Walk-in Refrigerators Market Size

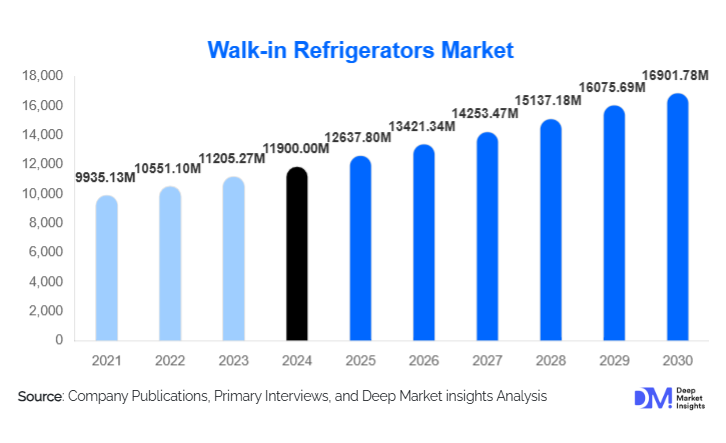

According to Deep Market Insights, the global walk-in refrigerators market size was valued at USD 11,900.00 million in 2024 and is projected to grow from USD 12,637.80 million in 2025 to reach USD 16,901.78 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The walk-in refrigerators market growth is primarily driven by the rapid expansion of cold-chain infrastructure, rising demand from foodservice and pharmaceutical industries, and increasing adoption of energy-efficient and smart refrigeration systems across both developed and emerging economies.

Key Market Insights

- Foodservice and hospitality remain the largest demand drivers, supported by the global expansion of quick-service restaurants, hotels, and catering services.

- Energy-efficient and low-GWP refrigeration systems are gaining prominence as governments tighten environmental and energy regulations.

- North America dominates the global market, driven by replacement demand, pharmaceutical cold-chain investments, and strict food safety standards.

- Asia-Pacific is the fastest-growing region, supported by cold storage capacity additions in China, India, and Southeast Asia.

- Medium-temperature walk-in units account for the largest share, reflecting strong demand for chilled food and pharmaceutical storage.

- IoT-enabled and modular walk-in refrigeration systems are reshaping procurement decisions by offering predictive maintenance and operational efficiency.

What are the latest trends in the walk-in refrigerators market?

Shift Toward Energy-Efficient and Sustainable Refrigeration

Energy efficiency has become a central focus in the walk-in refrigerators market as operators seek to reduce operating costs and comply with increasingly stringent regulations. Manufacturers are investing in high-performance insulation materials such as PIR and advanced PUF panels, along with inverter-driven compressors and natural refrigerants like CO₂ and ammonia. Sustainability-driven procurement is particularly strong in Europe and North America, where eco-design and energy labeling regulations influence purchasing decisions. This trend is also accelerating retrofit and replacement demand, as older systems are phased out in favor of compliant, lower-energy alternatives.

Technology-Enabled Smart Walk-in Refrigeration Systems

Digitalization is transforming walk-in refrigerators into intelligent cold-storage assets. IoT-enabled temperature monitoring, cloud-based compliance reporting, and predictive maintenance systems are increasingly integrated into new installations. These features are especially critical for pharmaceutical, healthcare, and food processing applications where temperature deviations can lead to significant losses. Smart walk-in systems improve uptime, reduce energy waste, and enable remote asset management, making them highly attractive to large retail chains and logistics operators managing multiple locations.

What are the key drivers in the walk-in refrigerators market?

Expansion of Foodservice and Organized Retail

The rapid growth of organized retail formats, including supermarkets, hypermarkets, and convenience stores, is a key driver of walk-in refrigerator demand. Foodservice operators require reliable, high-capacity refrigeration for perishable goods, while retail chains increasingly rely on centralized and back-of-store cold storage. The rise of cloud kitchens and dark stores has further increased demand for compact, modular walk-in refrigeration systems in urban areas.

Growth of Pharmaceutical and Healthcare Cold Chains

Pharmaceutical products such as vaccines, biologics, and specialty drugs require strict temperature control throughout storage and distribution. Increased healthcare spending, expanded immunization programs, and growth in biologics manufacturing have significantly boosted demand for walk-in refrigerators in hospitals, laboratories, and pharmaceutical warehouses. This segment benefits from high compliance requirements, making it a high-value and resilient demand driver.

What are the restraints for the global market?

High Initial Capital Investment

Walk-in refrigeration systems require substantial upfront investment, including insulated panels, refrigeration units, installation, and electrical infrastructure. This high capital requirement can deter small foodservice operators and independent retailers, particularly in developing markets. Although long-term energy savings can offset costs, initial affordability remains a challenge.

Volatility in Raw Material Prices

Fluctuations in the prices of steel, aluminum, insulation foams, and refrigerants directly impact manufacturing costs and profit margins. Sudden increases in raw material prices can delay projects, increase end-user pricing, and create uncertainty for manufacturers operating on long-term contracts.

What are the key opportunities in the walk-in refrigerators industry?

Cold-Chain Infrastructure Development in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are investing heavily in cold-chain infrastructure to reduce food wastage and support agricultural exports. Government-backed cold storage programs, food parks, and logistics hubs present significant opportunities for walk-in refrigerator manufacturers, particularly for medium- and large-capacity systems.

Integration of Smart and Value-Added Services

Manufacturers that bundle hardware with digital services such as monitoring, maintenance contracts, and energy optimization tools can unlock recurring revenue streams. This service-oriented model improves customer retention and differentiates suppliers in an increasingly competitive market.

Product Type Insights

Walk-in coolers dominate the market, accounting for approximately 52% of global revenue in 2024, driven by widespread use in foodservice, retail, and pharmaceutical storage. Walk-in freezers represent a significant share due to rising demand for frozen food and long-term storage applications. Combination walk-in units are gaining traction in facilities requiring both chilled and frozen storage within limited footprints, particularly in supermarkets and food processing plants.

Installation Type Insights

Indoor walk-in refrigerators lead the market with around 61% share, as they are extensively deployed in supermarkets, hotels, hospitals, and industrial kitchens. Outdoor walk-in units are gaining momentum in logistics hubs, cold storage facilities, and large food processing plants where space constraints and operational flexibility are critical. Modular and mobile units are emerging as niche solutions for temporary storage and rapid deployment needs.

End-Use Industry Insights

The foodservice and hospitality sector accounts for nearly 36% of total market demand, supported by global restaurant expansion and catering services. Food processing and cold storage represent the fastest-growing end-use segment, driven by frozen food consumption and export-oriented agriculture. Pharmaceuticals and healthcare contribute a smaller but high-value share, characterized by strict compliance requirements and stable long-term demand.

| By Product Type | By Installation Type | By Panel Construction | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global walk-in refrigerators market, led by the United States. Strong food safety regulations, replacement demand, and robust pharmaceutical cold-chain infrastructure support market growth. Canada also contributes steadily through retail modernization and healthcare investments.

Europe

Europe accounts for about 24% of the market, with Germany, the U.K., France, and Italy as key contributors. Demand is heavily influenced by energy efficiency standards and sustainability regulations, driving the adoption of advanced and eco-friendly walk-in refrigeration systems.

Asia-Pacific

Asia-Pacific represents roughly 29% of global demand and is the fastest-growing region, with a CAGR exceeding 9%. China and India lead growth due to rapid cold storage expansion, food processing investments, and pharmaceutical manufacturing growth. Southeast Asia is emerging as a strong secondary growth hub.

Latin America

Latin America accounts for about 7% of the market, led by Brazil and Mexico. Growth is driven by retail expansion, food exports, and the gradual modernization of cold-chain infrastructure.

Middle East & Africa

The Middle East & Africa region holds around 8% of the global market share. Demand is driven by food imports, hospitality growth, and government investments in cold storage, particularly in the UAE, Saudi Arabia, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Walk-in Refrigerators Market

- Carrier Global Corporation

- Daikin Industries

- Trane Technologies

- Johnson Controls

- Danfoss

- Panasonic Corporation

- Mitsubishi Electric

- Hussmann Corporation

- Bitzer SE

- Heatcraft Worldwide Refrigeration

- GEA Group

- LU-VE Group

- Zanotti S.p.A.

- Blue Star Limited

- Emerson Electric Co.