Virtual Studio Market Size

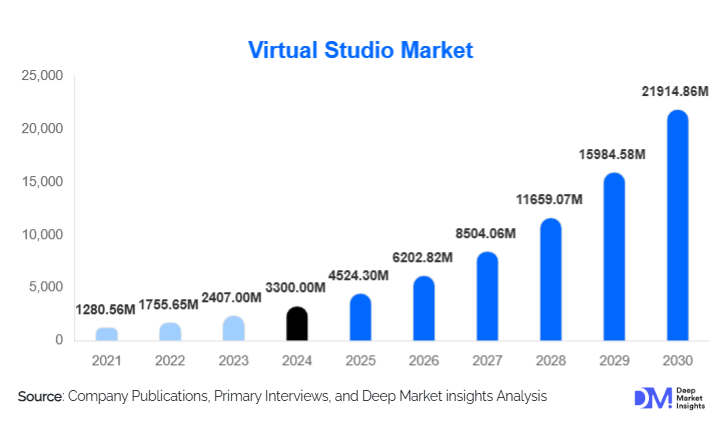

According to Deep Market Insights, the global virtual studio market size was valued at USD 3,300.00 million in 2024 and is projected to grow from USD 4,524.30 million in 2025 to reach USD 21,914.86 million by 2030, expanding at a CAGR of 37.1% during the forecast period (2025–2030). Market growth is fuelled by the rapid adoption of real-time rendering technologies, LED-volume stages, AI-driven virtual production pipelines, and cloud-based collaboration, which are transforming global content creation ecosystems across film, television, advertising, gaming, and live events.

Key Market Insights

- Software dominates the market, accounting for over 55% of global revenue in 2024 due to the rising adoption of real-time rendering engines and virtual set design tools.

- LED volume and in-camera VFX technologies are expanding rapidly, replacing traditional green-screen and reducing post-production costs for studios.

- North America leads the global market with more than 30% share in 2024, supported by advanced studio ecosystems and strong investments from major film/TV producers.

- Asia-Pacific is the fastest-growing region, driven by booming OTT platforms, rising regional content production, and reduced setup costs for virtual studios.

- Cloud-based virtual production is accelerating adoption among SMEs, independent creators, and advertising agencies seeking low-CapEx alternatives.

- AI-assisted pipelines, automated scene generation, and virtual collaboration tools are reshaping production workflows and improving efficiency.

What are the latest trends in the Virtual Studio Market?

AI-Driven Virtual Production Pipelines Transforming Content Creation

AI is rapidly reshaping the virtual studio landscape. Studios are increasingly integrating AI for automated scene generation, intelligent lighting control, streamlined motion capture, and real-time digital asset creation. These tools reduce creative cycle times and lower production costs, enabling even smaller studios to create cinematic-quality output. AI-assisted workflows also enhance post-production, enabling automated rotoscoping, real-time background replacement, and seamless integration of VFX elements. As AI models become more sophisticated, virtual studios are transitioning from manual-intensive pipelines to highly automated, adaptive ecosystems that accelerate decision-making and improve creative consistency across global production teams.

Expansion of LED-Volume Virtual Sets and Real-Time Rendering

LED-volume studios are becoming the centerpiece of next-generation virtual production. The combination of high-resolution LED panels, camera tracking systems, and real-time game-engine rendering enables studios to capture final-pixel visual effects during filming. This eliminates many green-screen limitations, reduces post-production workloads, and provides actors with more realistic environments. Falling LED panel prices, improvements in color accuracy, and enhanced GPU capabilities are making LED volumes increasingly accessible. Production houses, broadcasters, and streaming platforms are aggressively adopting these technologies to shorten production timelines while achieving higher visual quality.

What are the key drivers in the Virtual Studio Market?

Surging Demand for High-Quality, Cost-Efficient Content Production

The rapid rise of global streaming platforms, the expansion of online content creation, and the growing need for high-volume, high-quality visual media are driving demand for virtual studios. Producers can now create diverse environments without costly location shoots or physical set construction. This cost-efficiency, combined with accelerated production cycles, has made virtual production a preferred method among studios of all sizes. The ability to reuse digital environments across multiple projects further enhances ROI, enabling long-term cost reductions.

Real-Time Rendering, Motion Capture, and Cloud Collaboration Advancements

Massive improvements in GPUs, camera tracking, and motion capture systems are enabling real-time visualization on set. Directors and cinematographers can see near-final outputs during filming, improving creativity and accuracy. Cloud-based virtual studios are also revolutionizing global collaboration, allowing designers, VFX artists, and animators to work together remotely, reducing geographical constraints. These technological advancements are dramatically lowering barriers to entry and enabling virtual production to scale rapidly across industries.

What are the restraints for the global market?

High Capital Costs and Technical Complexity

Despite rapid adoption, the setup cost for LED-volume studios, including LED panels, tracking systems, rendering hardware, and studio lighting, remains high. SMEs often struggle with CapEx and opt for rental or subscription-based solutions. Additionally, integrating multiple hardware and software components requires skilled engineers, which can be difficult for smaller operators to source and retain.

Interoperability and Talent Shortages

Lack of standardized workflows and interoperability between rendering engines, motion capture tools, LED systems, and post-production platforms can create operational inefficiencies. A shortage of experienced virtual production specialists, including real-time rendering artists, technical directors, and virtual cinematographers, further slows market expansion. Emerging markets face the greatest talent gap, limiting adoption speed.

What are the key opportunities in the Virtual Studio Industry?

Regional Expansion into Emerging Content Markets

With OTT platforms expanding aggressively in India, China, South Korea, Southeast Asia, and Latin America, demand for high-quality local-language content is surging. Virtual studios offer a scalable, cost-effective solution for rapid content creation. Companies investing early in regional studio infrastructure, training programs, and bundled service models stand to gain substantial market share as regional content ecosystems mature.

Cloud-Based Virtual Studios and Subscription Models

Rental LED stages, virtual-production-as-a-service (VPaaS), and cloud-rendering pipelines provide immense opportunities for vendors and new entrants. These models lower financial barriers and open the market to SMEs, independent filmmakers, advertisers, corporate content creators, and event organizers. Recurring revenue structures, monthly subscriptions, pay-per-use rendering, and service retainers are expected to become foundational business models.

Product Type Insights

Software leads the virtual studio market, accounting for over 55% of revenue in 2024. Real-time rendering engines, virtual set design tools, asset management systems, and AI-driven VFX platforms are increasingly essential to production workflows. Hardware, including LED volumes, motion capture systems, and high-performance GPUs, represents the second-largest segment. Services such as managed virtual production, studio rentals, and consulting are rapidly expanding as studios seek flexible options without long-term CapEx commitments.

Application Insights

Feature films and episodic streaming content dominate application demand, driven by the need for high-production-value environments and rapid turnaround cycles. Advertising and commercial production are the fastest-growing application areas as brands adopt virtual studios for cost-efficient digital campaigns. Live events, virtual concerts, and corporate broadcasts are emerging applications enabled by advancements in LED-wall display accuracy and immersive XR technologies. Training, simulation, and educational content are also expanding as organizations adopt virtual environments for interactive instruction.

Distribution Channel Insights

Direct enterprise sales dominate among large studios procuring integrated virtual production systems. SaaS-based and cloud distribution models are expanding rapidly, supporting SMEs and independent creators. Virtual production service providers, offering LED-wall stages, real-time rendering specialists, and project-based collaborations, serve as high-growth channels. Digital marketplaces for virtual assets, 3D environments, and production templates are also gaining traction, enabling creators to scale content output cost-effectively.

End-User Insights

Large film studios and broadcasters account for nearly 65–70% of market revenue due to heavy investment in LED volumes, real-time rendering, and high-end VFX workflows. Independent creators, digital agencies, e-learning companies, and corporate content teams are emerging as high-growth segments, driven by the availability of cloud-based tools and subscription models. Live-event producers and virtual concert organizers are increasingly adopting immersive XR stages, further expanding demand.

| By Component | By Technology Type | By Deployment Model | By End Use / Application | By Enterprise Size |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 30–33% share in 2024. The U.S. is home to major studios, advanced production infrastructure, and leading virtual production technology developers. Strong demand for blockbuster films, streaming originals, and high-end advertising campaigns fuels adoption. Cloud technology maturity and high investments in LED-volume staging further strengthen the region.

Europe

Europe contributes around 20–25% of the market, with the U.K., Germany, and France leading adoption. Strong film subsidies, a well-developed VFX industry, and the rising presence of virtual production studios support growth. European broadcasters and OTT services are increasingly shifting toward virtual sets to reduce costs and accelerate creative workflows.

Asia-Pacific

APAC is the fastest-growing market. India, China, South Korea, and Japan are major contributors, driven by explosive OTT demand and rising local-language content production. Regional studios are investing in LED-wall stages and cloud-based collaboration tools to meet aggressive content timelines. Outsourced VFX and animation work also strengthens APAC’s ecosystem.

Latin America

LATAM is an emerging market where demand is growing among advertisers, streaming platforms, and independent creators. Brazil and Mexico lead adoption. Budget constraints encourage the use of cloud-based virtual production solutions rather than full-scale physical installations.

Middle East & Africa

MEA is witnessing rising demand, especially in the UAE, Saudi Arabia, and South Africa. Governments are investing in creative industries as part of economic diversification strategies. High-end live events and broadcast productions are driving the adoption of LED-wall studios and XR stages.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Virtual Studio Market

- Epic Games, Inc.

- NVIDIA Corporation

- Adobe Inc.

- Avid Technology, Inc.

- Vizrt Group

- Autodesk, Inc.

- Blackmagic Design Pty Ltd

- Chaos Group

- OTOY, Inc.

- SideFX Software

- Foundry

- Luxion Inc.

- Harmonic Inc.

- Monarch Innovative Technologies

- PreSonus Audio Electronics

Recent Developments

- In February 2025, Epic Games announced advanced AI-assisted virtual environment tools designed to automate scene generation and streamline real-time rendering for LED-volume stages.

- In March 2025, Nvidia unveiled a cloud-based GPU rendering service tailored for virtual production studios, enabling cost-efficient remote collaboration across global teams.

- In April 2025, Blackmagic Design expanded its virtual production hardware portfolio with enhanced camera tracking modules and LED-wall synchronization systems.