Web3 Gaming Market Size

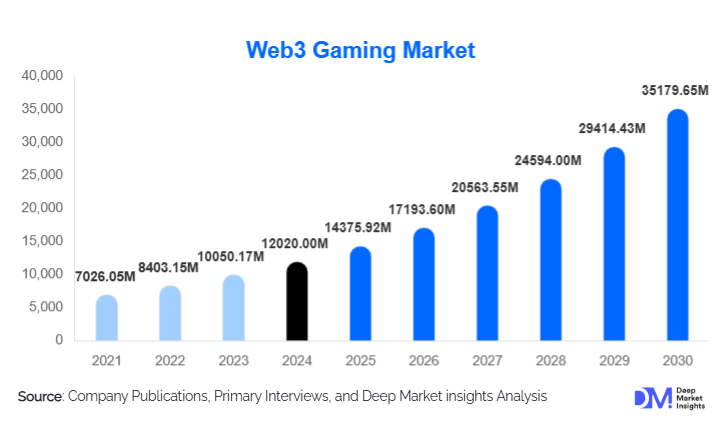

According to Deep Market Insights, the global web3 gaming market size was valued at USD 12020.00 million in 2024 and is projected to grow from USD 14375.92 million in 2025 to reach USD 35179.65 million by 2030, expanding at a CAGR of 19.60% during the forecast period (2025–2030). Growth is driven by rapid advancements in blockchain scalability, surging adoption of tokenized in-game assets, increasing participation from global gaming studios, and the expansion of interoperable virtual worlds powered by NFTs and decentralized infrastructure. Rising interest from publishers, investors, and emerging markets is transforming Web3 gaming from a niche crypto-driven segment into a foundational pillar of next-generation digital entertainment.

Key Market Insights

- Interoperable NFT assets and cross-game economies are becoming central to the Web3 gaming experience, enabling players to own, trade, and monetize digital items across multiple virtual environments.

- Layer-2 blockchains and gaming-optimized sidechains are significantly reducing transaction fees, driving mass adoption by removing friction in gameplay and asset trading.

- Asia-Pacific dominates user adoption, especially in play-to-earn and mobile-first gaming ecosystems.

- North America leads in development, infrastructure, and investment inflows, with major studios and platforms piloting Web3 integrations.

- Institutional and brand partnerships are accelerating mainstream penetration, with publishers experimenting with tokenized characters, collectibles, and metaverse experiences.

- Emerging technology, AI, cross-chain bridges, and zk-rollups are reshaping game design, user onboarding, and real-time asset synchronization.

What are the latest trends in the Web3 gaming market?

Interoperable Metaverse Ecosystems Accelerating Growth

Web3 gaming is shifting toward highly interoperable metaverse environments where digital assets, avatars, land parcels, wearable items, and utilities can move freely across multiple games and platforms. Developers are adopting standardized token frameworks such as ERC-721, ERC-1155, and semi-fungible tokens to support cross-platform asset portability. This trend strengthens asset liquidity, deepens community engagement, and increases game lifetime value as users form multi-platform identities. Metaverse alliances among game publishers are rising, enabling shared economies and collaborative world-building. As interoperability increases, user switching costs decrease, fueling transactions and long-term monetization.

AI-Enhanced and Tokenized Gameplay Experiences

AI-driven personalization is rapidly blending with tokenized mechanics to create dynamic, player-specific experiences. AI-generated NPCs, adaptive storytelling, and predictive gameplay balance are being paired with on-chain rewards, staking systems, and NFT crafting. AI also improves fraud detection, reduces exploit risks, and optimizes token economies. For players, AI-enabled difficulty scaling and intelligent content recommendations make Web3 games more accessible, increasing retention and in-game spending. The fusion of AI and blockchain is expected to be a defining force in next-generation game development, enhancing both immersion and economic stability.

What are the key drivers in the Web3 gaming market?

Blockchain Scalability and Low-Cost Transactions

Advances in Layer-2 networks, zk-rollups, and optimized sidechains have drastically lowered the cost of in-game blockchain interactions. Microtransactions, once prohibitively expensive on Layer-1 networks, are now instantaneous and affordable, allowing seamless asset creation, trading, and crafting. This shift eliminates one of the biggest barriers to mainstream Web3 gaming adoption and encourages publishers to integrate on-chain mechanics more deeply into gameplay.

Surging Demand for Player Ownership and Monetization

Gamers increasingly prefer ecosystems where digital goods belong to them rather than centralized platforms. NFTs and tokenized assets enable players to buy, sell, or rent items, creating new forms of value exchange. This democratization of digital ownership enhances user engagement and introduces additional monetization channels for studios, such as royalties on secondary market trades, token staking, and asset-based subscriptions. The broader cultural shift toward decentralized digital ownership is amplifying demand for asset-rich Web3 gaming ecosystems.

What are the restraints for the global market?

Regulatory Uncertainty and Token Classification Challenges

The classification of tokens as securities, the need for robust KYC/AML frameworks, and inconsistent regulations across major markets create operational challenges for publishers and marketplaces. Uncertainty around taxation, royalties, and token distribution models slows enterprise adoption and increases compliance costs. For Web3 games targeting global audiences, navigating diverse regional policies remains a significant barrier.

User Onboarding Complexity and Trust Deficit

Despite UX improvements, many players still struggle with wallet setup, private key management, bridging assets, and understanding tokenomics. Historical scams and poorly designed token economies have created skepticism toward Web3 projects. This trust deficit requires studios to implement transparent mechanics, consumer protections, and simplified onboarding. Until frictionless custodial wallets and integrated fiat rails become mainstream, mass-market penetration will remain limited.

What are the key opportunities in the Web3 gaming industry?

Cross-Game Marketplaces and Asset Liquidity Platforms

The demand for universal NFT marketplaces that support cross-game asset liquidity is rising sharply. These platforms enable secure trading, renting, and fractionalizing of high-value in-game NFTs. Studios can earn incremental revenue from trading fees, royalties, and marketplace integrations. As interoperability grows, cross-game asset liquidity will become one of the most influential value drivers in Web3 gaming.

Emerging Markets, APAC, LATAM, and Africa, Fueling Play-to-Earn Expansion

Mobile-first markets such as the Philippines, Vietnam, India, Nigeria, and Brazil are accelerating P2E adoption. High smartphone penetration, underbanked populations, and interest in supplemental income opportunities make these regions ideal for tokenized game economies. Guild networks, localized onboarding solutions, and community-driven training programs further enhance accessibility. These emerging markets are expected to contribute a substantial share of daily active users and transaction volumes through 2030.

Product Type Insights

Play-to-earn (P2E) games dominate the market, accounting for nearly 38% of 2024 revenues due to strong transaction flows, active user participation, and robust secondary trading. Metaverse and virtual world games are rapidly growing, driven by brand partnerships, virtual land sales, and immersive social experiences. Collectible and digital card games attract collectors and high-value NFT buyers with limited-edition drops and competitive gameplay. Casual mobile Web3 games appeal to mass audiences seeking low-friction, reward-based engagement, positioning them for exponential growth as Layer-2 technologies mature.

Application Insights

Ownership-focused gaming applications, such as NFT trading, crafting, and staking, are central to Web3 user activity. Esports-driven Web3 applications are gaining momentum, offering tokenized tournament rewards and collectible digital trophies. Metaverse applications supporting virtual concerts, events, and branded experiences are expanding the role of Web3 beyond gaming into social entertainment. DAO-based governance applications empower communities to influence game updates and asset economics, increasing user loyalty and participation.

Distribution Channel Insights

Mobile platforms represent the largest distribution channel, accounting for over half of all user activity due to accessibility and expanding P2E ecosystems. PC platforms remain strong for metaverse and high-fidelity AAA Web3 games requiring powerful hardware. Web-based distribution through decentralized launchers and D2C marketplaces is rising as studios bypass traditional app store restrictions. Social media, influencer marketing, and community-driven channels such as Discord and Telegram serve as powerful discovery engines for Web3 games.

End-User Insights

Retail gamers represent the largest end-user share, driving daily active engagement, NFT trading, and token circulation. Guilds and P2E organizations are the fastest-growing segment, managing player networks and optimizing earnings for large communities. Collectors and NFT investors contribute disproportionate revenue through high-value purchases and speculation-driven trading. Enterprises, brands, and IP owners are emerging as significant customers for metaverse partnerships, virtual merchandise, and tokenized fan engagement models.

| By Offering / Product Type | By Game Genre / Application Type | By Blockchain Layer | By Monetization Model | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 30% of global Web3 gaming revenues, supported by strong developer ecosystems, venture investment, and leading blockchain platforms. The U.S. drives innovation in infrastructure, marketplaces, and AAA Web3 game development. Regulatory developments, institutional capital flows, and brand partnerships continue to shape market expansion across the region.

Europe

Europe is a technologically mature market with high adoption of decentralized applications. Countries such as the U.K., Germany, and France are advancing blockchain innovation hubs and esports-integrated Web3 initiatives. European users exhibit strong interest in digital collectibles, governance participation, and metaverse events, making the region one of the fastest-growing in NFT-based gaming adoption.

Asia-Pacific

APAC holds the largest user base, with approximately 40% market share. South Korea and Japan lead in high-quality Web3 game development, while Southeast Asia serves as the epicenter of P2E adoption. India is emerging as a major growth hub, fueled by mobile gaming trends and increasing participation in tokenized ecosystems. Expanding internet penetration and pro-digital policies support long-term growth.

Latin America

Latin America is rapidly adopting Web3 gaming, with Brazil, Mexico, and Argentina at the forefront. Economic conditions encourage participation in P2E ecosystems, while strong crypto communities support NFT trading and community-driven game growth. Market expansion is reinforced by guild networks and localized gaming experiences.

Middle East & Africa

MEA markets show accelerating interest in metaverse investments and blockchain gaming. The UAE and Saudi Arabia are investing heavily in virtual world infrastructure, while African markets, especially Nigeria and South Africa, exhibit strong grassroots adoption of P2E models. The region’s young, mobile-first population positions MEA as a future high-potential growth hub.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Web3 Gaming Market

- Animoca Brands

- Sky Mavis

- Dapper Labs

- Immutable

- Gala Games

- Enjin

- Mythical Games

- Wemade

- Sorare

- Uplandme, Inc.

- Illuvium

- Decentraland Foundation

- PlayDapp

- WAX Labs

- Yield Guild Games (YGG)

Recent Developments

- In 2025, Immutable announced a major upgrade to its zkEVM gaming chain, reducing costs and enhancing developer tools to accelerate AAA Web3 game launches.

- In 2025, Animoca Brands expanded its metaverse partnerships, onboarding global entertainment IPs into its interoperable gaming ecosystem.

- In 2025, Sky Mavis introduced advanced cross-chain bridges for Ronin, enabling seamless asset movement between major chains and expanding liquidity for in-game NFTs.