Wearable Cooling Device Market Size

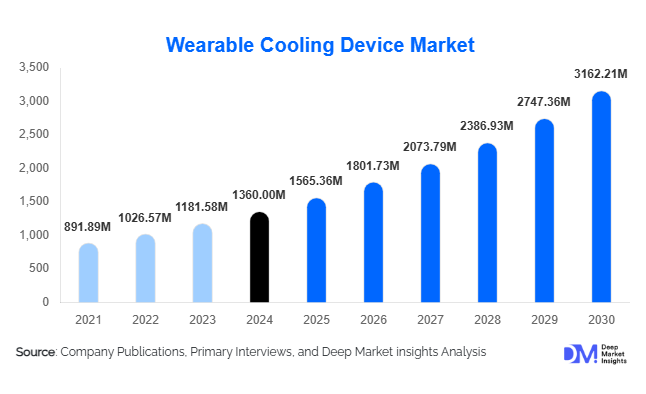

According to Deep Market Insights, the global wearable cooling device market size was valued at USD 1,360 million in 2024 and is projected to grow from USD 1,565.36 million in 2025 to reach USD 3,162.21 million by 2030, expanding at a CAGR of 15.1% during the forecast period (2025–2030). The market’s growth is primarily driven by rising global temperatures, increasing awareness of heat-related health risks, widespread adoption of wearable technologies, and growing demand across industrial, consumer, and healthcare applications.

Key Market Insights

- Wearable cooling is shifting from niche industrial use to mainstream consumer and lifestyle adoption, as rising global heat and comfort demands drive growth beyond workplace safety to everyday use, sports, and health/wellness segments.

- Vests and jackets remain the dominant product type globally, favored for their large coverage area and higher cooling capacity, particularly in industrial and occupational safety applications.

- Phase Change Material (PCM)-based passive cooling leads among cooling technologies, appealing to cost-sensitive industrial buyers and consumers looking for low-maintenance, battery-free solutions.

- Industrial & occupational safety applications continue to drive demand, especially for outdoor workers in construction, manufacturing, logistics, and agriculture in hot climates.

- Asia-Pacific is emerging as a key growth region, driven by rising industrialization, a large outdoor workforce, increasing heat exposure, and growing consumer demand for wearable comfort solutions.

- Integration with smart wearables and IoT-based adaptive cooling solutions is gaining traction, which is elevating the market’s value proposition and opening up premium segments.

Latest Market Trends

Smart textile integration & IoT-enabled cooling wearables are gaining traction

Manufacturers are increasingly embedding smart-textile technologies, sensors, and microprocessors into cooling garments. These next-generation wearables can automatically regulate temperature in response to ambient heat or body temperature, adjust cooling intensity, and even connect to mobile apps for monitoring or customization. This trend is particularly appealing to tech-savvy consumers, sports enthusiasts, and industrial buyers seeking advanced personal-cooling solutions, and it is helping shift wearable cooling from purely utilitarian PPE to premium lifestyle products.

Growing adoption in occupational safety and regulatory-driven demand

With heatwaves becoming more frequent and workplace heat stress being recognized as a major occupational hazard, companies and governments are increasingly investing in wearable cooling as part of safety gear. Construction firms, logistics companies, and outdoor labor contractors are rolling out cooling vests and neckbands to protect workers from heat exhaustion and related illnesses. In many regions, regulatory pressure is encouraging the adoption of personal cooling, in turn boosting demand for industrial-grade wearable cooling devices.

Expansion into consumer, fitness, and healthcare segments

Beyond industrial use, wearable cooling devices are gaining popularity among consumers, athletes, and healthcare users. Fitness enthusiasts, outdoor sports participants, and urban commuters in hot climates are adopting cooling wearables for comfort and performance. In healthcare, cooling garments are being explored for thermoregulation in vulnerable populations, such as the elderly or patients with heat sensitivity, expanding the addressable market. This diversification is helping stabilize demand across seasons and regions, making wearable cooling a year-round market rather than a seasonal niche.

Market Drivers

Increasing global heat stress and health awareness

One of the most significant drivers is the rising incidence of extreme heat conditions worldwide, due to climate change, urban heat-island effects, and more frequent heatwaves. As people become more aware of heat-related health risks like dehydration, heat exhaustion, and heat stroke, there is a growing demand for personal cooling solutions. This applies not just to outdoor workers, but also to urban dwellers, commuters, and recreation enthusiasts. The health-conscious mindset is pushing wearable cooling from a “luxury” or “niche” product into a mainstream necessity in many hot climate regions.

Advancements in cooling technologies and wearable design

Technological innovation in phase change materials (PCM), thermoelectric cooling, portable fan systems, lightweight and breathable fabrics, and ergonomic design has improved the performance, comfort, and practicality of wearable cooling devices. Simultaneously, improvements in battery life (for active cooling systems), manufacturing techniques, and materials cost reduction have made these devices more accessible and affordable. As a result, wearable cooling devices are increasingly viable for everyday use, sporting activities, and extended work shifts, not just short-term industrial tasks.

Diversifying end-use across multiple sectors

Wearable cooling devices are no longer confined to industrial work environments. Their adoption is sprawling into sectors such as sports and fitness, healthcare, elder care, outdoor recreation, logistics and delivery, and even home/garden use. This diversification reduces dependence on any single sector and spreads demand across a broader base. The multiplicity of use-cases, from athletic performance to occupational safety, from patient comfort to daily heat relief, is strengthening market resilience and fueling growth.

Market Restraints

High cost and affordability constraints

Despite technological advancements, many wearable cooling devices, particularly active systems with thermoelectric modules, battery packs, or hybrid cooling, remain relatively expensive compared to traditional clothing or passive cooling alternatives. This cost barrier limits penetration among price-sensitive consumers, especially in developing economies, and restricts adoption to premium segments or industrial buyers with safety budgets. As a result, widespread mass-market adoption can be challenging without further cost reduction or economies of scale.

Battery life, usability limitations, and comfort concerns

Active cooling devices often suffer from limited battery life, bulkiness, and maintenance needs (recharging, cleaning, re-wetting for evaporative vests). For prolonged use, such as full work shifts or extended outdoor exposure, these factors can become inconvenient. Moreover, wearables may restrict mobility, cause discomfort, or require frequent adjustment, which can deter users. These usability and comfort issues remain a key restraint for both consumer and industrial adoption, particularly for daily wear or recreational applications.

Market Opportunities

Industrial PPE mandates and heat-stress regulations

As governments and regulatory bodies around the world increasingly recognize occupational heat stress as a major hazard, especially in construction, mining, agriculture, and manufacturing, there is a growing opportunity to integrate wearable cooling devices into mandated personal protective equipment (PPE). Companies will be compelled to invest in cooling garments to comply with regulations and safeguard worker health, creating a stable institutional demand channel. This is especially relevant in rapidly industrializing regions and hot climate countries, offering a long-term, volume-driven growth opportunity for manufacturers.

Smart wearable cooling integrated with fitness and lifestyle tech

With rising interest in wearable fitness trackers, smart clothing, and IoT-enabled gear, there is a strong opportunity to position cooling wearables as the next generation of “smart apparel.” Integrating temperature sensors, adaptive cooling algorithms, app-based controls, and even health monitoring (e.g., hydration, body temperature) can appeal to health-conscious consumers, athletes, and urban dwellers. This integration could open premium segments, increase average selling price, and support recurring upgrade cycles as technology evolves.

Expansion into emerging high-heat regions and export-driven demand

Many developing and emerging economies, especially in South Asia, Southeast Asia, the Middle East, Africa, and Latin America, face increasing heat exposure, large outdoor working populations, and rising urbanization. These regions represent a substantial growth opportunity for wearable cooling devices. Manufacturers, especially in developed markets, can leverage export demand, while regional players may begin local production under schemes or incentives aimed at climate adaptation and labor welfare. This regional expansion and export potential could significantly broaden the global customer base.

Product Type Insights

Wearable cooling vests, jackets, and hoodies continue to dominate the market, commanding the largest share due to their ability to deliver uniform, full-torso cooling, which is especially valuable in industrial and occupational safety settings. These garments are particularly preferred for outdoor labor, construction, and heavy-duty work because they offer maximal surface coverage and cooling efficiency. On the other hand, demand for smaller, more portable form factors, such as neckbands, caps/helmets, wristbands, and clip-on fans, is increasing among consumers, commuters, and fitness users seeking lightweight, discreet cooling. As smart textiles and IoT-enabled versions enter the market, these lighter wearable forms are expected to witness high growth rates, especially in consumer and lifestyle segments.

Application Insights

The industrial and occupational safety application remains the largest use case globally, driven by demand from construction, manufacturing, agriculture, logistics, and outdoor labor sectors. Cooling garments in this segment are often selected for durability, coverage, and passive or PCM-based cooling, balancing cost and maintenance. Meanwhile, growing application segments include consumer comfort (urban dwellers, commuters), sports & fitness (runners, cyclists, outdoor athletes), and healthcare (elder care, patient cooling, heat-sensitive individuals). Seasonal and regional summer demand, combined with rising heat awareness, make these secondary applications critical growth drivers. The diversification of applications ensures that wearable cooling is not limited to high-risk professions but is also available for everyday lifestyle, wellness, and health scenarios.

Distribution Channel Insights

The distribution of wearable cooling devices is primarily via two channels: B2B institutional sales (industrial buyers, PPE distributors, enterprises) and B2C retail (e-commerce platforms, specialty retailers, and direct-to-consumer brand websites). Industrial buyers often procure cooling garments in bulk for workforce safety, while consumers typically purchase via online marketplaces or specialty fitness and outdoor gear stores. OEM contracts and uniform suppliers also play a role, especially for large enterprises or government agencies implementing safety gear programs. As demand broadens to consumers and lifestyle segments, e-commerce and direct sales channels are becoming increasingly important, offering manufacturers a scalable way to reach global markets, including emerging regions.

End-User Insights

Industrial workers, particularly outdoor laborers in construction, manufacturing, agriculture, mining, and logistics, constitute the largest end-user base, driven by occupational safety needs and regulatory compliance. Sports enthusiasts and outdoor recreation participants represent another growing segment, increasingly adopting cooling wearables to improve comfort and performance during workouts, endurance activities, or summer sports. Healthcare and elder-care users are also emerging as a notable segment, especially in regions with hot climates or for individuals with heat-sensitivity issues. Finally, general consumers, commuters, urban dwellers, and daily outdoor users are gradually adopting wearable cooling as a lifestyle product, seeking relief from heat during travel, errands, or day-to-day activity. This wide range of end-users helps stabilize demand across seasons and economic cycles.

| By Product Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for wearable cooling devices. Strong purchasing power, high awareness of heat-related health risks, well-established occupational safety regulations, and early adoption of wearable technologies contribute to the region’s dominance. Industrial buyers, particularly in construction, manufacturing, and logistics, lead demand, while consumers and athletes adopt cooling wearables for comfort and outdoor activities. The U.S. is the primary contributor, with Canada also participating substantially. As a result, North America continues to represent the largest share of global demand as of 2024.

Asia-Pacific (APAC)

Asia-Pacific is emerging as the fastest-growing region in the wearable cooling market. Countries such as India, China, Southeast Asia nations, and parts of South Asia are witnessing rapid industrialization, urbanization, infrastructure growth, and expanding outdoor labor populations. Combined with rising temperatures, frequent heatwaves, and growing consumer awareness, this region is seeing accelerating demand for industrial safety wearables and consumer cooling solutions. As regional manufacturing scales up and costs decrease, APAC is expected to gain a progressively larger share of the global market, potentially rivaling North America by 2030.

Europe

Europe exhibits moderate but stable demand for wearable cooling, driven chiefly by industrial safety compliance, construction, and logistics sectors, particularly in southern countries with hotter climates or summer heat peaks. Consumer adoption, while growing, is steadier than in hot-climate regions, as temperate climates and milder summers limit year-round demand. Demand also arises from outdoor recreation, sports, and occasional heat spells. Overall, Europe’s growth is incremental and steady, contributing a meaningful portion of the global market without dramatic spikes.

Middle East & Africa (MEA)

The Middle East and Africa are increasingly significant for wearable cooling demand, owing to high ambient temperatures, long outdoor working hours, and growing infrastructure and construction activity. Gulf countries, North Africa, and Sub-Saharan regions with large outdoor labor populations and rising health awareness are beginning to adopt wearable cooling devices, primarily for industrial safety and worker comfort. Though the market base is smaller compared to North America or APAC, MEA is one of the fastest-growing regions, with substantial upside potential as awareness and infrastructure investments rise.

Latin America (LATAM)

Latin America shows emerging demand, particularly in countries with tropical climates and growing urban and industrial populations, such as Brazil, Mexico, and some Central American nations. Demand comes both from industrial/occupational safety in construction and manufacturing, and from consumer segments seeking relief from heat in urban settings. Growth is slower compared to APAC or MEA, but it is steady, with potential to expand as economic development continues and awareness increases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wearable Cooling Device Market

- Vifel

- Hypercool

- Peltor

- Blaux

- Cave Wearables

- O2Cool

- LG Electronics

- Samsung Electronics

- Honeywell International

- Zephyr Technologies

- FANtastic

- IcyBreeze

- Moore’s Cloud

- Seiko

- Sony Corporation

Recent Developments

- In early 2025, Hypercool unveiled a new PCM-based cooling vest targeting construction workers in the Middle East and Southeast Asia, designed for extended wear under high-temperature conditions with enhanced breathability and extended passive cooling up to 6–8 hours.

- In mid-2025, LG Electronics launched a smart wearable cooling jacket integrated with temperature sensors and Bluetooth-based mobile app control, marking one of the first major consumer-electronics entries into wearable cooling apparel aimed at urban commuters and fitness users.

- In September 2025, Honeywell International expanded its industrial-safety PPE portfolio by acquiring a niche PCM-cooling garment manufacturer, signaling consolidation in the industrial-grade cooling segment and an increased push toward global distribution under an established safety-gear brand.