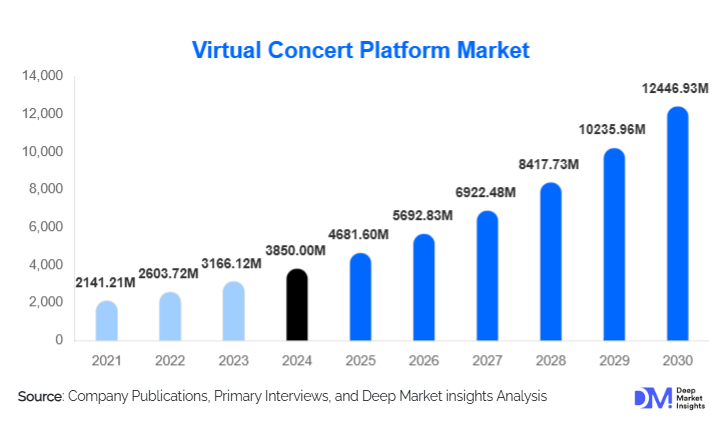

Virtual Concert Platform Market Size

According to Deep Market Insights, the global virtual concert platform market size was valued at USD 3,850 million in 2024 and is projected to grow from USD 4,681.60 million in 2025 to reach USD 12,446.93 million by 2030, expanding at a CAGR of 21.6% during the forecast period (2025–2030). The virtual concert platform market growth is primarily driven by the rapid digitalization of live entertainment, rising demand for immersive and interactive fan experiences, and the increasing adoption of extended reality (XR), AI, and blockchain-based monetization models by artists and event organizers.

Key Market Insights

- Virtual concerts are transitioning from pandemic-driven alternatives to long-term entertainment formats, complementing physical concerts and enabling global audience reach.

- Fully virtual and hybrid concert platforms dominate adoption, as they offer device-agnostic access and scalable monetization for artists and organizers.

- North America leads the market, supported by strong broadband infrastructure, high digital spending, and early adoption of VR and metaverse technologies.

- Asia-Pacific is the fastest-growing region, driven by mobile-first consumption, gaming ecosystems, and a large digitally native population.

- Music concerts remain the dominant content type, while DJ and electronic music events show the highest engagement in immersive environments.

- New revenue streams such as NFTs, digital merchandise, and brand sponsorships are reshaping platform economics and artist monetization.

What are the latest trends in the virtual concert platform market?

Metaverse-Enabled and Immersive Concert Experiences

Virtual concert platforms are increasingly evolving into metaverse-native environments that allow users to attend events as avatars, interact socially, and explore persistent digital venues. These experiences move beyond passive viewing to offer real-time audience participation, gamification, and virtual economies. Platforms are leveraging game engines, spatial audio, and real-time rendering to create highly immersive concerts that replicate—or enhance—the energy of physical events. This trend is particularly strong among Gen Z and gaming communities, positioning immersive concerts as a crossover between music, gaming, and social networking.

Blockchain-Driven Monetization and Digital Ownership

The integration of blockchain technology is transforming how virtual concerts are monetized. NFT-based tickets, limited-edition digital collectibles, and token-gated fan experiences are becoming mainstream offerings. These tools provide artists with transparent royalty structures while offering fans a sense of digital ownership and exclusivity. Platforms are also experimenting with decentralized fan communities, where access to events, merchandise, and backstage content is controlled through digital tokens. This trend is strengthening artist-fan relationships while diversifying platform revenue streams beyond traditional ticket sales.

What are the key drivers in the virtual concert platform market?

Global Shift Toward Digital-First Entertainment

Consumers increasingly prefer on-demand, interactive, and location-independent entertainment experiences. Virtual concert platforms align well with these preferences by enabling global access, flexible viewing, and enhanced interactivity. Younger demographics, in particular, value digital social experiences that combine music with real-time engagement, driving sustained demand for virtual concerts beyond temporary disruptions to physical events.

Cost Efficiency and Scalability for Artists and Organizers

Virtual concerts significantly reduce logistical costs associated with touring, venue rentals, and travel. Artists can reach millions of fans simultaneously while maintaining creative control and higher profit margins. This scalability is especially attractive to independent artists and mid-tier labels seeking global exposure without the financial risks of physical tours.

What are the restraints for the global market?

Hardware and User Experience Limitations

While immersive virtual concerts offer high engagement, widespread adoption of VR-based experiences remains constrained by hardware costs and comfort issues. Many consumers still rely on 2D streaming due to limited access to VR headsets, particularly in price-sensitive regions. These limitations restrict the pace at which fully immersive platforms can achieve mass adoption.

Content Saturation and Monetization Pressure

The growing number of virtual events has intensified competition, leading to content fatigue among users. Without strong differentiation through exclusive artists or immersive features, platforms may face declining willingness to pay. Continuous investment in content and technology is required, which can pressure margins and slow profitability for smaller players.

What are the key opportunities in the virtual concert platform industry?

Emerging Market Expansion and Mobile-First Platforms

Emerging economies in the Asia-Pacific, Latin America, and the Middle East represent significant growth opportunities. Large, young populations with high mobile and social media usage are increasingly consuming digital music content. Mobile-first virtual concert platforms optimized for low bandwidth and regional content can unlock substantial untapped demand and accelerate global market penetration.

Brand-Sponsored and Corporate Virtual Events

Brands are increasingly using virtual concerts for product launches, customer engagement, and experiential marketing. These events offer measurable engagement metrics, global reach, and creative flexibility. As brands allocate higher budgets to digital experiences, partnerships with virtual concert platforms are expected to become a major revenue driver, particularly in enterprise-focused (B2B) segments.

Platform Type Insights

Fully virtual concert platforms dominate the market, accounting for approximately 38% of global revenue in 2024, due to their accessibility across devices and lower development costs. Hybrid physical-virtual platforms are gaining traction as artists and festivals seek to extend the reach of live events through digital streaming. Metaverse-native platforms, while currently smaller in share, represent the fastest-growing segment as immersive technologies mature and user adoption increases.

Revenue Model Insights

Ticket-based monetization remains the leading revenue model, contributing nearly 41% of total market revenue, reflecting consumer familiarity with pay-per-event pricing. Subscription-based models are expanding rapidly, particularly for recurring artist channels and festival series. NFT sales, digital merchandise, and brand sponsorships are emerging as high-margin revenue streams, enhancing platform profitability and artist earnings.

End-Use Insights

Event organizers and promoters represent the largest end-use segment, accounting for roughly 29% of market demand, as they leverage virtual platforms to scale festivals and branded events globally. Independent artists are the fastest-growing end-use group, benefiting from direct-to-fan monetization models. Brands and corporate hosts are also increasing adoption, using virtual concerts for marketing, employee engagement, and customer loyalty initiatives.

| By Platform Type | By Technology Stack | By Revenue Model | By Content Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global virtual concert platform market in 2024, led by the United States. High digital spending, strong cloud infrastructure, and early adoption of VR and metaverse technologies support regional dominance. Major platforms and technology providers headquartered in the region further strengthen innovation and commercialization.

Asia-Pacific

Asia-Pacific holds nearly 31% of the global market and is the fastest-growing region, expanding at over 24% CAGR. China, Japan, South Korea, and India are key contributors, supported by mobile-first consumption, gaming ecosystems, and a large base of digitally native users. Localized content and regional artist platforms are accelerating adoption.

Europe

Europe represents around 22% of the market, driven by the U.K., Germany, and France. The region shows strong demand for hybrid concerts and digital music festivals, supported by advanced broadband infrastructure and high consumer willingness to pay for premium digital experiences.

Latin America

Latin America accounts for approximately 5% of global revenue, led by Brazil and Mexico. Growth is driven by high mobile streaming usage and increasing engagement with global music events, particularly among younger audiences.

Middle East & Africa

The Middle East & Africa region holds about 6% of the market, with Saudi Arabia and the UAE emerging as key growth hubs due to government-backed digital entertainment initiatives and investments in metaverse infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Virtual Concert Platform Market

- Meta Platforms Inc.

- Tencent Holdings

- Sony Group Corporation

- Apple Inc.

- Microsoft Corporation

- ByteDance Ltd.

- Epic Games

- Roblox Corporation

- Wave XR

- Live Nation Entertainment

- Veeps

- Stageverse

- AmazeVR

- MelodyVR

- Sansar (Wookey Project Corp.)