating fabrics, and reflective safety elements are emerging as niche but high-growth offerings. These innovations are appealing to tech-savvy consumers and winter sports enthusiasts seeking multifunctional cold-weather accessories.

What are the key drivers in the winter hats market?

Growth in Outdoor and Winter Sports Activities

Rising participation in winter sports such as skiing, snowboarding, hiking, and mountaineering is a key driver of winter hats demand. Post-pandemic recovery in winter tourism has led to higher sales of functional headwear designed for extreme cold conditions. Outdoor recreation culture, particularly in North America and Europe, continues to sustain consistent seasonal demand.

Fashion Integration and Seasonal Styling

Winter hats have evolved from purely functional products into fashion accessories. Seasonal collections, influencer-driven trends, and urban styling have increased purchase frequency, particularly among younger consumers. Fashion-led demand is strongest in women’s and children’s segments, where design variety and color options play a critical role in purchasing decisions.

What are the restraints for the global market?

Seasonality-Driven Demand Volatility

The winter hats market is highly seasonal, with demand concentrated in colder months. This creates inventory management challenges for manufacturers and retailers, often resulting in discounting and margin pressure during off-season periods. Unpredictable winter weather patterns further amplify demand volatility.

Raw Material Price Fluctuations

Price instability in raw materials such as wool, synthetic fibers, and fleece affects production costs and profit margins. Manufacturers operating in the mass-market segment are particularly vulnerable, as pricing flexibility is limited and cost increases cannot always be passed on to consumers.

What are the key opportunities in the winter hats industry?

Expansion in Asia-Pacific and Emerging Cold Regions

Asia-Pacific presents a major growth opportunity, driven by expanding middle-class populations, increasing winter travel, and rising fashion consciousness. Countries such as China, Japan, and South Korea are witnessing strong demand for both functional and fashion-oriented winter hats. Localized designs and digital-first retail strategies offer significant entry opportunities for new market participants.

Customization and Direct-to-Consumer Models

Customization through embroidery, personalized colorways, and limited-edition collections is creating new value streams. Direct-to-consumer channels allow brands to engage directly with customers, improve margins, and respond quickly to changing fashion trends. Subscription-based seasonal accessories and limited drops are also gaining popularity.

Product Type Insights

Beanies and knit caps account for approximately 38% of the global winter hats market in 2024, making them the leading product type due to their universal appeal and cost-effectiveness. Trapper and aviator hats are gaining traction in extremely cold regions, while balaclavas and face-covering hats are increasingly adopted for outdoor sports and occupational use. Pom-pom hats and berets contribute to fashion-driven demand, particularly in urban and premium segments.

Material Insights

Wool-based winter hats lead the market with a 34% share, supported by superior thermal insulation and premium positioning. Acrylic and synthetic fibers follow closely due to affordability and durability, particularly in mass-market offerings. Fleece and polyester blends are widely used in sports and performance hats, while faux fur materials are gaining popularity as ethical alternatives to natural fur.

Distribution Channel Insights

Online marketplaces dominate distribution, accounting for nearly 46% of global sales in 2024. The growth of e-commerce is supported by convenience, wider product selection, and competitive pricing. Offline retail, including specialty stores and hypermarkets, remains important for tactile product evaluation, while brand-owned websites are gaining traction through loyalty programs and customization options.

End-Use Insights

Daily wear and fashion applications represent the largest end-use segment, contributing over 51% of total demand. Outdoor and sports usage is the fastest-growing segment, expanding at over 7.5% CAGR, driven by winter tourism and recreational activities. Occupational use, including construction, cold storage, and logistics, is emerging as a stable demand contributor in colder regions.

| By Product Type | By Material Type | By End User | By Distribution Channel | By Usage |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 31% of the global winter hats market in 2024, led by the United States and Canada. Prolonged winters, high disposable incomes, and strong outdoor activity culture support sustained demand. Premium and performance-oriented winter hats are particularly popular in this region.

Europe

Europe accounts for nearly 27% of global market share, with strong demand from Germany, the U.K., France, and Nordic countries. Sustainability-focused purchasing behavior and fashion-driven consumption are key growth drivers.

Asia-Pacific

Asia-Pacific represents around 24% of the market and is the fastest-growing region, registering a CAGR of approximately 7.8%. China, Japan, and South Korea lead regional demand, driven by urbanization, winter tourism, and growing fashion awareness.

Latin America

Latin America contributes a smaller but growing share, led by countries with colder southern regions such as Argentina and Chile. Demand is primarily driven by seasonal fashion and export-oriented winter tourism.

Middle East & Africa

Demand in the Middle East & Africa is concentrated in colder and mountainous regions, as well as among outbound winter travelers. Premium winter hats are popular in GCC countries due to high purchasing power.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Winter Hats Market

- VF Corporation

- Columbia Sportswear Company

- Adidas AG

- Nike, Inc.

- New Era Cap Company

- Puma SE

- Under Armour, Inc.

- Patagonia, Inc.

- Arc'teryx Equipment

- H&M Group

- Inditex

- Deckers Brands

- Canada Goose Holdings

- Mammut Sports Group

- Helly Hansen