Wax Melts Market Size

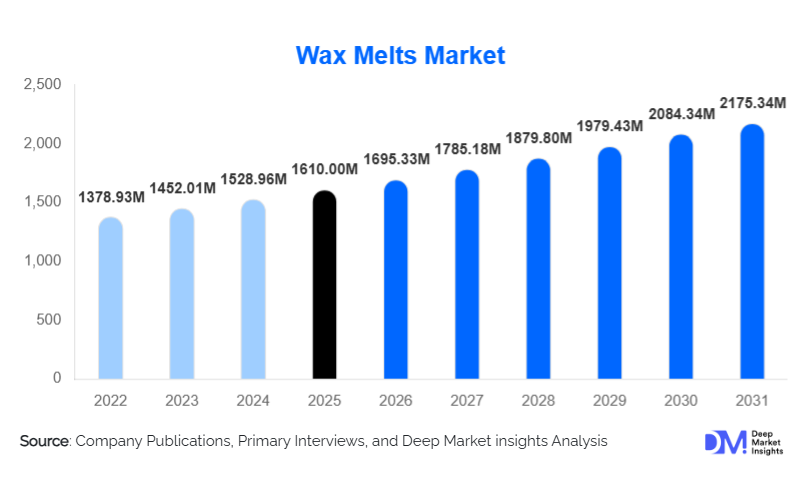

According to Deep Market Insights, the global wax melts market size was valued at USD 1610 million in 2025 and is projected to grow from USD 1695.33 million in 2026 to reach USD 2175.34 million by 2031, expanding at a CAGR of 5.3% during the forecast period (2026–2031). Market growth is primarily driven by rising consumer preference for flameless home fragrance solutions, increasing awareness of aromatherapy and wellness benefits, and rapid expansion of online and direct-to-consumer sales channels. Wax melts are increasingly being adopted as a safer, customizable, and cost-effective alternative to scented candles, supporting sustained global demand.

Key Market Insights

- Flameless fragrance solutions are gaining strong traction, particularly among households with children and pets, boosting wax melt adoption.

- Natural and sustainable wax melts made from soy, coconut, and beeswax are growing faster than paraffin-based products.

- North America dominates global consumption, supported by high discretionary spending on home décor and wellness products.

- Asia-Pacific is the fastest-growing region, driven by urbanization, e-commerce penetration, and lifestyle premiumization.

- Online retail channels account for nearly one-third of global sales, supported by subscription models and influencer-driven marketing.

- Product innovation in fragrances and formats is intensifying competition and driving repeat purchases.

What are the latest trends in the wax melts market?

Rising Demand for Natural & Clean-Label Wax Melts

Consumers are increasingly shifting toward wax melts made from natural, renewable, and biodegradable waxes such as soy, coconut, and beeswax. Clean-label positioning, allergen transparency, and essential oil-based fragrances are becoming key purchase criteria. Brands are responding by reducing synthetic additives, lowering VOC emissions, and introducing eco-friendly packaging. This trend is particularly strong in Europe and North America, where sustainability and health-conscious consumption are influencing household fragrance choices.

Customization and Premium Fragrance Experiences

Personalization is emerging as a major trend, with consumers seeking customizable fragrance blends, seasonal collections, and limited-edition releases. Premium artisan wax melts, often hand-poured and sold through D2C platforms, are gaining popularity. Subscription boxes offering curated scent assortments are also expanding, increasing customer lifetime value and brand loyalty.

What are the key drivers in the wax melts market?

Growing Focus on Home Wellness and Ambience

The global shift toward wellness-oriented lifestyles has increased demand for aromatherapy and mood-enhancing products. Wax melts infused with calming, energizing, or stress-relief fragrances are widely used in residential spaces, supporting consistent demand growth. The work-from-home trend has further amplified spending on home ambience and comfort products.

Safety Advantages Over Traditional Candles

Wax melts offer a flameless alternative to candles, reducing fire hazards and smoke emissions. This safety advantage is a key driver for families, rental properties, hotels, and commercial spaces, accelerating substitution away from traditional candles.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in paraffin wax, natural waxes, and fragrance oil prices can impact manufacturing costs and profit margins. Smaller producers are particularly vulnerable to supply chain disruptions and price volatility.

Regulatory Compliance and Fragrance Restrictions

Stringent regulations related to fragrance ingredients, allergen disclosures, and chemical safety—especially in Europe—can increase compliance costs and slow new product launches.

What are the key opportunities in the wax melts industry?

Expansion in Emerging Urban Markets

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are creating new demand for affordable home fragrance products. Wax melts offer an attractive entry-level luxury product for first-time consumers in these regions.

Smart Warmers and Technology Integration

The integration of smart electric warmers, app-controlled fragrance intensity, and personalized scent recommendations presents significant growth opportunities. Technology-enabled product ecosystems can enhance user experience and encourage repeat purchases.

Wax Type Insights

Paraffin wax melts dominate the market, accounting for approximately 42% of global revenue in 2025, due to their low cost and strong scent throw. However, soy wax melts are the fastest-growing segment, supported by sustainability preferences and premium positioning. Beeswax and coconut wax melts occupy niche but high-margin segments, particularly in wellness-focused applications.

Fragrance Type Insights

Floral fragrances lead the market with an estimated 28% share, driven by broad consumer appeal and widespread residential use. Gourmand and fruity fragrances are growing rapidly, particularly among younger consumers, while woody and spicy scents are favored in premium and masculine-oriented product lines.

Distribution Channel Insights

Online retail channels account for roughly 31% of global wax melt sales, driven by D2C platforms, subscription services, and marketplace visibility. Specialty home fragrance stores remain important for premium products, while supermarkets and hypermarkets dominate volume sales in mass-market segments.

End-Use Insights

Residential use represents approximately 60% of total demand, supported by increasing household spending on décor and wellness. Commercial applications—particularly in hotels, spas, offices, and wellness centers—are the fastest-growing end-use segment, benefiting from ambient scenting trends and cost-effective fragrance solutions.

| By Wax Type | By Fragrance Type | By Product Format | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds around 34% of the global wax melts market, led by the United States. High consumer awareness, strong e-commerce penetration, and premium home fragrance spending support market leadership.

Europe

Europe accounts for nearly 27% of global demand, driven by sustainability-focused consumption in the U.K., Germany, and France. Regulatory emphasis on clean-label fragrances shapes product innovation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR exceeding 10%. China, India, and Japan are key growth markets, supported by urban lifestyles, gifting culture, and expanding online retail.

Latin America

Brazil and Mexico lead demand in Latin America, supported by growing middle-class consumption and increasing availability of international home fragrance brands.

Middle East & Africa

Demand is rising in premium hospitality and residential segments, particularly in the UAE and South Africa, supported by luxury living trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wax Melts Market

- Scentsy, Inc.

- Yankee Candle (Newell Brands)

- Bath & Body Works

- Reckitt Benckiser (Air Wick)

- Procter & Gamble

- S.C. Johnson

- Godrej Consumer Products