Subscription Box Market Size

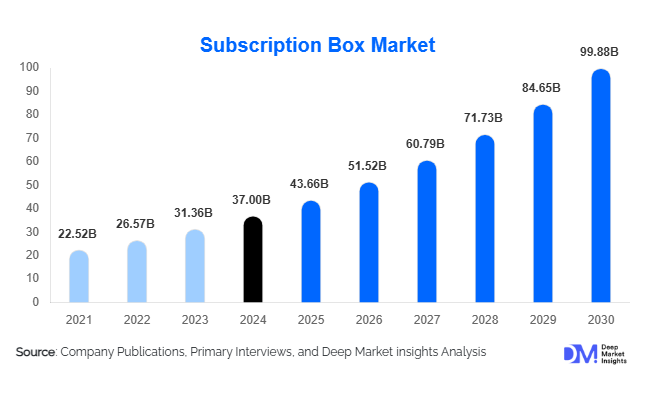

According to Deep Market Insights, the global subscription box market size was valued at USD 37 billion in 2024 and is projected to grow from USD 43.66 billion in 2025 to reach USD 99.88 billion by 2030, expanding at a CAGR of 18% during the forecast period (2025–2030). The subscription box market growth is primarily driven by increasing demand for convenience, rising popularity of personalized and curated products, and the expansion of niche offerings across beauty, food, wellness, and lifestyle categories.

Key Market Insights

- Replenishment and curated subscription boxes dominate globally, offering convenience for essential items and novelty experiences for discovery-oriented consumers.

- Beauty & personal care boxes lead the market, accounting for over 30% of global revenue in 2024, driven by high margins and influencer-led promotion strategies.

- North America is the largest market, contributing approximately 42–45% of global revenue, supported by a mature e-commerce infrastructure and high disposable income.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, growing internet penetration, and urban consumer adoption in India, China, and Southeast Asia.

- Technology-driven personalization and AI analytics, as well as sustainable and eco-friendly practices, are reshaping subscription box offerings and customer engagement.

- Cross-border subscription boxes and export-driven demand, especially in beauty, food, and lifestyle categories, are expanding the global market footprint.

What are the latest trends in the subscription box market?

Personalization and AI-Driven Recommendations

Subscription box companies are increasingly leveraging AI and data analytics to create personalized experiences. By analyzing consumer behavior, preferences, and purchase history, companies can curate boxes tailored to individual tastes. Dynamic customization, predictive replenishment, and recommendation engines reduce churn and increase customer satisfaction. Personalization extends beyond product selection, influencing packaging, messaging, and delivery schedules, making each box feel unique. Brands integrating advanced analytics are witnessing stronger retention and higher lifetime value per subscriber.

Sustainability and Eco-Friendly Practices

Consumers are gravitating toward brands that prioritize sustainability. Subscription box operators are introducing recyclable or reusable packaging, minimizing single-use plastics, and sourcing ethically. Clean, cruelty-free, and organic product offerings are becoming more prevalent. Brands are also highlighting carbon offset initiatives and eco-conscious supply chains. This trend appeals strongly to environmentally conscious consumers and differentiates offerings in a competitive market, enhancing brand loyalty while addressing global environmental concerns.

What are the key drivers in the subscription box market?

Rising Demand for Convenience and Automated Purchases

Consumers increasingly seek “set-and-forget” purchasing experiences for personal care, household essentials, and pet products. Replenishment boxes provide a seamless solution, reducing shopping frequency while ensuring timely deliveries. This convenience is particularly valuable in developed markets with busy lifestyles, driving recurring subscriptions and predictable revenue streams.

Desire for Novelty and Discovery

Curation-based subscription boxes satisfy consumers’ desire to discover new products. By combining surprise, experimentation, and personalization, brands create high engagement levels. Categories like beauty, wellness, and gourmet foods benefit the most, as consumers are willing to explore new offerings without leaving home. The social media “unboxing” phenomenon further amplifies engagement, contributing to word-of-mouth growth.

Growth of E-Commerce and Digital Platforms

The rise of e-commerce, improved logistics, and mobile payment adoption has enabled subscription box companies to scale globally. Online marketing, influencer campaigns, and content-driven social media strategies attract new subscribers efficiently. Younger demographics, familiar with digital platforms, are particularly responsive to these trends, increasing adoption across multiple regions.

What are the restraints for the global market?

High Churn and Subscription Fatigue

Maintaining long-term subscriber engagement remains challenging. Consumers may cancel subscriptions due to repetitive content, lack of perceived value, or novelty wear-off. High churn increases customer acquisition costs and reduces lifetime revenue, requiring continuous innovation in curation, personalization, and customer engagement.

Operational and Logistics Challenges

Fulfillment, shipping, and packaging costs pose significant hurdles. Perishable food items, fragile products, and international deliveries require sophisticated supply chain management. Companies must invest in warehousing, cold chain logistics, and last-mile delivery solutions to maintain quality and meet customer expectations, which can constrain profitability.

What are the key opportunities in the subscription box industry?

Expansion into Emerging Markets

Emerging economies in the Asia-Pacific, Latin America, and parts of Africa represent untapped potential. Rising disposable incomes, urbanization, and increasing digital adoption offer opportunities for brands to introduce niche and localized subscription offerings. Tailoring products to local tastes and leveraging e-commerce infrastructure can unlock substantial growth in these markets.

Integration of Technology and Personalization

AI, machine learning, and predictive analytics enable hyper-personalized offerings, improving retention and upselling opportunities. Advanced recommendation engines, automated replenishment, and interactive digital experiences enhance customer satisfaction. Companies that effectively integrate technology can differentiate themselves and reduce churn.

Focus on Sustainability and Ethical Offerings

Brands emphasizing eco-friendly packaging, clean products, and ethical sourcing are attracting environmentally conscious consumers. Integrating sustainability into brand identity and customer experience enhances loyalty, supports premium pricing, and aligns with global regulatory trends and consumer preferences.

Product Type Insights

Replenishment boxes dominate the market, offering essential products such as personal care, household goods, and pet supplies. Curated discovery boxes, particularly in beauty and gourmet foods, are growing rapidly due to the novelty and social media “unboxing” appeal. Standardized mid-tier boxes attract the largest subscriber base, balancing affordability with quality. Premium and luxury boxes cater to niche high-income segments, focusing on exclusivity and specialized content.

Application Insights

Beauty & personal care remains the largest application segment, with over 30% share of global revenue in 2024. Food & beverage, wellness, and lifestyle categories are expanding, driven by health-conscious and experiential consumers. Pet, kids, and hobby-focused boxes are emerging niches, contributing to market diversification. Cross-category bundles and hybrid offerings (e.g., wellness + food) are gaining traction, increasing average subscription value.

Distribution Channel Insights

Direct-to-consumer online platforms dominate, leveraging e-commerce websites, mobile apps, and subscription management platforms. Retail partnerships and pop-up activations complement online sales, providing physical touchpoints and brand visibility. Social media, influencer marketing, and content-driven campaigns are central to customer acquisition and retention. Corporate gifting and cross-border subscriptions are emerging as secondary channels, particularly for premium and niche boxes.

Consumer Insights

Millennials and Gen Z account for the majority of subscribers, valuing personalization, novelty, and convenience. Wellness enthusiasts and pet owners are rapidly growing segments, reflecting lifestyle trends. Families and high-income individuals drive demand for premium and curated boxes. Subscription flexibility, skip/pause options, and unique unboxing experiences are critical to maintaining loyalty and reducing churn.

Age Group Insights

Subscribers aged 25–40 years dominate, balancing disposable income with curiosity for new experiences. Younger consumers (18–24) prefer lower-cost and experimental boxes, while older consumers (41–60) are gravitating toward premium and wellness-focused subscriptions. Multi-generational households are also driving demand for family-oriented and educational boxes.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 42–45% of global revenue, led by the U.S. and Canada. Mature e-commerce infrastructure, high disposable incomes, and early adoption of subscription models support market dominance. Beauty, food, and lifestyle boxes drive the largest demand, with premium and curated offerings growing rapidly.

Europe

Europe contributes around 25–30% of global revenue, with the UK, Germany, and France leading adoption. Sustainability-focused and experiential boxes are particularly popular. Digital platforms and social media influence buying patterns, while niche segments like eco-friendly and artisanal products show strong growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with high CAGRs forecasted for India, China, Japan, and Southeast Asia. Rising middle-class incomes, urbanization, and mobile commerce adoption drive demand. Beauty, wellness, and food boxes are particularly attractive, supported by influencer marketing and increasing cross-border subscriptions.

Latin America

Latin America shows emerging demand, primarily from Brazil, Mexico, and Argentina. Growing e-commerce infrastructure and rising urban incomes support the adoption of curated and niche subscription boxes, although overall market share remains under 10% in 2024.

Middle East & Africa

Urbanized regions like the UAE, Saudi Arabia, and South Africa show increasing interest in premium and lifestyle boxes. Africa remains a production hub and domestic market for certain niche categories, while the Middle East demonstrates a growing appetite for curated and luxury offerings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Subscription Box Market

- HelloFresh

- Blue Apron

- FabFitFun

- Birchbox

- Dollar Shave Club

- Ipsy

- Stitch Fix

- BarkBox

- The Honest Company

- Home Chef

- Loot Crate

- Nature Delivered

- SnackCrate

- Allure Beauty Box

- PetSmart Subscription Boxes

Recent Developments

- In March 2025, HelloFresh expanded its offerings in Asia-Pacific, launching region-specific meal kits tailored to local tastes and dietary preferences.

- In February 2025, FabFitFun introduced a new AI-driven personalization platform, allowing subscribers to customize box contents and improve engagement and retention.

- In January 2025, Birchbox rolled out sustainable packaging initiatives across North America and Europe, including recyclable boxes and zero-waste filler materials.