Water Filter Market Size

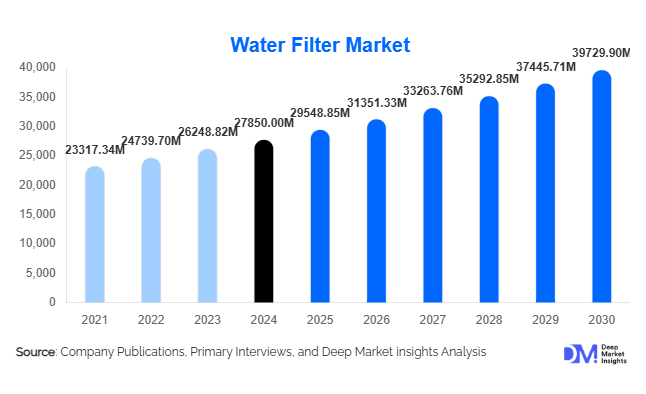

According to Deep Market Insights, the global water filter market size was valued at USD 27,850.00 million in 2024 and is projected to grow from USD 29,548.85 million in 2025 to reach USD 39,729.90 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The water filter market growth is primarily driven by increasing concerns over water contamination, rising health awareness among households, urbanization in developing regions, and technological innovations in water purification solutions.

Key Market Insights

- Residential water filtration is the dominant segment, driven by urban households’ demand for safe drinking water and preference for point-of-use filtration solutions like under-sink and faucet-mounted filters.

- Reverse Osmosis (RO) filters lead technology adoption, offering superior removal of heavy metals, nitrates, and pathogens, making them the most preferred choice in both residential and industrial applications.

- Asia-Pacific dominates the global market, led by China and India, owing to rapid urbanization, growing industrial demand, and government initiatives promoting safe drinking water.

- North America is a major regional market, with the U.S. and Canada driving demand for smart and premium water filters, supported by high disposable incomes and strict water quality regulations.

- Online retail channels are increasingly shaping consumer behavior, offering convenience, product reviews, and subscription-based filter replacement services that boost repeat sales.

- Technological innovations, including IoT-enabled filters, smart sensors, and multi-stage filtration systems, are enhancing product differentiation and market penetration globally.

What are the latest trends in the water filter market?

Smart and IoT-Enabled Water Filtration

Water filter manufacturers are increasingly integrating IoT-enabled sensors and smart technologies that provide real-time monitoring of water quality, filter usage, and replacement alerts. These innovations appeal to urban, tech-savvy consumers seeking convenience and advanced functionality. Subscription-based services for filter replacements and app-connected monitoring systems are becoming standard in developed regions, enabling manufacturers to build recurring revenue streams while enhancing consumer engagement and trust.

Eco-Friendly and Sustainable Filtration Solutions

Environmental sustainability is driving the adoption of filters with reusable cartridges, energy-efficient purification systems, and low-waste production methods. Manufacturers are focusing on eco-friendly activated carbon, biodegradable components, and energy-saving RO systems to meet growing regulatory and consumer expectations. This trend aligns with global initiatives to reduce plastic consumption and promote clean water access without environmental harm, making sustainability a key differentiator in product offerings.

What are the key drivers in the water filter market?

Rising Awareness of Waterborne Diseases

Health consciousness and increased awareness of contaminants such as heavy metals, chlorine, microplastics, and microorganisms are major growth drivers. Consumers are prioritizing safe drinking water solutions for households, schools, and offices. This trend is particularly pronounced in urban areas of developing countries where municipal water quality is inconsistent, encouraging the adoption of advanced filtration technologies.

Urbanization and Growing Residential Demand

Rapid urbanization in Asia-Pacific, Latin America, and parts of Africa has expanded household water consumption. Urban consumers prefer under-sink, countertop, and faucet-mounted filters due to ease of installation, aesthetic appeal, and effective purification. Increasing disposable incomes in these regions are enabling more consumers to invest in high-quality water filters, boosting residential demand.

Technological Advancements and Product Innovation

Manufacturers are introducing multi-stage filtration systems, UV and RO hybrid filters, and smart IoT-enabled water purifiers. These innovations improve water safety, convenience, and energy efficiency, encouraging adoption across residential, commercial, and industrial sectors. Advanced systems also reduce maintenance frequency and enhance user experience, further driving market growth globally.

What are the restraints for the global market?

High Cost of Advanced Filtration Systems

Premium filtration technologies such as RO and UV filters are expensive to purchase and maintain, which limits adoption among low-income households. The recurring cost of replacement cartridges and maintenance may deter price-sensitive consumers, particularly in emerging economies.

Regulatory and Standardization Challenges

Inconsistent water quality regulations across regions pose challenges for manufacturers. Compliance with diverse local standards increases operational complexity, affects product certification, and may slow down market expansion in emerging regions. Lack of standardized labeling and performance metrics can also reduce consumer trust in certain products.

What are the key opportunities in the water filter industry?

Emerging Market Penetration

Rapid urbanization in India, China, Brazil, and South Africa is creating untapped potential for residential and commercial water filters. Growing disposable incomes and government programs promoting safe drinking water present significant opportunities for international players to establish localized manufacturing and distribution networks, catering to these high-growth regions.

Integration of Smart Technologies

IoT-enabled filters and smart purification systems offer opportunities to differentiate products. Real-time monitoring, app connectivity, and predictive maintenance enhance user convenience and support subscription models. Smart filters are increasingly preferred in North America and Europe, where health-conscious and tech-savvy consumers drive premium product adoption.

Government Policies and Infrastructure Investments

Government initiatives promoting clean water access, sustainable infrastructure, and municipal water treatment programs are driving demand for advanced water filtration systems. Public-private collaborations and investments in water purification infrastructure provide opportunities for manufacturers to expand project-based sales and industrial solutions in emerging economies.

Product Type Insights

Under-sink water filters dominate the market, accounting for 28% of 2024 global sales. Their discreet installation, high purification capacity, and growing adoption in urban households contribute to this leadership. Faucet-mounted filters follow closely due to their convenience and lower upfront cost. Whole-house filtration systems are expanding in industrial and institutional applications, while pitcher and countertop filters continue to cater to the budget-conscious consumer segment.

Technology Insights

Reverse Osmosis (RO) technology leads the global market, with a 35% share in 2024, owing to its ability to remove dissolved solids, heavy metals, and microbial contaminants. Activated carbon filters remain widely used in residential applications for chlorine and odor removal, while UV and ceramic filters are preferred in regions prioritizing pathogen disinfection. Multi-stage systems are gaining popularity among premium residential and commercial users, integrating multiple purification technologies for superior performance.

Distribution Channel Insights

Online retail dominates with 32% of market share in 2024, benefiting from e-commerce growth, convenience, and digital marketing. Offline retail channels, including supermarkets and specialty stores, continue to play a major role in residential adoption, particularly for replacement cartridges. Direct sales and project-based channels are crucial for industrial and municipal contracts, enabling manufacturers to secure large-scale deployments and recurring service agreements.

End-Use Insights

The residential segment is the largest end-user, representing 40% of market demand in 2024, driven by urban households seeking clean and safe drinking water. Commercial adoption in offices, restaurants, and hotels is rising, especially for RO and UV systems. Industrial demand, particularly in pharmaceuticals, food & beverage, and electronics manufacturing, requires high-purity water. Export-driven demand is growing in developing countries where local manufacturing cannot meet quality standards, creating opportunities for international water filter suppliers.

| By Product Type | By Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant share (25%) of the global market, led by the U.S. and Canada. High health awareness, adoption of smart filters, and stringent water quality regulations are driving demand. Residential and commercial sectors dominate, with premium RO and multi-stage filters being highly preferred.

Europe

Europe accounts for 22% of 2024 sales, with Germany, the UK, and France leading adoption. Growth is driven by eco-friendly filters, high household awareness, and regulatory compliance. Smart filtration systems and subscription-based replacement services are increasingly popular in urban markets.

Asia-Pacific

Asia-Pacific dominates globally with a 38% share, driven by China and India. Rapid urbanization, government initiatives for clean water, industrial demand, and growing household income are key drivers. India is the fastest-growing market (9.5% CAGR), fueled by government programs such as Jal Jeevan Mission and rising residential adoption.

Latin America

Brazil and Argentina are leading regional markets, with growing residential and commercial demand due to inconsistent municipal water quality. Outbound import of premium filters is also increasing to meet domestic gaps.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, and Africa, led by South Africa and Kenya, are emerging markets. Scarcity of clean water, high urbanization, and increasing adoption of advanced filtration solutions are driving growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Water Filter Market

- Brita

- Culligan

- Pentair

- 3M

- A. O. Smith

- Honeywell

- LG Electronics

- Whirlpool

- Pureit (HUL)

- Kent RO Systems

- Coway

- Haier

- Parker Hannifin

- Aqua International

- Mitsubishi Chemical

Recent Developments

- In 2025, Brita launched IoT-enabled water filters with smart monitoring features across Europe, expanding its premium product portfolio.

- In 2024, Pentair introduced multi-stage RO systems for industrial and residential segments in North America and APAC, focusing on energy-efficient purification.

- In 2024, Culligan expanded its direct-to-consumer subscription model in the U.S., enabling automated filter replacements and real-time water quality monitoring.