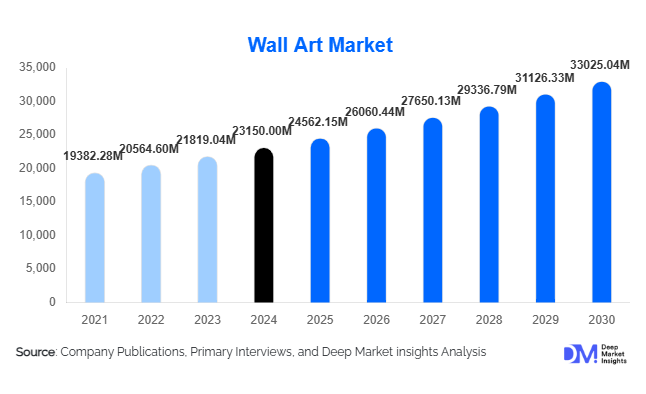

Wall Art Market Size

According to Deep Market Insights, the global wall art market size was valued at USD 23,150.00 million in 2024 and is projected to grow from USD 24,562.15 million in 2025 to reach USD 33,025.04 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The wall art market growth is driven by rising residential remodeling activity, increasing demand for personalized interior décor, rapid expansion of online and direct-to-consumer channels, and strong commercial demand from hospitality, corporate offices, and retail spaces.

Key Market Insights

- Canvas and framed wall art dominate global demand due to affordability, versatility, and ease of customization across residential and commercial spaces.

- Online and D2C platforms account for over 40% of global sales, reshaping purchasing behavior through personalization, fast delivery, and competitive pricing.

- Residential applications lead demand, supported by home décor trends, urbanization, and growing consumer focus on interior aesthetics.

- Asia-Pacific is the fastest-growing region, fueled by urban housing growth, rising middle-class incomes, and expanding e-commerce penetration.

- Sustainability and eco-friendly materials are gaining traction, influencing product innovation and premium pricing strategies.

- Technology adoption, including AI-based design tools and AR visualization, is improving customer engagement and conversion rates.

What are the latest trends in the wall art market?

Personalized and Custom Wall Art on the Rise

Personalization has become one of the most influential trends shaping the wall art market. Consumers increasingly prefer custom photo canvases, personalized typography art, and region-specific designs that reflect individual identity and lifestyle preferences. Advances in digital printing and online design interfaces allow buyers to customize artwork size, color palette, framing, and imagery with minimal lead times. This trend is particularly strong among millennials and urban households, where wall art is viewed as an extension of personal branding and home storytelling rather than a generic décor element.

Technology-Enabled Visualization and Smart Décor

Augmented reality (AR) and artificial intelligence (AI) tools are transforming how consumers shop for wall art. AR-based mobile applications allow users to visualize artwork on their walls before purchasing, reducing return rates and improving buyer confidence. AI-powered recommendation engines suggest art styles based on room design, color schemes, and past purchases. These technologies are increasingly integrated into e-commerce platforms, enabling brands to differentiate themselves and enhance digital customer experiences.

What are the key drivers in the wall art market?

Growth in Residential Remodeling and Interior Décor Spending

Rising investments in home improvement and interior décor are a primary driver of wall art demand. Consumers are increasingly prioritizing aesthetic upgrades as part of lifestyle enhancement, especially in urban apartments and single-family homes. Wall art offers a relatively affordable way to transform living spaces, making it a preferred décor upgrade across income groups. Increased influence of social media, interior design influencers, and short-term rental platforms has further accelerated this trend globally.

Expansion of Commercial and Hospitality Infrastructure

Commercial demand from hotels, restaurants, corporate offices, healthcare facilities, and retail chains is significantly contributing to market growth. Wall art is widely used to enhance ambiance, reinforce branding, and improve customer and employee experience. Global recovery in tourism and expansion of co-working and flexible office spaces are driving bulk procurement of wall art, particularly in hospitality and corporate segments.

What are the restraints for the global market?

Price Sensitivity and Cost Pressures

Despite growing demand, price sensitivity remains a challenge, particularly in developing markets. Premium wall art products face adoption barriers due to higher material costs, logistics expenses, and import duties. Fluctuations in raw material prices, such as canvas, wood, metal, and glass, can also impact profitability and pricing strategies, especially for small and mid-sized manufacturers.

Market Fragmentation and Design Imitation

The wall art market is highly fragmented, with a large number of regional players and independent artists. This leads to intense competition and frequent design imitation, which can dilute brand differentiation and compress margins. Intellectual property protection remains a challenge, particularly for digital designs sold through online platforms.

What are the key opportunities in the wall art industry?

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Increasing homeownership and demand for affordable yet stylish décor are driving wall art adoption in countries such as China, India, Vietnam, Brazil, and the UAE. Localized designs and region-specific themes offer strong potential for new market entrants.

Sustainable and Eco-Friendly Wall Art

Sustainability-focused wall art using recycled frames, water-based inks, and eco-friendly canvases is gaining popularity among environmentally conscious consumers. Brands investing in sustainable sourcing and production practices can command premium pricing and build long-term customer loyalty. Government incentives supporting sustainable manufacturing further enhance this opportunity.

Product Type Insights

Canvas wall art holds the largest share of the global market, accounting for approximately 34% of total revenue in 2024, due to its lightweight nature, affordability, and suitability for customization. Framed wall art follows closely, favored in premium residential and commercial interiors for its durability and aesthetic appeal. Metal wall art and glass & acrylic wall art represent fast-growing niche segments, driven by demand for contemporary and industrial-style interiors. Posters, prints, and textile-based wall art cater largely to the mass-market and rental housing segments, where affordability and easy replacement are key decision factors.

Application (End-Use) Insights

The residential segment dominates the wall art market, contributing nearly 62% of global demand in 2024, supported by home décor trends and personalization preferences. Commercial applications represent the fastest-growing segment, expanding at over 10% CAGR, driven by hospitality, corporate offices, healthcare facilities, and retail environments. Emerging applications include co-living spaces, educational institutions, and wellness centers, where wall art is increasingly used for branding, ambiance creation, and psychological well-being.

Distribution Channel Insights

Online channels dominate wall art distribution, accounting for approximately 41% of global sales, supported by e-commerce marketplaces and direct-to-consumer brand websites. Offline channels such as art galleries, home décor stores, and specialty art retailers continue to play a crucial role in premium and customized purchases. Hybrid distribution models, combining physical showrooms with online customization tools, are gaining traction, particularly among premium brands.

Price Range Insights

The mid-range segment (USD 100–500) leads the market with nearly 46% share, reflecting strong demand for quality wall art at accessible price points. Mass-market products priced below USD 100 cater to younger consumers, rental housing, and budget-conscious buyers, while premium and luxury wall art priced above USD 500 serves high-income households and commercial buyers seeking exclusivity and artistic value.

| By Product Type | By Material | By Price Range | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global wall art market, led by the United States, which alone represents nearly 24% of global demand. High consumer spending on home décor, strong e-commerce adoption, and a mature interior design industry support regional dominance. Demand is particularly strong for customized canvas prints and premium framed art.

Europe

Europe holds around 28% market share, driven by countries such as Germany, the UK, and France. Design-conscious consumers, strong art culture, and sustainability-focused purchasing behavior characterize the region. Eco-friendly and minimalist wall art styles are especially popular across European markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for approximately 26% of global revenue and expected to grow at over 10.5% CAGR. China and India are the largest contributors, supported by urban housing growth, rising middle-class incomes, and expanding online retail ecosystems.

Latin America

Latin America represents a smaller but steadily growing market, led by Brazil and Mexico. Rising urbanization and increasing interest in home décor are driving demand, particularly for affordable and mid-range wall art products.

Middle East & Africa

The Middle East & Africa region is supported by strong demand from the UAE and Saudi Arabia, driven by luxury real estate, hospitality expansion, and premium interior décor projects. In Africa, demand is concentrated in urban centers and tourism-driven commercial spaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wall Art Market

- IKEA

- King & McGaw

- Desenio Group

- Society6

- Minted

- Saatchi Art

- Art.com

- West Elm

- Z Gallerie

- Great Big Canvas

- iCanvas

- Urban Outfitters

- JUNIQE

- ElephantStock

- Wayfair (Wall Art Division)