Virtual Tourism Market Size

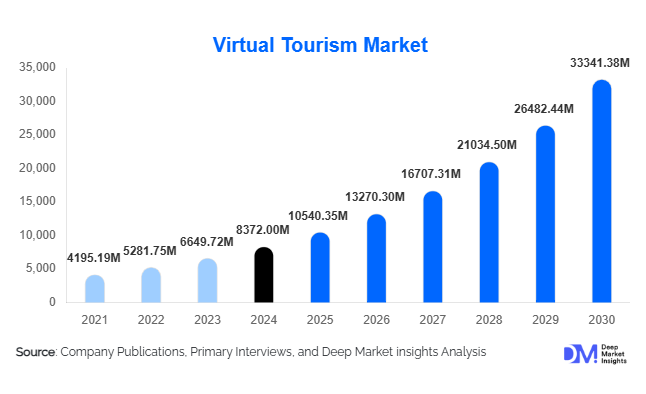

According to Deep Market Insights, the global virtual tourism market size was valued at USD 8,372.00 million in 2024 and is projected to grow from USD 10,540.35 million in 2025 to reach USD 33,341.38 million by 2030, expanding at a CAGR of 25.90% during the forecast period (2025–2030). The virtual tourism market growth is primarily driven by rising adoption of immersive technologies, increasing demand for remote travel experiences, and the integration of virtual reality (VR), augmented reality (AR), and AI-powered personalization across global tourism and educational ecosystems.

Key Market Insights

- Immersive VR and AR technologies are reshaping how travelers explore destinations, enabling high-fidelity virtual experiences that enhance both pre-trip planning and remote tourism accessibility.

- Interactive and gamified experiences are gaining significant traction, especially among digitally native consumers seeking personalized and social virtual travel journeys.

- North America dominates the global virtual tourism market, supported by advanced technology adoption and integration of virtual tours in travel booking platforms.

- Asia-Pacific is the fastest-growing region, driven by rising smartphone penetration, expanding internet access, and strong government-led digital tourism initiatives.

- Education and cultural institutions are emerging as major adopters, leveraging virtual tourism for remote learning, virtual field trips, and 3D museum experiences.

- AI-driven personalization and real-time 3D content streaming are accelerating user engagement and expanding commercial opportunities within the market.

What are the latest trends in the virtual tourism market?

AI-Personalized and Interactive Virtual Travel Experiences

Virtual tourism is rapidly evolving from static 360° visuals to fully interactive, AI-customized journeys. Platforms now analyze user behavior, travel interests, and preferred environments to generate tailored travel itineraries in real time. These experiences allow users to explore destinations through branching storylines, interactive historical environments, and gamified cultural exploration. AI-driven avatars, real-time virtual tour guides, and multi-user exploration modes are transforming virtual travel into a social and immersive digital lifestyle product rather than a passive viewing format. This trend is redefining engagement and expanding virtual tourism into education, wellness, and corporate training sectors.

High-Fidelity VR, AR & Mixed Reality Integration

The market is witnessing widespread adoption of VR headsets, AR-enabled smartphones, and mixed reality (MR) environments that blend physical and digital experiences. Travelers can now walk through virtual replicas of museums, natural landscapes, hotels, and historical landmarks with spatial audio, environmental simulations, and haptic feedback. These technologies enable fully immersive previews of real-world trips, enhancing decision-making and boosting conversion for travel operators. MR tourism installations in airports, museums, and cultural venues further blur the lines between physical and virtual exploration. The trend aligns strongly with younger demographics seeking technological sophistication and experiential digital engagement.

What are the key drivers in the virtual tourism market?

Growing Global Demand for Immersive Digital Experiences

Consumers increasingly prefer immersive digital content that offers adventure, cultural exposure, and personalized exploration from the comfort of their homes. The rise of virtual experiences during and after the pandemic accelerated permanent shifts toward digital tourism consumption. As VR and AR devices become more accessible, users are embracing virtual tourism for entertainment, pre-trip planning, and unique cultural experiences that transcend physical limitations.

Technological Advancements and Lower Entry Barriers

The rapid evolution of 3D rendering engines, AI algorithms, cloud-based VR streaming, and spatial computing has significantly reduced production costs and device requirements. Affordable headsets, mobile AR, and browser-based immersive platforms have broadened market access. These innovations enable tourism boards, hotels, museums, and travel agencies to create scalable virtual experiences with strong monetization potential.

What are the restraints for the global market?

High Hardware Costs and Limited Accessibility

Despite rapid technological expansion, high-quality VR devices remain expensive for many consumers, particularly in developing markets. This limits mass adoption and can restrict immersive experiences to mobile-based or lower-fidelity platforms. Additionally, bandwidth limitations in certain regions hinder seamless streaming of high-resolution virtual environments.

Content Production Challenges and Lack of Standardization

High-end virtual tourism requires significant investment in 3D modeling, volumetric capture, and interactive content development. Inconsistent quality across platforms and the absence of universal content standards create fragmented user experiences. Small and mid-sized tourism operators often struggle with production costs, slowing overall market scaling.

What are the key opportunities in the virtual tourism industry?

Immersive Destination Marketing & Digital Twins

Tourism boards and hospitality brands can leverage virtual tourism as a powerful marketing tool by building high-fidelity digital twins of cities, resorts, and cultural attractions. These virtual environments allow travelers to preview destinations in detail, improving booking conversions and fostering strong brand engagement. Digital twins also support sustainable tourism by reducing the environmental impact of exploratory travel.

Education, Cultural Institutions & Remote Learning

Virtual tourism offers museums, universities, and cultural organizations the ability to extend their physical presence globally. Virtual field trips, interactive museum tours, and historical recreation experiences are gaining significant popularity. These solutions present a scalable opportunity for subscription-based educational content, partnerships with schools, and international cultural outreach programs.

Product Type Insights

Interactive immersive experiences dominate the virtual tourism market, accounting for approximately 38% of the 2024 market share. These experiences combine real-time decision-making, gamified elements, and AI-driven personalization to create high-value digital journeys. VR-led experiences follow closely, supported by the increasing availability of headsets and demand for lifelike exploration. Static 360° tours remain relevant for entry-level users and cost-sensitive institutions, while AI-generated environments continue gaining traction due to rapid scalability and minimal production costs.

Application Insights

Virtual destination previews are widely adopted within the travel and hospitality sector, enabling users to explore hotels, attractions, and cruise routes. Educational applications—such as virtual field trips and cultural heritage tours—are rapidly growing as institutions search for engaging, remote-learning formats. Corporate applications, including team-building activities and international cultural training, represent an emerging and lucrative niche. Additionally, virtual museums and art galleries are expanding global access to cultural experiences, strengthening demand for subscription-based platforms.

Distribution Channel Insights

Direct-to-consumer (D2C) digital platforms dominate virtual tourism distribution with approximately 58% market share, as users access immersive content via mobile apps, VR platforms, and browser-based portals. B2B channels—including enterprise licensing for hotels, universities, and museums—constitute the next major segment. Software marketplaces and ecosystem integrations, particularly through VR headset app stores, are accelerating monetization. Social media platforms and influencer-led virtual journeys are emerging as important discovery channels, especially for younger demographics.

Traveler Type Insights

Digital-native travelers, including Gen Z and younger millennials, account for the largest share of virtual tourism adoption due to their comfort with immersive technologies. Families and educational groups are rapidly embracing virtual tourism for interactive learning experiences. Senior travelers represent a notable emerging segment, as virtual tourism provides accessible alternatives to physical travel and enables safe exploration of distant destinations.

Age Group Insights

Individuals aged 18–35 represent the fastest-growing age group in the virtual tourism market, driven by high digital engagement and interest in interactive entertainment. The 36–55 age category contributes significantly to revenue through premium VR experiences and educational content purchases. Older adults aged 56+ increasingly utilize virtual tourism for mobility-friendly exploration and wellness-related immersive experiences.

| By Experience Type | By Technology | By End-User | By Content Provider Model | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the market with approximately 36% share in 2024, supported by strong adoption of VR/AR devices, high digital literacy, and investment by major tech companies. The U.S. drives regional demand, with tourism operators, entertainment studios, and educational institutions integrating virtual experiences into their offerings.

Europe

Europe holds around 28% market share and is a key hub for cultural and heritage-focused virtual tourism. Countries such as the U.K., France, and Germany invest heavily in virtual museums, digital archives, and immersive tourism marketing initiatives. The region’s strong emphasis on sustainable tourism further fuels adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a rate exceeding 30% annually. Increased smartphone penetration, rising middle-class consumption, and government-led digital tourism initiatives in China, India, Japan, and South Korea are driving demand. Virtual tourism is being integrated into education, smart city programs, and national tourism promotion campaigns.

Latin America

Latin America is gradually adopting virtual tourism, with Brazil, Mexico, and Argentina emerging as key contributors. Growing interest in cultural exchange, remote learning, and digital events is stimulating market expansion among younger and urban populations.

Middle East & Africa

The region is expanding its virtual tourism ecosystem through investments in smart tourism infrastructure, digital museums, and immersive cultural showcases. Countries such as the UAE and Saudi Arabia are pioneering large-scale digital tourism programs aligned with Vision 2030 initiatives. African nations are leveraging virtual tourism to promote wildlife, heritage sites, and diaspora engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Virtual Tourism Market

- Meta Platforms (Oculus)

- Airbnb

- Expedia Group

- Tripadvisor

- Microsoft

- Apple

- Sony

- HTC Corporation

- Unity Technologies

- Niantic

- Wander

- Visit.org

- Sketchfab

- Great Big Story VR

Recent Developments

- In March 2025, Meta expanded its VR tourism content library on Quest platforms, introducing high-fidelity tours of UNESCO World Heritage sites.

- In January 2025, Google Maps rolled out advanced 3D immersive exploration tools that allow users to navigate cities in virtual reality.

- In February 2025, Expedia Group partnered with major hotel chains to introduce VR-based room selection and virtual property previews.