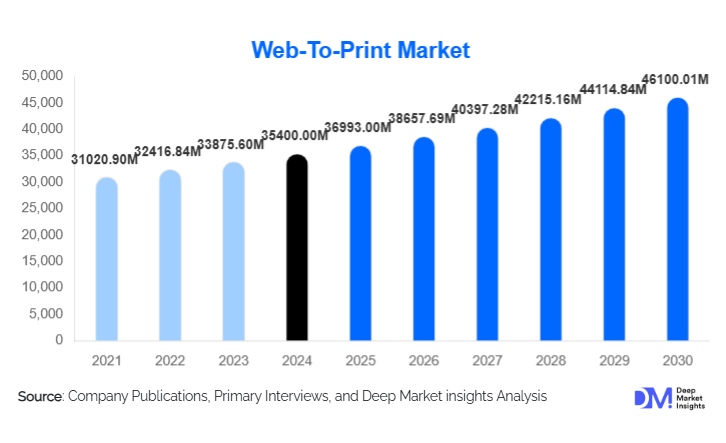

Web-To-Print Market Size

According to Deep Market Insights, the global web-to-print market size was valued at USD 35,400.00 million in 2024 and is projected to grow from USD 36,993.00 million in 2025 to reach USD 46,100.01 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The web-to-print market growth is primarily driven by accelerating digital transformation across the printing industry, rising demand for mass customization, and the growing adoption of cloud-based print management platforms by enterprises and small-to-medium print service providers.

Key Market Insights

- Cloud-based web-to-print solutions dominate the market, accounting for over 60% of global revenue due to scalability, lower upfront costs, and SaaS-based pricing models.

- SMEs represent the largest user base, leveraging web-to-print platforms to automate workflows and compete with larger print enterprises.

- Marketing collateral remains the leading application, supported by continuous demand for brochures, flyers, posters, and promotional materials.

- North America leads the global market, driven by high digital maturity and early adoption of print automation technologies.

- Asia-Pacific is the fastest-growing region, supported by SME digitization, expanding e-commerce, and government-backed manufacturing initiatives.

- Integration with AI, MIS, and ERP systems is reshaping platform capabilities and enhancing operational efficiency.

What are the latest trends in the web-to-print market?

Rapid Shift Toward Cloud-Native SaaS Platforms

The web-to-print market is witnessing a strong shift toward cloud-native SaaS platforms that offer subscription-based access, automatic upgrades, and remote scalability. Print service providers are increasingly replacing on-premise systems with cloud solutions to reduce IT overheads and support distributed operations. SaaS-based platforms enable faster onboarding, real-time pricing, and seamless integration with e-commerce storefronts, making them particularly attractive to SMEs and online print businesses.

AI-Driven Design Automation and Personalization

Artificial intelligence is becoming a key differentiator in web-to-print solutions. AI-powered tools now automate layout correction, template recommendations, variable data printing, and image optimization. These capabilities reduce manual errors and turnaround times while enabling hyper-personalized print products at scale. The trend aligns with rising demand for customized marketing materials, packaging, and promotional merchandise across industries.

What are the key drivers in the web-to-print market?

Growing Demand for Mass Customization

Brands increasingly require personalized print materials tailored to regional, demographic, and individual customer preferences. Web-to-print platforms enable variable data printing and real-time customization without increasing operational complexity. This driver is particularly strong in marketing, retail, and corporate branding applications, where customization directly impacts customer engagement.

Expansion of E-commerce and Digital Ordering

The rapid growth of B2B and B2C e-commerce is fueling demand for seamless online print ordering systems. Web-to-print platforms integrate design, ordering, proofing, payment, and fulfillment into a single digital workflow. As online-first business models expand globally, web-to-print has become a core infrastructure component for modern print operations.

What are the restraints for the global market?

Complex Integration with Legacy Systems

Many print service providers operate legacy MIS, ERP, and printing hardware systems that are not easily compatible with modern web-to-print platforms. Integration complexity and customization requirements increase deployment timelines and costs, slowing adoption among smaller or traditional printers.

Data Security and Compliance Concerns

Handling proprietary designs, customer data, and pricing information exposes web-to-print platforms to cybersecurity risks. Enterprises increasingly demand compliance with data protection regulations and advanced encryption standards, which raises development and operational costs for solution providers.

What are the key opportunities in the web-to-print industry?

Emerging Market Adoption and Localization

Asia-Pacific, Latin America, and the Middle East present strong growth opportunities as SMEs and local print businesses digitize operations. Localization of language, pricing models, tax compliance, and regional workflows offers vendors a clear pathway to penetrate high-growth markets. Countries such as India, China, Brazil, and Saudi Arabia are expected to generate incremental demand through SME digitization and government-supported manufacturing initiatives.

Advanced Technology Integration

Integration of AI, IoT-enabled printers, AR/VR previews, and blockchain-based order authentication presents opportunities for premium platform offerings. These technologies enhance transparency, reduce waste, and improve customer experience, enabling vendors to differentiate and command higher margins.

Deployment Model Insights

Cloud-based deployment dominates the global web-to-print market, accounting for approximately 62% of total revenue in 2024. The leadership of this segment is primarily driven by its lower total cost of ownership, faster deployment timelines, scalability, and remote accessibility. Cloud-based platforms allow print service providers (PSPs) and enterprises to eliminate heavy upfront infrastructure investments while benefiting from automatic software updates, enhanced cybersecurity protocols, and subscription-based pricing models. These advantages are particularly attractive to SMEs and e-commerce-driven print businesses operating across multiple locations.

Another key growth driver for cloud deployment is its ability to seamlessly integrate with ERP, CRM, MIS, and e-commerce platforms, enabling real-time pricing, order tracking, and inventory management. The increasing adoption of distributed and hybrid work models has further accelerated demand for cloud-based web-to-print systems that support remote order approvals and centralized brand asset management.

Application Insights

Marketing collateral is the leading application segment in the web-to-print market, contributing nearly 29% of global revenue in 2024. This segment’s dominance is driven by continuous demand for brochures, flyers, posters, banners, and point-of-sale materials across industries such as retail, FMCG, real estate, and financial services. Web-to-print platforms enable rapid campaign execution, consistent brand messaging, and localized customization, making them essential tools for modern marketing operations.

Packaging and labels represent one of the fastest-growing application segments, fueled by the rise of short-run, customized, and on-demand packaging. E-commerce brands and D2C companies increasingly rely on web-to-print solutions to manage packaging variations, seasonal branding, and personalized labeling at scale. This trend is particularly strong in food & beverage, cosmetics, and pharmaceuticals. Other applications—including apparel and promotional merchandise, books and publishing, signage and large-format printing, and photo products—collectively expand the market’s application landscape. Growth across these segments is supported by rising personalization trends, digital storefront integration, and the increasing use of web-to-print platforms for print-on-demand business models.

End-Use Industry Insights

Advertising and marketing agencies account for the largest share of web-to-print demand globally, driven by their need for fast turnaround times, multi-client brand management, and scalable customization. Agencies leverage web-to-print platforms to standardize brand assets, streamline approvals, and execute high-volume, multi-region campaigns efficiently. Retail and e-commerce represent the fastest-growing end-use segment, supported by the expanding need for branded packaging, promotional inserts, catalogs, and in-store signage. As online retailers scale operations globally, web-to-print solutions enable centralized control over print procurement while allowing localized customization for regional markets.

Corporate enterprises increasingly adopt web-to-print platforms to manage internal print needs such as corporate stationery, marketing materials, and compliance documents in a cost-efficient and standardized manner. Education, healthcare, and government sectors are also emerging as steady growth contributors, using web-to-print systems to ensure consistency, regulatory compliance, and controlled procurement across distributed institutions.

| By Deployment Model | By Application | By End-Use Industry | By Organization Size |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global web-to-print market, led by the United States. Regional dominance is driven by high digital maturity, widespread adoption of digital and industrial printing technologies, and the strong presence of leading web-to-print vendors. Enterprises in North America prioritize workflow automation, cost optimization, and seamless integration with enterprise IT systems. The region also benefits from a mature e-commerce ecosystem and high demand for personalized marketing materials, further reinforcing adoption.

Europe

Europe accounts for nearly 28% of global demand, with Germany, the U.K., and France leading adoption. Growth in the region is supported by a strong publishing, packaging, and industrial printing base. Regulatory emphasis on operational efficiency, sustainability, and waste reduction has accelerated the adoption of digital and on-demand printing models, where web-to-print platforms play a central role. European enterprises also demonstrate high demand for multilingual, compliance-ready print workflows.

Asia-Pacific

Asia-Pacific represents around 24% of the global market and is the fastest-growing region, expanding at over 16% CAGR. Growth is driven by rapid SME digitization, expanding commercial printing capacity, and strong government-backed manufacturing and digital transformation initiatives. China and India dominate regional demand due to large-scale print ecosystems, rising e-commerce penetration, and increasing adoption of SaaS platforms. Cost-effective cloud solutions and mobile-first adoption further accelerate growth across Southeast Asia.

Latin America

Latin America contributes approximately 8% of global revenue, with Brazil and Mexico leading regional adoption. Growth is supported by rising SME participation, expanding digital marketing activity, and increasing awareness of workflow automation benefits among print service providers. Improving internet penetration and the gradual shift toward e-commerce-driven print demand are strengthening the market outlook across the region.

Middle East & Africa

The Middle East & Africa region accounts for roughly 6% of the global market. Adoption is led by the UAE and Saudi Arabia, supported by strong investments in digital infrastructure, smart city initiatives, and enterprise modernization programs. In Africa, South Africa anchors demand due to its established commercial printing sector. Increasing government digitization efforts and rising private-sector investment in print automation are expected to drive steady long-term growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Web-To-Print Market

- HP Inc.

- Xerox Corporation

- Canon Inc.

- Ricoh Company, Ltd.

- Electronics For Imaging (EFI)

- Agfa-Gevaert Group

- Konica Minolta

- Fujifilm Holdings

- Vistaprint

- Printful

- OnPrintShop

- Aleyant Systems

- Avanti Systems

- BlueCrest

- Rocketprint Software