Water Sports Gear Market Size

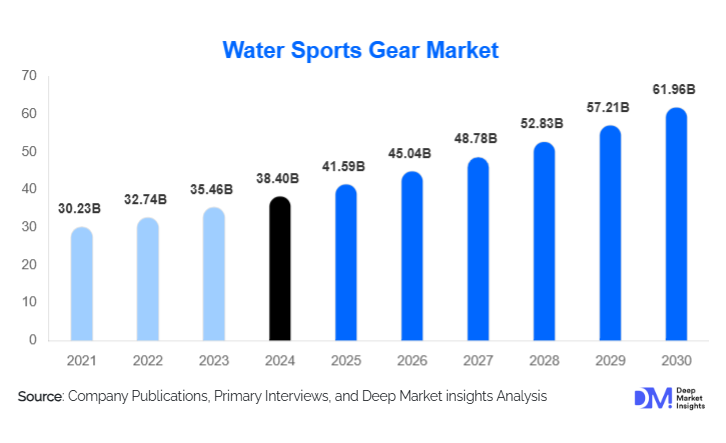

According to Deep Market Insights, the global water sports gear market size was valued at USD 38.4 billion in 2024 and is projected to grow from USD 41.59 billion in 2025 to reach USD 61.96 billion by 2030, expanding at a CAGR of 8.3% during the forecast period (2025–2030). The water sports gear market growth is primarily driven by rising participation in recreational and adventure water activities, strong recovery in coastal and marine tourism, increasing safety regulations mandating protective equipment, and continuous innovation in lightweight, durable, and performance-enhancing materials.

Key Market Insights

- Protective gear remains the backbone of the market, supported by mandatory safety norms for recreational and professional water sports activities.

- Surfing, paddleboarding, and kayaking are witnessing rapid participation growth, driven by lifestyle-oriented fitness trends and youth engagement.

- North America dominates global demand, supported by premium product adoption, strong retail networks, and high disposable income.

- Asia-Pacific is the fastest-growing regional market, driven by marine tourism development and rising middle-class participation.

- Mid-range pricing tiers account for the highest revenue share, balancing affordability and performance for mass consumers.

- Digital and direct-to-consumer channels are reshaping sales dynamics, improving brand reach and pricing transparency.

What are the latest trends in the water sports gear market?

Sustainability and Eco-Friendly Materials Gaining Momentum

Manufacturers are increasingly adopting recycled plastics, plant-based neoprene alternatives, and low-impact manufacturing processes to meet rising environmental expectations. Consumers, particularly in Europe and North America, are showing a strong preference for eco-certified gear, encouraging brands to invest in sustainable innovation. This trend is also reinforced by regulatory pressure to reduce petroleum-based material usage and carbon footprints across production facilities.

Technology-Enabled and Smart Water Sports Equipment

Smart gear integration is emerging as a premium growth trend, with GPS-enabled life jackets, dive computers, and performance-tracking wearables gaining traction. These innovations enhance safety, improve user experience, and allow real-time monitoring for professional and recreational users alike. Connected equipment is particularly appealing to younger, tech-savvy consumers and professional athletes seeking performance optimization.

What are the key drivers in the water sports gear market?

Rising Participation in Recreational and Fitness-Oriented Water Sports

Water sports such as paddleboarding, kayaking, and surfing are increasingly viewed as holistic fitness and wellness activities. Recreational consumers accounted for over 60% of total demand in 2024, driven by urban lifestyle shifts toward outdoor leisure, health awareness, and experiential sports. Social media exposure and global sporting events continue to amplify participation levels.

Growth in Marine and Adventure Tourism

The recovery of global tourism has significantly boosted institutional and rental demand from resorts, cruise operators, and adventure tourism providers. Coastal infrastructure investments and government-backed tourism initiatives have strengthened long-term procurement demand for standardized, durable water sports gear.

Advancements in Materials and Product Design

Innovations in lightweight composites, abrasion-resistant fabrics, and thermal insulation have improved product durability and comfort. These advancements support higher replacement cycles and encourage consumers to upgrade to premium and mid-range products, positively impacting overall market value.

What are the restraints for the global market?

High Cost of Premium and Professional-Grade Equipment

Advanced diving gear, high-performance boards, and certified safety equipment remain cost-intensive, limiting adoption in price-sensitive markets. While rental models mitigate this challenge, high upfront costs continue to restrict direct ownership among first-time and casual users.

Environmental Regulations and Raw Material Constraints

Restrictions on neoprene and petroleum-based polymers have increased compliance and sourcing costs. Manufacturers are required to invest in alternative materials and certifications, which can pressure margins in the short term and slow product rollout timelines.

What are the key opportunities in the water sports gear industry?

Expansion of Coastal and Inland Water Tourism Infrastructure

Government investments in marinas, artificial surfing lagoons, and inland water recreation facilities are creating sustained demand for rental and institutional-grade equipment. Long-term supply contracts with hospitality operators offer stable revenue opportunities for manufacturers.

Emerging Markets and Youth Participation

Countries such as India, Indonesia, Brazil, and Mexico are witnessing rising youth participation in water sports. Affordable entry-level products, localized manufacturing, and e-commerce penetration provide significant opportunities for brands to scale volumes in these high-growth markets.

Product Type Insights

Protective gear dominates the market, accounting for approximately 34% of total revenue in 2024, driven by safety regulations and universal applicability across activities. Apparel, particularly wetsuits and rash guards, represents a strong secondary segment, supported by product replacement cycles and premium material adoption. Equipment and accessories such as boards, paddles, and fins contribute significantly to value growth due to higher average selling prices.

Activity Type Insights

Surfing and windsurfing collectively lead the market, supported by global sporting events, strong lifestyle branding, and high consumer engagement. Paddleboarding and kayaking are the fastest-growing activities, driven by accessibility, low entry barriers, and fitness appeal. Scuba diving and snorkeling continue to generate stable demand from tourism-driven markets.

Distribution Channel Insights

Specialty sports retail stores account for the largest share of sales, as consumers prefer expert guidance and product fitting for technical gear. Online direct-to-consumer channels are growing rapidly, supported by digital marketing, competitive pricing, and broader product visibility. Institutional and rental sales form a stable B2B channel, particularly in tourism-driven regions.

End-User Insights

Recreational consumers dominate demand, contributing over 60% of global revenue in 2024. Tourism and hospitality operators represent the fastest-growing end-use segment, driven by expansion in adventure tourism and resort-based water sports offerings. Defense, rescue, and safety agencies provide a steady institutional demand for certified protective equipment.

| By Product Type | By Activity Type | By Distribution Channel | By End User | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of global market revenue in 2024, led by the United States and Canada. High disposable incomes, premium product adoption, and strong participation in recreational water sports underpin regional dominance.

Europe

Europe holds nearly 27% of the market, with strong demand from Germany, France, the U.K., Spain, and Italy. Sustainability-driven purchasing behavior and well-developed coastal tourism support steady growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 9.8% CAGR. China, Australia, Japan, India, and Indonesia are key growth markets, supported by tourism infrastructure development and rising middle-class participation.

Latin America

Latin America contributes around 8% of global revenue, led by Brazil and Mexico. Surfing culture and coastal tourism are key growth drivers, particularly in premium and mid-range product categories.

Middle East & Africa

The Middle East and Africa account for approximately 6% of the market, driven by luxury marine tourism investments in the UAE and growing recreational participation in South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|