Video Managed Services Market Size

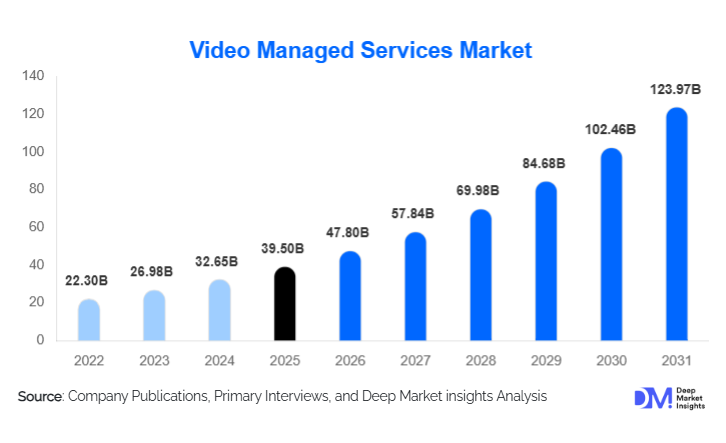

According to Deep Market Insights, the global video managed services market size was valued at USD 39.50 billion in 2024 and is projected to grow from USD 47.80 billion in 2025 to reach USD 123.97 billion by 2030, expanding at a CAGR of 21.0% during the forecast period (2025–2030). Market growth is primarily driven by the rising adoption of AI-powered video analytics, increasing demand for cloud-based surveillance and storage, and rapid investments in smart city infrastructure and intelligent transportation systems globally.

Key Market Insights

- Cloud-based video managed services dominate the market due to scalability, cost efficiency, and remote accessibility, attracting enterprises and SMEs globally.

- Video surveillance managed services are the leading service type, accounting for nearly 42% of the 2024 market, reflecting strong demand for security monitoring and compliance-driven deployments.

- North America holds the largest regional share, driven by high security spending, early adoption of cloud platforms, and widespread smart city initiatives.

- Asia-Pacific is the fastest-growing region, fueled by government-backed infrastructure projects, urbanization, and rapid enterprise adoption of managed services in China and India.

- Government and public sector adoption is rising, especially for urban surveillance, transportation hubs, and critical infrastructure, creating multi-year contracts for managed service providers.

- Technological integration, including AI-driven analytics, edge computing, and predictive video monitoring, is reshaping the market and expanding use cases beyond traditional security.

What are the latest trends in the video managed services market?

AI-Driven and Edge Analytics Adoption

Video managed services are increasingly incorporating artificial intelligence and edge computing to enable real-time detection, facial recognition, anomaly monitoring, and predictive analytics. Enterprises are leveraging these insights for operational efficiency, loss prevention, and business intelligence beyond traditional security. AI-powered video analytics allows automated alerts, crowd management, and behavioral insights, which enhance the value proposition for industries like retail, manufacturing, and transportation. Edge computing reduces latency, ensures rapid response, and minimizes network dependency, which is critical for remote or high-security sites.

Shift to Cloud-Based and Hybrid Deployments

Cloud and hybrid managed video services are emerging as the dominant deployment models. Organizations are moving away from capital-intensive on-premise systems toward subscription-based services, reducing upfront costs while improving scalability and accessibility. Cloud platforms also enable centralized monitoring, cross-location analytics, and enhanced cybersecurity. Hybrid models allow sensitive data to remain on-premises while leveraging cloud analytics, catering to regulatory compliance requirements, and balancing operational efficiency with security.

What are the key drivers in the video managed services market?

Rising Security and Risk Mitigation Needs

Enterprises and governments are adopting managed video services to address increasing security threats, theft, and safety risks. Continuous 24/7 monitoring, rapid incident response, and reliable system uptime make managed services more attractive than internally operated video systems. Security-driven demand is particularly strong in retail, transportation, BFSI, and government sectors, where video surveillance is critical for operational integrity and regulatory compliance.

Cost Optimization and Operational Efficiency

Organizations are outsourcing video management to reduce capital expenditure, IT staffing costs, and maintenance complexities. Subscription-based pricing models offer predictable operating expenses, making video managed services particularly appealing to SMEs and multi-location enterprises. This allows companies to access sophisticated analytics and monitoring capabilities without investing heavily in hardware or IT infrastructure.

What are the restraints for the global market?

Data Privacy and Regulatory Challenges

Strict regulations related to data storage, facial recognition, and cross-border video transmission create compliance challenges, particularly in Europe and parts of Asia. Companies must invest in data protection measures, secure storage, and encryption to meet legal standards. Regulatory uncertainty can delay deployments and limit adoption in sensitive sectors.

Network Dependency and Infrastructure Limitations

High-performance video managed services require reliable, high-bandwidth connectivity. In regions with limited network infrastructure, latency and downtime can affect real-time monitoring and analytics, restricting adoption in remote or underdeveloped areas. Network reliability remains a key technical challenge, especially for cloud-based deployments.

What are the key opportunities in the video managed services industry?

Smart City and Public Infrastructure Projects

Government initiatives to modernize urban infrastructure, including intelligent surveillance, traffic monitoring, and public safety systems, present significant opportunities. Managed services enable municipalities to deploy large-scale systems without high upfront costs. Multi-year contracts with transportation hubs, smart city grids, and emergency response centers are expected to drive consistent revenue streams for service providers.

Integration of Advanced Analytics and AI

There is growing potential to combine video services with AI-based analytics for business intelligence, operational optimization, and predictive security. Enterprises are increasingly leveraging video data for insights on customer behavior, workflow efficiency, and loss prevention, expanding the market beyond traditional security monitoring. Providers offering advanced analytics and predictive monitoring gain a competitive edge.

Emerging Markets in Asia-Pacific and the Middle East

Rapid urbanization, infrastructure development, and technology adoption in countries like China, India, and the UAE are driving demand for managed video solutions. Organizations with limited in-house IT capabilities are increasingly adopting fully managed services. Additionally, regulatory mandates for surveillance in banking, transportation, and critical infrastructure sectors enhance adoption potential in these emerging regions.

Service Type Insights

Video surveillance managed services dominate the market, accounting for roughly 42% of global revenue in 2024, reflecting widespread adoption across retail, commercial, and government sectors. Video hosting and storage services are growing rapidly due to cloud adoption, while video analytics services are emerging as a high-value segment, driven by AI and machine learning applications. Streaming and content management solutions are increasingly used for corporate communications and educational platforms, further diversifying service applications.

Application Insights

Security and surveillance remain the primary application, with nearly 47% share of 2024 market revenue. Operational monitoring and customer analytics are rising applications, enabling enterprises to optimize workflows, enhance business intelligence, and improve customer experience. Compliance and risk management applications are gaining traction in regulated industries, while traffic and crowd management solutions are increasingly deployed in smart city projects.

End-Use Industry Insights

Commercial & retail leads end-use demand with approximately 28% of the market, leveraging video services for loss prevention, operational monitoring, and consumer analytics. Transportation & logistics, BFSI, and government & public safety sectors are key adopters. Emerging applications in healthcare, education, and hospitality indicate potential for further growth. Retail and government sectors exhibit export-driven demand, particularly in Asia-Pacific infrastructure and North American enterprise deployments.

| By Service Type | By Deployment Model | By End-Use Industry | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, holding 36% of the global share in 2024. The U.S. leads adoption due to early technology integration, smart city initiatives, and robust enterprise security spending. Canada shows growing demand across transportation and critical infrastructure. Both countries favor cloud-based solutions and AI-enabled video analytics.

Europe

Europe holds approximately 22% of the market. The UK, Germany, and France lead adoption, with hybrid and cloud-based deployments common due to strict data privacy and compliance regulations. Demand is increasing for AI-driven operational and security applications, particularly in transportation, manufacturing, and BFSI sectors.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing 29% to the market, with China, India, Japan, and South Korea as major contributors. Rapid urbanization, government-backed smart city programs, and industrial digitalization are key growth drivers. Cloud adoption and AI analytics are increasing across enterprises and public sector projects.

Middle East & Africa

MEA accounts for 8% of the market. UAE and Saudi Arabia drive demand with investments in smart city and airport infrastructure. Intra-regional adoption is growing in South Africa, Nigeria, and Kenya for industrial and government applications.

Latin America

Latin America contributes 5% of the global market. Brazil and Mexico lead adoption in retail and government applications. Outbound technology and enterprise services from North America are supporting regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|