Wedding Flowers Market Size

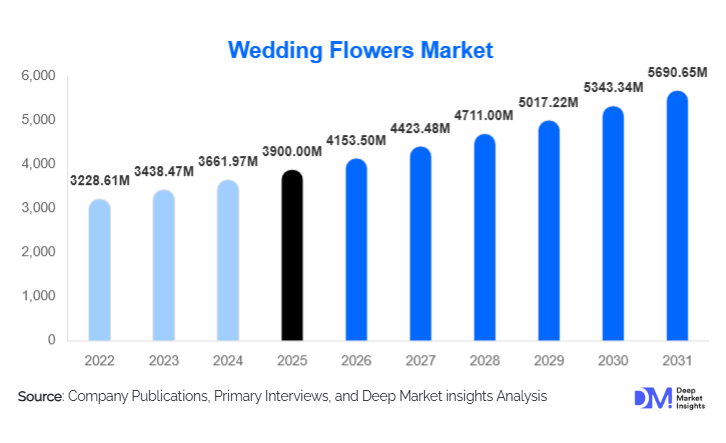

According to Deep Market Insights, the global wedding flowers market size was valued at USD 3900.00 million in 2025 and is projected to grow from USD 4153.50 million in 2026 to reach USD 5690.65 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031).

Growth in the wedding flowers market is supported by rising per-wedding décor expenditure, the cultural indispensability of flowers in wedding ceremonies, and increasing demand for luxury, destination, and theme-based weddings across major regions.

Key Market Insights

- Fresh-cut flowers accounted for approximately 71% of global market value in 2025, driven by cultural tradition and visual preference.

- Asia-Pacific led the market with nearly 38% share, supported by high wedding volumes and ceremonial flower usage.

- Luxury and destination weddings are increasing average floral spend per event, particularly in Southeast Asia, Europe, and the Middle East.

- Preserved and stabilized flowers are the fastest-growing category, benefiting from sustainability and reusability trends.

- Offline florists and studios dominate distribution, accounting for nearly 58% of global revenue due to customization and on-site execution needs.

- The top five global suppliers account for approximately 22% of total market value, indicating moderate fragmentation with strong upstream control.

What are the latest trends in the wedding flowers market?

Large-Scale Floral Installations and Experiential Décor

Modern weddings increasingly emphasize immersive floral environments rather than isolated arrangements. Demand for ceremony arches, mandap installations, aisle florals, ceiling décor, and large reception backdrops has risen significantly. Luxury and destination weddings are at the forefront of this trend, where floral décor can account for 8–12% of total wedding budgets. This shift has materially increased flower volumes per event and strengthened pricing power for premium suppliers.

Sustainability and Preserved Flower Integration

Environmental considerations are influencing flower sourcing decisions, particularly in Europe and North America. Preserved, dried, and reusable floral formats are being integrated to reduce waste, control costs, and minimize logistics dependency. Florists are increasingly deploying hybrid designs that combine fresh focal flowers with preserved components, improving margins while aligning with sustainability expectations.

Digital Visualization and Advance Customization

Technology adoption is reshaping procurement and design workflows. Digital mood boards, AI-assisted visualization tools, and 3D décor previews enable couples and planners to finalize designs prior to procurement. This reduces wastage, improves inventory planning, and allows suppliers to better manage pricing and margins, especially for destination weddings.

What are the key drivers in the wedding flowers market?

Rising Per-Wedding Expenditure and Premiumization

Global wedding spending has increased steadily since 2021, with décor emerging as one of the fastest-growing budget components. Flowers remain a non-discretionary element due to their symbolic and visual importance. Demand for rare blooms, imported flowers, and custom color palettes has raised average order values, particularly in luxury and designer weddings.

Cultural and Religious Centrality of Flowers

In Asia-Pacific, the Middle East, and parts of Europe, flowers are integral to religious rituals, ceremonial exchanges, and symbolic traditions. Their usage extends beyond decoration to garlands, offerings, and accessories. This cultural embedment ensures structurally resilient demand, insulating the market from short-term economic fluctuations.

Growth of Destination and Multi-Day Weddings

Destination weddings typically span multiple events, including pre-wedding functions, main ceremonies, receptions, and post-wedding celebrations. Each event requires distinct floral setups, substantially increasing flower consumption per wedding and supporting higher-value supply contracts.

What are the restraints for the global market?

Import Dependence and Price Volatility

Many high-consumption markets rely on imported flowers from the Netherlands, Kenya, Colombia, and Ethiopia. Freight costs, fuel price fluctuations, currency volatility, and cold-chain disruptions directly impact pricing and profitability. Seasonal supply constraints further amplify volatility during peak wedding months.

Labor Intensity and Skilled Workforce Constraints

Wedding floral design is labor-intensive and requires skilled designers for arrangement, installation, and dismantling. Labor shortages and rising wages in developed markets increase operating costs and constrain scalability, particularly for independent studios during peak seasons.

What are the key opportunities in the wedding flowers industry?

Destination Wedding Supply Partnerships

Hotels and resorts are increasingly forming long-term partnerships with flower suppliers to offer bundled wedding décor packages. This creates predictable, contract-based demand in destination hubs across Southeast Asia, Southern Europe, and the Middle East.

Preserved Flower Technology and IP Development

Advancements in flower stabilization technologies present opportunities for higher-margin products with longer shelf life. Companies investing in proprietary preservation techniques can reduce spoilage risk and differentiate offerings.

Direct Grower-to-Event Sourcing Models

Direct sourcing models connecting growers with venues and planners reduce intermediary costs, improve freshness, and enhance pricing transparency. These models are gaining traction in destination wedding markets.

Product Type Insights

Fresh-cut flowers dominated the market with approximately 71% share in 2025, reflecting their continued preference for traditional and premium wedding settings. Roses, orchids, lilies, and seasonal blooms remain the most commonly used due to their visual impact and symbolic value. Preserved and stabilized flowers represent the fastest-growing segment, expanding at over 8% CAGR, supported by rising demand for longer shelf life, color consistency, and reduced wastage in destination and multi-day weddings. Artificial and dried flowers continue to occupy a niche share but are gaining traction for pre-wedding events, backdrop installations, and rental-based décor, particularly where budget control and reusability are prioritized.

Application Insights

Ceremony floral décor is the largest application segment, accounting for nearly 29% of market value, driven by high flower density in mandaps, aisles, arches, and altar installations. These arrangements typically involve premium flowers and custom designs, resulting in higher per-event spending. Bouquets and wearable flowers remain high-value categories due to strong personalization demand across bridal bouquets, boutonnieres, corsages, and floral jewelry. Reception décor is expanding rapidly as weddings increasingly emphasize visual storytelling through themed table settings, ceiling installations, floral walls, and photo backdrops, particularly in luxury and destination weddings.

Distribution Channel Insights

Offline florists and floral studios account for approximately 58% of global sales, supported by the need for bespoke design, physical inspections, and on-site execution during events. These channels remain dominant for large-scale and high-budget weddings. Online platforms are expanding steadily in urban and semi-urban markets, primarily for standardized bouquets, accessories, and advance bookings. Meanwhile, direct grower-to-venue and grower-to-planner models are emerging in destination wedding hubs, helping reduce procurement costs, improve freshness, and streamline large-volume floral sourcing.

| By Flower Type | By Arrangement Type | By Freshness Type | By Wedding Format | By Sales Channel |

|---|---|---|---|---|

|

|

|

|

|

Product Type Insights

Fresh-cut flowers dominated the market with approximately 71% share in 2025, reflecting their strong preference across traditional and premium wedding formats. Roses, orchids, lilies, and seasonal blooms remain the most widely used varieties due to their visual impact, fragrance, and cultural symbolism. Preserved and stabilized flowers represent the fastest-growing segment, expanding at over 8% CAGR, supported by demand for extended shelf life, color consistency, and lower wastage in destination and multi-day weddings. Artificial and dried flowers continue to hold a niche position but are increasingly adopted for pre-wedding functions, backdrop installations, and rental-based décor, particularly where reusability and cost control are prioritized.

Application Insights

Ceremony floral décor is the largest application segment, accounting for nearly 29% of market value, driven by dense floral usage across mandaps, aisles, arches, and altar installations. These setups typically require premium flowers and custom layouts, resulting in higher per-event expenditure. Bouquets and wearable flowers remain high-value categories due to strong personalization demand for bridal bouquets, boutonnieres, corsages, and floral jewelry. Reception décor is expanding rapidly as weddings increasingly emphasize visual storytelling through coordinated table arrangements, ceiling installations, floral walls, and dedicated photo backdrops, particularly in luxury and destination-led celebrations.

Distribution Channel Insights

Offline florists and floral studios account for approximately 58% of global sales, supported by demand for bespoke design services, physical flower selection, and on-site execution. These channels continue to dominate large-scale and high-budget weddings. Online platforms are expanding steadily in urban and semi-urban markets, primarily for standardized bouquets, accessories, and advance ordering. At the same time, direct grower-to-venue and grower-to-planner models are gaining traction in destination wedding hubs, enabling cost efficiencies, improved freshness, and streamlined bulk sourcing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The wedding flowers market is moderately fragmented. The top five global suppliers collectively account for approximately 22% of total market value, reflecting upstream concentration in genetics and large-scale production rather than downstream consolidation.

Leading Companies in the Wedding Flowers Market

- Dümmen Orange

- Selecta One

- Syngenta Flowers

- Ball Horticultural Company

- Oserian Group

- Marginpar

- Flamingo Horticulture

- Finlays Flowers

- Queens Group

- Danziger

- Beekenkamp Plants

- Suntory Flowers

- Kariki Group

- Florecal Group

- Fides Oro