Wall Bed Market Size

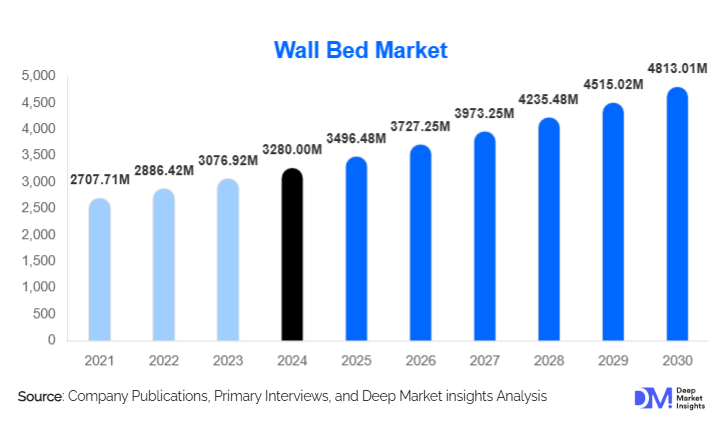

According to Deep Market Insights, the global wall bed market size was valued at USD 3280 million in 2024 and is projected to grow from USD 3496.48 million in 2025 to reach USD 4813.01 million by 2030, expanding at a CAGR of 6.6% during the forecast period (2025–2030). The wall bed market growth is primarily driven by the rising demand for compact and multifunctional furniture, growing urban micro-apartment trends, and increasing adoption of technologically advanced, automated wall beds across residential and commercial sectors.

Key Market Insights

- Vertical wall beds and hydraulic mechanism systems dominate the market, supported by ease of installation, durability, and affordability for mainstream consumers.

- Residential applications account for over 45% of global market demand, driven by rising urbanization and small-space living globally.

- Asia-Pacific is the fastest-growing region, led by India, Japan, and China with expanding smart housing projects and space-efficient living trends.

- Online direct-to-consumer distribution channels are gaining significant traction, accounting for 32% of sales in 2024.

- Premium and customized modular wall bed solutions are rapidly rising due to growing preference for automated, convertible, and space-saving furniture.

- 40% of new wall bed installations in 2024 integrated workspace and storage features, highlighting the trend of multifunctional living environments.

What are the latest trends in the Wall Bed Market?

Smart and Automated Wall Bed Systems

Technology integration is transforming the wall bed industry, with automated foldable systems using hydraulic, gas spring, and motorized lifts becoming mainstream. IoT-based voice controls, remote operation, and safety sensors are increasingly being embedded in premium wall bed offerings. AI-assisted space design software now enables consumers to virtually plan room configurations, driving customized furniture adoption. Smart wall beds are especially in demand among senior citizens, luxury apartment owners, and tech-savvy millennials, improving convenience and multifunctionality.

Growing Demand for Modular and Multifunctional Furniture

Wall beds are evolving beyond basic fold-out units into highly modular furniture systems combining sofas, shelving, desks, workstations, wardrobes, and lounge options. This multifunctional integration aligns with rising remote work culture, increasing home renovations, and the popularity of home offices. Manufacturers are offering fully convertible wall bed solutions that convert from bedroom to office, living area, or entertainment room, enabling greater space optimization in micro-living environments.

What are the key drivers in the Wall Bed Market?

Urbanization and Smart City Housing Development

With over 56% of the global population now living in urban areas, the demand for space-saving and transformable furniture has grown significantly. Rising construction of studio apartments, co-living spaces, and modular homes is accelerating wall bed adoption, especially in cities like Tokyo, London, New York, Mumbai, and Beijing.

Rising Popularity of Smart, Connected, and Ergonomic Furniture

The integration of smart automation, ergonomic features, and enhanced material durability has made wall beds more attractive to modern consumers. Features such as weight-sensing, soft-close mechanisms, and power-assisted lifting increase safety and accessibility for diverse age groups.

Growing Adoption in Hospitality and Co-Living Spaces

Hotels, serviced apartments, student housing, and co-living facilities are increasingly installing wall beds to maximize occupancy rates and multifunctional room usage. Hospitality installations alone accounted for over 20% of total 2024 wall bed installations, with strong momentum in Europe and North America.

What are the restraints for the Global Wall Bed Market?

High Cost and Structural Installation Challenges

Premium wall beds, especially automated ones, carry high installation costs due to structural reinforcement requirements. Advanced models can range from USD 2,500 to USD 7,000, making them less accessible in cost-sensitive markets.

Durability and Standardization Issues

The lack of standardized safety protocols across regions leads to quality inconsistencies, which affect consumer trust. Budget products often face wear-and-tear issues, leading to mechanical failure risks.

What are the key opportunities in the Wall Bed Market?

Integration with Home Automation and Smart Interior Design

The emergence of smart homes and IoT-based living environments offers an opportunity for manufacturers to develop app-controlled, sensor-enabled wall beds tailored to tech-savvy consumers and premium home installations.

Commercial Expansion in Hospitality, Student Housing, and RVs

Hotels, student hostels, recreational vehicle (RV) manufacturers, and office wellness rooms are increasingly adopting wall beds. Customizable foldable furniture for these sectors represents a high-growth opportunity through 2030.

Product Type Insights

Vertical wall beds lead the market with 37% share in 2024, favored for their compatibility with compact rooms and ease of deployment. Horizontal beds are gaining traction in markets with lower ceiling heights. Sofa-wall bed and desk-wall bed combinations are rising fast due to multifunctional living trends, especially among remote workers and students.

Mechanism Insights

Hydraulic wall beds dominate with 34% share, offering cost-effective and durable solutions for widespread residential adoption. Automated motorized wall beds are gaining popularity in premium segments, projected to grow at over 12% CAGR through 2030 due to smart home integration trends.

Distribution Channel Insights

Online direct-to-consumer platforms hold 32% market share, driven by customization tools, digital design visualization, and increasing online furniture purchases. Furniture showrooms and home interior contracting firms continue to serve premium customers seeking customized installations and consultancy.

Price Range Insights

Mid-range wall beds (USD 800–2500) account for 41% of market value in 2024 due to affordability and practical functionality. Premium and luxury wall beds are growing fastest in Europe, the U.S., and the Middle East, driven by smart home integration and customization demand.

End-Use Insights

Residential applications dominate with 45% share of global demand, followed by hospitality and student housing segments. Rapid adoption in co-living spaces, rental apartments, and modular housing units is fueling growth. RV and office wellness rooms represent emerging niche applications with high growth potential.

| Product Type | Mechanism | Distribution Channel | Price Range | End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a 32% market share in 2024, led by the U.S. and Canada. Demand is driven by urban micro-apartment living, smart home adoption, and premium customization trends. The U.S. also dominates commercial deployment, especially in serviced apartments and RVs.

Europe

Europe represents 29% of the market, with Germany, France, Italy, and the U.K. as leading contributors. High adoption of modular living concepts, custom furniture solutions, and design-focused interiors supports growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at 11.8% CAGR. Rising demand in Japan, China, India, and South Korea is fueled by urban housing constraints, smart city projects, and increased middle-class home renovation spending.

Latin America

Brazil, Mexico, and Argentina are key contributors, with moderate but expanding demand driven by rising urbanization and hospitality sector investments.

Middle East & Africa

Growth is concentrated in UAE, Saudi Arabia, and South Africa, particularly within luxury residential projects and premium hospitality sectors supporting modular interiors and space-saving designs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

Market competition is moderately fragmented. The top five players control approximately 28% of the global market, with strong demand for brand-backed quality, safety, and customization features. Mid-market competition is intense, driven by online direct-to-consumer brands.

Key Players in the Wall Bed Market

- IKEA

- Clei S.r.l.

- Hafele

- Murphy Wall Beds Hardware Inc.

- Wilding Wallbeds

- BredaBeds

- FlyingBeds International

- Expand Furniture

- Zoom-Room Murphy Beds

- Bestar

- Resource Furniture

- WallBedKing

- Twin Oaks

- Furl

- Lagrama Furniture

Recent Developments

- In June 2024, Clei S.r.l. launched an AI-enabled modular wall bed solution with smart workspace integration for urban homes and micro-apartments.

- In March 2024, IKEA announced investment in a new manufacturing facility in Poland dedicated to automated and sustainable foldable furniture systems.

- In January 2025, Hafele introduced an upgraded hydraulic wall bed system optimized for commercial hospitality projects and office wellness rooms.