Wax Crayons Market Size

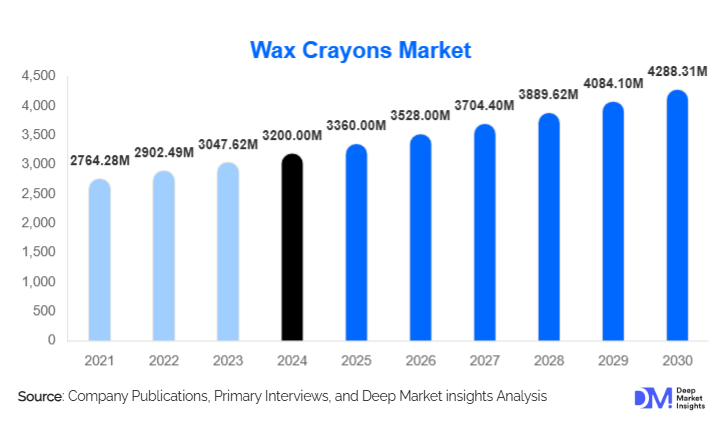

According to Deep Market Insights, the global wax crayons market size was valued at USD 3,200 million in 2024 and is projected to grow from USD 3,360 million in 2025 to reach USD 4,288.31 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Growth in the wax crayons market is primarily driven by rising demand for creative learning materials in schools, the expanding global arts & crafts segment, and increasing adoption of eco-friendly, non-toxic crayons made from soy or beeswax.

Key Market Insights

- Educational demand continues to dominate, with schools and preschools accounting for over 60% of global consumption in 2024.

- Asia-Pacific leads the global wax crayons market, contributing about 34% of the total market value in 2024, driven by population growth and educational expansion.

- Eco-friendly and sustainable wax crayons are gaining traction, fueled by parental awareness and safety regulations in North America and Europe.

- Online retail channels are expanding rapidly, reshaping distribution dynamics and enabling direct-to-consumer and subscription models.

- Premium and specialty crayons (metallic, fluorescent, washable, twistable) are becoming key revenue drivers in developed markets.

- China, India, and the United States together account for nearly 45% of the global production and consumption of wax crayons.

What are the latest trends in the wax crayons market?

Eco-Friendly and Non-Toxic Crayons Leading the Transition

Growing environmental and health consciousness among consumers is pushing manufacturers toward sustainable product innovation. Non-toxic, biodegradable wax crayons made from soy or beeswax are gaining substantial traction. Educational institutions in the U.S. and Europe increasingly require certified safe materials for school supplies, creating strong incentives for greener crayons. Companies are marketing “clean-label” crayons, free from paraffin, VOCs, and synthetic dyes, to meet parental expectations and align with sustainability standards. The shift toward eco-friendly crayons also enhances export opportunities to environmentally regulated markets in Europe and North America.

Expansion of Arts & Crafts and Hobbyist Demand

The rise of adult coloring, DIY crafts, and art therapy has significantly broadened the consumer base for wax crayons. Adult hobbyists and creative professionals increasingly prefer premium, artist-grade wax crayons featuring richer pigmentation and unique finishes such as metallic or water-soluble variants. Social media trends encouraging creative self-expression are helping reposition crayons beyond children’s tools, driving new demand in high-value niches. This expansion is redefining the wax crayons market from a purely educational commodity to a lifestyle and creativity product category.

Digital Commerce and Direct-to-Consumer Models

Online channels have become vital for crayon sales, supported by the proliferation of e-commerce platforms and subscription-based stationery kits. Direct-to-consumer brands now offer customizable color sets, licensed character packs, and bundled art-supply kits, improving engagement and margins. Subscription boxes delivering themed crayons monthly have gained traction among parents and educators. Manufacturers are integrating digital tools for virtual art lessons, augmented-reality coloring, and interactive learning experiences, blending traditional coloring with digital creativity to appeal to tech-savvy consumers.

What are the key drivers in the wax crayons market?

Increasing Focus on Early Childhood Education

Governments and private institutions worldwide are investing heavily in early childhood education. As crayons are essential for early learning, their demand directly correlates with preschool and primary enrollment rates. Developing regions in Asia-Pacific and Latin America are driving the bulk of new growth, as improving literacy and creativity-based curricula boost crayon consumption in bulk educational procurements.

Product Innovation and Material Advancements

Manufacturers are investing in innovation to create differentiated offerings such as washable, twistable, jumbo, and metallic crayons. The shift toward soy- and beeswax-based products adds both sustainability and premium appeal. Ergonomic designs for toddlers, break-resistant formulations, and better color payoff are helping brands enhance user experience and retention in both children and adult markets.

Rising Popularity of Creative Hobbyism

The global rise of the DIY movement and art-therapy culture has boosted demand among teenagers and adults. Creative communities on social media platforms such as Pinterest, Instagram, and YouTube encourage artistic expression, reinforcing steady demand for coloring materials. Premium crayon sets targeted toward artists and hobbyists now form a growing revenue stream, expanding the overall market beyond traditional education use.

What are the restraints for the global market?

Raw Material Cost Volatility

Wax crayons rely heavily on raw materials such as paraffin, soy wax, and beeswax. Fluctuations in global wax prices, often tied to petroleum and agricultural markets, can disrupt supply chains and pressure profit margins. Rising costs of natural waxes and color pigments also affect premium crayon manufacturers. These cost pressures often compel producers to adjust formulations or pricing, limiting profit scalability.

Substitution by Digital and Electronic Art Tools

The rapid adoption of tablets, stylus pens, and digital coloring applications among children poses a substitution threat. As digital learning expands in classrooms, traditional stationery tools like crayons may lose relative share in creative education. To remain relevant, crayon brands are exploring hybrid art solutions and interactive learning kits that blend analog and digital experiences.

What are the key opportunities in the wax crayons industry?

Sustainability and Green Manufacturing

Growing regulatory and consumer preference for sustainable products offers a significant opportunity for companies investing in green materials. Transitioning to soy- or beeswax-based bases and biodegradable wrappers allows manufacturers to access premium price points and institutional contracts in regulated markets. Eco-certifications and transparent sourcing practices can further enhance brand value and export competitiveness.

Emerging Market Education Growth

The rapid expansion of educational infrastructure in Asia-Pacific, the Middle East, and Latin America is creating large-scale opportunities. With preschool enrollment rising by over 7% annually in many emerging economies, bulk institutional purchases are expected to sustain volume growth. Establishing local manufacturing units or partnerships in these regions can help reduce import dependency and logistics costs while tapping into government education programs.

Digital Integration and Customization

Interactive learning models combining crayons with digital experiences, such as augmented-reality coloring books and educational apps, are opening new product segments. Brands that merge traditional coloring tools with modern technology can capture digital-native consumers. Additionally, personalized crayon sets (custom color mixes, name-engraved boxes) cater to gifting and premium markets, offering differentiated value propositions.

Product Type Insights

Standard wax crayons remain the dominant product type, accounting for about 45% of the global market in 2024. Their affordability and universal availability sustain high institutional demand. However, eco-friendly crayons and specialty variants such as metallic and washable crayons are growing at faster rates, benefiting from higher margins and premium positioning. Manufacturers are expanding color ranges and packaging designs to appeal to both children and adult users, with global branding initiatives enhancing shelf presence in supermarkets and online stores.

Material Composition Insights

Paraffin wax-based crayons dominate the market with around 52% share in 2024 due to their cost efficiency and ease of large-scale manufacturing. However, demand for soy wax-based and beeswax-based crayons is growing rapidly, supported by consumer preference for natural, safe, and biodegradable materials. The soy wax segment is expected to post the fastest CAGR (7%+ through 2030), driven by product safety certifications and sustainability initiatives.

Application Insights

Educational institutions remain the largest application segment, representing nearly 60% of the total market value in 2024. The surge in early education programs and creative learning curricula globally ensures stable demand. Meanwhile, arts & crafts/hobbyist applications are the fastest-growing segment, fueled by adult coloring and therapeutic art trends. Industrial marking crayons represent a small but stable niche for specialized use in manufacturing and construction sectors.

Distribution Channel Insights

Offline retail (stationery stores, supermarkets, hypermarkets) dominates global distribution with around 48% share, supported by impulse purchases and institutional supplies. Nevertheless, online channels are rapidly expanding, projected to capture over 35% of sales by 2030. E-commerce platforms, D2C websites, and subscription box models are increasingly important for personalized and premium crayon products, particularly in developed markets.

| By Product Type | By Material Composition | By End User | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for about 27% of the global market value (USD 0.86 billion in 2024). The U.S. leads consumption and innovation, emphasizing non-toxic and washable crayons. Strong demand for premium, themed, and licensed crayon sets supports steady growth. School system procurements and large retail chains such as Walmart and Target remain critical sales channels.

Europe

Europe represents around 22% of global revenue (USD 0.70 billion in 2024), with Germany, the U.K., and France as leading markets. European consumers favor eco-friendly, safety-certified products and artisanal crayons. Market growth is stable, supported by strong regulatory frameworks and sustainability standards that promote non-toxic, recyclable packaging and green manufacturing processes.

Asia-Pacific

The Asia-Pacific region leads globally with a 34% share (USD 1.09 billion in 2024) and is the fastest-growing market. China and India together account for a major share of production and consumption, driven by expanding educational infrastructure and a large child population. Southeast Asia is also emerging as a key growth cluster, with rising household incomes and e-commerce accessibility fueling consumer reach.

Latin America

Latin America contributes about 10% of global value, led by Brazil and Mexico. The region is witnessing growing demand due to expanding early-education programs and increasing awareness of creative learning benefits. Domestic manufacturing is limited, so imports from Asia remain essential. Market entry opportunities exist for brands offering low-cost, non-toxic crayons tailored to school systems.

Middle East & Africa

The Middle East & Africa hold roughly 7% share of global sales, with rising education spending in GCC nations and South Africa. Government education reforms and growing disposable incomes are driving steady demand for school art supplies. Imports dominate regional markets, but localized assembly and distribution are expanding due to regional education investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wax Crayons Market

- Crayola LLC

- Faber-Castell AG

- Staedtler Mars GmbH & Co. KG

- Sakura Color Products Corporation

- Maped Helix USA

- BIC Group

- Sargent Art Inc.

- Dixon Ticonderoga Company

- Camlin Kokuyo Ltd.

- Luxor Writing Instruments Pvt. Ltd.

- Amos Corporation

- Jovi S.A.

- Ningbo Zhenyang Stationery Co., Ltd.

- Shanghai M&G Stationery Inc.

- MEGA Brands Inc.

Recent Developments

- In March 2025, Crayola introduced its first 100% biodegradable soy-wax crayon line, targeting the eco-friendly school supplies segment in North America and Europe.

- In February 2025, Faber-Castell launched an online personalization tool allowing customers to design custom crayon boxes with name engraving and bespoke color selections.

- In January 2025, Staedtler expanded its Asia-Pacific production facility in Vietnam to enhance exports to ASEAN and India under the company’s sustainability initiative.

- In December 2024, Maped announced a new washable crayon range formulated with recycled packaging and certified non-toxic pigments.