Wall-Mounted Tissue Box Market Size

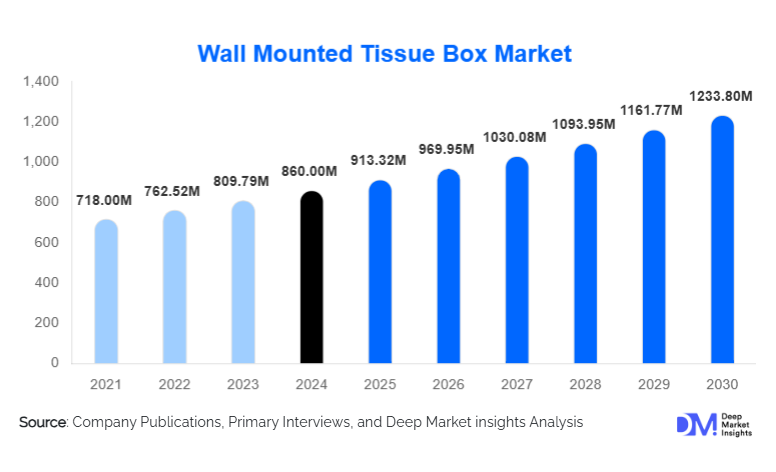

According to Deep Market Insights, the global wall-mounted tissue box market size was valued at USD 860 million in 2024 and is projected to grow from USD 913.32 million in 2025 to reach USD 1233.8 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for space-efficient hygiene solutions, growing public sanitation initiatives, and rising adoption in commercial, healthcare, and hospitality sectors globally.

Key Market Insights

- Stainless steel and corrosion-resistant materials dominate the market, ensuring durability and hygiene in commercial and healthcare applications.

- Lockable commercial dispensers are preferred in public and high-traffic areas, providing controlled usage and reducing theft and wastage.

- North America leads in value-based adoption, driven by premium residential and hospitality demand, while Asia-Pacific dominates in volume consumption due to rapid urbanization and infrastructure development.

- Mid-range wall-mounted tissue boxes account for the largest segment, balancing aesthetics, durability, and cost-effectiveness across both residential and commercial sectors.

- E-commerce is emerging as a key distribution channel, enabling direct-to-consumer sales and customization options for premium segments.

- Technological advancements, such as adhesive-based mounting and antimicrobial coatings, are improving product functionality and hygiene performance.

What are the latest trends in the wall-mounted tissue box market?

Premiumization and Designer Products

Consumers and commercial establishments are increasingly seeking designer and premium wall-mounted tissue boxes that combine aesthetics with functionality. Brushed metal finishes, wood-metal hybrids, and sleek contemporary designs are gaining popularity in high-end residential bathrooms, hotels, and luxury office spaces. Manufacturers are leveraging modern design trends to offer customizable solutions that cater to interior décor preferences. This trend is particularly strong in Europe and North America, where premium products can command higher margins and reinforce brand differentiation.

Smart and Hygiene-Enhanced Products

The market is witnessing a shift toward hygiene-oriented and smart dispensers, especially in healthcare and public infrastructure. Features such as sensor-based automatic dispensing, lockable refills, and antimicrobial surfaces are being adopted to minimize cross-contamination and enhance user convenience. These innovations are appealing to institutions with high hygiene standards, including hospitals, airports, and corporate facilities. Smart wall-mounted tissue boxes with refill alerts and energy-efficient sensors are emerging as growth enablers, particularly in technologically advanced markets.

What are the key drivers in the wall-mounted tissue box market?

Expansion of Commercial and Hospitality Infrastructure

Rapid growth in office spaces, retail malls, hotels, and resorts is driving significant demand for wall-mounted tissue boxes. High-traffic environments require durable, low-maintenance, and hygienic dispensers, making wall-mounted solutions ideal. This infrastructure expansion, particularly in APAC and North America, is positively impacting market growth, with large-scale procurement contracts favoring standardized commercial products.

Increasing Hygiene Awareness and Infection Control

Post-pandemic awareness regarding hygiene and disease prevention has amplified the adoption of enclosed and lockable dispensers. Hospitals, clinics, and public facilities are increasingly specifying wall-mounted tissue boxes to reduce cross-contamination, comply with regulatory standards, and improve overall sanitation. This has been a key growth driver in both developed and emerging markets.

Urbanization and Residential Renovation Trends

Urban households and high-rise apartments favor space-saving, wall-mounted designs for bathrooms and kitchens. Renovation and remodeling activities in cities are driving replacement demand for modern, durable, and visually appealing dispensers. Mid-range and premium products are particularly popular, catering to evolving consumer expectations around both utility and aesthetics.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating costs of stainless steel, aluminum, and ABS plastics impact manufacturing expenses and profitability, particularly for economy segment products. Suppliers often face margin pressures due to unpredictable price swings, which can restrict market expansion in price-sensitive regions.

Low Differentiation in the Economy Segment

In the budget category, commoditization limits pricing power and profitability. Minimal variation in design and material quality among competitors makes it challenging for manufacturers to maintain sustainable margins, slowing growth in this segment.

What are the key opportunities in the wall-mounted tissue box market?

Public Sanitation and Infrastructure Modernization

Government investment in public sanitation projects, including airports, schools, hospitals, and railways, presents significant opportunities. Standardized wall-mounted tissue boxes are essential for hygiene compliance, offering repeat institutional procurement cycles. Emerging economies in APAC and the Middle East are investing heavily in such projects, providing long-term growth potential for both domestic and international manufacturers.

Integration of Smart and Hygiene-Enhanced Features

Technological adoption, including touchless dispensing, sensor-based refills, and antimicrobial coatings, creates premium product opportunities. Commercial buyers, particularly in healthcare and hospitality, are willing to pay higher prices for enhanced safety and hygiene benefits. Smart products also enable predictive maintenance and inventory control, further driving B2B adoption.

E-Commerce and Direct-to-Consumer Expansion

Digital platforms have opened opportunities for manufacturers to sell directly to consumers and small businesses. E-commerce enables customization, dynamic pricing, and subscription-based refill services. Rising online penetration in Asia-Pacific, North America, and Europe is helping manufacturers expand market reach, especially for mid-range and premium segments.

Product Type Insights

Mid-range wall-mounted tissue boxes dominate the global market, accounting for the largest share of overall revenue due to their optimal balance between durability, functional design, and cost-effectiveness. These products are widely adopted across commercial buildings, hospitality establishments, and urban residential spaces, where buyers prioritize long product life, ease of maintenance, and modern aesthetics without incurring premium pricing. The leading driver for this segment is its versatility; mid-range dispensers meet both institutional procurement standards and residential consumer expectations, making them suitable for large-volume installations.

Premium and designer wall-mounted tissue boxes are gaining strong traction in hospitality, luxury residential, and high-end commercial spaces, driven by increasing emphasis on interior aesthetics, brand image, and customer experience. Hotels, resorts, and premium office buildings increasingly invest in designer finishes such as brushed stainless steel, matte black coatings, and wood-metal composites to enhance bathroom ambience. Meanwhile, economy wall-mounted tissue boxes remain essential in price-sensitive public infrastructure, educational institutions, and mass residential housing projects, where procurement decisions are driven primarily by affordability and functional compliance.

Application Insights

Commercial buildings, including offices, retail complexes, and mixed-use developments, represent the largest application segment in the wall-mounted tissue box market. High footfall, frequent usage, and the need for standardized, durable hygiene fixtures drive consistent demand. Corporate offices increasingly favor wall-mounted dispensers to ensure ease of cleaning, space optimization, and uniform restroom design across facilities.

Hospitality and healthcare applications are among the fastest-growing segments. In hospitality, hotels and resorts are adopting premium and designer dispensers to align with upscale interior themes and enhance guest experience. In healthcare facilities, demand is driven by strict infection control protocols, hygiene regulations, and the need for enclosed, touch-minimized dispensing solutions. Public infrastructure, including airports, railway stations, schools, and government buildings, accounts for substantial demand, supported by government-led sanitation initiatives and infrastructure modernization programs.

Distribution Channel Insights

Offline retail channels, including home improvement stores, sanitary ware outlets, and authorized distributors, remain the dominant distribution route, primarily due to large-volume B2B procurement by commercial, healthcare, and public-sector buyers. Institutional customers prefer offline channels for product standardization, bulk pricing negotiations, after-sales support, and long-term supplier relationships.

However, e-commerce is rapidly gaining share, particularly in the residential and small commercial segments. Online platforms enable direct-to-consumer sales, wider product visibility, customization options, and competitive pricing. The growth of digital marketplaces and manufacturer-owned websites is also supporting subscription-based refill models and faster last-mile delivery. Manufacturers are increasingly adopting omnichannel strategies, leveraging offline strength for institutional sales while expanding online presence to capture urban residential and premium consumers.

End-Use Insights

Commercial and hospitality end-use segments are the fastest-growing contributors to market expansion, driven by continuous growth in office buildings, shopping malls, hotels, and tourism infrastructure. These sectors demand high-durability, lockable, and aesthetically consistent dispensers to manage high usage volumes efficiently. Healthcare facilities represent a steady-growth end-use segment, where emphasis on hygiene, infection prevention, and regulatory compliance sustains long-term demand.

Residential end-use is growing steadily, supported by urbanization, rising disposable incomes, and increasing consumer focus on organized and modern bathroom accessories. High-rise residential projects and home renovation trends are particularly influential in driving mid-range and premium product demand. Additionally, export-driven demand plays a significant role, with manufacturing hubs in China and India supplying large volumes to North America, Europe, and the Middle East, benefiting from cost-efficient production and established global supply chains.

| By Product Type | By Material Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America, led by the United States and Canada, accounted for approximately 24% of the global wall-mounted tissue box market in 2024. Regional growth is driven by strong demand for premium and designer products across commercial offices, hospitality properties, and high-income residential segments. High renovation and replacement activity in aging office buildings and hotels further supports consistent demand. Additionally, stringent hygiene standards, accessibility regulations, and sustainability requirements encourage the adoption of advanced, durable, and touchless dispensers, reinforcing the region’s leadership in value-based consumption.

Europe

Europe holds around 21% of the global market share, with Germany, the U.K., France, and Italy leading demand. Regional growth is driven by strict hygiene regulations, sustainability mandates, and a strong preference for aesthetically refined bathroom solutions. The widespread adoption of eco-friendly materials, recyclable components, and minimalist design aesthetics supports demand for mid-range and premium wall-mounted tissue boxes. Public facility upgrades and hospitality renovations across Western Europe further contribute to steady market expansion.

Asia-Pacific

Asia-Pacific represents the largest volume market, accounting for approximately 38% of global demand, and is the fastest-growing region with a CAGR exceeding 8%. Growth is primarily driven by rapid urbanization, large-scale infrastructure development, and rising hygiene awareness across China, India, Japan, and Southeast Asia. Expanding hotel capacity, commercial real estate development, and government-led public sanitation programs are major demand drivers. In addition, the rapid growth of e-commerce platforms is accelerating residential adoption, while cost-efficient manufacturing in the region supports strong export activity.

Middle East & Africa

The Middle East and Africa region is experiencing robust growth, led by the UAE and Saudi Arabia. Key drivers include large-scale infrastructure investments, tourism-driven hospitality expansion, and commercial real estate development. High disposable incomes in Gulf countries support demand for premium and designer dispensers, while public infrastructure projects and healthcare investments across Africa are boosting adoption of durable, economy, and mid-range products. Government-backed urban development programs further reinforce long-term growth potential.

Latin America

Latin America, led by Brazil and Mexico, shows gradual yet stable growth in the wall-mounted tissue box market. Demand is primarily driven by commercial buildings, retail spaces, and high-end residential projects in urban centers. Increasing foreign investment in commercial infrastructure and export-oriented procurement from global manufacturers supports regional expansion. While price sensitivity remains a constraint, growing awareness of hygiene standards and modernization of public facilities are expected to gradually strengthen market demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Wall-Mounted Tissue Box Market

- Bobrick Washroom Equipment

- ASI Group

- Kimberly-Clark Professional

- Tork (Essity)

- Bradley Corporation

- Kohler

- Moen

- American Standard

- Dolphin Solutions

- Frost Products

- Gamco

- San Jamar

- JVD Group

- CWS Hygiene

- Stern Engineering