Water Shoes Market Size

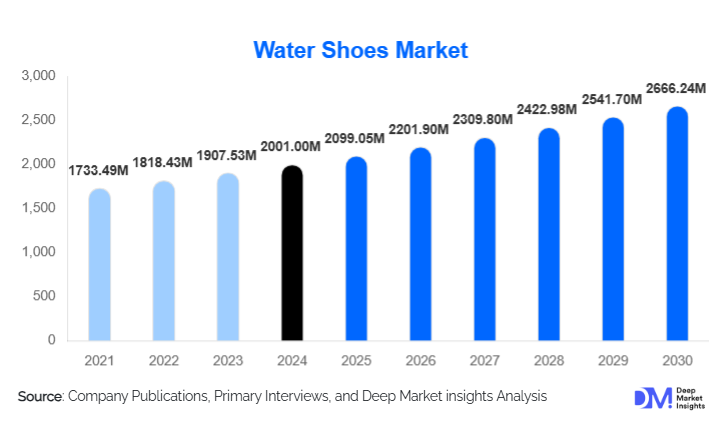

According to Deep Market Insights, the global water shoes market size was valued at USD 2,001.00 million in 2024 and is projected to grow from USD 2,099.05 million in 2025 to reach USD 2,666.24 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). Market growth is driven by rising participation in water sports and adventure tourism, increasing coastal and beach-related recreational activities, and growing consumer preference for multifunctional, lightweight, and quick-dry footwear.

Key Market Insights

- Recreational and beach-use water shoes dominate global demand, accounting for the largest share due to mass consumer adoption.

- North America leads the market by value, supported by high participation in water sports and premium product uptake.

- Asia-Pacific is the fastest-growing region, driven by expanding coastal tourism and rising disposable incomes.

- Mid-priced water shoes (USD 20–50) represent the largest revenue share, balancing affordability and performance.

- Online channels are rapidly gaining dominance, fueled by direct-to-consumer strategies and e-commerce penetration.

- Sustainable and recycled-material water shoes are emerging as a key innovation focus for manufacturers.

What are the latest trends in the water shoes market?

Hybrid Water-to-Land Footwear Gaining Popularity

Manufacturers are increasingly designing hybrid water shoes that function seamlessly across aquatic and urban environments. These products feature improved aesthetics, enhanced cushioning, and flexible soles, enabling consumers to use them beyond beaches and water sports. This trend is expanding the addressable market and reducing seasonality-related demand fluctuations.

Sustainable Materials and Lightweight Designs

The use of recycled plastics, bio-based rubber, and breathable mesh fabrics is rising. Consumers are showing a higher willingness to pay for eco-friendly products, especially in Europe and North America. Lightweight, barefoot-style water shoes are also gaining traction among adventure enthusiasts and minimalist footwear users.

What are the key drivers in the water shoes market?

Growth in Water Sports and Adventure Tourism

Increasing participation in activities such as kayaking, paddleboarding, rafting, snorkeling, and surfing is a primary growth driver. Adventure tourism operators and resorts often recommend or require water shoes for safety, directly supporting consistent demand.

Rising Coastal and Beach Tourism

Global recovery in tourism and increased spending on beach vacations are boosting consumer purchases of water shoes, particularly among first-time and casual users.

What are the restraints for the global market?

Seasonal Demand Patterns

In temperate regions, water shoe sales remain highly seasonal, leading to uneven revenue cycles and inventory challenges for manufacturers and retailers.

Price Sensitivity in Emerging Markets

Although demand is growing in Asia-Pacific and Latin America, price sensitivity limits premium product penetration, putting pressure on margins unless localized manufacturing is adopted.

What are the key opportunities in the water shoes industry?

Expansion in Emerging Coastal Economies

Rapid growth in beach tourism across Southeast Asia, Latin America, and parts of the Middle East presents significant opportunities for volume expansion through localized product offerings.

Sustainable and Eco-Certified Product Lines

Brands that invest early in sustainability certifications and recycled materials can differentiate their offerings, command premium pricing, and align with tightening environmental regulations.

Product Type Insights

Closed-toe water shoes dominate the global water shoes market, accounting for approximately 38% of total revenue in 2024. Their leadership is driven by superior toe protection, enhanced grip, and suitability for rugged environments such as rocky shorelines, river rafting, canyoning, and kayaking. These shoes are widely preferred by adventure tourists, professional water sports participants, and utility users who prioritize safety and durability over minimal design.

Open-toe water shoes and sandals primarily cater to casual beachgoers and recreational swimmers, where comfort, breathability, and ease of wear are the primary purchase drivers. Sock-type and minimalist water shoes are gaining popularity among fitness-focused users and travelers seeking lightweight, packable options for light water activities. Hybrid water shoes represent the fastest-growing product sub-segment, driven by increasing consumer demand for versatile, multi-purpose footwear that can transition seamlessly between water, outdoor trails, and casual urban use. Design innovation, lifestyle-oriented aesthetics, and reduced seasonality are accelerating the adoption of hybrid water shoes globally.

Material Insights

Mesh and synthetic textile-based water shoes lead the market with over 40% share in 2024, supported by their excellent breathability, quick-drying performance, lightweight construction, and cost efficiency. These materials are well-suited for mass-market recreational use and are widely adopted across mid-range price segments. Neoprene-based water shoes continue to hold strong demand in colder-water applications and professional water sports due to their insulation, flexibility, and snug fit. They are commonly used in activities such as surfing, diving, and rafting, particularly in North America and Europe.

Recycled and bio-based materials are emerging as a high-growth material category, driven by sustainability-focused consumer preferences and regulatory pressure on footwear manufacturers to reduce environmental impact. Brands integrating recycled plastics and eco-friendly rubber compounds are gaining traction, particularly in Europe and premium market segments.

Distribution Channel Insights

Online distribution channels account for nearly 49% of global water shoes sales, making them the leading channel by revenue. Growth is fueled by the rapid expansion of brand-owned direct-to-consumer (DTC) platforms, global e-commerce marketplaces, and improved digital marketing strategies. Online channels benefit from wider product availability, competitive pricing, consumer reviews, and convenience, making them especially attractive to younger and tech-savvy consumers.

Offline specialty sports and outdoor retail stores remain critical for premium, professional-grade, and technical water shoes, where consumers value physical product trials, expert recommendations, and in-store demonstrations. Mass merchandisers and hypermarkets continue to support volume sales in entry-level and mid-priced segments.

End-User Insights

Men represent the largest end-user segment, holding approximately 47% of the global water shoes market share in 2024. This dominance is driven by higher participation rates in adventure sports, water-based recreation, fishing, and professional marine activities. Men also show higher adoption of closed-toe and hybrid water shoes designed for rugged performance. The women’s segment is growing steadily, supported by rising participation in recreational water activities, fitness-focused water sports, and travel-driven purchases. Increased availability of women-specific designs and aesthetic improvements is further boosting adoption.

The kids segment is expanding in line with family-oriented beach tourism and water park visitation. Parents increasingly prioritize safety, grip, and foot protection for children, supporting demand for durable and slip-resistant water shoes.

| By Product Type | By Application | By Distribution Channel | By Price Band |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global water shoes market in 2024, led by the United States. Regional dominance is driven by a strong outdoor recreation culture, high participation in water sports, and widespread access to beaches, lakes, and rivers. High disposable income levels support premium product adoption, while established retail infrastructure and strong brand presence further reinforce demand. Growth is also supported by adventure tourism, fishing activities, and rising interest in hybrid water-to-land footwear.

Europe

Europe holds around 27% market share, with major demand originating from Germany, France, Italy, Spain, and the U.K. Growth in the region is driven by coastal tourism, water sports participation, and strong consumer emphasis on sustainability and product quality. European consumers show a high preference for eco-friendly materials and durable designs, encouraging manufacturers to focus on recycled and low-impact water shoes. Well-developed tourism infrastructure and regulatory support for sustainable products further strengthen market growth.

Asia-Pacific

Asia-Pacific represents approximately 25% of the global water shoes market and is the fastest-growing region, expanding at over 9% CAGR. Growth is fueled by the rapid expansion of coastal and beach tourism, rising disposable incomes, and increasing participation in recreational water activities. China, Japan, South Korea, and Southeast Asian countries benefit from large consumer bases, growing domestic tourism, and improving e-commerce penetration. Cost-effective manufacturing capabilities in the region also support competitive pricing and export-driven growth.

Latin America

Latin America accounts for roughly 9% of global demand, supported by beach tourism growth in Brazil, Mexico, and the Caribbean. Favorable climate conditions, expanding tourism infrastructure, and increasing participation in water-based recreational activities are key demand drivers. Growth is primarily concentrated in mid-range and affordable water shoes, reflecting regional price sensitivity.

Middle East & Africa

The Middle East & Africa region contributes around 7% of global revenue, with demand concentrated in the UAE, South Africa, and key coastal tourism destinations. Growth is supported by luxury beach tourism, water parks, and marine recreation investments in the Middle East, while Africa benefits from expanding adventure tourism and coastal leisure activities. Increasing infrastructure development and tourism diversification strategies are expected to support steady long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|